Industrial Services Market Outlook:

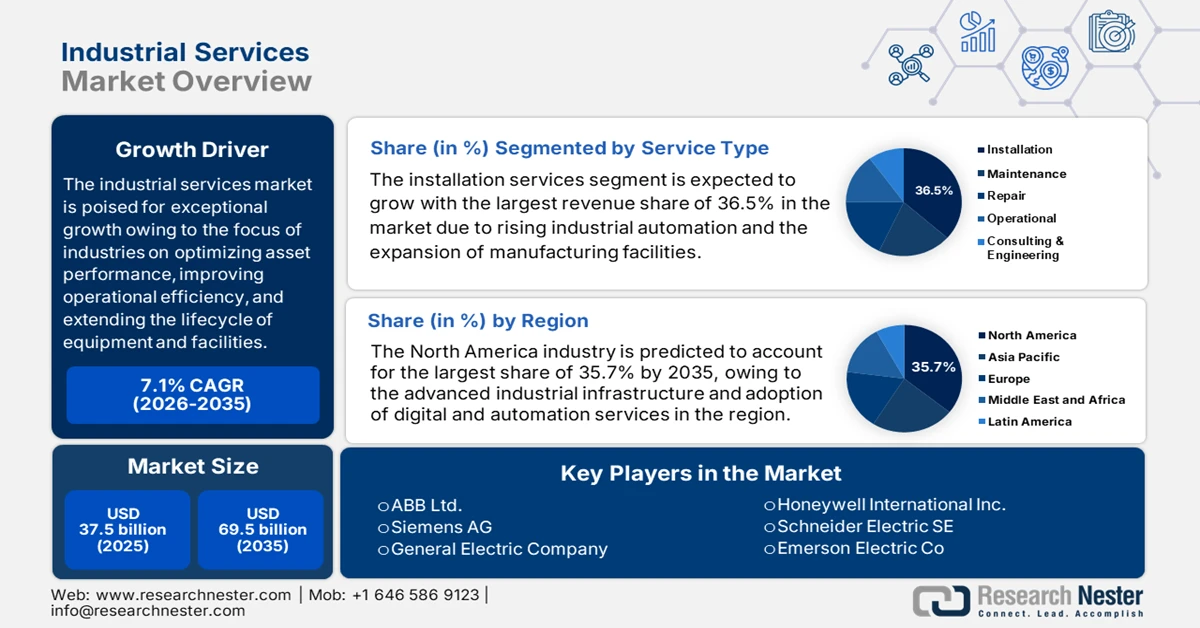

Industrial Services Market size was valued at USD 37.5 billion in 2025 and is projected to reach USD 69.5 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial services is evaluated at USD 40.1 billion.

The industrial services market is poised for exceptional growth, owing to the focus of industries on optimizing asset performance, improving operational efficiency, and extending the lifecycle of equipment and facilities. In this context, Bilfinger SE, which is an international industrial services provider, reported that has been announced for inclusion in the STOXX Europe 600 index in June 2025. The company delivers services across the entire industrial value chain in Europe, North America, and the Middle East, and its revenues exceeded USD 5.4 billion (€5 billion) in 2024. Hence, such instances enhance the firm’s visibility and credibility with investors, which in turn can attract additional capital for expansion projects, enable larger industrial service contracts, and support growth in the industrial services sector.

Furthermore, the aspects of energy transition initiatives, expansion of manufacturing capacity, and heightened emphasis on safety, compliance, and reliability are stimulating unprecedented growth in the market. In October 2024, H.I.G. Capital, a global alternative investment firm with USD 65 billion under management, announced the acquisition of Rainham Industrial Services, a UK provider of installation, maintenance, and refurbishment services for the power generation, energy-from-waste, nuclear, and manufacturing sectors. Rainham operates from four UK locations, delivering mechanical, access, insulation, painting, and cleaning services, and the company benefits from an ageing industrial base and a growing power generation industry. It plans to expand its offerings through selective M&A while retaining its existing management team. Hence, this transaction demonstrates a strong private equity appetite driven by ageing infrastructure and consolidation opportunities.