Power Transformer Market Outlook:

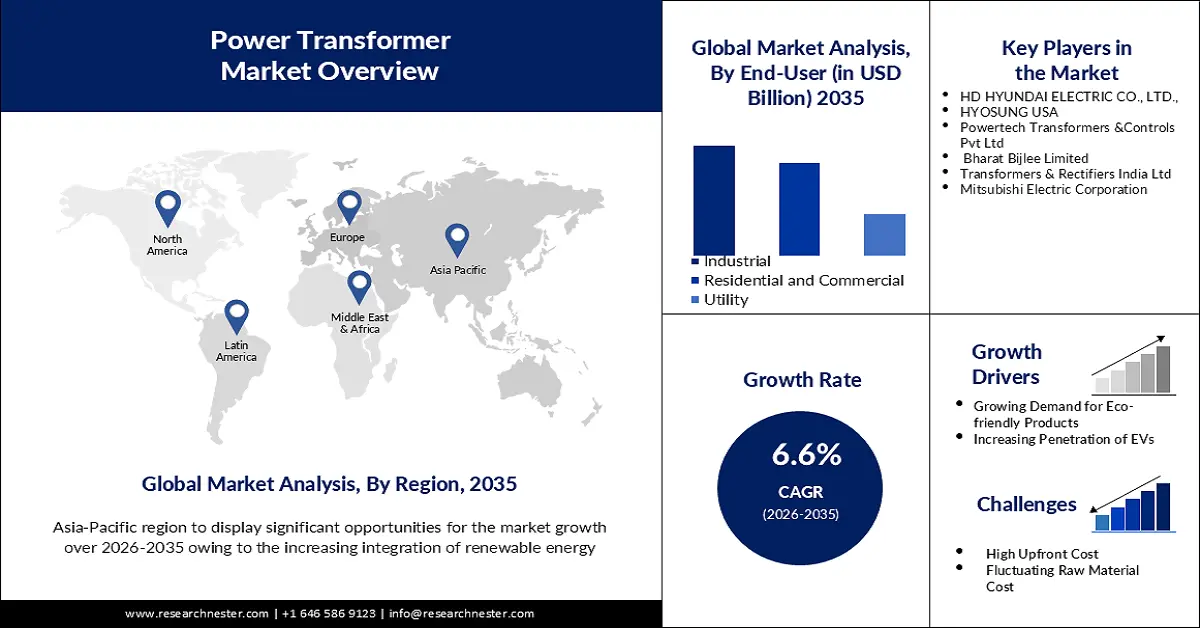

Power Transformer Market size was valued at USD 28.43 billion in 2025 and is likely to cross USD 53.87 billion by 2035, expanding at more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power transformer is assessed at USD 30.12 billion.

An increase in power generation and grid development projects is what drives the total quantity of power transformers. Power transformer demand is driven by the modernization, development, and improvement of power grids, which also support the industry's overall growth. Some of the nations and areas leading the way in the implementation of smart grids are Japan, which in 2022 announced a USD 155 billion funding package to encourage investments in smart power networks.

The growing penetration of electric cars (EVs) offers power transformers the chance to assist in the creation of EV charging infrastructure. Transformers are essential for providing charging stations with an effective and dependable power supply. Power transformers are a necessary part of the infrastructure used to charge electric cars. They assist in reducing grid electricity from high voltages to lower voltages required for different EV charging capacities. Electric car charging is now safe and effective thanks to this development. Programs like the FAME India project, tax breaks, and production-linked incentives are designed to give the electric vehicle (EV) sector a boost.

