EUROPE AND ASIA PACIFIC KRAFT PAPER MARKET

Part 1: Market Definition and Research Methodology

Market and solution definition

Research objective

Part 2: Research Methodology

Part 3: Executive Summary

Part 4: Policies & Standards

Part 5: Production Data by Country

Part 6: Import Quantity by Country

Part 7: Europe Kraft Paper Market (USD Billion & Million Tons)

- Market Dynamics

- Drivers

- Restraints

- Market Overview – Market Size and Forecast (2018–2027)

- Market segmentation by:

- Product Type

- Application

- End-User

- By Country

U.K. Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Germany Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

France Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Italy Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Spain Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Rest of Europe Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Part 8 Asia Pacific Kraft Paper Market (USD Billion & Million Tons)

- Market Dynamics

- Drivers

- Restraints

- Market Overview – Market Size and Forecast (2018–2027)

- Market segmentation by:

- Product Type

- Application

- End-User

- By Country

Indonesia Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

South Korea Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

China Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

India Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Malaysia Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Vietnam Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Australia Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Philippines Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Rest of Asia Pacific Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Company Analysis

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Part 9: Africa Pacific Kraft Paper Market (USD Billion & Million Tons)

- Market Overview – Market Size and Forecast (2018–2027)

- Market segmentation by:

- Product Type

- Application

- End-User

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Assessment of Leading Companies

Part 10: Competitive Landscape

- Company profiles of top players

- Mondi

- Segezha Group

- Stora Enso

- Nordic Paper

- Natron-Hayat

- Smurfit Kappa

- Daio Paper Corporation

Kraft Paper Market Outlook:

Kraft Paper Market size was over USD 19.2 billion in 2025 and is anticipated to cross USD 30.39 billion by 2035, growing at more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of kraft paper is estimated at USD 20.01 billion.

The Kraft paper market growth can be primarily attributed to rising efforts to eliminate plastic use from the environment. According to the International Union for Conservation, a projected 20 million metric tons of plastic litter end up in the environment every year, and the amount is projected to increase significantly by 2040. Additionally, according to the Sustainable Ocean Alliance in July 2022, almost 1 million marine animals die due to plastic pollution every year. To overcome the alarming consequences of plastic usage on the environment, people are looking for biodegradable options. Kraft paper is considered to be the sustainable alternative to plastic, the kraft paper market is expected to thrive in the coming period.

Additionally, the governments across the globe are emphasizing on prohibition of the usage of single-use plastic and promoting awareness regarding sustainable paper solutions. This is encouraging kraft paper market players in various sectors to use Kraft paper.

Key Kraft Paper Market Insights Summary:

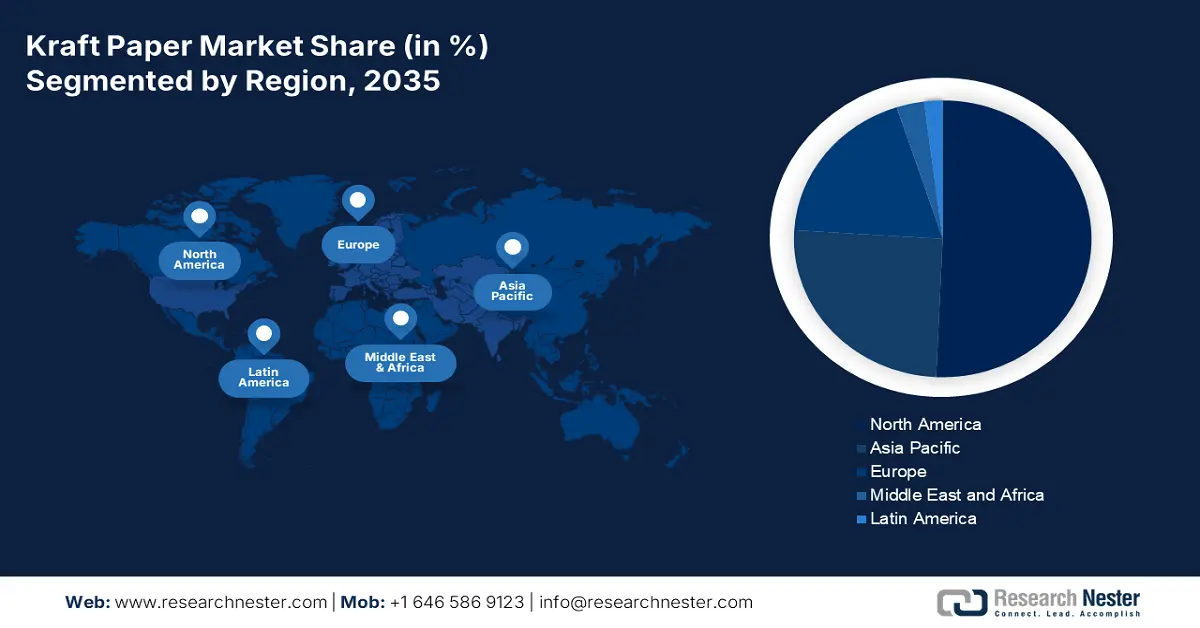

Regional Highlights:

- North America kraft paper market will hold around significant share by 2035, driven by rising emphasis on sustainable packaging and bans on single-use plastic.

- Asia Pacific market will secure significant revenue share by 2035, driven by rapid urbanization and the booming food and retail sector.

Segment Insights:

- The chipboard segment in the kraft paper market is projected to achieve the highest CAGR over 2026-2035, fueled by the superior protection and strength of chipboard packaging.

- The packaging segment in the kraft paper market is projected to achieve the highest CAGR through 2035, driven by increased use in food packaging and a consumer shift toward sustainable practices.

Key Growth Trends:

- Increasing popularity of fast-food restaurants

- Wide-spreading eCommerce sector

Major Challenges:

- Limited moisture resistance

- Fewer color options

Key Players: Mondi Group Plc, Natron-Hayat, DS Smith Plc., Asia Pulp & Paper , Smurfit Kappa Group, Shree Narayan Kraft Paper Mill LLP , JB Craft Paper LLP.

Global Kraft Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.2 billion

- 2026 Market Size: USD 20.01 billion

- Projected Market Size: USD 30.39 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Sweden

- Emerging Countries: China, India, Japan, Thailand, Mexico

Last updated on : 8 September, 2025

Kraft Paper Market Growth Drivers and Challenges:

Growth Drivers

- Increasing popularity of fast-food restaurants: Kraft paper is becoming a popular choice for packaging as it is durable, eco-friendly, and has a natural aesthetic appeal. On the back of this, various fast-food restaurants are quitting the use of plastic and adopting sustainable options such as Kraft paper. According to a study by Grain.org, a non-profit organization, 44% of the 12 million pieces of plastic ocean litter were linked to take-out food products. These factors are compelling entrepreneurs to use sustainable packaging materials such as kraft paper.

- Wide-spreading eCommerce sector: Kraft paper contains 100% fibers and possesses outstanding strength properties. Also, it is considered an appropriate choice for e-commerce applications due to its ease of printability for brand purposes. Kraft paper is considered to be fit for making mailer bags, eGrocery bags, and eCommerce form-fill-seal packaging for an eCommerce business. According to the International Trade Administration, global B2C ecommerce revenue is projected to reach USD 5.5 trillion by 2027. The business owners are carrying the social responsibility in the burgeoning sector and putting efforts into sustainable packaging.

- Increasing usage in personal care and cosmetics: According to data published by the World Economic Forum in September 2023, the cosmetic industry generates almost 120 billion packaging units in a year. Also, plastic production from the sector produces 3.4% of greenhouse gas emissions globally, which is higher than the aviation industry’s carbon footprint. Hence, sustainability in the cosmetics industry is prominent in reducing environmental impact and meeting the rising demand for eco-friendly product packaging.

Challenges

- Limited moisture resistance: One prominent disadvantage of the kraft paper is its poor moisture resistance. Even the standard Kraft paper has low resistance and can lose its strength when exposed to moisture, causing damage to the stored product.

- Fewer color options: The natural color of the kraft paper is brown, and while it can be dyed or bleached, the process can enhance the cost of production. The bleaching process also reduces the eco-friendliness of the kraft paper.

Kraft Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 19.2 billion |

|

Forecast Year Market Size (2035) |

USD 30.39 billion |

|

Regional Scope |

|

Kraft Paper Market Segmentation:

Product Segment Analysis

The chipboard forming segment in kraft paper market is anticipated to grow at the highest CAGR over the forecast period. The growth can be attributed to factors such as greater protection and strength of the packaging material, which lowers the chances of damage that can occur to a product. According to the data published by the International Forwarding Association in February 2023, 14% of damages occur due to incorrect temperature, and 25% due to physical damage. Chipboard is thicker and sturdier than a sheet of paper. These are cost-efficient as well as space-saving for the packing of the product. On the back of these factors, the chipboard forming segment is projected to witness remarkable growth and remain in huge demand from consumers.

Application Segment Analysis

The packaging segment in kraft paper market is projected to account for the highest growth during the assessed period. The growth of the segment can be attributed to the higher usage in restaurants for food packaging. A survey conducted by the Auguste Escoffier School of Culinary Arts in September 2024, 75% of Americans find it more convenient to eat at home and takeout their orders. Consumers are willing to pay more for a product if the company is following sustainable practices for the packaging. Kraft paper is widely adopted by companies to reduce carbon emissions, gaining versatile packaging, lowering the delivery costs, and enhancing the brand reputation.

Our in-depth analysis of the global kraft paper market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Kraft Paper Market Regional Analysis:

North America Market Insights

The North America kraft paper market is projected to register a remarkable revenue share between 2026 and 2035, owing to rising emphasis on sustainable packaging and efforts to curb the usage of single-use plastic. For instance, according to the World Economic Forum in January 2024, 12 states that have banned single-use plastic are Colorado, California, Delaware, Connecticut, New York, New Jersey, Washington, Rhode Island, Oregon, Hawaii, Maine, and Vermont. Due to these efforts from the governments, business owners in various sectors are adopting sustainable practices. According to The Observatory of Economic Complexity in 2022, the United States imported kraft paper worth USD 887 million, mainly from Canada (USD 622 million) and Sweden (USD 70 million). Similarly, in Canada, the government is committed to protecting the safety and environment of civilians. Owing to these factors, the market is anticipated to garner a significant share.

Asia Pacific Market Insights

The kraft paper market in the Asia Pacific region is gaining traction to exhibit a significant share, owing to rapid urbanization and the booming food and retail sector. A rising number of businesses and consumers are adopting eco-friendly solutions as an alternative to single-use plastic. The sectors such as food and beverages, retail, e-commerce, and personal care are moving forward to adopt recyclable and biodegradable packaging. For instance, Kraft paper in India, various market players are making premium quality Kraft papers and even exporting to numerous nations. According to The Observatory of Economic Complexity in 2023, India exported USD 106 million of kraft paper, particularly to the United Arad Emirates and Saudi Arabia. The rising demand for sustainable packaging practices in China, also acting as catalyst for the growth of the market.

Kraft Paper Market Players:

- WestRock Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mondi Group Plc.

- Natron-Hayat

- DS Smith Plc.

- Asia Pulp & Paper

- Smurfit Kappa Group

- Shree Narayan Kraft Paper Mill LLP

- JB Craft Paper LLP

The competitive landscape of the Kraft market is rapidly evolving as established key players, cosmetic manufacturing giants, and new entrants are investing in sustainable practices. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global kraft paper market:

Recent Developments

-

On September 23, 2019, Nordic Paper AS, one of the manufacturers engaged in the business of manufacture of greaseproof paper and kraft paper entered into a performance-based contract with SKF Norge AS, by which efforts would be initiated to raise productivity in Säffle mill.

-

On May 28, 2019, Stora Enso Oyj, a Finland based paper and pulp manufacturer announced that it would invest about USD 350 million and the money would be used to convert Oulu paper mill in Finland for packaging production purposes.

- Report ID: 2283

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Kraft Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.