Biobanking Market Outlook:

Biobanking Market size was over USD 26.7 billion in 2025 and is projected to reach USD 60.37 billion by 2035, growing at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biobanking is evaluated at USD 28.74 billion.

The growth of the market is primarily attributed to the significant propagation in the biotechnology sector across the globe. The biotechnology sector is a science-driven industry that creates healthcare products by using molecular biology and living organisms. For instance, the biotechnology sector in India alone is expected to reach approximately USD 81 billion in 2022, to reach nearly USD 152 billion by 2025, and USD 310 billion by 2030. Furthermore, the proliferation of genomics research activities for various diseases study is another significant factor that is driving the growth of the global biobanking market during the projected period.

Biobanks assist in the development of multi-omics biobanks, in which insights from genomes, proteomics, and metabolomics are linked with radiomic data to produce a fresh and personalized technique for disease treatment. The implementation of big data and AI have been transforming the array of biobanks for the more advanced development of precision medicine. For instance, the purpose of precision medicine is to deliver clinicians the ability to determine the best course of action for a patient effectively, and accurately. The precision medicine eco-system, which is constantly evolving, is the answer to the issue. Precision medicine emphasizes the significance of integrating molecular profiling with well-established clinical index values to develop diagnostic, predictive, and therapeutic approaches customized to the requirements of each patient. For the precision medicine ecosystem to be used to its full potential, data must be properly interpreted. The best course of action to be taken for each unique patient group is determined by the precision medicine ecosystem's combination of genomic and clinical data. Moreover, increasing advancement in orthopedic procedures implying stem cells is also anticipated to fuel up the market growth of the global biobanking market over the forecast period.

Key Biobanking Market Insights Summary:

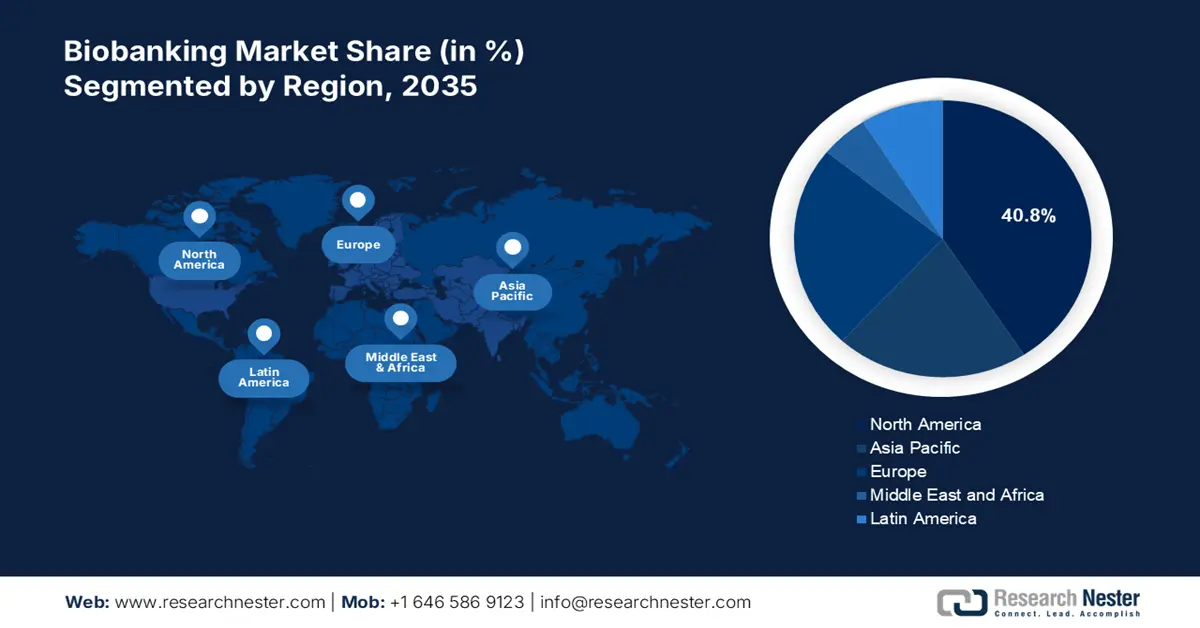

Regional Highlights:

- North America biobanking market will secure around 40.8% share by 2035, driven by the rising adoption of advanced technology and growing awareness regarding biobanking.

Segment Insights:

- The blood products segment in the biobanking market is forecasted to hold the largest share by 2035, driven by the rising demand for blood specimens and the increasing prevalence of hematological disorders.

- The clinical research segment in the biobanking market is expected to hold a significant share by 2035, influenced by the systematic use of biobanking for large-scale clinical research data collection.

Key Growth Trends:

- Growing Research Activities Associated with Genomics

- Increasing Instances of Umbilical Cord Blood Cell Conservation

Major Challenges:

- Associated High Cost of Storage of Specimen Samples

- Misconceptions about Biobanking

Key Players: UK Biobank Limited, Thermo Fisher Scientific Holdings, Inc., Tecan Trading AG, Hamilton Bonaduz AG, Bay Biosciences LLC., ISENET USA LLC, ASKION GmbH, Promega Corporation, VWR International, LLC., Merck KGaA.

