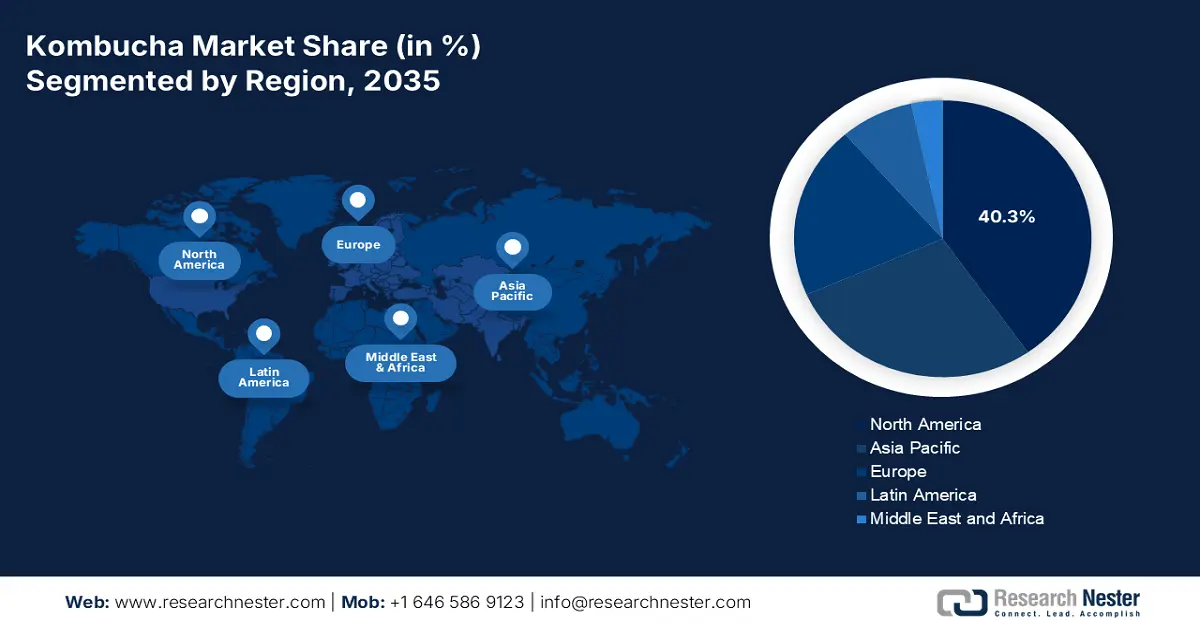

Kombucha Market - Regional Analysis

North America Market Insights

North America in the kombucha market is anticipated to account for the largest share of 40.3% by the end of 2035. The market’s growth in the region is readily fueled by an increase in consumer awareness regarding probiotics and gut health, mainstream retail distribution, robust disposable income, functional innovation, administrative certification, and focus on sustainability. According to an article published by the Economic Research Service in June 2025, sugar deliveries for beverage and food usage have been lowered by 25,000 STRV to 12.1 million, particularly in the U.S., thereby enhancing the market in the overall region.

The market in the U.S. is growing significantly, owing to regulatory and premiumization maturation, the customer’s demand for low-sugar and organic options, intense support from the USDA's National Organic Program, and effective retail channel expansion. As stated in the August 2023 NLM article, the aspect of added sugar intake among youth and children in the country is extremely high, with almost 65% of those aged between 2 to 19 years not catering to the 2020-2025 Dietary Guidelines for Americans’ suggestions to restrict sugar that constitutes less than 10% of overall energy intake. This has denoted a huge growth opportunity for the market in the country, with increased focus on low sugar intake.

Sugar Utilization and Supply in the U.S.

