Industrial Heater Market Outlook:

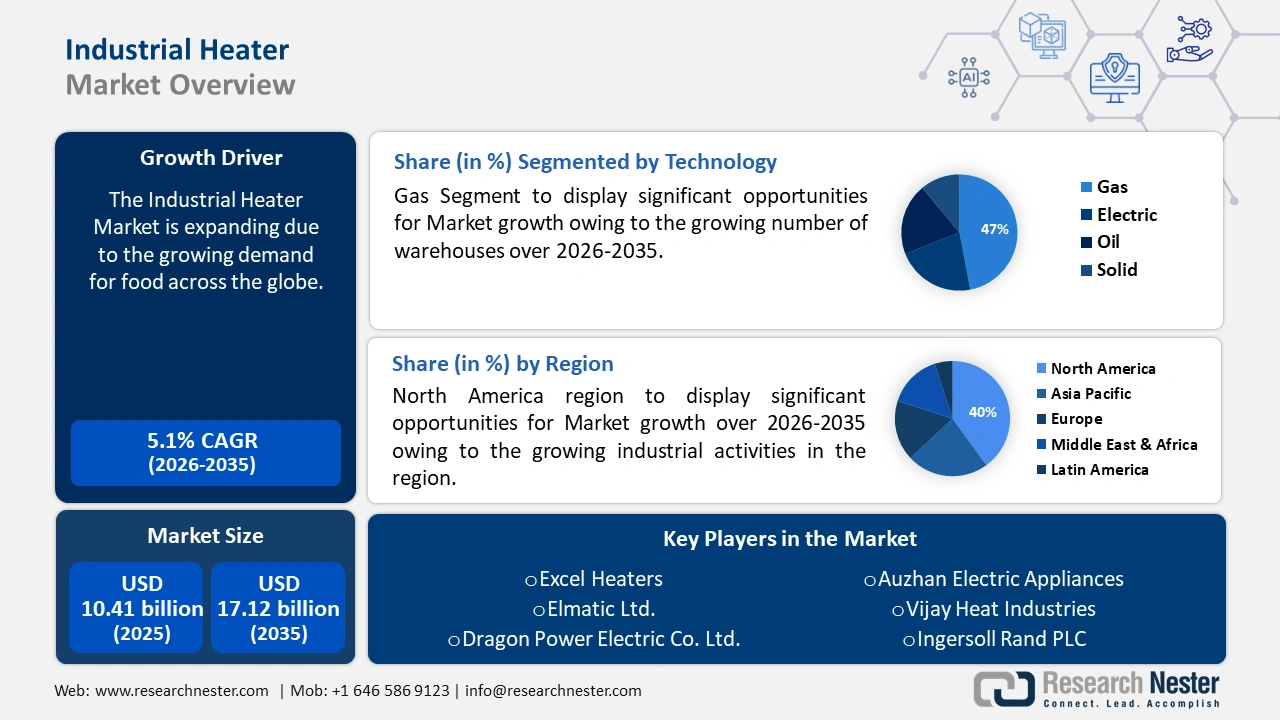

Industrial Heater Market size was over USD 10.41 billion in 2025 and is poised to exceed USD 17.12 billion by 2035, growing at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial heater is estimated at USD 10.89 billion.

The market is growing as a result of the rising demand for food across the globe, leading to extensive usage of industrial heaters since heat may be needed during food processing, beverage preparation, product packing, and product storage processes. As per estimates from the Food and Agriculture Organization, to feed the 9.1 billion people that will inhabit the planet by 2050, total food production would need to increase by about 70%.

