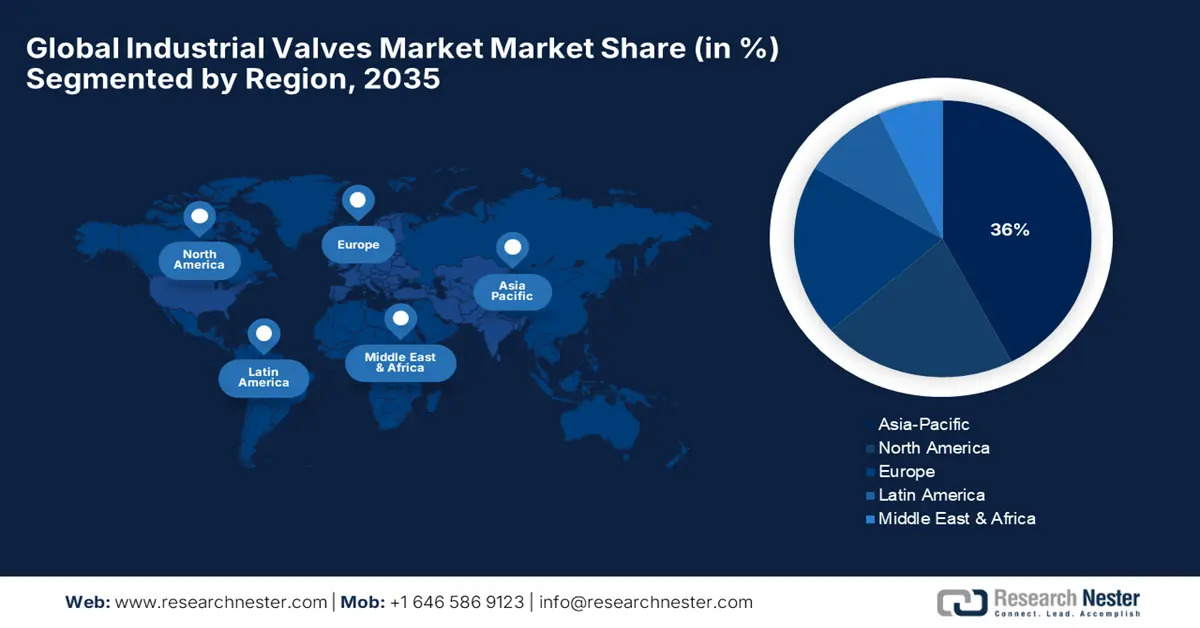

Industrial Valve Market - Regional Analysis

Asia Pacific Market Insights

The industrial valves market in Asia-Pacific (APAC) is experiencing robust growth, driven by rapid industrialization, energy demand, and infrastructure investments. The region is set to capture 36% of the global market share by 2035, with China and India leading sales volumes. The water & wastewater sector is another key driver, with millions of valves annually deployed under initiatives like China’s Sponge Cities and India’s Jal Jeevan Mission. Additionally, power plant expansions (coal, renewables) and pharmaceutical growth further boost demand. Smart valve adoption is rising and supported by IoT integration in Japan and South Korea.

The industrial valves market in China is growing rapidly, driven by massive energy projects, water infrastructure upgrades, and manufacturing expansion. The country accounts for over 30% of APAC's valve demand, with major sales annually for oil & gas pipelines. The chemical industry fuels demand for corrosion-resistant valves, and smart valve adoption is rising with government-backed IoT integration. Strict environmental regulations also push upgrades to low-emission valves.

India assigned Rs. 3.6 Lakh Crore to the estimated outlay of Jal Jeevan Mission as part of the 'Har Ghar Jal' program over five years from 2019-2024. The 15th Finance Commission has identified drinking water supply and sanitation as a national priority and has graced the Rural Local Bodies / Panchayat Raj Institutions (RLBs/PRIs) with funds amounting to Rs. 2.36 lakh Crore from 2021-22 to 2025-26. Consequently, 60% of the above fund, i.e, Rs. 1.42 lakh Crore has been provided as Tied Grants, use exclusively only for drinking water, rainwater harvesting, and sanitation & maintenance of open-defecation free (ODF) village. This unprecedented level of investment in rural areas all over the country is leading to increased economic activities, an enhanced rural economy, and enhanced job opportunities for rural communities. This is a step of progress to ensure a potable water supply with improved sanitation in villages towards transforming these villages into 'WASH enlightened ' villages. As per the Government of India, in 2022-23, so far, released total of Rs 22,975.34 Crore has been released to 21 eligible States for implementing Jal Jeevan Mission, financial year 2022-23.

North America Market Insights

The industrial valves market in North America is set to capture 18% of the global market share by 2035, and it is experiencing steady growth, driven by strong demand across industries such as oil & gas, chemicals, power generation, and water treatment. The North American industrial valve market will benefit from a highly developed manufacturing base and considerable investment in infrastructure, such as pipeline and refinery upgrades. Growing technologies such as smart valves and automated flow control only add to the impetus for industrial valve adoption. The growing emphasis on sustainability among businesses and the effects of environmental regulations affecting energy usage, corrosion reduction, and improved efficiencies will further aid the market growth in the long term.

The U.S. will easily dominate the North American market due to the primarily large-scale oil & gas production, petrochemical complexes, and water infrastructure projects. Factors such as the government's focus and strategy on energy security, shale gas exploration, and renewable energy will further support valve use in all refineries and related power plants. The increasing advancements in automation in process industries are also largely attributed to further uptake of control valves and smart valves. The effects of EPA promoting water reuse and recycling, as well as greater emission restrictions, will continue to shape the growth of the U.S. industrial valves market across numerous industries.

U.S. Valves Trade Data (2024)

|

Exporting Country |

Value (USD) |

Importing Country |

Value (USD) |

|

Canada |

2.72B |

China |

$3.56B |

|

Mexico |

2.41B |

Mexico |

$3.49B |

|

China |

903M |

Germany |

$1.45B |

|

Germany |

877M |

Japan |

$1.38B |

|

United Kingdom |

669M |

Italy |

$1.05B |

Source: OEC

Europe Market Insights

The industrial valves market in Europe is set to capture 17% of the global market share by 2035, and it is growing steadily, driven by energy transition, infrastructure modernization, and stringent environmental regulations. However, continuing demand for industrial valves from the water treatment, oil & gas, and chemicals sectors supports growth. With the EU driving a focus towards sustainable manufacturing and automation, the opportunity for valves further expands. Increased consumption of renewable energy projects and the electrical supply grid, combined with improved distribution networks, will further drive the development, manufacturing, and use of industrial valves in a very wide range of industrial applications. Additionally, industrial valves rely on other steel bars for durable construction, ensuring strength, longevity, and performance in demanding industrial applications.

Germany’s Other Steel Bars Trade in 2023

|

Exporting Country |

Value (USD) |

Importing Country |

Value (USD) |

|

France |

$228M |

Italy |

$248M |

|

China |

$159M |

China |

$227M |

|

Italy |

$153M |

Austria |

$181M |

|

Austria |

$134M |

Spain |

$133M |

|

Poland |

$102M |

France |

$122M |

Source: OEC