Key Power Transformer Market Insights Summary:

Regional Highlights:

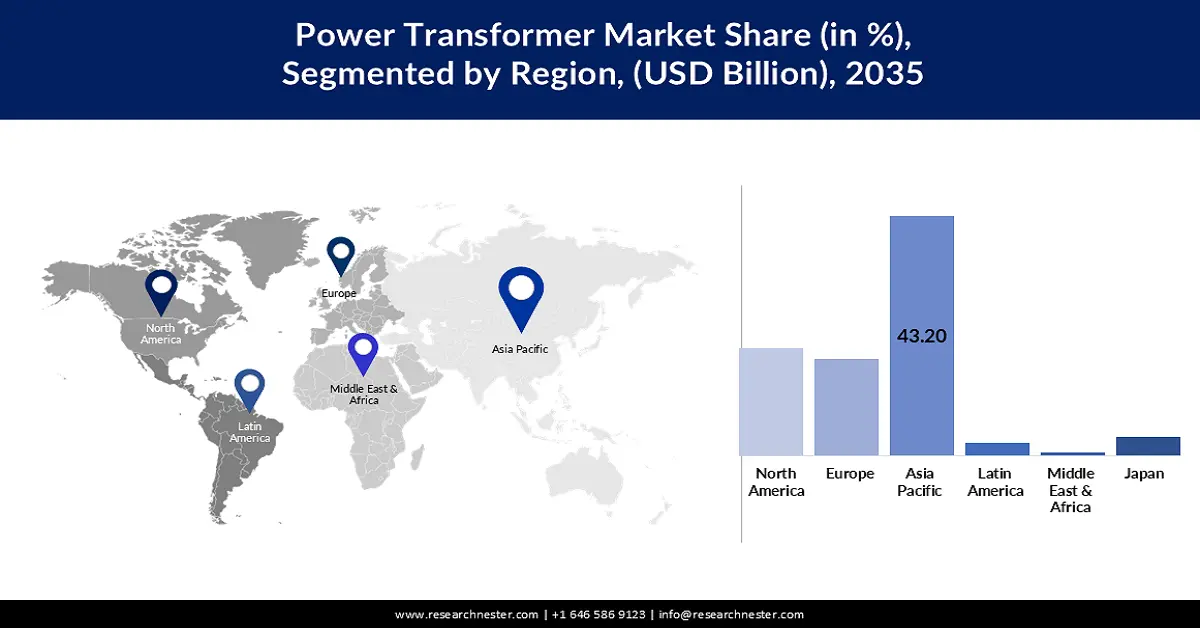

- Asia Pacific power transformer market will secure over 43.20% share by 2035, fueled by renewable energy adoption and increased grid integration.

- North America market will account for 26% share by 2035, attributed to rising electricity demand and grid infrastructure enhancement.

Segment Insights:

- The three phase segment in the power transformer market is projected to capture a 61% share by 2035, driven by the dominance of delta/star connections enabling efficient industrial power delivery.

- The industrial segment in the power transformer market is expected to experience substantial growth over the forecast period 2026-2035, influenced by the usage of heavy-duty transformers in industrial operations requiring high voltage stability.

Key Growth Trends:

- Demand for Eco-friendly Transformers

- Penetration of Phase Shifting Transformer

Major Challenges:

- Fluctuating Raw Material Prices

- Environmental Concerns associated are anticipated to hinder the power transformer market growth in the forecast period

Key Players: of HD HYUNDAI ELECTRIC CO., LTD., HYOSUNG USA, Powertech Transformers &Controls Pvt Ltd, Bharat Bijlee Limited, Transformers & Rectifiers India Ltd, Mitsubishi Electric Corporation.

Global Power Transformer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.43 billion

- 2026 Market Size: USD 30.12 billion

- Projected Market Size: USD 53.87 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 16 September, 2025

Power Transformer Market Growth Drivers and Challenges:

Growth Drivers

-

Demand for Eco-friendly Transformers - In accordance with environmental concerns, eco-friendly transformers employ non-toxic and biodegradable insulating lubricants, which lessens their ecological imprint. In this regard, Enel Spa unveiled a brand-new electric transformer in July 2022 for use in solar parks. This transformer uses biodegradable fluids, emits less CO2, and requires less resources to build. In addition to requiring over 14 less tons of different materials to construct the transformers, this will save more than 45 metric tons of CO2 equivalent emissions. It was first used in Spain and was being launched globally.

-

Penetration of Phase Shifting Transformer - The power flow on the transmission grid is controlled by these transformers. They are designed to protect power lines and equipment with higher voltage from heat overloads while controlling the flow of electricity across both networks. PSTs can improve the real power handling of transmission lines, allowing for flexibility in the actual energy transfer, and have little impact on VAR. In general, PSTs increase the stability of transmission systems, decrease network losses, and improve their efficiency.

