Global Intravascular Temperature Management Market Size, Forecast, and Trend Highlights Over 2025-2037

Intravascular Temperature Management Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 3.7 billion by the end of 2037, rising at a CAGR of 8.1% during the forecast period (2025-2037). In 2025, the industry size of intravascular temperature management is estimated at USD 1.6 billion.

The increasing incidence of healthcare events, such as cardiac arrest and stroke, requiring specialized care, is creating a surge in the market. According to a 2023 report from ScienceDirect, 10.0% and 50.0% of worldwide mortality and cardiovascular deaths originated from out-of-hospital cardiac arrest (OHCA). Similarly, in 2021, the numbers of prevalence, incidents, and deaths due to strokes around the globe were 93.8 million, 11.9 million, and 7.0 million, showing a massive increment of 86.0%, 70.0%, and 44.0%, respectively, from 1990 and 2021, respectively (NLM). Furthermore, the global age-standardized ischemic stroke incidence rate is predicted to be 89.3 per 100,000 by 2030 (American Heart Association).

Further, the heightening risk factors, such as the rapidly aging population and the increasing occurrence of cardiovascular diseases (CVD) across the world, are magnifying this patient pool. In this regard, WHO projected the global count of people aged over 60 and over to surpass 2.1 billion by 2050, from 1.4 billion in 2024. Simultaneously, the global prevalence and crude mortality of CVD are expected to rise by 90.0% and 73.4% by 2050, from 2025 (NIH). On the other hand, the worldwide expenditure on stroke is anticipated to double by 2050, from USD 890.0 billion in 2021 (NLM). Thus, the growing economic burden of these ailments is pushing pioneers associated with the market to introduce more publicly accessible and affordable options.

As a result of continuous efforts to establish standardized and affordable payers’ pricing in the market, companies are investing in R&D. The producer price index (PPI) and consumer price index (CPI) in this sector experienced a year-on-year rise of 4.5% and 4.0% between 2023 and 2024. Thus, manufacturers in this field are focusing on reducing the overall cost of components (catheters and cooling systems) production and workforce utilization. Furthermore, the optimization of the domestic raw material supply chain for medical-grade sensitive drugs, used in intravascular temperature management (IVTM) devices, is also crucial to serve the discussed purpose.

Intravascular Temperature Management Sector: Growth Drivers and Challenges

Growth Drivers

- Heavy capital influx in research and development: The need for advanced patient management tools and device components is pushing manufacturers in the intravascular temperature management market to invest more in R&D projects. Their collaborative and strategic movements are garnering a next-generation pipeline with better outputs, user convenience, and adaptability. This is helping medical settings address the unmet requirements of each individual by simplifying and personalizing treatment prognosis. For instance, in November 2023, ZOLL attained 510(k) clearance from the FDA for its two new additions to its Thermogard portfolio, HQ and XP Temperature Management Systems, for adults with hyperthermic indications.

- Government investments and efforts to improve medical care: Considering the severity of associated illnesses, several public health authorities are proactively promoting investments in the market. Their aim to make quality medical care accessible for every patient through adequate reimbursement policies and subsidiary schemes is inspiring both MedTech manufacturers and consumers to bring advancement in this sector. This can also be testified by the rising Medicare spending on hospital outpatient services, including advanced technologies, which surpassed USD 80.5 billion in 2023.

Historical Patient Growth and Market Implications for Intravascular Temperature Management (IVTM) + D5 Manufacturers

The trend of utilizing offerings from the intravascular temperature management market witnessed a significant boost during the COVID-19 pandemic. This event escalated the spread of awareness about early detection and intervention among heart patients worldwide. Specifically, the tendency to use IVTM systems among residents undergoing critical care and associated medical professionals heightened notably. Even after the pandemic struck, the magnifying patient population, driven by several risk factors, is influencing authorities in developing nations to invest more in resource allocation and technology adoption.

Worldwide Growth of Patient Pool (2010-2020)

|

Country |

2010 Patient Base (in million) |

2020 Patient Base (in million) |

Growth Rate (in %) |

|

U.S. |

0.52 |

1.4 |

140.4 |

|

Germany |

0.34 |

0.8 |

100.5 |

|

France |

0.23 |

0.6 |

100.2 |

|

Spain |

0.11 |

0.5 |

200.4 |

|

Australia |

0.07 |

0.3 |

200.3 |

|

Japan |

0.09 |

0.4 |

185.3 |

|

India |

0.05 |

0.3 |

400.1 |

|

China |

0.04 |

0.4 |

400.5 |

Revenue Opportunities for IVTM Manufacturers

Upon thorough observation of the historical and current demography, the revenue potential of the intravascular temperature management market is statistically established. Additionally, the projected enlargement in the patient pool is also expected to generate greater cash flow for key players in this field. Emerging landscapes such as India and China are presenting great investment opportunities due to a large consumer base and government initiatives. Furthermore, strategic upgradation in product pipeline and collaborative R&D are projected to broaden the scope of conducting profitable business across both developed and under-development regions.