Key Industrial Heater Market Insights Summary:

Regional Highlights:

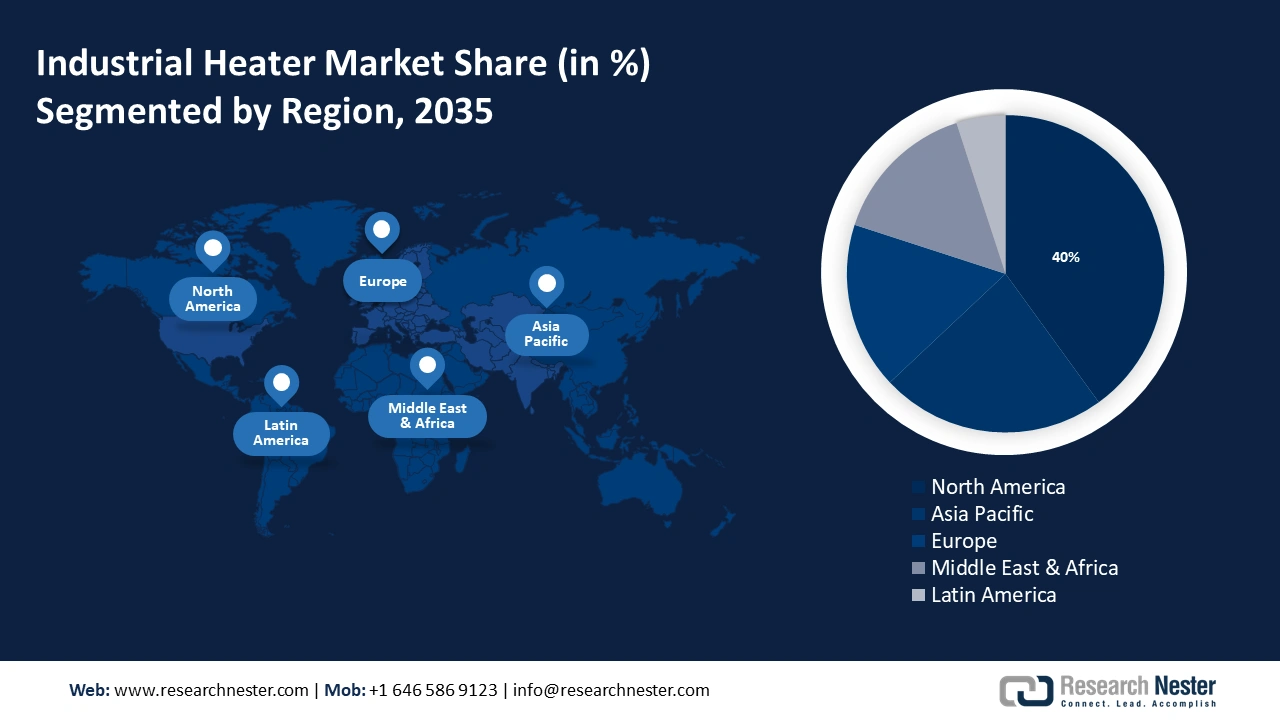

- North America industrial heater market will secure over 40% share by 2035, driven by growing industrial activities and manufacturing expansion.

- Asia Pacific market will generate huge revenue by 2035, driven by increasing urbanization and industrial heater demand.

Segment Insights:

- The gas segment in the industrial heater market is anticipated to see substantial growth till 2035, fueled by the growth of e-commerce increasing warehouse heating needs.

- The chemical segment in the industrial heater market is expected to experience significant growth through 2026-2035, influenced by the need for precise temperature control in chemical processes.

Key Growth Trends:

- Growing focus on environmental sustainability

- Expanding oil and gas industry

Major Challenges:

- Growing focus on environmental sustainability

- Expanding oil and gas industry

Key Players: Powrmatic Ltd., Excel Heaters, Elmatic Ltd., Dragon Power Electric Co. Ltd., Vijay Heat Industries, Laars Heating Systems, AUZHAN ELECTRIC APPLIANCES (SHANGHAI) CO., LTD., Kantilal Chunilal and Sons Ltd., Ingersoll Rand Inc., Carver Group, Watlow Electric Manufacturing Co., Winterwarm.

Global Industrial Heater Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.41 billion

- 2026 Market Size: USD 10.89 billion

- Projected Market Size: USD 17.12 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Industrial Heater Market Growth Drivers and Challenges:

Growth Drivers

- Growing focus on environmental sustainability - Reducing the environmental impact of industrial heating can also be achieved by using industrial heaters, which are a more sustainable choice since they consume less energy and emit fewer greenhouse gases.

In 2023, more than 55% of businesses began utilizing more environmentally friendly resources, such as recycled materials and goods with reduced emissions. - Expanding oil and gas industry - One of the most crucial components in the heating of gas and oil is the industrial heater, which is an incredibly effective appliance that delivers substantial amounts of immediate heat where it's needed.

As per the International Energy Agency, the oil and gas industry's average return on capital between 2010 and 2022 was between 6 and 9%. - Growing sales of automobiles - The automotive sector is expanding rapidly, which will bolster demand for car heaters to satisfy the needs of manufacturing processes at high temperatures, and to enhance the engine's cold starting performance. Global auto sales increased from around 66 million vehicles in 2021 to over 67 million vehicles in 2022.

Challenges

- Stringent rules and regulations - For many establishments and businesses, industrial heating is necessary, however, installation of industrial heating systems may be subject to legal or construction regulations that contribute to an appliance's reasonable level of safety.

Respecting the heater standards and regulations established by industry associations and regulatory agencies is essential to ensuring the safe operation of heaters, which are made to protect people and their belongings from any risks that could arise from using heaters. Moreover, adhering to these standards can pose a challenge for the heater producers since it can be time-consuming and resource-intensive. - Fluctuating cost of raw materials - Volatility in prices of raw materials such as steel, and aluminum can lead to supply chain disruptions causing production delays and impacting the overall production costs.

Industrial Heater Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 10.41 billion |

|

Forecast Year Market Size (2035) |

USD 17.12 billion |

|

Regional Scope |

|

Industrial Heater Market Segmentation:

Technology Segment Analysis

Gas segment is projected to account for around 47% industrial heater market share by 2035. It is anticipated that by 2025, there will be more than 170,000 warehouses worldwide, owing to the growth of e-commerce.

A tubular heat exchanger receives hot exhaust gas from a burner in a gas air heater that warms the surrounding air in sizable industrial and commercial spaces using a gas burner. For heating large, open rooms, commercial gas heaters are an excellent option and are more affordable, dependable, and efficient as compared to electric heaters. Large areas make up warehouses and industrial structures which necessitate the use of gas industrial heaters, which are essential to keep warehouses and industrial areas warm and cozy. Moreover, it might be difficult to heat warehouses in the winter, which makes gas-fired unit air heaters ideal for these settings.

Additionally, heat is produced by the conversion of electrical energy in electric industrial heaters, which are employed in many different operations when raising an object's or process's temperature is necessary in vast locations such as factories, garages, warehouses, and more where gas is either unavailable or not a chosen option.

Application Segment Analysis

Over the forecast period, the chemical segment in the industrial heater market is estimated to record a significant CAGR. Immersion heaters are essential in many chemical industry processes because they provide accurate temperature control, improve the execution of chemical reactions, and aid in separation procedures to ensure optimal reaction kinetics and product quality.

Furthermore, industrial heaters are indispensable in the chemical sector as they enable the purification and isolation of chemical compounds with high accuracy. Industrial heaters find widespread use in heating utilities within chemical plants for heating air streams for drying applications and preheating feedstock.

Chemical industries require consistent temperature maintenance to ensure that chemicals and liquids remain in their proper state. Many processes and components in these industries rely on heat, such as molded and extruded components, steam heating, and so on. Thus, there is a significant need for industrial heaters in this area, resulting in industrial heater market growth. As per estimates, in 2022, the worldwide chemical industry's total revenue was more than USD 6 trillion.

