Curved Temperature Monitor Patch Market Outlook:

Curved Temperature Monitor Patch Market size was valued at USD 480.4 million in 2025 and is projected to reach USD 951.2 million by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of curved temperature monitor patch is estimated at USD 510.5 million.

The patient population necessitating temperature monitoring in post-surgical cases, chronic disease management, and neonatal care is the key factor behind the robust growth of the worldwide curved temperature monitor patch market. As of the HRSA September 2025 data CWBYCTP donor registry in the U.S. includes over 9.4 million adult donors and more than 246,500 cord blood units, enabling support to a large pool for blood stem cell transplants. Also in fiscal year 2024, the program facilitated 7,550 unrelated blood stem cell transplants, with 6,457 for U.S. patients. By May 2025, over 83,000 new adult donors were added, creating the need for real-time temperature monitoring in the clinical setting.

In addition, the requirement of healthcare systems and consumers seeking more efficient and comfortable methods for temperature monitoring also fosters a favorable business environment for the curved temperature monitor patch market. As evidence, in May 2025, Philips declared that it successfully rolled out its wearable ePatch and AI-driven Cardiologs analytics platform across 14 hospitals in Spain, including University Hospital Vall d’Hebron, to monitor heart patients. It also stated that the ePatch offers up to 14 days of cardiac monitoring, with enhanced patient comfort, and allows daily activities without any disruption.

Key Curved Temperature Monitor Patch Market Insights Summary:

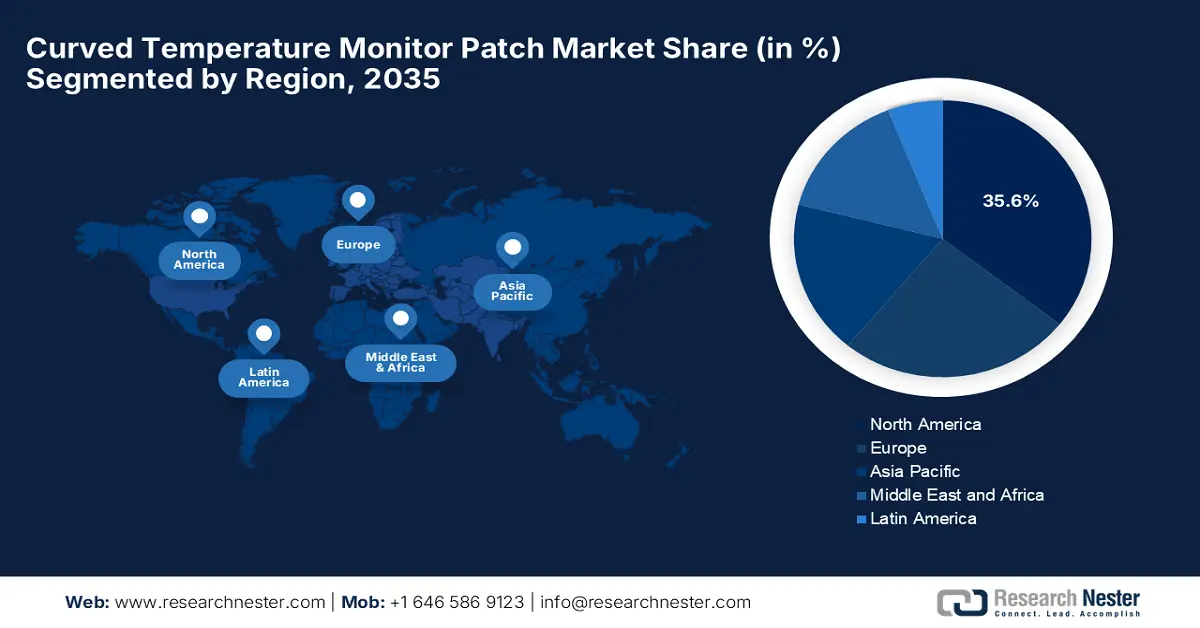

Regional Insights:

- North America is projected to dominate the curved temperature monitor patch market with a 35.6% share by 2035, supported by continuous regulatory backing and a well-established healthcare infrastructure.

- Asia Pacific is expected to record the fastest expansion during 2026–2035, propelled by an aging population, growing digital healthcare adoption, and government-supported manufacturing programs.

Segment Insights:

- The merchant segment in the curved temperature monitor patch market is anticipated to command the largest revenue share of 60.6% by 2035, fueled by broad distribution networks and strategic collaborations with healthcare providers and wearable technology firms.

