Global Intraspinal Abscess Treatment Market Size, Forecast, and Trend Highlights Over 2025-2037

Intraspinal Abscess Treatment Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 3.1 billion by the end of 2037, rising at a CAGR of 7.1% during the forecast period 2025-2037. In 2025, the industry size of intraspinal abscess treatment is evaluated at USD 1.6 billion.

Rising cases of spinal infections, such as osteomyelitis and discitis, are becoming a global health concern, driving demand in the intraspinal abscess treatment market. According to the CDC, the annual number of incidences of the associated ailment was 250,020 till 2024, exhibiting a 3.2-5.3% year-over-year (YoY) increment rate. Another NIH report calculated the rise in hospitalizations due to the same spinal illness to be 12.4% from 2020 to 2023. Additionally, the heightening worldwide prevalence of diabetes, spinal surgeries, obesity, and immunosuppressive conditions is propelling the volume of this demography. This indicates a surge in effective curatives, including antibiotics, surgical devices, and imaging agents, contributing to the ongoing business flow in this sector.

The payers’ pricing availed by the involved associates in the intraspinal abscess treatment market highly depends on the raw material supply chain and production capabilities. Thus, inflation in the overall cost of the required components and a shortage of sufficient localized supply chains are impacting individual competency in offering comprehensive pricing. For instance, in 2023, the producer price index (PPI) of spinal infection treatments rose by 4.5%. Simultaneously, CMS observed a 6.4% increment in the consumer price index (CPI) of hospital-administered intraspinal treatments. This showcases the presence of the risk of patients’ financial exhaustion, creating an economic barrier and restricting worldwide adoption. However, new technologies are being introduced to reduce this burden.

Intraspinal Abscess Treatment Market: Growth Drivers and Challenges

Growth Drivers

- Improvements in accessibility and quality of healthcare: The clinical studies, demonstrating the significant contribution of hospital admissions, are fuelling innovation of cost-effective solutions and approaches to minimize the need for visits. This also highlighted the importance of early-stage diagnosis to obtain the best patient outcomes, ensuring the effectiveness of the available options in the intraspinal abscess treatment market. For instance, during a 2022 AHRQ study, it was established that early therapy implementation can reduce the rate of hospitalization by 22.3% and showcased its ability to save around USD 1.4 billion in healthcare expenses in U.S. settings over 2 years.

- Advanced technologies to streamline operations: The ongoing advances in diagnostic imaging are revolutionizing the accuracy and efficacy of commodities from the intraspinal abscess treatment market. The benefits of utilizing automated magnetic resonance imaging (MRI) analysis in both diagnosis and treatment prognosis are highly praised and desired by clinical settings around the world. For instance, a recent NIH study found the potential of an AI-driven detection tool to be effective in reducing identification time by 50.2% for each clinical trial. Such results are inspiring MedTech pioneers to develop technologically advanced solutions. In this regard, in 2024, Medtronic unveiled an AI-based spinal drainage system, delivering 20.1% faster detection.

Challenges

- Financial exhaustion and economic disparities: Despite cost reduction during treatment, the high initial cost of enrolment for the available options in the intraspinal abscess treatment market often creates economic barriers among patients, particularly from resource-constrained regions. For instance, in 2024, the co-pays for minimally invasive abscess surgeries rose to USD 2556.5 in Germany, eliminating the accessibility of 20.4% of eligible patients. Additionally, the absence of adequate reimbursement policies also deters wide adoption in this sector. In this regard, the Government of Brazil revealed that over 70.5% of the patients requiring advanced spinal treatments in Brazil were not covered by SUS.

Intraspinal Abscess Treatment Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.1% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2037) |

USD 3.1 billion |

|

Regional Scope |

|

Intraspinal Abscess Treatment Segmentation

Type (Epidural Abscess, Subdural Abscess, Intramedullary Abscess)

Based on type, the epidural abscess segment is predicted to capture the largest share of 42.5% in the intraspinal abscess treatment market over the assessed timeline. This kind of spinal infection is more prevalent than the other type, making it a priority for both consumers and healthcare service providers. The close association of its occurrence with diabetes and post-surgical complications also propels the patient pool of this segment. According to the CDC report, the incidences of infections after surgeries increased by 15.3% by 2024 from 2020. Additionally, NIH revealed that the rate of enrollment for diagnosis in this discipline rose by 25.4% in the U.S. and Europe due to the increased popularity and adoption of MRI.

End user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers)

In terms of end users, the hospitals segment is anticipated to show dominance over the intraspinal abscess treatment market with a share of 55.4% by the end of 2037. The essentiality of hospitalization to treat afflicted patients is the primary driver behind this segment’s augmentation. As per WHO, over 65.3% of spinal abscess candidates need to be admitted to hospitals for complete treatment. Moreover, the cost of surgical interventions performed in these organizations is remarkably high, averaging up to USD 18,000.5 per case, resulting in higher revenue generation than in other clinical settings. Further, the proven efficacy of MRI-guided drainage and targeted antibiotic therapy, improving recovery times by 30.5% in leading U.S. hospitals, are also contributing to this segment’s growth.