Global Biobanking Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.7 billion

- 2026 Market Size: USD 28.74 billion

- Projected Market Size: USD 60.37 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Biobanking Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Research Activities Associated with Genomics - As per the World Health Organization (WHO), as a result of significant investments made during the COVID-19 pandemic, the percentage of countries capable of carrying out genomic surveillance expanded from 54% to 68% between March 2021 and January 2022.

- Genomics research is the study of full genetics along with the complement of an organism. It is generally conducted to prepare personalized medicines and focus on the editing, mapping, structure, function, and evolution of a genome. Furthermore, there has been growing popularity of genomics in cancer care for providing personalized medicines to the patients for the cure. In addition, genomic research can obtain several public targets, such as a reduction in health disparities. Therefore, the surge in genomics research is expected to fuel market growth over the forecast period.

-

Increasing Instances of Umbilical Cord Blood Cell Conservation – For instance, in Japan, approximately 36% of childbirth facilities presently provide umbilical cord blood cell storage to private biobanks, which is an increase from 15% in the past.

-

Escalating Count of Biobanks Globally - For instance, the worldwide number of biobanks reached around 130 by the end of 2018. Hence, the surge in the number of biobanks is expected to enlarge the market size over the forecast period.

-

Rising Cases of Hemophilia and Bleeding Disorders - Hemophilia is a disorder that interrupts the clotting of blood. It is a rare disorder that can develop in humans based on their genetics. For instance, between 2021 to 2022, approximately 200 thousand people were noticed to be living with hemophilia across the globe.

Challenges

- Associated High Cost of Storage of Specimen Samples - The process of specimen sample storage in biobanks requires costly equipment, which in turn, makes the entire process of storage expensive. This factor is estimated to hinder the growth of the biobanking market.

- Deficit in Counselling and Training on Medical Ethics

- Misconceptions about Biobanking

Biobanking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 26.7 billion |

|

Forecast Year Market Size (2035) |

USD 60.37 billion |

|

Regional Scope |

|

Biobanking Market Segmentation:

Specimen Type Segment Analysis

The global biobanking market is segmented and analyzed for demand and supply by specimen type into blood products, human tissue, nucleic acids, cell lines, biological fluids, and others. Out of these sub-segments, the blood products segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising demand for the collection of specimens of blood products, the radically increasing the ratio of accidents, and the potentially growing prevalence of several types of hematological disorders across the globe. For instance, in the United States, one person is diagnosed with leukemia, lymphoma, or myeloma every 4 minutes. Furthermore, in the United States, approximately 189,500 individuals were anticipated to be diagnosed with leukemia, lymphoma, or myeloma in 2021. Furthermore, blood products improve maternal health and child mortality and save millions of lives.

Application Segment Analysis

The global biobanking market is also segmented and analyzed for demand and supply by application into regenerative medicine, life science research, and clinical research. Amongst these segments, the clinical research segment is expected to garner a significant share. In clinical research, biobanking is used for the systematic collection of data on a large scale and tissues for additional research purposes. Clinical research can last for an uncertain period, where biobanks become useful to preserve specimens with 100% quality for a prolonged time. For instance, in FY 2020, the National Institutes of Health were estimated to fund approximately USD 16 billion for clinical research in the United States.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Specimen Type |

|

|

By Storage Type |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biobanking Market Regional Analysis:

North American Market Insights

North America region is likely to hold over 40.8% market share by 2035, fueled by the rising adoption of advanced technology and growing awareness regarding biobanking. For instance, the 16 largest pharmaceutical firms in the United States invested about USD 140 billion in research and development in 2021, which represents a 43% hike from 2016. Additionally, the surge in stem cell practices in the region to develop solutions for various diseases backed by the ongoing development via stem cell technology in regenerative medicines is further projected to expand the market size during the forecast period. Stem cell technology has become the most important treatment method for multiple diseases such as cancer, rare genetic diseases, diabetes, Alzheimer’s, and others. In the United States, approximately 30 million people suffer from diabetes. However, in 2018, around 25 million people were diagnosed with diabetes in a similar region.

Biobanking Market Players:

- UK Biobank Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Holdings, Inc.

- Tecan Trading AG

- Hamilton Bonaduz AG

- Bay Biosciences LLC.

- ISENET USA LLC

- ASKION GmbH

- Promega Corporation

- VWR International, LLC.

- Merck KGaA

Recent Developments

-

Thermo Fisher Scientific Inc. and Qatar Genome Program (QGP), a member of Qatar Foundation, partnered to speed up genomic research and clinical applications of predictive genomics in Qatar to accelerate the benefits of precision medicine across Arab populations worldwide. By combining whole genome sequencing data with an Axiom custom genotyping array for Pan-Arab populations, this partnership aims to advance scientific research and provide insights into conditions such as diabetes, cardiovascular and metabolic disorders, autism, and other genetic disorders.

-

UK Biobank Limited released the Whole Genome Sequencing (WGS) data of 200,000 UK Biobank participants for research use. Through these steps, researchers are estimated to understand the genetic factors of the disease and accelerate advanced drug discovery work.

- Report ID: 4602

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biobanking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.