- The health monitoring segment is forecasted to secure a notable 50.5% share by 2035, driven by increased adoption in hospitals and clinics for real-time patient temperature tracking in post-operative and neonatal care.

Key Growth Trends:

- Advancements in wearable technologies

- Rising prevalence of chronic diseases

Major Challenges:

- Hurdles related to stringent regulatory frameworks

- Competition from conventional thermometers

Key Players: 3M Company (U.S.), Medtronic plc (Ireland), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Becton, Dickinson and Company (U.S.), Smith & Nephew plc (UK), Cardinal Health (U.S.), Johnson & Johnson (U.S.), Stryker Corporation (U.S.), B. Braun SE (Germany), Terumo Corporation (Japan), Coloplast A/S (Denmark), ConvaTec Group PLC (UK), ICU Medical, Inc. (U.S.), Mölnlycke Health Care AB (Sweden), Paul Hartmann AG (Germany), Nitto Denko Corporation (Japan), Romsons Group (India), BSN medical (Essity) (Germany), Medline Industries, LP (U.S.).

Global Curved Temperature Monitor Patch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 480.4 million

- 2026 Market Size: USD 510.5 million

- Projected Market Size: USD 951.2 million by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 24 October, 2025

Curved Temperature Monitor Patch Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in wearable technologies: The innovations in terms of flexible electronics and material science have led to the development of highly efficient, durable, and comfortable monitor patches, driving business in the market. For instance, in May 2021, Blue Spark Technologies announced a U.S. observational trial with Bristol Myers Squibb using the TempTraq wearable Bluetooth temperature monitor to track patients undergoing CAR T therapy. It also stated that the device provides continuous, real-time temperature data to help detect early signs of cytokine release syndrome, which is a common CAR T side effect, hence positively impacting market growth.

- Rising prevalence of chronic diseases: The increasing instances of chronic conditions such as diabetes, cardiovascular diseases, and respiratory ailments are appreciably driving demand for these temperature monitoring solutions. As per a WHO article published in November 2024, diabetes affected around 14% of adults across all nations in 2022, which provides an encouraging opportunity for the pioneers, boosting the curved temperature monitor patch market.

- Growing demand for home healthcare: The rise in home healthcare is expected to propel the growth in the curved temperature monitor patch market. Besides, these devices also enable remote patient monitoring, allowing patients to receive care at home beneficial for the aging population, necessitating ongoing care for chronic conditions. For instance, in April 2023, Honeywell announced that it had launched a real-time health monitoring system using a wearable skin patch to continuously track vital signs both in hospitals and at home, making it suitable for standard market growth.

Challenges

- Hurdles related to stringent regulatory frameworks: As the approval durations for the products in the curved temperature monitor patch market have lengthened in recent years, this has delayed the launches. Therefore, these extended approval times caused a major hindrance to the rapid innovation, thereby limiting the availability of the latest technologies to patients and service providers. Furthermore, this delay not only increases development expenses but also creates uncertainty in this field.

- Competition from conventional thermometers: The global curved temperature monitor patch market still faces competition from conventional thermometers, which highly impact adoption, innovation, and evaluation processes. In addition, the presence of well-established alternatives creates pressure on the companies to focus on continued innovations and prove their superior accuracy, convenience, and cost-effectiveness to justify the switch, thus negatively influencing the pace of product development.

Curved Temperature Monitor Patch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 480.4 million |

|

Forecast Year Market Size (2035) |

USD 951.2 million |

|

Regional Scope |

|

Curved Temperature Monitor Patch Market Segmentation:

Trade Segment Analysis

The merchant segment is likely to grow at a rapid pace, capturing the largest revenue share of 60.6% in the curved temperature monitor patch market during the forecast duration. The dominance of the segment is attributable to the widespread distribution networks and partnerships with various healthcare providers and wearable tech manufacturers. Besides, these merchants play a pivotal role in ensuring market penetration in diverse geographies, thereby fueling revenue growth in the curved temperature monitor patch industry.

Application Segment Analysis

In terms of application health monitoring segment is predicted to capture a significant share of 50.5% in the curved temperature monitor patch market by the end of 2035. The growth in the segment is backed by hospitals and clinics, which are increasingly adopting these patches for real-time patient temperature tracking, particularly in terms of post-operative and neonatal care. In January 2024, Monash Children’s Hospital reported that it conducted a trial from March to August 2022 using the Temptraq wireless temperature monitoring patch on pediatric patients. It also reported that it was as accurate as traditional ear thermometers while reducing patient discomfort and nurse workload.

