In-vitro Diagnostics for Cardiology and Neurology Market Outlook:

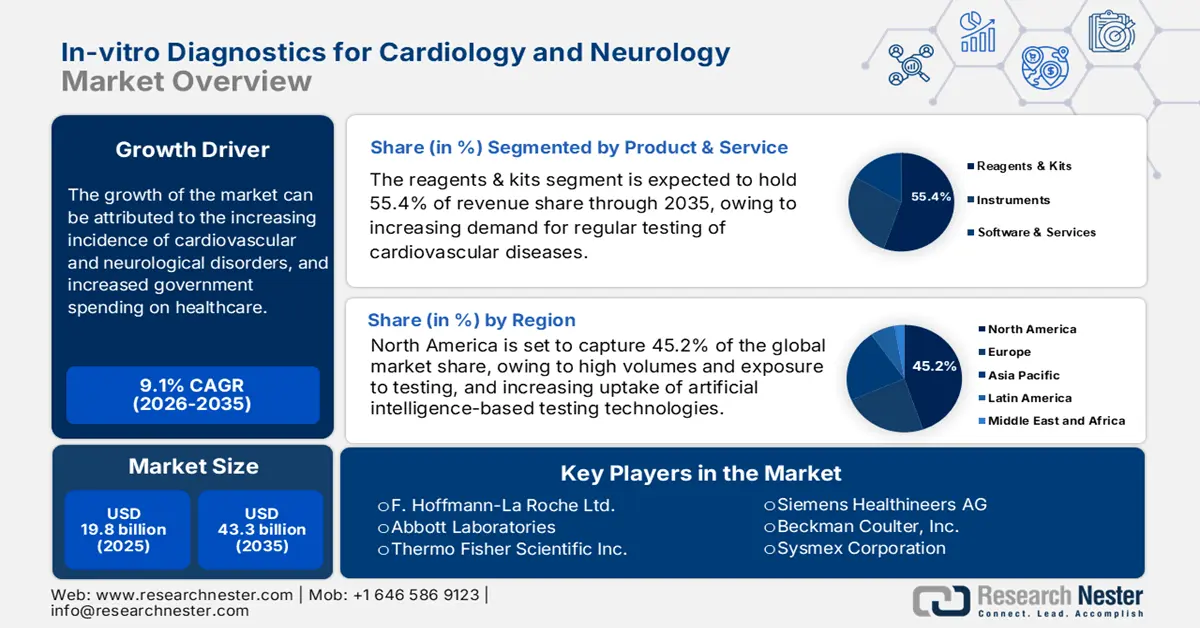

In-vitro Diagnostics for Cardiology and Neurology Market size was valued at USD 19.8 billion in 2025 and is projected to reach USD 43.3 billion by the end of 2035, rising at a CAGR of 9.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of in-vitro diagnostics for cardiology and neurology is assessed at USD 21.6 billion.

The in-vitro diagnostics for cardiology and neurology market caters to a large patient population of cardiovascular diseases (CVD) and neurological disorders. According to an NLM subgroup analysis, CVD-related occurrence, crude mortality, and crude disability-adjusted life years (DALYs) are predicted to increase by 90.0%, 73.4%, and 54.7% between 2025 and 2050 worldwide. It also mentioned that the number of deaths due to this condition is poised to amplify from 20.5 million to 35.6 million during the same timeline. This resembles to the urgent need for the deployment and utilization of advanced diagnostic solutions in order to prevent disease progress and fatalities.

The current dynamics of payers' pricing in the in-vitro diagnostics for cardiology and neurology market are primarily shaped by the increasing pressure on manufacturers to balance cost containment with performance and quality. As major public and private payers in this sector are increasingly prioritizing high affordability benchmarks, the need for both producers and service-providers to adopt value-based pricing models emphasizes. However, the cost-effectiveness of in-vitro diagnostics (IVD) in delivering is helping the sector outperform other testing methods. In this regard, a 2024 NLM study revealed that the full adoption of PrecisionCHD as the primary assessment method for initial coronary heart disease (CHD) can save USD 113.6 million in one year for the U.S. healthcare system.

