Integrated Passive Devices Market Outlook:

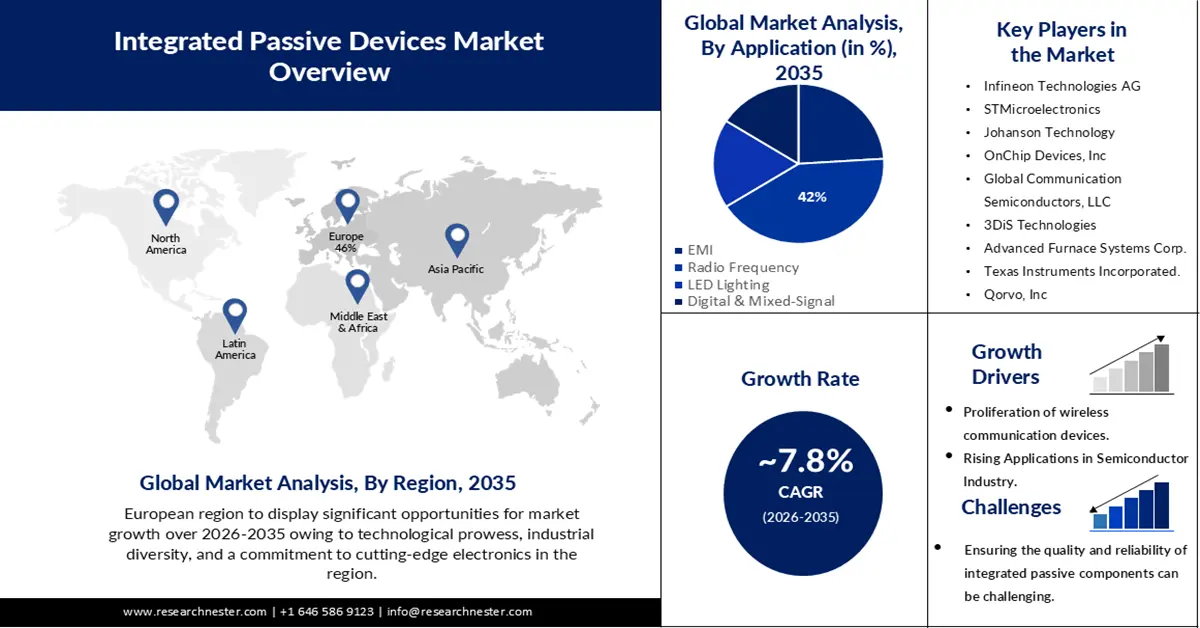

Integrated Passive Devices Market size was valued at USD 1.59 billion in 2025 and is set to exceed USD 3.37 billion by 2035, registering over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of integrated passive devices is estimated at USD 1.7 billion.

The proliferation of wireless communication devices has increased demand for Integrated Passive Devices (IPDs). As per estimates, there were around 8 billion wireless subscriptions, by the end of 2021. These devices require various passive components like filters, baluns, and couplers, which can be integrated into a single chip using IPD technology. This integration reduces the space required and enhances the performance of the device. With the growing popularity of smartphones, tablets, smartwatches, and IoT devices, the demand for IPDs is expected to increase further. According to RNPL Analysts IoT connections increased by 18%, IoT analytics projects that that by 2023, there will be 16.7 billion active endpoints worldwide. The technology offers a cost-effective solution for miniaturization and high performance in electronic devices.

Also, the global rollout of 5G networks demands high-performance and compact components. Integrated passive devices (IPD) play a crucial role in 5G infrastructure by providing essential passive components for single filtering, impedance matching, and frequency tuning in RF front-end modules. Between the end of 2021 and the end of 2022, the number of 5G wireless connections worldwide climbed by 76%, to a maximum of 1.05 billion. As 5G adoption grows, so does the demand for IPDs.

Key Integrated Passive Devices Market Insights Summary:

Regional Highlights:

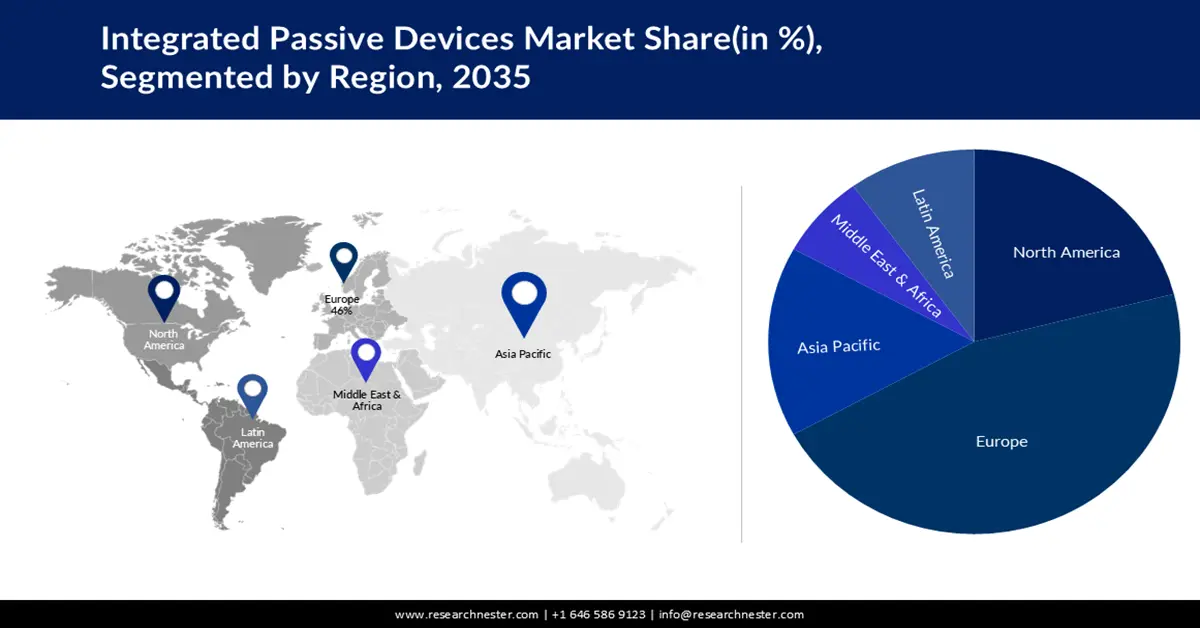

- Europe integrated passive devices market is anticipated to achieve a 46% share by 2035, driven by technological prowess, industrial diversity, and a commitment to cutting-edge electronics.

Segment Insights:

- The radio frequency segment in the integrated passive devices market is projected to secure a 42% share by 2035, fueled by growing utilization of consumer electronics and the advent of 5G.

- The automotive segment in the integrated passive devices market is anticipated to achieve a majority of revenue share by 2035, driven by increasing reliance on sophisticated electronics in vehicles.

Key Growth Trends:

- Advancements in Semiconductor Manufacturing

- Automotive Electronics and IoT Growth

Major Challenges:

- Ensuring the quality and reliability of integrated passive components can be challenging.

Key Players: Integrated Passive Devices, Infineon Technologies AG, STMicroelectronics, Johanson Technology, OnChip Devices, Inc, Global Communication Semiconductors, LLC, 3DiS Technologies, Advanced Furnace Systems Corp., Texas Instruments Incorporated., Qorvo, Inc, Broadcom.

Global Integrated Passive Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.59 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.37 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Taiwan

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 16 September, 2025

Integrated Passive Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in Semiconductor Manufacturing- Technological advancements in semiconductor fabrication techniques have led to the development of advanced packaging technologies, enabling the integration of passive components into a single chip. This integration enhances the overall performance, reduces power consumption, and optimizes space utilization within electronic systems.

-

Miniaturization in Electronics - As consumer demand for smaller, lighter, and more efficient electronic devices increases, the need for compact components like IPDs rises. IPDs offer a smaller footprint compared to discrete passive components, enabling products such as smartphones, wearables, and IoT devices.

-

Automotive Electronics and IoT Growth- The automotive industry’s Shift towards electric vehicles (EVs), connected cars, and IoT integration within vehicles necessitates smaller and more reliable electronic components. IPDs offer advantages in terms of size, reliability, and performance, making them suitable for automotive applications.

-

Cost and Space Efficiency- Integration of passive components into a single chip reduces the overall cost of manufacturing by eliminating the need for separate assembly of discrete components. Additionally, it saves valuable space on the PCB (Printed Circuit Board), allowing manufacturers to design more compact and feature-rich devices.

Challenges

-

Complex Design and Fabrication- The design and fabrication of IPDs can be intricate due to the integration of various passive components into a single chip. Achieving high levels of integration without compromising performance requires sophisticated design techniques and manufacturing processes, which can increase development costs and complexity.

-

Shrinking the size of components in IPDs to meet the demands of miniaturization can pose challenges in terms of reliability.

-

Ensuring the quality and reliability of integrated passive components can be challenging.

Integrated Passive Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 1.59 billion |

|

Forecast Year Market Size (2035) |

USD 3.37 billion |

|

Regional Scope |

|

Integrated Passive Devices Market Segmentation:

Application Segment Analysis

The radio frequency segment is anticipated to hold 42% share of the global integrated passive devices market during the forecast period. As estimated, the radio frequency components garner a revenue of around USD 26 billion in 2021. The radio frequency segment is witnessing a surge in demand due to the growing utilization of consumer electronics such as notebooks, smartphones, tablets, game consoles, wearables, and other white goods. Among these, smartphones are the major driving factor for the increasing market of the radio frequency segment. With the advent of 5G technology, there is an increasing need for the deployment of radio frequency components in smartphones. This, in turn, is expected to further drive the growth of the radio frequency segment in the consumer electronics industry.

End-User Segment Analysis

The automotive segment is expected to possess the majority of revenue share in the integrated passive devices market due to the sector's increasing reliance on sophisticated electronics. As vehicles evolve toward electric, connected, and autonomous systems, IPDs offer compact, reliable solutions for space-constrained automotive electronics. As observed by RNPL Analysts, 40% Less Footprint Is Made Possible by Renesas Automotive IPD. IPDs enable size reduction, enhanced functionality, and improved performance in critical applications like sensor systems, power management, connectivity modules, and infotainment systems, driving their extensive adoption and prominence within the automotive industry.

Our in-depth analysis of the global integrated passive devices market includes the following segments:

|

Application |

|

|

End-User |

|

|

Material |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Integrated Passive Devices Market Regional Analysis:

European Market Insights

Europe industry is set to hold largest revenue share of 46% by 2035. The market’s growth in the region is fuelled by technological prowess, industrial diversity, and a commitment to cutting-edge electronics. With a solid foundation in semiconductor research and manufacturing, European nations drive innovations in IPD technology, enabling the integration of various passive components into compact, high-performance chips. This integration finds significant applications in Europe’s automotive sector, facilitating advancements in electric vehicles, connected cars, and industrial automation. Additionally, the region’s focus on 5G technology and telecommunications infrastructure fuels the demand for IPDs in high-frequency RF components. The availability of continuous 5G wireless broadband service for all urban areas and transit routes by 2025 and 5G coverage of all populated areas by 2030 are among the primary connectivity goals set forward by the EU. 72% of EU citizens are currently covered with 5G, according to official figures. Collaborations among research institutions, industries, and government initiatives bolster the development of specialized Integrated Passive Devices solutions, ensuring Europe's position as a pivotal player in shaping the future of integrated passive devices across multiple sectors.

North American Market Insights

North America integrated passive devices market is expected to garner noteworthy revenue share. North America is a driving force in integrated passive devices (IPD) technology. The region's focus on cutting-edge semiconductor manufacturing and design capabilities, along with a robust consumer electronics market, leads to a high demand for compact, feature-rich devices such as smartphones, wearables, and IoT gadgets. Furthermore, the rapid deployment of 5G networks and North America's leadership in telecommunications fuel the need for IPDs in high-frequency RF components. The automotive sector also leverages IPDs for innovations in electric vehicles and connected car technologies. Through collaborations between tech giants, research institutions, and semiconductor companies, North America pushes the boundaries of IPD advancements, shaping the electronics industry across industries.

Integrated Passive Devices Market Players:

- Integrated Passive Devices

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infineon Technologies AG

- STMicroelectronics

- Johanson Technology

- OnChip Devices, Inc

- Global Communication Semiconductors, LLC

- 3DiS Technologies

- Advanced Furnace Systems Corp.

- Texas Instruments Incorporated.

- Qorvo, Inc

- Broadcom.

Recent Developments

- Leading semiconductor product supplier MACOM Technology Solutions Inc. ("MACOM") announced a partnership that shows how its VCSEL driver and trans-impedance amplifier (TIA) and Broadcom's VCSEL laser, photodetector, and PAM-4 DSP can work together for 100Gbps per lane multi-mode fiber (MMF) applications.

- The details of STMicroelectronics' (NYSE: STM) partnership with Microsoft, an ST Authorized partner, to enhance the security of new Internet-of-Things (IoT) applications have been made public. STMicroelectronics is a leading worldwide semiconductor company that serves clients in a variety of electronics applications.

- Report ID: 5490

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Integrated Passive Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.