Challenges

-

Fluctuating Raw Material Prices - Copper, steel, and aluminum are the primary materials used to produce electricity transformers. Due to the increased overall prices for these raw materials, sales of power transformers will be reduced in middle and lower-income countries. During the production process, copper transformer windings allow for an easy weld. However, high material costs can be incurred due to excessive copper consumption.

-

Environmental Concerns associated are anticipated to hinder the power transformer market growth in the forecast period.

- Significant capital investment need is another significant factor posing limitations on the power transformer market growth in the forecast period.

Power Transformer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 28.43 billion |

|

Forecast Year Market Size (2035) |

USD 53.87 billion |

|

Regional Scope |

|

Power Transformer Market Segmentation:

Phase Segment Analysis

In terms of phase, the three-phase segment share in power transformer market is anticipated to surpass 61% by the end of 2035. Three-phase transformers have six windings, three for the primary and three for the secondary, connected in either a delta or a triangle configuration. These circuits can be regarded as part of a single-phase converter. Delta and star are the two most common forms of three-phase connections. A delta connection, also known as a mesh connection, consists of three windings connected at the end, forming a closed loop without a neutral point.

End User Segment Analysis

Based on end user, the industrial segment in power transformer market is anticipated to record the highest revenue share of 44% during the forecast period. These transformers are mainly used in industrial settings, such as manufacturing plants, refineries, mining operations, and other heavy-duty applications. To be able to withstand the intense operating conditions, heavy construction and insulation are commonly used in industry transformers. Industrial supply voltage in Canada stands at 600 VAC similar to that of the US at 480 VAC on the other hand Europe stands at 400 volts in common industrial voltage. The majority of factories are typically supplied with 480V three-phase power, but stepping down the transformers reduces the voltage to 240 V, 208 or 120 for small devices and appliances.

Our in-depth analysis of the global power transformer market includes the following segments:

|

Phase |

|

|

Core |

|

|

Insulation |

|

|

Power Rating |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Transformer Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 43.2% by 2035. The growth of the power transformers industry can be boosted by renewable energy adoption in this region. Integration into the grid of these subsidiary energy resources is needed in order to move away from conventional energy sources, such as solar and wind. In order to ensure efficient transmission and distribution of renewable energy, power transformers play a crucial role in raising or lowering voltage levels. In Asia, in 2019 there was renewable energy production around 2,929,465 GWh, 3,150,570 GWh in 2020, and 3,480,502 GWh in 2021. It is expected that the region will present favorable growth prospects for the power transformers industry due to rising concerns over greenhouse gas emissions and their environmental risks. The need for power transformers in the country is growing due to an increase in manufacturing, infrastructure development and construction work. Rising energy demand and growing interest in the production of renewables are at the heart of power transformer market expansion.

North American Market Insights

The power transformer market share in the North America region is expected to cross 26% during the forecast period. Due to increased electricity demand, the market for power transformers is growing in this area. The need for additional power transformers to increase and improve the electric grid is growing as a result of increasing worldwide demand

Power Transformer Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CG Power & Industrial Solutions Ltd.

- Siemens Energy

- General Electric

- HD HYUNDAI ELECTRIC CO., LTD.

- HYOSUNG USA

- Powertech Transformers &Controls Pvt Ltd

- Bharat Bijlee Limited

- Transformers & Rectifiers India Ltd

- Mitsubishi Electric Corporation

Recent Developments

- Siemens Energy is investing 150 million dollars to expand operations in Charlotte, North Carolina, which will create almost 600 local jobs by addressing the national shortage of power transformers. The power transformers, which convert high voltage electricity to lower voltages, are a vital part of any electrical distribution network that links the generation and transmission.

- GE Renewable Energy announced that in the last few weeks it has received a number of orders to supply 765kV transformers and reactors into India from its Grid Solutions business. Power Grid Corporation of India Ltd., the country's biggest state-owned transmission company, won those contracts. Therefore, being part of order, GE will be producing 13 units of 765 kV transformers and 32 numbers of 765 kV reactors.

- Report ID: 5977

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Transformer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.