Insulin Pen Cap Market Outlook:

Insulin Pen Cap Market size was valued at USD 500.3 million in 2025 and is projected to reach USD 983.8 million by the end of 2035, rising at a CAGR of 7.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of insulin pen cap is estimated at USD 535.7 million.

The rising occurrence of diabetes and the increasing adoption of insulin pen caps as a convenient and user-friendly method of insulin delivery are fostering a highly profitable business environment for the insulin pen cap market. According to an article published by the World Health Organization in November 2024, the people living with diabetes surpassed 830 million in 2022, wherein a faster rise is witnessed in low- and middle-income countries. It also stated that in the same year, 14% of adults aged 18 and older had diabetes, which caused 1.6 million deaths in 2021, denoting the presence of a strong consumer base.

Furthermore, the study by the National Institute of Health in February 2023 revealed that approximately 7.4 million people in the U.S. with diabetes use insulin, and total insulin expenditure nearly doubled per person after the Affordable Care Act. Also, for insured individuals, out-of-pocket costs were relatively stable or decreased slightly, as insurance absorbed most of the rising costs. Meanwhile, uninsured patients experienced a significant increase in insulin OOP expenses, rising from USD 1,678 to USD 2,800 on a yearly basis post-ACA.

Key Insulin Pen Cap Market Insights Summary:

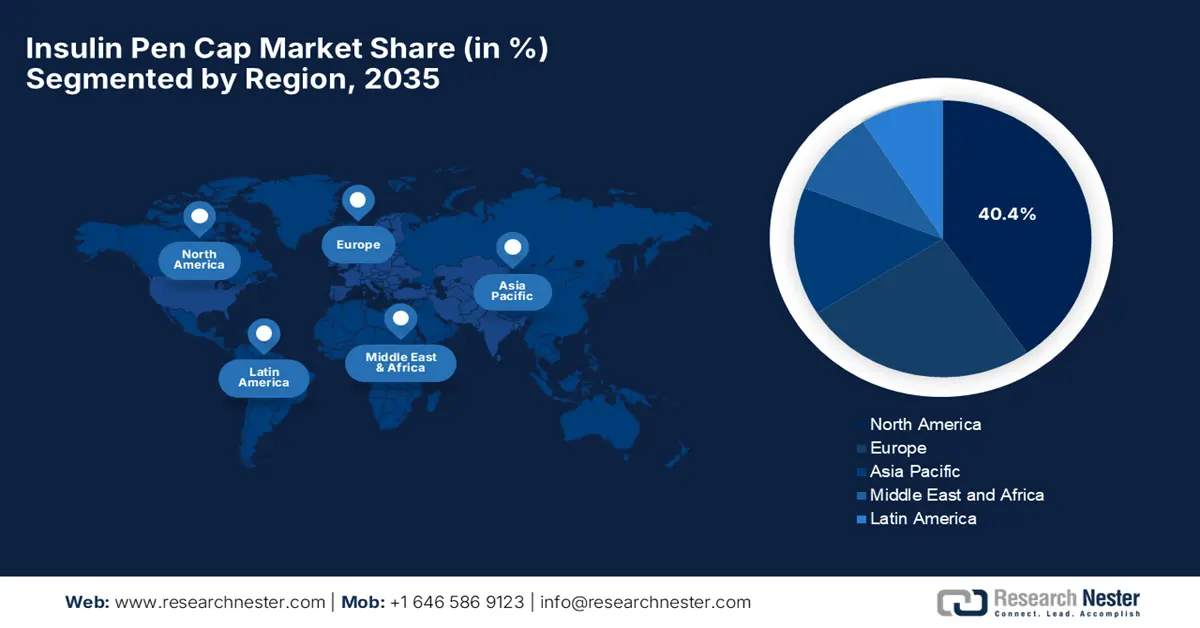

Regional Highlights:

- The North America insulin pen cap market is anticipated to command a 40.4% revenue share by 2035, attributed to advanced healthcare infrastructure and strategic collaborations between healthcare providers and medical device companies.

- The Asia Pacific region is projected to record the fastest growth from 2026 to 2035, impelled by rising awareness of diabetes management and rapid adoption of modern drug delivery devices.

Segment Insights:

- The smart caps segment of the insulin pen cap market is projected to hold the largest revenue share of 55.7% during 2026–2035, propelled by the integration of digital health technologies to enhance diabetes management.

- The reusable pen caps segment is anticipated to secure a 28.5% share by 2035, fueled by the growing adoption of reusable pens for their cost-effectiveness and reduced plastic usage.

Key Growth Trends:

- Shift towards patient-centric delivery systems

- Escalating home care trends

Major Challenges:

- Limited compatibility across devices

- Data privacy & security concerns

Key Players: Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Sanofi (France), Ypsomed Holding AG (Switzerland), Emperra GmbH E-Health Technologies (Germany), Companion Medical, part of Medtronic (U.S.), Bigfoot Biomedical (U.S.), Diabnext (France), Jiangsu Delfu Medical Device Co., Ltd. (China), Berlin-Chemie AG, a Menarini Group Company (Germany), HTL-Strefa S.A. (Poland), B. Braun SE (Germany), Terumo Corporation (Japan), Owen Mumford Ltd. (UK), Medtronic plc (Ireland), Insulet Corporation (U.S.), Roche Diabetes Care, Inc. (Switzerland), ARKRAY, Inc. (Japan), Becton, Dickinson and Company (BD) (U.S.), NIPRO Medical Corporation (Japan)

Global Insulin Pen Cap Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 500.3 million

- 2026 Market Size: USD 535.7 million

- Projected Market Size: USD 983.8 million by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 22 October, 2025

Insulin Pen Cap Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards patient-centric delivery systems: The consumer preference for convenient insulin pens when compared to vials and syringes has witnessed a rise over recent years, which is appreciably driving growth in this market. IDF in August 2023 reported that it welcomed the inclusion of insulin pens in the WHO essential medicines list in 2023, which underscores the growing recognition of preference for pen-based insulin delivery. It also stated that a survey by T1International found that people with diabetes favor insulin pens due to their ease of use, dosing accuracy, and suitability in a variety of environments.

- Escalating home care trends: The healthcare systems across all nations are deliberately emphasizing self-care and home-based management for diseases, which can be witnessed through more diabetic patients managing their insulin at home. As per an article published by the CDC in May 2024, its diabetes self-management education and support program assists individuals with diabetes to manage their condition at home through coaching and practical skill-building. Hence, such programs reflect the broader shift toward patient-led healthcare, denoting a positive market outlook.

- Enhanced materials & manufacturing innovation: The innovations in terms of materials, such as better plastics, more durable or lighter components, and manufacturing processes, are enhancing the product performance in this market. For instance, in October 2024, TekniPlex Healthcare introduced ISCC PLUS-certified bio-based medical-grade PVC compounds that match the performance of conventional PVC, thereby offering up to 90% CO₂ reduction. Hence, the introduction of such sustainable, high-performance materials encourages both manufacturers and consumers to adopt upgraded cap designs that align with environmental goals.

Top 10 Countries or Territories by Number of Adults (20-79 years) with Diabetes in 2021 and Projected for 2045 (in millions)

|

Country/Territory (2021) |

People with Diabetes (2021, millions) |

Country/Territory (2045) |

People with Diabetes (2045, millions) |

|

China |

140.9 |

China |

174.4 |

|

India |

74.2 |

India |

124.9 |

|

Pakistan |

33.0 |

Pakistan |

62.2 |

|

U.S. |

32.2 |

U.S. |

36.3 |

|

Indonesia |

19.5 |

Indonesia |

28.6 |

|

Brazil |

15.7 |

Brazil |

23.2 |

|

Mexico |

14.1 |

Bangladesh |

22.3 |

|

Bangladesh |

13.1 |

Mexico |

21.2 |

|

Japan |

11.0 |

Egypt |

20.0 |

|

Egypt |

10.9 |

Turkey |

13.4 |

Source: NIH

Major Partnerships and Developments in Connected Insulin Solutions and Automated Delivery Systems

|

Year |

Company |

Collaboration/Announcement |

Description |

|

2025 |

Tandem Diabetes Care & UVA Center |

Multi-year research collaboration on closed-loop insulin systems |

Advancing fully automated insulin delivery R&D |

|

2021 |

WellDoc & Eli Lilly |

Integration of the BlueStar app into Lilly’s connected insulin solutions |

Digital insulin management app integration |

|

2021 |

Eli Lilly & Dexcom, Glooko, myDiabby, Roche |

International agreements for Tempo Pen and Tempo Smart Button compatibility |

Connected insulin pen data integration globally |

Source: Company Official Press Releases

Challenges

- Limited compatibility across devices: One of the most considerable challenges in the insulin pen cap market is the lack of proper standardization and compatibility across different insulin pen brands and models. Besides, most of the insulin caps are designed for specific pens, which limits adoption among users who are utilizing multiple insulin types. This, in turn, complicates the procurement for healthcare systems, hindering widespread utilization.

- Data privacy & security concerns: Smart insulin pen caps collect and transfer health data, which includes dosing patterns and glucose levels which is leading to concerns of data security. The absence of adequate cybersecurity protections or non-compliance with data protection laws such as HIPAA or GDPR can lead to healthcare systems to data breached by exposing patient data. Therefore, ensuring end-to-end encryption and regulatory compliance remains a major obstacle in this field.

Insulin Pen Cap Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 500.3 million |

|

Forecast Year Market Size (2035) |

USD 983.8 million |

|

Regional Scope |

|

Insulin Pen Cap Market Segmentation:

Product Type Segment Analysis

Smart caps segment is projected to garner the largest revenue share of 55.7% in the market during the forecast timeline. The integration of digital health technologies to improve diabetes management is the key factor driving the dominance of this segment. In December 2022, BIOCORP reported that it received 510(k) FDA clearance for its smart insulin pen cap, Mallya, which automatically captures and transmits insulin dose data to a digital app, supporting multitherapy tracking across various pen types, hence encouraging more firms to establish their footprint in this segment.

Pen Type Segment Analysis

In terms of pen type reusable pen caps segment is predicted to capture a market share of 28.5% by the end of 2035. The widespread use of reusable pens due to their cost-effectiveness and low plastic usage when compared to disposable pens is propelling growth in this segment. As per an article published by Frontiers in March 2022, Reusable insulin pens revolutionized insulin delivery, wherein Novo Nordisk is offering greater convenience, accuracy, and flexibility compared to traditional syringes. It also stated that major manufacturers such as Eli Lilly and Sanofi followed with their own devices, making reusable pens a preferred choice for long-term insulin therapy across all nations.

Distribution Channel Segment Analysis

Based on the distribution channel hospital pharmacies segment is anticipated to gain a lucrative share of 25.3% in the market during the analyzed time frame. The growth in the segment originates from the high volume of initial insulin prescriptions and diabetes management guidance provided in clinical settings. Also, most of the diabetes diagnoses and treatment plans are initiated and adjusted based on clinical care, which is ensured through a steady demand from hospital pharmacies, thus denoting a wider segment scope.

Our in-depth analysis of the insulin pen cap market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Pen Type |

|

|

Distribution Channel |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insulin Pen Cap Market - Regional Analysis

North America Market Insights

North America market is identified as the dominating region, capturing the largest revenue share of 40.4% by the end of 2035. The region’s advanced healthcare infrastructure and collaborations between healthcare providers and medical device companies are the key factors behind this leadership. For instance, in August 2024, Abbott announced a partnership with Medtronic to integrate its FreeStyle Libre continuous glucose monitoring technology with Medtronic’s automated insulin delivery and smart insulin pen systems, thus enhancing patient choice and simplifying diabetes care.

The U.S. remains the key contributor to growth in the regional market owing to the significant healthcare spending and the presence of leading pharmaceutical and medical device manufacturers and their strategic activities. For instance, in October 2025, Ypsomed reported that it is establishing its first U.S. manufacturing facility in North Carolina, investing around CHF 200 million (USD 215 million) to enhance production capacity and serve the domestic patients, hence suitable for standard market growth.

Canada is successfully portraying steady growth in the insulin pen cap market, owing to the strong focus on quality and compliance with substantial funding grants. Testifying this Health Canada in February 2024 announced plans to advance universal pharmacare, which also includes single-payer coverage for essential diabetes medications and supplies across different provinces and territories. It also stated that the initiative aims to improve access to insulin and plans to establish a dedicated fund to support access to diabetes devices and supplies such as insulin pens, pen caps, syringes, glucose test strips, and continuous glucose monitors.

Government of Canada Diabetes-Related Funding Initiatives

|

Initiative |

Amount |

Duration |

Purpose |

|

National Framework for Diabetes & Research Initiatives |

USD 25 million |

5 years (2021–2026) |

Develop a national framework, support diabetes research, surveillance, and prevention. |

|

— Partnership to Defeat Diabetes (CIHR & Breakthrough T1D) |

USD 15 million (Government) |

5 years |

Jointly fund USD 30 million in Type 1 diabetes research (with USD 15 million from Breakthrough T1D donors). |

|

— Diabetes Prevention Challenge (Impact Canada) |

USD 10 million |

5 years |

Identify new approaches and test interventions to reduce risks associated with Type 2 diabetes. |

|

Healthy Canadians and Communities Fund |

USD 20 million/year |

Ongoing |

Promote healthy living (e.g., physical activity, healthy eating, tobacco cessation). |

Source: Health Canada

APAC Market Insights

Asia Pacific market is likely to grow at the fastest rate from 2026 to 2035, efficiently supported by increasing awareness of diabetes management and the adoption of modern drug delivery devices. In February 2025, Gan & Lee Pharmaceuticals notified that its insulin glargine injection and prefilled pen are approved in Malaysia, which underscores the company’s strong regulatory and quality capabilities. Therefore, the availability of these insulin products will enhance treatment access and healthcare outcomes in this region.

China is gaining traction in the market, highly attributed to the integration of advanced medical devices into national healthcare plans and local production of diabetes management tools. On the other hand, urbanization and enhanced access to healthcare services have contributed to the rise in the utilization of insulin pens and their accessories as well. Furthermore, the country’s government is aimed at improving diabetes infrastructure, thus fostering a reliable demand for insulin pen caps.

India is one of the central players in the insulin pen cap market, which is efficiently fueled by the heightened demand for convenient insulin delivery solutions. In addition, the rise of both private and increased availability of insulin delivery devices, thereby providing encouraging opportunities for both domestic and international pen cap suppliers. In September 2024, IIT Madras launched the Shankar Center of Excellence for diabetic research, wherein funding was received from an alumnus. Subramonian Shankar, aiming to drive innovation in diabetes research and technology development. Hence, the center will support start-ups and bridge academic research with industry applications.

Europe Market Insights

Europe market is readily blistering growth, highly influenced by its mature healthcare infrastructure and a strong adoption of advanced drug delivery technologies. For instance, in November 2024, Medtronic reported that it received U.S. FDA clearance for its new InPen app, which now includes missed meal dose detection, enabling the upcoming launch of its Smart MDI system paired with the Simplera continuous glucose monitor. This marks the first to offer real-time, personalized recommendations to correct missed or inaccurate insulin doses for people using multiple daily injections.

The U.K. is presenting an optimistic opportunity for players in the insulin pen cap market owing to the presence of a well-established national health system and proactive diabetes management programs. Simultaneously, the NHS-backed initiatives that emphasize digital health have encouraged the adoption of insulin delivery accessories that improve patient adherence and monitoring. The country’s market also benefits from a has a strong emphasis on preventative care and long-term disease management, gaining interest in tools that provide data-driven insights.

France is the representation of an influential landscape for the market, facilitated by the digital health adoption, ongoing innovations that enhance medication adherence, and real-time monitoring. In January 2024, the U.S. FDA reported that Biocorp Production’s Solosmart injection pen adapter is cleared under 510(k) as a Class II medical device substantially equivalent to its predicate, the Mallya device. The SoloSmart is a smart cap designed to fit specific Sanofi insulin pens, capturing and wirelessly transmitting dose and timing data via Bluetooth Low Energy to a mobile application.

Key Insulin Pen Cap Market Players:

- Novo Nordisk A/S (Denmark)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company (U.S.)

- Sanofi (France)

- Ypsomed Holding AG (Switzerland)

- Emperra GmbH E-Health Technologies (Germany)

- Companion Medical, part of Medtronic (U.S.)

- Bigfoot Biomedical (U.S.)

- Diabnext (France)

- Jiangsu Delfu Medical Device Co., Ltd. (China)

- Berlin-Chemie AG, a Menarini Group Company (Germany)

- HTL-Strefa S.A. (Poland)

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Owen Mumford Ltd. (UK)

- Medtronic plc (Ireland)

- Insulet Corporation (U.S.)

- Roche Diabetes Care, Inc. (Switzerland)

- ARKRAY, Inc. (Japan)

- Becton, Dickinson and Company (BD) (U.S.)

- NIPRO Medical Corporation (Japan)

- Bigfoot Biomedical, the company acquired by Abbott, is pioneering with smart insulin pen caps with continuous glucose monitoring. The company also designs the product in such a way that it enables insulin dose recommendations for people with diabetes, thereby enhancing personalized management.

- Medtronic plc is one of the most prominent players in the insulin pen cap market, leveraging its expertise in both insulin delivery systems and diabetes tech. The firm deliberately supports the development of intelligent cap solutions that synchronize with CGM and insulin dosing data platforms for closed-loop management.

- Novo Nordisk A/S is recognized as the global insulin leader, wherein it collaborates with digital health firms and integrates add-on cap technology into its smart insulin pen ecosystem. The organization’s prime focus is to ensure compatibility and ease of data tracking for users, which encourages steady capital influx in this field.

- Diabnext is the centralized player in this field, which is emerging through the development of Bluetooth-enabled insulin pen caps that capture injection data in real time and sync with diabetes apps. Therefore, this empowers both service providers and patients with efficient insights and glycemic control patterns.

- Emperra GmbH is best known for its benchmark product called ESYSTA smart insulin system. The company has developed exclusive pen cap devices that come with wireless data transfer to cloud-based health records, thereby aiming to reduce errors in manual insulin logging. Therefore, this attracts the investors in this field, denoting an optimistic market opportunity.

Here is a list of key players operating in the global market:

The global insulin pen cap market is extremely consolidated, wherein the manufacturers such as Novo Nordisk, Eli Lilly, and Sanofi are leveraging vertical integration by providing proprietary caps. For instance, in March 2022, Insulcloud, which is a Spain-based company developing real-time monitoring devices for disposable insulin pens, reported that it had formed a strategic alliance with American multinational Dexcom to integrate glucose and insulin administration data into patients' digital medical records. Hence, this collaboration enhances Insulcloud’s 360º diabetes monitoring technology, enabling data sharing with healthcare providers across the country’s public and private health systems.

Corporate Landscape of the Insulin Pen Cap Market:

Recent Developments

- In November 2024, Medtronic reported that it received the U.S. FDA clearance for its enhanced InPen app, enabling the launch of its Smart MDI system integrated with the new Simplera disposable CGM, directly supporting MDI users.

- In September 2023, Abbott announced that it had acquired Bigfoot Biomedical, which is the developer of the FDA-cleared Bigfoot Unity connected insulin pen cap system that integrates continuous glucose monitoring data to provide insulin dosing recommendations directly on the pen cap.

- Report ID: 8190

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insulin Pen Cap Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.