|

Components |

2023-2024 |

2024-2025 |

2025-2026 |

|

Beginning stocks |

1,843 |

2,131 (May and June) |

2,032 (May) |

|

Total Production |

9,313 |

9,311 (May) |

9,285 (May) |

|

Total Imports |

3,840 |

2,944 (May) |

2,475 (May) |

|

Total Supply |

14,995 |

14,387 (May) |

13,791 (May) |

|

Total Exports |

249 |

100 (May and June) |

100 (May and June) |

|

Miscellaneous |

81 |

- |

- |

|

Total Deliveries |

12,534 |

12,255 (May) |

12,255 (May) |

|

Total Usage |

12,864 |

12,355 (May) |

12,355 (May) |

|

Stock-to-use ratio |

16.6% |

16.4% (May) |

11.6% (May) |

Source: Economic Research Service

Canada market is also growing due to the robust emphasis on localized sourcing and health claims compliance, strong oversight by Health Canada for regulating particular health probiotics under the Natural Health Products (NHP) framework. In addition, the sudden push toward sustainable and localized production is also boosting the market in the country. As stated in the October 2023 Food Chemistry Advances article, the Center of Diseases Control of British Columbia (BCCDC) noted that pH levels should not be lower than 2.5, while the alcohol level should not be over 1%, thereby ensuring to maintenance food safety plan in the country.

Europe Market Insights

Europe in the kombucha market is expected to emerge as the fastest-growing region during the projected duration. The market’s development in the region is highly attributed to deeply ingrained wellness and health culture, especially in the North and West regions, strict regional food safety and labeling policies, which are administered by the Europe Food Safety Authority (EFSA). Besides, the strong need for organic certification in the region is also boosting the market. For instance, as noted in the April 2025 USDA article, an arrangement has been made with Europe Union, wherein organic wine can be exported to the region, comprising 100% organic ingredients, and non-organic substances are not permitted under 7 CFR 205.605 are readily prohibited, thus suitable for the market’s upliftment.

The market in the UK is gaining increased exposure, owing to the aspect of a well-established health food retail industry and a generous customer base that is extremely receptive to wellness trends. In addition, the market’s growth is also driven by consumers appealing to seek low-alcohol and functional alternative options to cider and beer. As per an article published by GFI Europe in September 2025, the latest research has stated that advanced ways of producing regular foods by utilizing fermentation can add £9.8 billion (€11.2 billion) to the country’s economy, which has bolstered the market’s demand.

The kombucha market in Germany is also developing due to the increased focus on certified organic and domestically sourced ingredients, as well as trends that readily align with kombucha’s ultimate value proposition. Additionally, the Federal Ministry of Food and Agriculture proactively promotes the concept of organic farming, which is also fueling the market’s development in the overall country. According to the 2025 World of Organic Agriculture data report, the international organic drink and food sales have reached 136 billion euros as of 2023, with Germany’s contribution accounting for 16,080 million euros, thus making it suitable for uplifting the market.

APAC Market Insights

Asia Pacific market is considered to grow steadily by the end of the predicted timeline. The market’s exposure in the region is highly driven by a rise in disposable incomes, increased urbanization, and a deep-seated cultural familiarity with fermented beverages and foods. In addition, the market in South Korea and Japan has demanded premium and functional varieties, while emerging economies, such as India and China, are fueled by huge urban populations. Besides, the aspect of government support for functional food advancement, with agencies in South Korea and China readily establishing clear administrative regulations for the market’s welfare.

The kombucha market in China is gaining increased exposure, owing to the presence of the China Food and Drug Administration (CFDA), which has established a standard green channel for clearing health foods, which has diminished the registration timeline for products with suitable probiotic advantages. In addition, this regulatory efficacy has readily escalated the market entry for both international and domestic brands, therefore driving intensified innovation and competition. Besides, the presence of different tea varieties is also uplifting the overall market in the country.

The market in India is also growing due to the existence of a young and health-conscious urban population. Additionally, the Ministry of Food Processing Industries (MoFPI) readily supports this particular segment through the availability schemes, such as the Pradhan Mantri Kisan SAMPADA Yojana, which effectively offers grants for food processing facilities. According to an article published by NLM in February 2025, undernutrition is a massive health challenge among domestic adolescents, wherein 253 million falls into the age group ranging between 10 to 19 years. Therefore, this denotes a huge growth opportunity for the market to be readily adopted by the country’s population to ensure healthy lifestyles.

Fermented Beverages 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

India |

USD 113,000 |

USD 331,000 |

|

Sri Lanka |

USD 49,300 |

- |

|

United Arab Emirates |

USD 36,400 |

USD 1,200 |

|

Japan |

USD 5,800 |

USD 149,000 |

|

Hong Kong |

USD 2,560 |

- |

|

Maldives |

USD 1,840 |

- |

|

South Korea |

- |

USD 95,400 |

|

Thailand |

- |

USD 3,210 |

Source: OEC