Type Segment Analysis

Based on type flexible patch segment is likely to attain a considerable share of 45.3% in the curved temperature monitor patch market during the analyzed timeframe. Their adaptability to curved skin surfaces, enabling comfortable and continuous temperature monitoring, is fostering a favorable environment to capitalize on this sector. Besides their lightweight and biocompatible materials, they support long-term wear, which is crucial for patient compliance in chronic disease management. On the other hand, advances in materials science, such as stretchable electronics, also propel growth in this segment.

Our in-depth analysis of the curved temperature monitor patch market includes the following segments:

|

Segment |

Subsegments |

|

Trade |

|

|

Application |

|

|

Type |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Curved Temperature Monitor Patch Market - Regional Analysis

North America Market Insights

North America is anticipated to attain the largest share of 35.6% in the global curved temperature monitor patch market throughout the assessed timeframe. The continuous regulatory support and the robust healthcare infrastructure are key factors reinforcing the region’s dominance over this sector. In January 2022, greenteg AG announced the launch of COREmedical in the U.S. under emergency use authorization as a clinical thermometer for continuous, non-invasive core body temperature monitoring. This is a wearable device, and its compatibility with adhesive patches and smart devices enables flexible, remote monitoring in both medical and home care settings.

The U.S. dominates the regional curved temperature monitor patch market with commendable revenue opportunities fueled by value-based reimbursement policies and remote patient monitoring expansion. As of May 2025, CMS data it is found that Medicare broadly enables coverage of remote patient monitoring for both chronic and acute conditions, using a variety of medical devices to collect physiological data such as temperature, heart rate, and more. Therefore, this coverage helps technologies such as wearable patches, making them highly accessible, wherein the eligible are those under Medicare Part B with a medical condition requiring regular monitoring.

Canada's curved temperature monitor patch market represents consistent upliftment backed by the federal, provincial healthcare allocations and continued product innovations. In April 2021, MedTach announced the availability of the TempTraq wireless, which is a continuous body temperature monitoring patch in the country following Health Canada registration. The firm further underscored that the system enables remote, real-time fever detection and integrates with existing electronic health records for streamlined clinical use, thus denoting a positive market outlook.

APAC Market Insights

Asia Pacific is likely to emerge as the fastest-growing region in the curved temperature monitor patch market during the discussed timeframe. This rapid upliftment is readily propelled by the rising aging population, digital healthcare adoption, and government-backed manufacturing initiatives. In October 2024, Hokkaido University and the University of Tokyo reported that their research team had developed a flexible, multimodal wearable sensor patch that uses edge computing on smartphones to detect health conditions such as arrhythmia, coughs, and falls in real time. The patch monitors signs such as ECG, respiration, skin temperature, and humidity, transmitting data via Bluetooth for continuous remote monitoring.

China is unfolding its dominance over the regional curved temperature monitor patch market during the assessed tenure, backed by the increasing adoption of wearable health technologies and a strong focus on remote patient monitoring. Healthcare providers and consumers in the country are increasingly leveraging these patches for their convenience and accuracy in terms of continuous temperature tracking. In addition, the presence of huge advancements in sensor technology and integration with smartphones and health platforms is fueling innovation in this market.

India is emerging in the curved temperature monitor patch market, owing to the government grants and domestic manufacturing initiatives. In August 2022, IIT Bhubaneswar reported that its scientists had developed a flexible, wearable patch that uses light to monitor various health parameters accurately. It also stated that the device can measure body temperature, pulse rate, joint movements, and even track facial and limb activities. Hence, such instances encourage both the domestic and foreign players to make investments in this field.

Europe Market Insights

The curved temperature monitor patch market in Europe is anticipated to reflect consistent progress supported by the governing bodies and a large consumer base. The region’s pace of progress in this field is also attributable to the key countries such as Germany, the UK, and France, and their unique developmental strategies. In January 2025, Henkel reported that it had launched two new light-cure adhesives called Loctite AA 3952 and SI 5057, which are designed specifically for bonding thermoplastic elastomers in flexible medical devices, thus denoting a positive market outlook.

Germany leads Europe’s curved temperature monitor patch market, attributed to its comprehensive healthcare spending. As the hub of innovation, the country facilitates a profitable business atmosphere throughout the discussed tenure. The country’s market also benefits from substantial public and private healthcare investments, which support the integration of advanced monitoring solutions such as wearable patches into clinical and home care settings. This is further bolstered by the country’s aging population, which effectively necessitates continuous health monitoring and the increasing adoption of connected health devices among consumers.

The U.K. also follows Europe’s curved temperature monitor patch market with a considerable share by the end of 2035. The country’s prominence in this landscape is reflected through its remote patient monitoring adoption and domestic manufacturing capabilities. For instance, in May 2022, Fleming Medical introduced the Medicare SteadyTemp, which is a high-tech adhesive sensor patch with a mobile app. The patch, worn on the chest, continuously measures body temperature with high accuracy and uses NFC technology to transfer data to a smartphone, hence suitable for sustained market growth.

Key Curved Temperature Monitor Patch Market Players:

- 3M Company (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc (Ireland)

- Abbott Laboratories (U.S.)

- Boston Scientific Corporation (U.S.)

- Becton, Dickinson and Company (U.S.)

- Smith & Nephew plc (UK)

- Cardinal Health (U.S.)

- Johnson & Johnson (U.S.)

- Stryker Corporation (U.S.)

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Coloplast A/S (Denmark)

- ConvaTec Group PLC (UK)

- ICU Medical, Inc. (U.S.)

- Mölnlycke Health Care AB (Sweden)

- Paul Hartmann AG (Germany)

- Nitto Denko Corporation (Japan)

- Romsons Group (India)

- BSN medical (Essity) (Germany)

- Medline Industries, LP (U.S.)

- 3M Company is considered to be the global powerhouse of healthcare & medical devices, which is also best known for its adhesive technologies and wearable health monitoring solutions. The company also benefits from the monitoring patches that have advanced materials that ensure both skin comfort and accurate readings.

- Abbott Laboratories is a prominent organization leading in terms of diagnostics and medical devices, wherein it also leverages a strong foothold in terms of wearable health monitoring technologies. The firm’s prime focus is to integrate temperature monitoring patches with a broader range of patient management systems, thereby allowing real-time data transmission to healthcare providers.

- Medtronic plc is best known for its innovation in terms of chronic disease management and hospital-grade monitoring equipment. The company includes curved temperature monitoring patches as a part of its broader portfolio, enabling continuous patient monitoring, especially for critical care.

- Philips Healthcare has been the most popular and well-known brand name among both healthcare providers and consumers as well. The company brings together the expertise of patient monitoring and connected health solutions to the curved temperature patch market. Philips is well known for its smart health technology and has successfully developed wearable patches that combine temperature sensing with other significant signs, offering proper monitoring.

- Nutromics is an innovative Australia-based startup that has made waves with its lab on a patch concept. Also, their wearable devices utilize advanced biosensors to detect temperature along with biochemical markers in sweat or interstitial fluid. This approach not only tracks temperature but also provides early diagnosis of conditions such as infections or heart attacks.

Below is the list of some prominent players operating in the global market:

The global curved temperature monitor patch market is readily dominated by the U.S. and Europe-based firms that leverage regulatory approvals as well as remote patient monitoring reimbursement policies. Leading pioneers such as 3M and Abbott are leveraging industrial-grade and diabetes-focused patches, whereas Philips and Medtronic are targeting hospital integrations. In March 2025, SSG Capital Advisors reported that it served as the investment banker to Blue Spark Technologies, Inc. in the sale of substantially all its assets to BST Technology Acquisition, Inc. Blue Spark is the central player specializing in wearable vital sign monitoring devices, notably the FDA and CE-cleared TempTraq, which is a wireless temperature patch transmitting data for up to 72 hours.

Corporate Landscape of the Curved Temperature Monitor Patch Market:

Recent Developments

- In April 2025, Baxter International announced the launch of the Hemopatch Sealing Hemostat with room temperature storage across Europe, improving accessibility for surgeons by eliminating refrigeration needs, offering effective tissue sealing and hemostasis in both open and minimally invasive surgeries.

- In November 2024, Henkel and Linxens collaborated to develop an innovative electronic skin patch featuring advanced micro-heating technology, which is aimed at improving patient comfort in medical wearables which This patch, created using printed electronics on flexible foils, can be integrated into thin, comfortable skin patches for medical applications.

- Report ID: 7869

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.