Intelligent Apps Market Outlook:

Intelligent Apps Market size was valued at USD 45 billion in 2025 and is estimated to reach USD 629.9 billion by the end of 2035, expanding at a CAGR of 30.2% throughout the forecast period, from 2026 to 2035. In 2026, the industry size of intelligent apps is estimated at USD 58.5 billion.

The market is driven by the continuous progress in artificial intelligence (AI) and machine learning (ML). These technologies are making it possible to develop applications that are not only automated but also context-aware and adaptive, providing a highly tailored user experience. The growth of the market is further stimulated by growing requirements for data-driven insights and increasing demand for greater efficiency in consumer and enterprise environments. A crucial trend propelling the market growth is the adoption of generative AI, enabling apps to generate content, automate sophisticated workflows, and engage with users in a more natural and conversational way. In February 2024, Salesforce, Inc. unveiled Einstein Copilot and the Einstein Trust Layer, infusing conversational AI in its enterprise apps to securely automate sales, service, and marketing workflows. This trend highlights the industry's emphasis on building smart, trusted, and effective business solutions.

Government policies that are designed to enhance national cybersecurity and advance digital innovation are also fueling the market's growth. As governments set new standards for data security and privacy, the need for smart apps that can comply with these is increasing. These rules are inducing developers to create more secure and reliable apps, creating more trust among users. In May 2024, the U.S. government released Version 2 of the National Cybersecurity Strategy Implementation Plan, which outlines more than 100 initiatives to implement the country's cybersecurity strategy in critical infrastructure and federal networks. This initiative, coupled with similar initiatives around the world, is building a safer and standardized platform for intelligent app development and deployment, further fueling market growth.

Key Intelligent Apps Market Insights Summary:

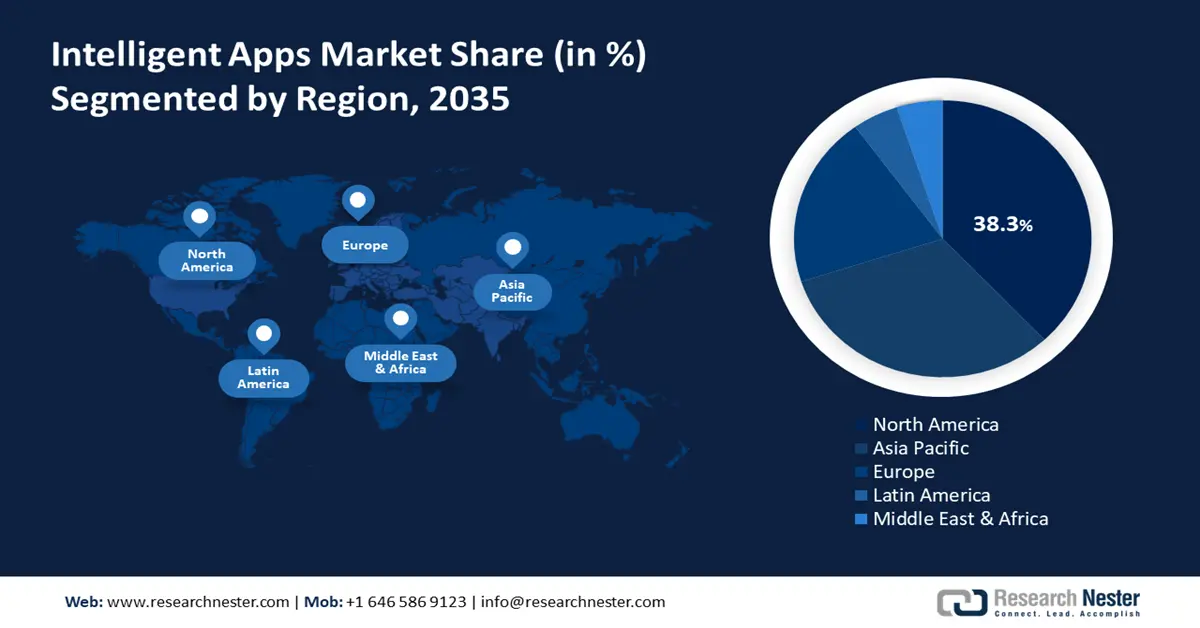

Regional Insights:

- By 2035, North America is projected to command a 38.3% share of the Intelligent Apps Market, spurred by the region’s dense concentration of technology firms and early AI and cloud adoption.

- Across 2026–2035, the Asia Pacific intelligent apps market is expected to grow at a 40% CAGR, fueled by the region’s economic expansion and mobile-first digital population.

Segment Insights:

- By 2035, the enterprise apps segment in the Intelligent Apps Market is projected to hold a 60% share, propelled by the rising need for automation and data-driven decision-making.

- The cloud-based deployment segment is expected to capture a 65.8% share by 2035, supported by the cost-effectiveness, scalability, and flexibility of cloud platforms.

Key Growth Trends:

- Proliferation of AI in enterprise and consumer applications

- Advances in generative AI and conversational interfaces

Major Challenges:

- Data privacy and security concerns

- Difficulty of AI model development and maintenance

Key Players: Google LLC,Microsoft Corporation,Amazon Web Services, Inc.,Apple Inc.,SAP SE,Salesforce, Inc.,Oracle Corporation,IBM Corporation,Samsung Electronics Co., Ltd.,Baidu, Inc.,Infosys Limited,Wipro Limited,Huawei Technologies Co., Ltd.,Cognizant Technology Solutions,Atlassian Corporation Plc

Global Intelligent Apps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45 billion

- 2026 Market Size: USD 58.5 billion

- Projected Market Size: USD 629.9 billion by 2035

- Growth Forecasts: 30.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 26 September, 2025

Intelligent Apps Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of AI in enterprise and consumer applications: The large-scale adoption of AI and ML technologies across both enterprise and consumer applications is a major growth driver for the intelligent apps market. In business life, AI is applied to automate processes, improve decision-making, and offer predictive insights. For customers, AI is offering more tailored and interactive experiences, ranging from smart home gadgets to ride-hailing apps. The capacity of smart apps to learn from how they are used by people and tailor their function on that basis is one of the main reasons for their increasing popularity. In March 2025, Baidu, Inc. extended its Apollo Go robotaxi and intelligent transportation applications with expanded fleet management and real-time traffic optimization to enhance the consumer ride-hailing experience across various Chinese cities. This extension reflects the concrete advantages of AI in developing wiser and more efficient consumer services.

- Advances in generative AI and conversational interfaces: Recent advances in generative AI and natural language processing are changing the potential of clever apps. These developments are making it possible to create advanced conversational interfaces, including chatbots and voice assistants, that can comprehend and reply to user questions in a more human way. Generative AI is also being applied to automate content generation, summarize content, and make smart suggestions. In May 2025, Google LLC introduced new Gemini AI capabilities in Workspace, extending generative support to a collection of productivity applications to enable users to write, summarize, and auto-arrange content more effectively. The inclusion of these sophisticated AI capabilities is increasingly powering smarter apps with greater intelligence and ease of use, leading to their increased adoption across diverse usage scenarios.

- Increasing need for tailored user experiences: There is an increasing demand from users for applications that are customized to their specific needs and interests. Smart apps are best at providing a personalized experience through the use of data and machine learning to learn user behavior and offer context-relevant content and suggestions. Such personalization not only improves user engagement but also customer loyalty and retention. Its capability to provide context-based information and services is one of the main differentiators for smart apps. In April 2025, Samsung Electronics Co., Ltd. released SmartThings enhancements that introduce AI-driven automations, which learn customer habits and automatically manage connected devices. This action enhances the smart consumer IoT app experience with a more automated and personalized smart home setting.

AI & ML Impact on the Intelligent Apps Market

The advent of AI and ML have reshaped the global I-Apps market through the streamlining of product development. Major developers in the market now rely on AI for simulation-based design and hyper-personalization. These tools have allowed companies to reduce time-to-market (TTM). The table below highlights the outcome of AI and ML integration in key players:

|

Company |

AI Application |

Impact |

|

Google (DeepMind) |

Data Center Energy Optimization |

The company's AI system directly controlled data center cooling, resulting in a 40% reduction in energy used for cooling, which contributed to a 15% improvement in overall energy efficiency (PUE). |

|

Microsoft (GitHub) |

AI-Powered Software Development |

In company-led research, developers using the AI tool GitHub Copilot completed coding tasks 55% faster than developers who did not. |

|

NVIDIA |

AI for Drug Discovery |

By using NVIDIA's BioNeMo AI drug discovery platform, the biotech company Recursion was able to "expedite their AI model training from months to days." |

|

Amazon |

AI-Powered Drone Delivery |

The company's Prime Air service uses AI for navigation and safety to achieve its goal of flying packages to customers' homes "in less than an hour." |

|

Meta |

Universal Speech Translation |

The company built SeamlessM4T, a foundational AI translation model that supports speech-to-speech translation for nearly 100 input languages and 35 output languages. |

Source: Google, Microsoft (GitHub), NVIDIA, Amazon, Meta

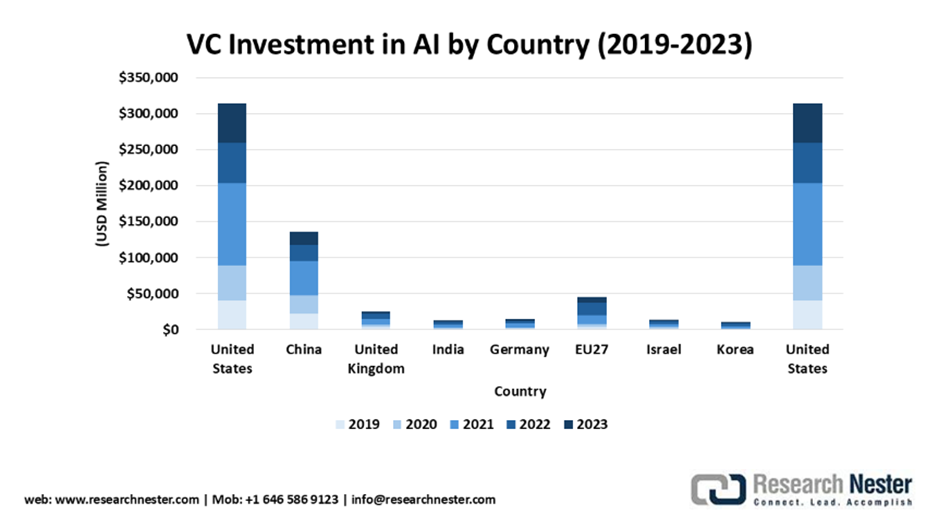

VC Investment in AI by Country (2019-2023)

The U.S. and China lead AI VC investment, with the U.S. peaking at over $114 billion in 2021, driving innovation in intelligent apps for enterprise and consumer use. The EU27 and U.K. show significant growth, reflecting increased focus on AI regulation and scalable SaaS solutions. Emerging hubs like India and Germany highlight global expansion of AI-driven applications in fintech, healthcare, and industrial automation, fueling cross-sector intelligent app development.

Source: OECD

Challenges

- Data privacy and security concerns: The growing dependence of smart apps on large amounts of data creates pertinent privacy and security issues. User data collection and processing can subject individuals to risks to their privacy if not processed accurately. Maintaining the security of such data is also a big issue, as smart apps can become a target for cyber threats. A single breach of data has serious implications, destroying user trust and causing extensive financial and reputational losses. This underlines the constant threats that organizations face and the value of incorporating solid security mechanisms into intelligent app design and development.

- Difficulty of AI model development and maintenance: The development and upkeep of intricate AI and machine learning models that drive intelligent apps can prove to be a major ordeal. Even training and fine-tuning the AI models can take time and consume resources. Maintaining the accuracy and fairness of these models over time is another key challenge since biased training data can produce unintended and dangerous consequences. In September 2025, the FY2025 Cybersecurity R&D Implementation Roadmap of the U.S. federal government identified agency research programs to develop AI security and critical infrastructure resilience. The roadmap recognizes technical challenges in designing secure and trustworthy AI systems and emphasizes conducting further research and development on these technologies.

Intelligent Apps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

30.2% |

|

Base Year Market Size (2025) |

USD 45 billion |

|

Forecast Year Market Size (2035) |

USD 629.9 billion |

|

Regional Scope |

|

Intelligent Apps Market Segmentation:

Type Segment Analysis

The enterprise apps segment is expected to hold a 60% share by 2035. This leadership is driven by the growing need for automation and data-driven decision-making in business. Enterprises are using smart apps to automate workflows, enhance operational efficiency, and lead their market. These apps are being implemented across multiple business functions, ranging from finance and supply chain to customer relationship management. In September 2025, Cognizant Technology Solutions released an AI-driven platform for finance and supply chain. The platform automates invoice processing, streamlines inventory, and forecasts disruptions, thus enhancing enterprise operational resilience and showcasing the tangible value of intelligent enterprise apps.

Deployment Segment Analysis

The cloud-based deployment segment is anticipated to maintain a dominant 65.8% market share through 2035. The cost-effectiveness, flexibility, and scalability of the cloud make it a perfect platform for hosting intelligent apps. Cloud providers provide an array of AI and machine learning services that facilitate developers to develop and deploy intelligent applications without the necessity for large on-premises infrastructure. Amazon Web Services, Inc. launched Amazon Bedrock API keys in July 2025, which make it easier for authentication to generate AI app development. The release accelerates the onboarding of smart apps without losing critical enterprise security controls, enabling developers to take advantage of the cloud's power more easily.

End user Vertical Segment Analysis

The Banking, Financial Services, and Insurance (BFSI) segment is expected to hold a 25.0% share during the forecast period. The BFSI sector is one of the largest users of smart apps, applying them to automate business functions, improve security, and provide personalized customer experiences. Smart apps are applied for anything from risk management and fraud detection to algorithmic trading and personalized finance recommendations. Requirements to meet tough regulations and secure sensitive customer information are also propelling this sector to use secure smart apps. In July 2025, Oracle Corporation unveiled its Oracle Fusion Cloud CX roadmap, which is based on generative and agentic AI. This roadmap is aimed at intelligent automation and AI-powered services to reimagine the customer experience across its CX applications, which are used extensively in the BFSI space.

Our in-depth analysis of the global intelligent apps market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Deployment |

|

|

End user Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intelligent Apps Market - Regional Analysis

North America Market Insights

North America is projected to contribute a 38.3% share of the intelligent apps market by 2035, spurred by a high density of technology firms and early adoption of cloud computing and AI. The region hosts a thriving startup ecosystem of mature players that are experimenting with what is possible with intelligent apps. The healthy venture capital ecosystem and availability of world-class research institutions are also fueling the market's growth.

The U.S. is a significant market in North America, with a rich tradition of innovation and a big and diverse base of consumers. The U.S. government is also a key driver of the market, with huge investments in research and development of AI. In January 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) published its FY2024-2026 Cybersecurity Strategic Plan. This plan harmonizes federal civilian cybersecurity activity with collective defense principles and secure-by-design, which facilitates more secure intelligent applications.

Canada market for intelligent apps continues to expand on the back of a robust tech industry and government efforts toward digital innovation. The government of Canada is funding AI research and has established a welcoming environment for startups and tech firms. In October 2024, the Canadian Centre for Cyber Security officially announced the publication of its National Cyber Threat Assessment for 2025-2026. The assessment gives Canadians important predictions and mitigation priorities, guiding risk management strategies and promoting the use of secure intelligent applications.

Asia Pacific Market Insights

Asia Pacific intelligent apps market is expected to rise at an impressive CAGR of 40% over the forecast period, driven by the region's economic growth and mobile-first population. The surge in smartphone adoption and rising demand for digital services are building a gigantic market for intelligent apps. Regional governments are also heavily investing in digital infrastructure and encouraging the construction of smart cities, which is further stimulating the demand for intelligent technologies.

China is a leader in the APAC market, with a massive population and a government that is heavily invested in becoming an AI hub. Technology firms are leading in AI innovation, producing a diverse array of smart apps for both consumer and enterprise purposes. In May 2024, China's Cyberspace Administration emphasized its continued oversight actions and governance efforts regarding AI and data security. These initiatives are part of a larger drive to promote the safe deployment and regulation of new technologies, influencing the creation of smart apps in the nation.

India is another prominent market in the region, boasting a fast-expanding digital economy and a vast and young population. The government of India's "Digital India" campaign is targeting to make the country a digitally empowered nation, which is generating a high demand for smart apps. In October 2023, the Indian National Security Council Secretariat organized the 'Bharat NCX 2023', a national-level cybersecurity exercise. This activity educated senior management and technical staff from key industries on modern cyber threats and incident management, encouraging a safer environment for the uptake of intelligent apps.

Europe Market Insights

Europe intelligent apps market is estimated to record continued growth, fueled by robust emphasis on data privacy and ethical AI. The GDPR has provided a framework that fosters the creation of trustworthy and transparent intelligent apps. The European Union is investing in AI research and innovation via initiatives like Horizon Europe, which is designed to strengthen the competitiveness of the region in the global technology arena.

Germany is one of Europe's leading markets with a robust industrial sector and emphasis on Industry 4.0. Intelligent apps are being utilized by German businesses to establish smart factories and streamline their production processes. In 2025, the German Federal Office for Information Security remained central to the country's technology assurance and incident coordination. The office's set policy focuses on national resilience and public-private partnership, which is a solid pillar for the development of the intelligent apps market.

The UK is also a lucrative market, with a lively tech startup ecosystem and a keen emphasis on AI research. The UK government has recognized AI as a priority area and is investing in initiatives to drive the development of the AI industry. In May 2025, the UK's National Cyber Security Centre (NCSC) launched new assurance plans at CYBERUK 2025. These plans aim to support organizations in proving their resilience and establishing national confidence in managing cyber risk, important to enable the mass adoption of smart apps.

Key Intelligent Apps Market Players:

- Google LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Amazon Web Services, Inc.

- Apple Inc.

- SAP SE

- Salesforce, Inc.

- Oracle Corporation

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Baidu, Inc.

- Infosys Limited

- Wipro Limited

- Huawei Technologies Co., Ltd.

- Cognizant Technology Solutions

- Atlassian Corporation Plc

The market for intelligent apps is extremely competitive, and there is a wide variety of participants, ranging from technology behemoths to disruptive startups, competing for market share. Market leaders like Google LLC, Microsoft Corporation, and Amazon Web Services, Inc. are using their leadership in cloud computing and AI to provide end-to-end platforms for developing and deploying intelligent apps. The competitive environment is also influenced by strategic partnerships and developer ecosystem building in earnest. In March 2023, Microsoft Corporation announced wider availability of its Copilot within Microsoft 365, introducing an AI assistant to its productivity app portfolio to facilitate users in creating content, analyzing data, and summarizing meetings.

The industry is also marked by high levels of merger and acquisition activity, where companies seek to acquire specialized knowledge and technology to bolster their product lines. The trend is causing the market to consolidate and give rise to more integrated and influential intelligent app platforms. In May 2025, IBM Corporation showcased developments in its WatsonX platform during its Think 2025 conference. The developments are intended to break data fragmentation constraints and deliver quicker, more accurate, and scalable generative-AI-powered intelligent apps within hybrid cloud estates. This emphasis on enterprise-class AI and data management is a defining differentiator for IBM in the competitive market.

Here are some leading companies in the intelligent apps market:

Recent Developments

- In September 2025, Microsoft Corporation announced new AI-powered capabilities across Dynamics 365 apps, adding deeper customer journey orchestration, predictive lead scoring, and automated service workflows to operationalize hyper-personalized enterprise experiences. These enhancements aim to empower businesses with more intelligent and efficient customer engagement strategies, driving significant improvements in customer satisfaction and operational efficiency.

- In June 2025, SAP SE unveiled a major SAP Business Technology Platform update that integrates generative AI and advanced analytics to accelerate the development and extension of intelligent enterprise applications. This update emphasizes SAP's commitment to infusing AI into its core offerings, enabling developers to build more sophisticated and intelligent applications with greater speed and ease.

- In June 2025, Oracle Corporation released Oracle Fusion Cloud HCM updates featuring an intelligent recruiting assistant, personalized growth paths, and predictive workforce analytics to bring AI-driven insights into HR applications. These new features are designed to optimize talent acquisition and development, providing HR professionals with advanced tools to identify, nurture, and retain top talent.

- Report ID: 2968

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intelligent Apps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.