Our in-depth analysis of the global intraspinal abscess treatment market includes the following segments:

|

Type |

|

|

Treatment |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

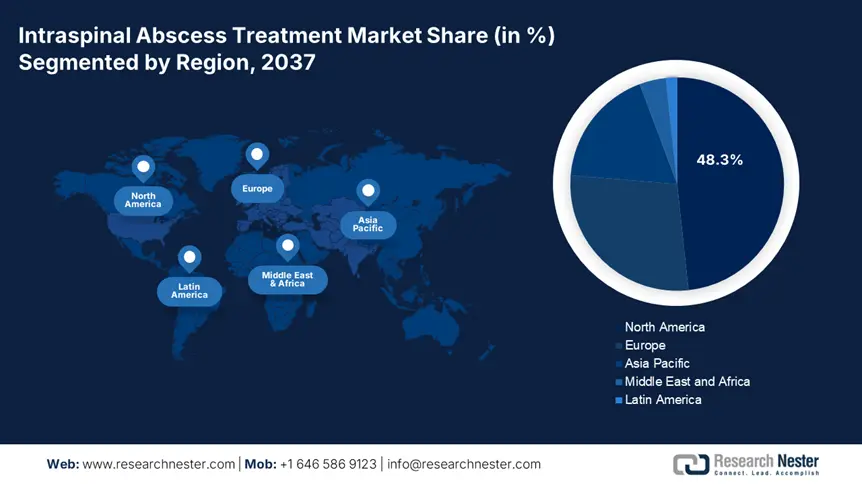

Intraspinal Abscess Treatment Industry - Regional Synopsis

North America Market Forecast

North America is poised to dominate the intraspinal abscess treatment market with a share of 48.3% throughout the discussed timeframe. This region is the origin of a large patient pool, pushing both public and private organizations to accommodate high-end solutions. For instance, in 2024, a CDC report calculated the number of new intraspinal abscess incidences in North America to be 45,030, representing a 9.4% rise from 2020. Its leadership is also attributable to Federal investments and technological advancements. For instance, till 2024, approximately 8.4% of the Federal Health Budget, totaling USD 3.4 billion, was dedicated to offering financial support to the spinal infection category in Canada. Similarly, in Ontario, a notable improvement in public access was observed by an 18.4% increment in spending from 2021 to 2024.

The U.S. is presenting a new scope of doing profitable business in the intraspinal abscess treatment market due to the widespread drug resistance among afflicted citizens. In this regard, the CDC reported that over 35.6% of cases from this particular patient pool in this country were resistant to methicillin, urging for alternatives. Additionally, the support from Medicare & Medicaid Services is significantly contributing to the nation’s recovery from the reimbursement gap by expanding their coverage in this category. For instance, in 2023, the net U.S. Medicare expenditure on intraspinal abscess treatment reached USD 850.4 million, saving USD 3200.4 out-of-pocket cost per patient. Furthermore, the nation’s spinal surgical device imports rose by 12.3% in 2024, attracting foreign forces to invest.

APAC Market Forecast

The Asia Pacific intraspinal abscess treatment market is projected to register the fastest growth by 2037. Several factors, such as the enlarging patient pool, investments in infrastructure, and favorable government initiatives, are driving the region’s remarkable pace of expansion and innovation in this sector. Its diverse demography and dynamics present a wide range of investment opportunities for both domestic and global pioneers. For instance, in Australia, the next-generation antibiotics segment is offering scope for garnering an annual sales value of USD 350.4 million from MSRA spinal infections. Simultaneously, South Korea and Malaysia are focusing on advanced surgical developments, such as minimally invasive techniques, to reduce the need for hospitalization expenses by 20.3%.

China is becoming a lucrative landscape of revenue generation for the intraspinal abscess treatment market due to the rising incidences of this ailment and the ambitious nationwide healthcare reformation. In this regard, the NMPA reported 1.7 million new diagnoses in 2023, among which, 25.4% received surgical treatment. Similarly, the country set its goals of doubling its neurological capacity by 2030, offering new opportunities for medical device suppliers with the potential to generate USD 1.3 billion in revenue. To obtain this level, China spent approximately 4.0 billion in 2024 on this category, demonstrating a notable 15.1% increase from 2019. This pathway is further fueled by proactive government participation in domestic API production escalation and accessibility enhancement.

Companies Dominating the Intraspinal Abscess Treatment Landscape

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (DePuy Synthes)

- Stryker

- Pfizer

- B. Braun

- Siemens Healthineers

- Roche

- Takeda Pharmaceutical

- Terumo Corporation

- Teva Pharmaceuticals

- Lupin Pharmaceuticals

- Dr. Reddy’s Laboratories

- CSL Limited

- Samsung Bioepis

- Yuhan Corporation

- Hikma Pharmaceuticals

- Fresenius Kabi

- Sun Pharmaceutical

- Pharmaniaga

- Mayne Pharma

The intraspinal abscess treatment market is evolving with ongoing discoveries and R&D cohorts in both technological and pharmaceutical disciplines. Key players in this sector are proactively following this pathway of globalizing their new findings and increasing their financial output. Their explorations are also highly focused on mitigating affordability and drug-resistance issues, fostering greater possibilities and new lines of business in this field. Furthermore, the recent penetration of surgical robots and AI assistance & analytics are revolutionizing and enhancing cost-effectiveness while adding the highest quality of diagnosis and therapeutics to this merchandise.

20 of such innovators and commercial giants are:

Recent Developments

- In June 2024, Medtronic revealed promising results after the commercial release of its minimally invasive drainage kit, VertiShield. This pipeline secured USD 1.3 billion in revenue generation, capturing 8.1% of the spinal device industry and showcasing a 40.2% reduction in surgical time during trials in Europe.

- In March 2024, Pfizer announced its achievements with its combination therapy of Ceftriaxone with Vancomycin, EmboCeph, to treat MRSA-resistant spinal abscesses. The company mentioned that it achieved over 12.3% market penetration within 6 months of its launch in North America and is projected to earn USD 450.4 million annually by 2026.

- Report ID: 3454

- Published Date: May 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert