Disposable Insulin Pen Market Outlook:

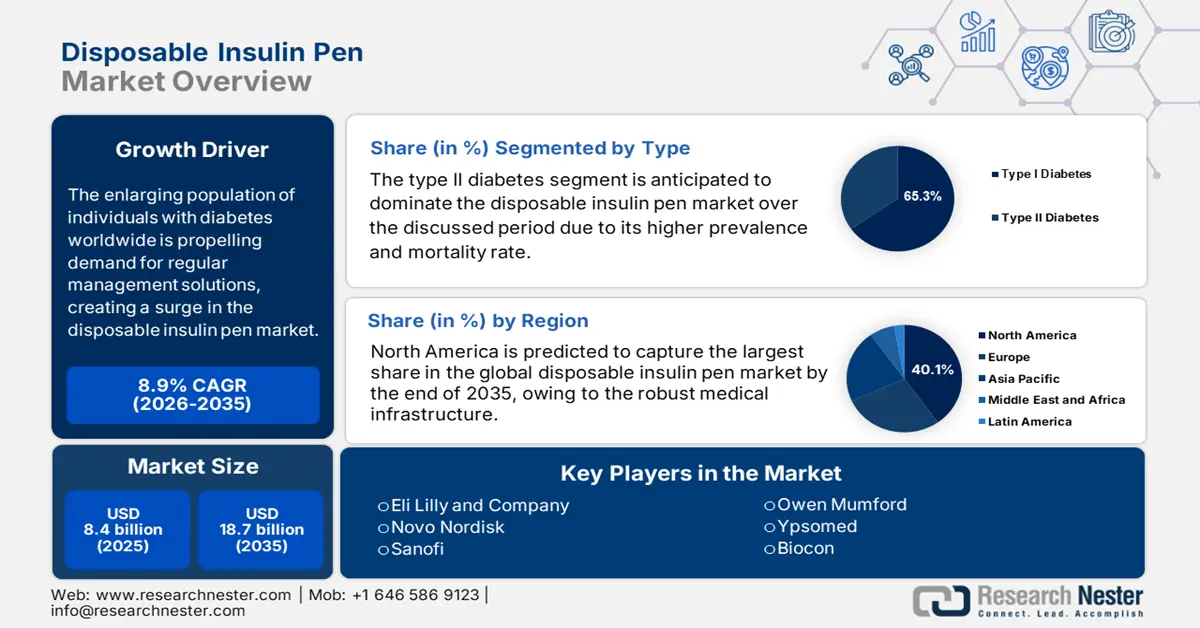

Disposable Insulin Pen Market size was valued at USD 8.4 billion in 2025 and is projected to reach USD 18.7 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period 2026-2035. In 2026, the industry size of the disposable insulin pens is evaluated at USD 9 billion.

The enlarging population of individuals with diabetes worldwide is propelling demand for regular management solutions, creating a surge in the market. According to the International Diabetes Federation (IDF) 2025 report, 11.1%, or 1 in 9, of those aged 20 to 79 have diabetes, and more than 40% are not aware they have the disease. Further, the estimates indicate that 1 in 8 adults, or 853 million people, would have diabetes by 2050, a 46% rise. Furthermore, growth in this sector can also be testified by the trade of insulin around the world, which needs convenient delivery solutions to be administered.

Despite the increasing demand, products from the market are still hard to access for consumers, particularly in price-sensitive and underserved regions. The major driving factors behind the payers' pricing in this sector include supply chain volatilities and heightening logistics expenses. This is pushing companies to discover more cost-effective solutions by adopting cost-optimized production measures. One of the growing trends is the proliferation of smart insulin pens that provide Bluetooth capabilities, dose tracking, and app integration that help limit human error and increase glucose control. Another growing trend is the shift toward at-home care, which has been accelerated in part by the COVID-19 pandemic. Sustainability is also now a consideration, and many manufacturers have launched initiatives to sty sustainable and reduce medical plastic waste.

Key Disposable Insulin Pen Market Insights Summary:

Regional Highlights:

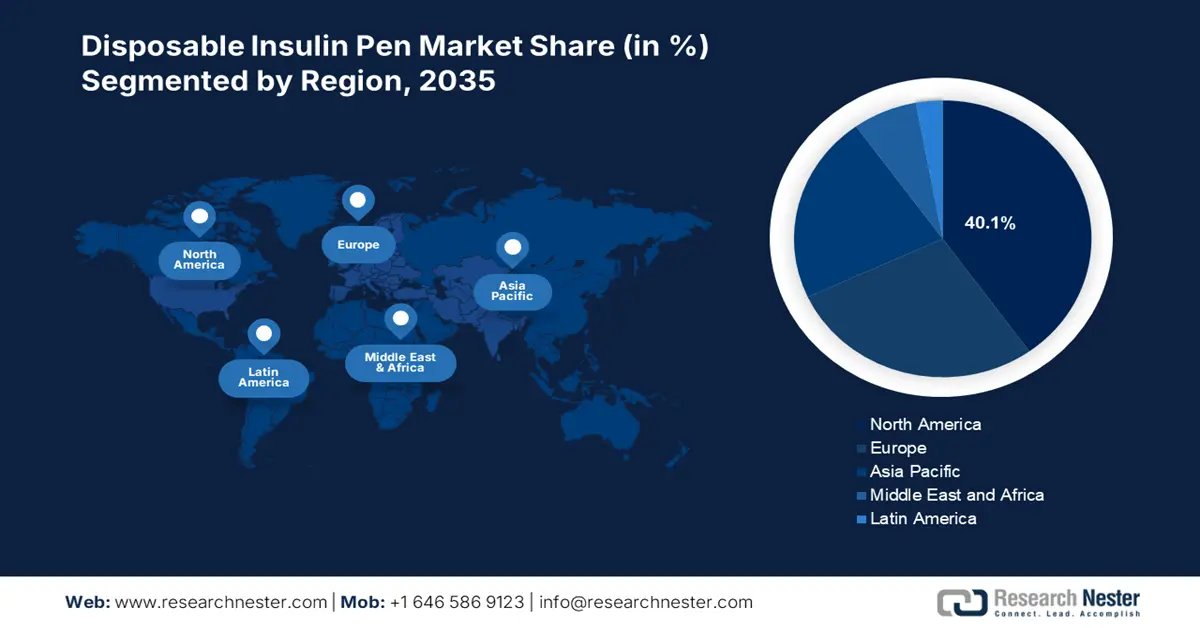

- The North America disposable insulin pen market is expected to secure a 40.1% share by 2035 in the Disposable Insulin Pen Market, arising from strong medical infrastructure, expanding patient volume, and supportive government and insurance initiatives to reduce out-of-pocket costs.

- Asia Pacific is forecasted to record the highest CAGR through 2035, supported by a vast diabetic population and rising healthcare spending across major economies.

Segment Insights:

- The type II diabetes segment is projected to command a 65.3% share by 2035 in the disposable insulin pen market, propelled by its high global prevalence and increasing preference for convenient insulin delivery solutions.

- The retail pharmacies segment is anticipated to attain a 50.5% share by 2035, strengthened by their broad distribution footprint and heightened consumer inclination toward accessible home-care medication channels.

Key Growth Trends:

- Government efforts to improve accessibility

- Ongoing product innovations and R&D investments

Major Challenges:

- Growing prevalence of counterfeits

- High cost of devices

Key Players: Novo Nordisk, Eli Lilly and Company, Sanofi, Biocon, Ypsomed, Owen Mumford, Gan & Lee Pharmaceuticals, Wockhardt, Medtronic, Becton Dickinson, Terumo Corporation, Emperra, Dongbao Pharmaceutical, Gerresheimer, SHL Medical, Haselmeier, B. Braun, Julphar, CP Pharmaceuticals, Hindustan Syringes & Medical Devices

Global Disposable Insulin Pen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.4 billion

- 2026 Market Size: USD 9 billion

- Projected Market Size: USD 18.7 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 20 August, 2025

Disposable Insulin Pen Market - Growth Drivers and Challenges

Growth Drivers

- Government efforts to improve accessibility: As diabetes becomes a global health concern, several governing bodies intend to invest in the market to make treatment more accessible to afflicted residents. As per the Agency for Clinical Innovation, to cut down on waste related to healthcare and achieve net zero emissions by 2035, the Northern Sydney Local Health District (NSLHD) launched a project to transition to reusable pens. These initiatives, coupled with bulk procurement by public medical settings and additional subsidies, are cumulatively mitigating the financial barrier in this sector, enabling a scope for worldwide expansion.

- Ongoing product innovations and R&D investments: The research cohort to develop next-generation technology for the market is creating new business opportunities by diversifying the pipeline. To keep pace and provide a better product experience, manufacturers are continually improving the designs of insulin pens. This includes redesigned ergonomic grips, adjustable dosage measurements, and better methods for handling insulin pens for elderly or visually impaired patients. Improvements in smart integrations also contribute to the advancement of insulin pens. Such improvements typically involve improvements to existing products and designs to decrease errors in diabetes management. Continually innovating will not only attract new users but will also encourage existing patients to upgrade to the new technology.

- Shift toward home care and self-administration: The movement towards home care and self-administration of medications is strongly fueling the increase in the market. Due to healthcare systems globally placing much more of an emphasis on patient-centered care and also a reduction in hospital visits, a larger pool of individuals with diabetes are moving towards self-monitoring of their diabetes conditions independently at home. Disposable insulin pens present a simple, easy, and portable solution in line with this movement for individuals managing their diabetes. These pens do not require the use of traditional syringes and vials, which offers benefits to insulin delivery and traditional delivery use of syringes with vials.

Challenges

- Growing prevalence of counterfeits: These products often impact consumer trust and create hesitation among investors, hindering gradual expansion in the disposable insulin pen market. The phenomenon of counterfeit or low-quality disposable insulin pens is a serious threat to patient safety in some areas of the globe. This has ultimately resulted in a loss of patient trust for using insulin pen therapy as well as reputational risks to legitimate manufacturers. While it is possible to establish systems to combat counterfeiting - such as novel packaging, authentication technologies, or tightened regulations - it would require a significant amount of upfront time and cost.

- High cost of devices: The cost of disposable pens can be viewed as an element of low affordability in countries with limited healthcare budgets and patient affordability in low-and middle-income countries. As the cost of insulin pens climbs, fewer diabetes patients/diabetics may not have the luxury of options to choose convenience over price. Therefore, some diabetic patients may select cheaper options that are less convenient. For manufacturers that do not have reduction or subsidy approaches, growth may stagnate in lower and moderate price regions.

Disposable Insulin Pen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2025-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 8.4 billion |

|

Forecast Year Market Size (2035) |

USD 18.7 billion |

|

Regional Scope |

|

Disposable Insulin Pen Market Segmentation:

Type Segment Analysis

Based on Type, the type II diabetes segment is anticipated to dominate the disposable insulin pen market with a share of 65.3% over the discussed period. Due to having a higher prevalence and mortality rate, this segment has become a priority for both investors and dedicated companies. As evidence, the International Diabetes Federation reported that more than 853 million people from across the globe are predicted to suffer from this condition by 2050. Simultaneously, the WHO highlighted the presence of high-risk factors for developing type II diabetes, such as aging and a sedentary lifestyle, to fuel a surge for convenient insulin delivery solutions, testifying to the segment's future leadership.

Distribution Channel Segment Analysis

In terms of distribution channels, the retail pharmacies segment is poised to garner the highest share of 50.5% throughout the assessed timeframe. The worldwide network and growing industry value of pharmacies are the primary drivers behind its proprietorship over other distributors in this sector. The broader range of offerings and purchase convenience are also strong foundations for retailers to establish a steady cash inflow in this category from home care applications. Furthermore, the possibility of earning a greater profit margin through premium pricing and direct consumer interaction is also fueling growth in this segment.

Application Segment Analysis

The home care segment is poised to dominate the market due to an increase in demand to manage diabetes outside of clinical settings. Disposable pens provide easier self-administration, making the therapy easier to access for patients who had no access to health care due to service inequities. Disposable pens also reduce hospital visits and decrease healthcare costs by allowing patients to attain proper glycemic control at home. As factors such as the support of educational programs and the shift in patient autonomy improve, the disposable pen sub-segment will likely continue to expand as consumer needs increase.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Insulin Pen Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest share of 40.1% in the global disposable insulin pen market by the end of 2035. Several growth factors, including robust medical infrastructure, an enlarging patient pool, and financial support from the government & insurers, are solidifying the region's leadership in this merchandise. Moreover, the efforts to minimize the burden of out-of-pocket expenditure to enhance public access to advanced diagnosis and care for diabetic residents are dragging the focus of investors to this merchandise.

The U.S. is augmenting the regional market with continuous federal investments and technological advancements. The initiatives taken by the national authorities are significantly fueling and influencing both domestic and foreign pioneers to develop new technologies for delivering medicine more efficiently and cost-effectively. In this regard, the penetration of AI-powered smart insulin injectors has evolved outcomes with precision dosing and improved adherence, inspiring consumers to invest more in this sector. Moreover, there is a high prevalence of diabetes in the U.S. This creates a sizable and consistent need for insulin delivery devices.

The market in Canada is growing steadily for a number of important reasons. The foremost rationale is the increasing prevalence of diabetes, which creates a greater need for easy and effective insulin delivery methods. The strength of Canada's healthcare system, along with government-supported reimbursement programs, is making the products more affordable and accessible to patients. The Ontario Ministry of Health supports a number of programs, policies, and services that further emphasize patient-centered care and chronic disease management, utilizing easy-to-use delivery devices like disposable insulin pens to reduce patient hospital visits and complications. As per the Government of Canada, in Canada, around 10% of the population has diabetes, and over 200,000 new cases are diagnosed each year.

APAC Market Insights

The Asia Pacific disposable insulin pen market is projected to exhibit the highest CAGR during the forecasted timeline. The region consists of one of the largest patient pools in the world, creating a sustainable consumer base for this merchandise. The rising volume of public spending on healthcare and increasing disposable income in emerging economies, such as China and India, are also accelerating the region's pace of propagation. Moreover, the dominance of China in supplying APIs for producing these insulin delivery systems is fostering a favorable environment for global leaders in this field to generate profitable revenue.

India is propagating the market at a significant pace due to rising diabetes mortality and government initiatives. As per the Ministry of Health and Family Affairs, the Government of India has taken preemptive actions to address diabetes as part of the National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD) under the National Health Mission (NHM). The establishment of 743 District NCD Clinics and 6,237 Community Health Center NCD Clinics across India, ensures care to the local communities. The accessibility and affordability gap and disparity in this landscape present a promising consumer base with various demands, fostering multiple business opportunities. Furthermore, the National Health Mission's subsidy program is promoting affordable solutions for its low-income diabetic citizens, propelling innovation in this field.

The market within China is rapidly developing, driven by several contributors. Improvements in accessibility to healthcare across urban and rural areas is resulting in accelerated treatment for all types of patients. The faster patients receive indications and start ‘self-managed’ therapy, the quicker we will see an increase in disposable pen adoption. The number of people with diabetes in China is increasingly aware of the options of diabetes self-management, and they prefer easy-to-use, portable, and prefilled insulin pens that allow for adherence to therapy.

Europe Market Insights

The disposable insulin pen market in Europe is steadily increasing because of several demographic, health care, and technological reasons. The region has a major diabetic population that is aging, which continues to keep the demand for easy-to-use insulin delivery devices high. European countries have a solid health care infrastructure and reimbursement systems that afford patients great access to more advanced diabetes care products. Some European countries also have insurance coverage or government-mandated subsidies that limit the cost that the patient has to pay out of pocket, so the product can be more widely adopted more quickly.

The market for single-use insulin injection devices in France is growing, primarily due to the increasing rates of diabetes among an aging population. France has a well-developed health system and full insurance, which has resulted in a better access and affordability for patients. The French government has instituted patient-centric chronic disease management and diabetic awareness programs that are leading to better self-management. Environmental regulations are driving manufacturers to move toward products that are more sustainable and that match the local consumers' interests.

Germany's market is rapidly expanding, mostly due to the high prevalence of type 1 and type 2 diabetes combined with an advanced healthcare delivery system. Germany has also placed a high emphasis on educational initiatives and self-management with patient, resulting in more possibilities for patient engagement/use of easy-to-use insulin delivery devices. Moreover, the regulations in Germany are generally conducive to the innovation of sustainable and safe medical devices. Increased awareness of diabetes and its early diagnosis will also increase demand for disposable insulin pens in the region.

Key Disposable Insulin Pen Market Players:

- Novo Nordisk

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company

- Sanofi

- Biocon

- Ypsomed

- Owen Mumford

- Gan & Lee Pharmaceuticals

- Wockhardt

- Medtronic

- Becton Dickinson

- Terumo Corporation

- Emperra

- Dongbao Pharmaceutical

- Gerresheimer

- SHL Medical

- Haselmeier

- B. Braun

- Julphar

- CP Pharmaceuticals

- Hindustan Syringes & Medical Devices

Currently, a majority control over the revenue generation in the market is held by key pioneers, including Novo Nordisk, Eli Lilly, and Sanofi, who collectively account for over 80.4% share. Their rigorous R&D activities and continuously expanding commercial territory are establishing a strong foundation in this category. Additionally, the ongoing innovation in this sector is elevating the functionality and efficiency of the existing pipeline, extending the reach of products. Simultaneously, key players in the emerging landscapes are focusing more on developing affordable biosimilars, solidifying their presence in price-sensitive regions.

Recent Developments

- In October 2024, Insulcloud, a pioneering healthtech company revolutionizing diabetes management, announced its strategic entry into the U.S. market following the FDA's clearance of the award-winning Insulclock CAP smart device. The device is intended to monitor patient utilization of disposable insulin pens in real time and assist patients with adherence to prescribed therapy. This commercialization milestone highlights the Insulclock CAP's safety, efficacy, and quality, and helps pave the way for millions of Americans living with diabetes to regain control of their insulin therapy with confidence and unprecedented precision.

- In November 2024, Medtronic plc, a leading global healthcare technology company, today announced U.S. Food and Drug Administration (FDA) clearance for its new InPen app that includes missed meal dose detection. With this clearance, the system will be the first to offer recommendations for missed or incorrect insulin doses and provide real-time, personalized information for people utilizing multiple daily injections (MDI) therapy.

- Report ID: 2253

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Insulin Pen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.