Product Segment Analysis

The duct segment in the industrial heater market is likely to generate substantial revenue by 2035. The growth can be attributed to the rising demand for HVAC systems. Industrial duct heaters come in various varieties and configurations and are an essential part of HVAC systems that are made to offer regulated and effective heating in commercial and industrial environments.

According to the International Energy Agency, by 2050, there will be 5.6 billion air conditioners in buildings worldwide, up from 1.6 billion at present.

Our in-depth analysis of the industrial heater market includes the following segments:

|

Technology |

|

|

Capacity |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Heater Market Regional Analysis:

North American Market Insights

North America region in industrial heater market is poised to dominate around 40% revenue share by the end of 2035. The market growth in the region is expected on account of growing industrial activities. The North American manufacturing industry is expected to expand as a result of regional specialties and industrial growth across a wide range of sectors.

The United States' manufacturing activity grew at its quickest rate since 2022, leading to higher demand for industrial heaters owing to their diverse uses in a range of industries, including manufacturing, food, and others. According to estimates, more than 9% of global economic production, or around USD 2 trillion, came from the highly diversified US manufacturing sector in 2023.

Moreover, the goal of the National Research Council Canada (NRC) and Natural Resources Canada (NRCan) is to find low-cost, low-carbon industrial heating technologies that will reduce carbon emissions to help the country move closer to its net-zero emissions goals, which may drive industrial heater market demand in Canada. The Canadian government committed to achieving net zero emissions by 2050 with the introduction of the Canadian Net-Zero Emissions Accountability Act in December 2020, which also includes a USD 15 billion plan with 64 initiatives aimed at achieving the country's 2030 target.

APAC Market Insights

The Asia Pacific region will also encounter huge revenue for the industrial heater market during the forecast period owing to the increasing urbanization. The region is undergoing a significant change owing to an unparalleled surge in its urban population driven by factors including employment opportunities, educational institutions, and urban lifestyle. This may drive the need for industrial heaters in the region.

As of 2023, cities were home to more than 60% of China's population. Furthermore, industrial heating is the primary source of energy consumption in China's industrial sector, with industrial heaters used in a variety of procedures to increase the temperature of an object or process.

South Korea is becoming more industrialized, with exceptional economic success and global integration over the last four decades, which may increase industrial heater market demand.

Besides this, to maintain a secure workplace while increasing output and efficiency, Japanese companies are also investing in robotic process automation, leading to an increase in the nation's need for industrial heaters. Compared to around 45% in the US, Japan has an overall automation potential of more than 50% of hours worked.

Industrial Heater Market Players:

- Powrmatic Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Excel Heaters

- Elmatic Ltd.

- Dragon Power Electric Co. Ltd.

- Vijay Heat Industries

- Laars Heating Systems

- AUZHAN ELECTRIC APPLIANCES (SHANGHAI) CO., LTD.

- Kantilal Chunilal and Sons Ltd.

- Ingersoll Rand Inc.

- Carver Group

- Watlow Electric Manufacturing Co.

- Winterwarm

To compete in the business, the major players in the industrial heater market are concentrating on economies of scale, brand recognition, technological advances, and marketing strategies.

Recent Developments

- Carver Group announced the acquisition of a leading manufacturer and distributor of industrial and commercial heating, ventilating, and air conditioning (HVAC) equipment, Powrmatic Limited to enhance its standing in the HVAC industry and to seize future expansion prospects in both domestic and international export markets.

In addition, Carver's manufacturing capacity is increased by the acquisition of a fourth production plant, which will enable them to provide their clients with a wider range of products and solutions. - Laars Heating Systems a manufacturer of boilers, water heaters, and pool heaters used in residential, commercial, and industrial applications announced the acquisition of Electro Industries, Inc. to broaden its offering for heating homes, businesses, and industrial spaces, for meeting customers' expanding needs as state and local electrification laws and regulations continue to change across North America.

- Report ID: 6036

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Heater Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.