Tabular Representation of Estimated Opportunities

|

Company |

Strategy |

Estimated Revenue (in USD) |

Impact Notes |

|

ZOLL Medical |

Product Innovation |

50.3 million |

Enhanced product portfolio leading to increased market share |

|

Medtronic |

Global Distribution Expansion |

40.1 million |

Leveraged extensive network to reach broader markets |

|

Smiths Medical |

Strategic Acquisition |

30.2 million |

Acquired complementary technologies to expand product offerings |

|

3M Company |

Regional Expansion |

25.4 million |

Entered emerging markets to tap into new customer bases |

|

Stryker Corporation |

Partnership with Healthcare Providers |

20.2 million |

Collaborated with hospitals to integrate IVTM solutions |

Challenge

- Incremental development and accessing cost: Despite ongoing financial support from public and private authorities, the economic disparity between patients and service providers is still an unavoidable issue in the market. Particularly, regions with limited resources and price-sensitive landscapes require affordable accommodations, which may limit the adoption of advanced tools in those markets. In addition, the absence and insufficiency of adequate reimbursement policies and insurance coverage may refrain people with budget limitations from enrolling for such treatment solutions. Furthermore, the price and supply disruptions in raw materials often escalate the pricing of the final product, making them more expensive for general use.

Intravascular Temperature Management Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.1% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2037) |

USD 3.7 billion |

|

Regional Scope |

|

Intravascular Temperature Management Segmentation

Product Type (Intravascular Cooling Catheters, Warming Catheters, Consumables)

Based on type, the intravascular cooling catheters segment is anticipated to dominate the intravascular temperature management market with a share of 46.7% by the end of 2037. Its wide use in stroke management, cardiac arrest recovery, and neuroprotection to enhance patient outcomes is one of the major drivers behind this segment’s leadership. Additionally, the ongoing research and development in this category is enhancing its performance and effectiveness through crafting innovative design and integrating artificial intelligence. Furthermore, the advancements in these catheters are opening new scopes of business by establishing their application pre-and post-operative management. For instance, in June 2021, Medtronic gained FDA clearance for its Freezor MAX Cardiac Cryoablation Catheter, treating abnormal heart rhythms.

Application (Cardiac Arrest, Traumatic Brain Injury, Fever Control)

In terms of applications, the cardiac arrest segment is poised to hold the largest share of 52.5% in the intravascular temperature management market over the assessed timeline. This segment’s augmentation is empowered by the continuously growing CVD patient pool and high-risk population across the world. Additionally, its correlation with emergency critical conditions and increasing sudden deaths are fueling this segment’s growth. Moreover, the heightening influence and prevalence of underlying comorbidities, such as myocardial ischemia, primary arrhythmia, and respiratory insufficiency, are also contributing to its proprietorship over other clinical disciplines related to this sector.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

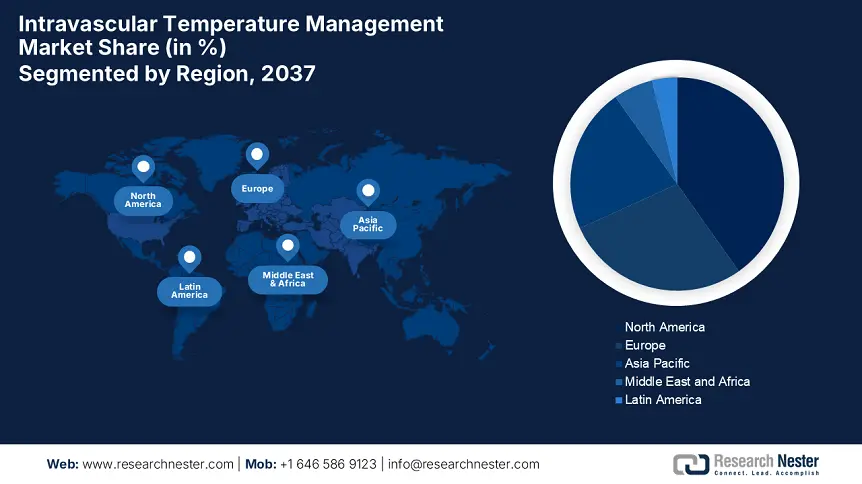

Intravascular Temperature Management Industry - Regional Synopsis

North America Market Statistics

The intravascular temperature management market in North America is predicted to capture the highest share of 40.2% throughout the discussed timeframe. The improved public access to advanced healthcare is the primary growth factor in this region. The continuous federal government investment in medical infrastructure in high-income countries, such as the U.S. and Canada, is creating a financially capable consumer base for this merchandise. Additionally, the robust reimbursement system and the enlarging patient pool across the region are escalating the volume of cash flow for both domestic and international leaders. This scenario is further making it a lucrative landscape for generating greater revenue.

Country-wise Government Spending on Critical Care Technology (2023)

|

Country |

Federal Budget (in USD) |

Medicare/Medicaid Support (in USD) |

Key Trends |

|

U.S. |

2.1 billion |

1.5 billion |

AI-driven IVTM, CMS reimbursement |

|

Canada |

450.0 million |

120.0 million |

Portable systems, provincial funding |

Till 2023, cardiac arrest affected approximately 600,000 people in the U.S., where OHCA cases were majorly frequent with 340,000 per year and the annual in-hospital cases were 292,000 (medRxiv). This reflects the continuously increasing demand in the market. Additionally, ongoing government investments toward new developments in this field are also contributing to the country’s regional dominance. For instance, in 2023, the federal government allocated USD 650.0 million for R&D in this category and among this 220.0 million was dedicated to advancing AI-modulated temperature management. Simultaneously, the improvements in insurance coverage are increasing public access to offerings from the sector.

APAC Market Analysis

Asia Pacific is anticipated to exhibit the highest CAGR in the global intravascular temperature management market by 2037. The rapidly aging population and CVD occurrences in several countries, including Japan, India, and China, are creating a significant surge for IVTM tools, fueling the region’s fast augmentation in this field. Besides, recent regulatory reformations for enhancing advanced healthcare access are garnering a favorable business environment for both global and domestic leaders. Furthermore, growing public and private investments in upgrading medical systems in emerging economies are establishing a strong foundation for this merchandise.

China is propagating the market with its exceptional abilities in manufacturing medical devices and a large consumer base. As of 2022, the nationwide annual incidence of cardiac arrest was 55,000, where over 230.0 million people were afflicted by CVD (NLM). The country’s leadership in global production output and import is also positioning it at the forefront of regional augmentation. Additionally, the governing bodies operating across the nation are promoting the adoption of standardized clinical instruments to attain the highest quality of care for patients with critical conditions. For instance, in 2023, multiple medical device standards were implemented by China to ensure the best outcomes and complete patient safety.

Companies Dominating the Intravascular Temperature Management Landscape

- Zoll Medical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Terumo Corporation

- Boston Scientific

- Access Scientific

- Medivance Inc.

- Cadi Scientific

- Thermo Fisher Scientific

- Philips Healthcare

- Medtronic plc

- Stryker Corporation

- 3M Company

- Becton, Dickinson and Company

- Smiths Medical

- Gentherm Incorporated

- The Surgical Company Group

- Belmont Instrument Corporation

- Biegler GmbH

- MicroPort

- The 37 Company

- Estill Medical Technologies

Key players in the intravascular temperature management market are currently following the trend of manufacturing expansion and globalization. They are rigorously conducting R&D projects to improve their product’s efficiency, enhancing the rate of adoption in this field. Similarly, they are making strategic MedTech acquisitions to integrate advanced technology in their pipeline, leveraging the capabilities of their offerings. For instance, 3M Company expanded its territory in India to grab lucrative opportunities from such an emerging marketplace. This cohort of pioneers include:

Recent Developments

- In September 2024, Medtronic launched a configurable one-system ECMO solution, VitalFlow, delivering simplicity and quality performance. It is designed to bridge the gap between bedside care and intra-hospital transport, offering physicians and clinicians an easier, smarter ECMO experience.

- In January 2024, ZOLL attained marketing clearance from the FDA and CE marking for a significant upgrade to the versatility of its Thermogard Temperature Management System. This single, streamlined platform offers solutions for personalized patient care with precise temperature control and intelligent analytics.

- Report ID: 1333

- Published Date: May 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intravascular Temperature Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert