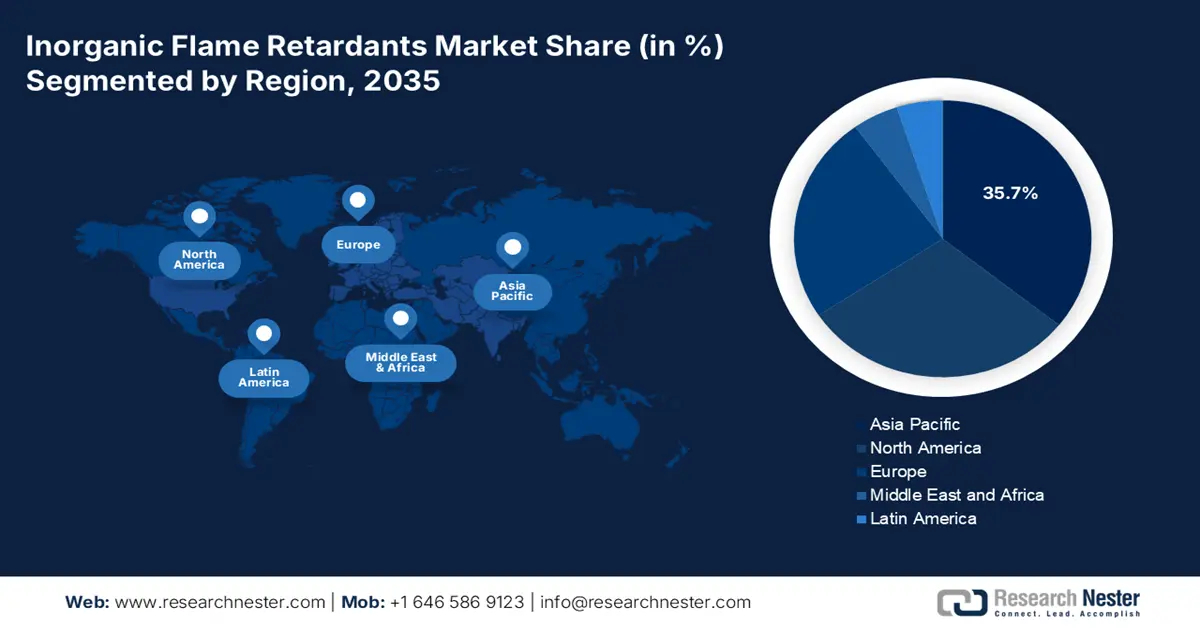

Inorganic Flame Retardants Market - Regional Analysis

Asia Pacific Market Insights

Asia-Pacific is expected to hold 35.7% of the market for inorganic flame retardants in 2035 due to factors like electrification, industrial growth, and sustainability regulations. Increased EV manufacturing, regulatory pressure for halogen-free retardants, and building safety regulations in China, India, Japan, and Southeast Asia are important motivators. In electronics and semiconductors, South Korea and Japan place a higher priority on non-toxic materials like magnesium hydroxide and aluminium. With the widespread adoption of building regulations and battery-grade fire safety measures, China leads the world in industrial consumption.

By the year 2035, it is anticipated that China will hold the largest share of revenue, approximately 41.2% in the APAC inorganic flame retardants market. This growth is attributed to its extensive industrial base and rigorous fire safety regulations. The swift expansion of electric vehicle manufacturing and significant infrastructure initiatives in the country requires a broad application of flame retardants in batteries, cables, and insulation materials. Albemarle Corporation, a prominent supplier of aluminum hydroxide-based flame retardants, has enhanced its presence in China through strategic alliances that cater to the increasing demand for halogen-free fire protection solutions.

India is expected to take the lead in the APAC inorganic flame retardants market, with a projected CAGR of 7.4% from 2026 to 2035. This growth is fueled by rapid urbanization, the development of an electric vehicle ecosystem, and the introduction of progressive green building and fire safety regulations. These elements are driving the demand for halogen-free, mineral-based flame retardants across the construction, automotive, and electronics industries. ICL Group, a worldwide leader in sustainable flame retardants, is actively broadening its operations in India by providing eco-friendly magnesium and phosphorus-based additives to support these industries.

North America Market Insights

The North America inorganic flame retardants market, which includes the U.S. and Canada, is expected to generate 27.7% of worldwide revenue by 2035, growing at a CAGR of 5.1% between 2026 and 2035. Growing uses in the electronics, automotive, and construction industries, together with strict fire safety laws enforced by organizations like OSHA and EPA, are driving the region's growth. Particularly, the increased production of electric vehicles and smart building retrofits has increased demand for ecologically friendly, non-halogenated retardants such as magnesium hydroxide and aluminium hydroxide.

In the U.S., regulations such as the Toxic Substances Control Act (TSCA) are accelerating the transition away from halogenated flame retardants due to concerns regarding environmental and health impacts. These regulatory pressures are contributing to a steady increase in the demand for inorganic flame retardants, which are regarded as safer and more sustainable alternatives. Industries including electronics, construction, and automotive are progressively embracing non-halogenated options. Huber Engineered Materials stands out as a prominent U.S.-based manufacturer of aluminum hydroxide flame retardants, actively providing eco-friendly solutions that adhere to TSCA standards.

By the year 2035, Canada is anticipated to capture the largest revenue share in the North American inorganic flame retardants market, propelled by rigorous building codes, sustainable construction methodologies, and a growing adoption of electric vehicles. Canada's commitment to non-toxic, halogen-free fire safety solutions in public infrastructure and green-certified buildings is enhancing the demand for mineral-based flame retardants. Rio Tinto, a leading producer of industrial minerals in Canada, plays a vital role by supplying aluminum compounds utilized in flame-retardant formulations across the construction and transportation industries.

Europe Market Insights

Europe's market is anticipated to witness consistent growth, propelled by rigorous fire safety regulations and a transition towards sustainable, non-halogenated alternatives. By 2025, the market size is projected to be around €2.16 billion, with a compound annual growth rate (CAGR) of 4.53% expected through 2030. Germany and the United Kingdom are predicted to capture the largest revenue shares in Europe by 2035, due to their strong industrial foundations and strict regulatory environments.

Germany is expected to dominate the European market by 2035, supported by its robust industrial sector, especially in automotive, electronics, and construction industries. In 2025, Germany's market size is forecasted to reach €124.079 million, representing about 1.34% of the global market. The nation's dedication to sustainability and adherence to stringent fire safety regulations further enhances the demand for non-halogenated flame retardants. Companies such as LANXESS AG are leading the way, providing magnesium hydroxide-based solutions under the Magtech brand, which are widely utilized in wire and cable applications.

The UK is also projected to maintain a substantial revenue share in the European market by 2035. In 2025, the market size in the UK is estimated to be €148.864 million. The country's strict fire safety regulations and focus on sustainable construction practices are driving the demand for inorganic flame retardants. Firms like BASF SE are playing a significant role in this expansion by offering eco-friendly flame retardant solutions that comply with the UK's regulatory requirements and sustainability objectives.