Key In-Vitro Diagnostics for Cardiology and Neurology Market Insights Summary:

Regional Highlights:

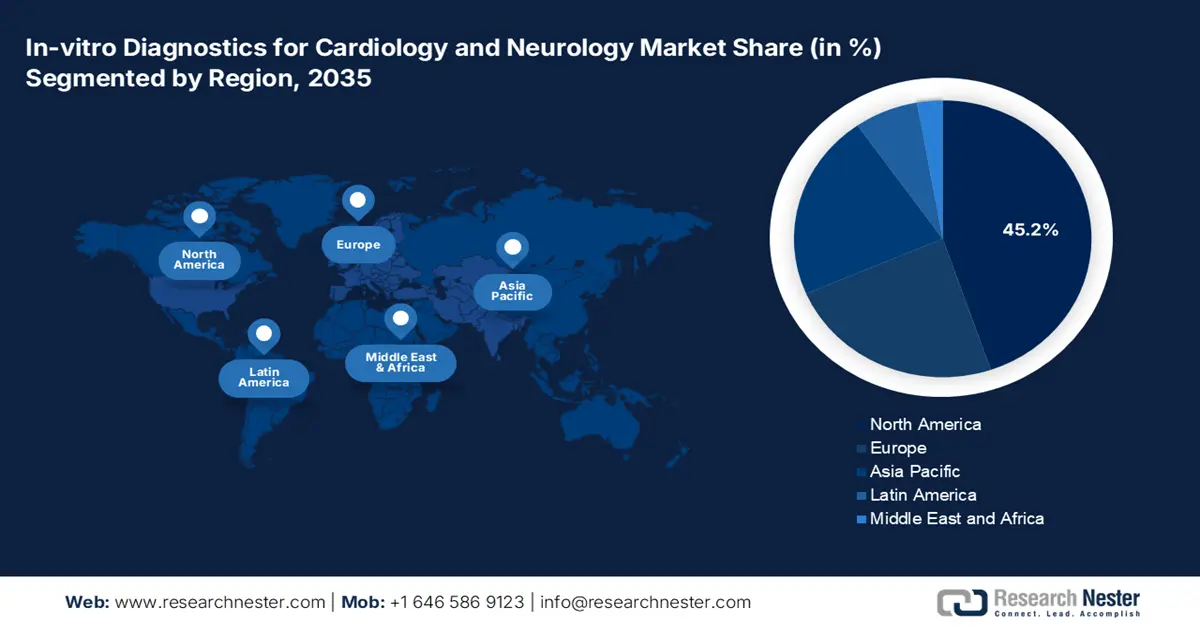

- North America is projected to dominate the in-vitro diagnostics for cardiology and neurology market with a 45.2% share by 2035, owing to robust healthcare infrastructure, rapid adoption of AI-based MedTech innovations, and strong integration of IVD technologies in cardiac and neurological assessments.

- Asia Pacific is expected to record the fastest growth rate during 2026–2035, supported by the surging prevalence of cardiovascular and neurological disorders, aging populations, and growing adoption of AI and POCT-based diagnostics across hospitals and remote care facilities.

Segment Insights:

- The reagents & kits segment is projected to capture a 55.4% share of the in-vitro diagnostics for cardiology and neurology market by 2035, fueled by the growing need for regular cardiovascular disease testing and the rising utilization of biomarker-based diagnostics such as troponin supported by expanding POC testing adoption.

- The point-of-care testing (POCT) segment is anticipated to hold a 22.9% market share by 2035, propelled by the increasing demand for rapid, on-site diagnostic solutions offering faster results, enhanced accessibility, and operational efficiency in decentralized and emergency care settings.

Key Growth Trends:

- Growing awareness and screening programs

- Revolution in neurological assessments

Major Challenges:

- Hurdles related to elongated compliance process

Key Players: Roche Holding AG, Abbott Laboratories, Siemens Healthineers AG, Danaher Corp. (Beckman Coulter), Thermo Fisher Scientific, QuidelOrtho Corporation, Sysmex Corporation, bioMérieux SA, Diasorin S.p.A., Werfen, Fujirebio, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Johnson & Johnson, Quest Diagnostics, Labcorp, Randox Laboratories Ltd., Mindray Bio-Medical, PerkinElmer, Inc., Agilent Technologies, Inc.

Global In-Vitro Diagnostics for Cardiology and Neurology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.8 billion

- 2026 Market Size: USD 21.6 billion

- Projected Market Size: USD 43.3 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 22 October, 2025

In-vitro Diagnostics for Cardiology and Neurology Market - Growth Drivers and Challenges

Growth Drivers

- Growing awareness and screening programs: Both medical professionals and patients are becoming more informed about the benefits of early diagnosis in preventing disease progression, which encourages them for routine screening. In this aspect, public health initiatives and government-funded programs are playing a crucial role in spreading awareness of cost-efficient and accessible tests available in the in-vitro diagnostics for cardiology and neurology market. As evidence, the Well-Integrated Screening and Evaluation for WOMen Across the Nation (WISEWOMAN) program provides backing for CVD risk factor assessments and preventive health services for women aged 35-64 living across America.

- Revolution in neurological assessments: IVD detection are currently earning global recognition for enabling early treatment and better outcomes for cognitive neurological conditions, prompting adoption in the in-vitro diagnostics for cardiology and neurology market. Particularly, the accuracy and speed delivered by these testing methods for chronic neurological disorders, including Alzheimer's (AZ) and Parkinson's disease, is settling new avenues for this sector. For instance, in May 2022, the FDA provided recognition to IVD as a minimally invasive testing of AZ by authorizing Lumipulse G Beta-Amyloid Ratio (1-42/1-40) in cerebrospinal fluid (CSF) as the first IVD biomarker.

- Tech-based upgrades in existing pipelines: Current technological breakthrough in the in-vitro diagnostics for cardiology and neurology market include automation and streamlining of assays, platforms, and data interpretation. These upgrades enhance the precision and speed of biomarker identification, where the cohort is further accompanied by the integration of AI and machine learning. Exemplifying the trend, in July 2025, Roche attained CE Mark for its Elecsys pTau181 test to measure phosphorylated Tau (pTau) 181 protein for AZ disease detection. The technology can offer a high negative predictive value (NPV) of 93.8%, along with 83.6% sensitivity. Moreover, such reliable, accessible, and cost-effective advances support future market expansion.

Demographic Trends and Projections in the In-vitro Diagnostics for Cardiology and Neurology Market

Projected Global Cardiovascular Disease Trends and Mortality (2025-2050)

|

Parameter |

Value/Description |

|

Age-standardized cardiovascular prevalence |

Relatively constant (-3.6%) |

|

Age-standardized cardiovascular mortality |

Decreasing (-30.5%) |

|

Age-standardized cardiovascular DALYs |

Decreasing (-29.6%) |

|

Leading cause of cardiovascular deaths in 2050 |

Ischaemic heart disease (20 million deaths) |

|

Main cardiovascular risk factor driving mortality in 2050 |

High systolic blood pressure (18.9 million deaths) |

|

Region with highest age-standardized cardiovascular mortality rate in 2050 |

Central Europe, Eastern Europe, and Central Asia |

|

Mortality rate in this region (2050) |

305 deaths per 100,000 population |

Source: NLM

Comparative Analysis of Commodities Available in the In-vitro Diagnostics for Cardiology and Neurology Market

Performance & Price Characteristics of Cardiac Diagnostic Technologies (2024)

|

Test Type |

Sensitivity |

Specificity |

Cost per Test (in USD) |

|

PrecisionCHD |

0.7 |

0.7 |

850 |

|

Exercise Electrocardiogram (ECG) |

0.5 |

0.6 |

891 |

|

Cardiac Computed Tomography Angiography (CCTA) |

0.9 |

0.7 |

806 |

|

CCTA + Image Processing |

0.9 |

0.8 |

1,556 |

|

Stress echo |

0.8 |

0.8 |

1,740 |

|

Single Photon Emission Computed Tomography (SPECT) |

0.8 |

0.7 |

4,162 |

|

Positron Emission Tomography (PET) |

0.8 |

0.8 |

4,637 |

|

Cardiac Magnetic Resonance Imaging (CMRI) |

0.8 |

0.8 |

1,432 |

|

Angiogram |

1.0 |

1.0 |

9,498 |

Source: NLM

Challenges

- Hurdles related to elongated compliance process: Regulatory hurdles form a considerable barrier to entry for manufacturers in the in-vitro diagnostics for cardiology and neurology market. The time-consuming and expensive process of acquiring approval from different regulatory agencies often causes budget overflow for innovators in this field. Besides, the inflationary development costs of associated products prohibit suppliers from setting comprehensive pricing, fostering a restrictive adoption dynamic among small- and medium-sized laboratories.

In-vitro Diagnostics for Cardiology and Neurology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 19.8 billion |

|

Forecast Year Market Size (2035) |

USD 43.3 billion |

|

Regional Scope |

|

In-vitro Diagnostics for Cardiology and Neurology Market Segmentation:

Product & Service Segment Analysis

Reagents & kits are expected to acquire the highest share of 55.4% in the in-vitro diagnostics for cardiology and neurology market by the end of 2035. The leadership is largely backed by the increasing demand for regular testing of CVD, particularly biomarkers such as troponin for heart attacks. Substantial consumption in this category is further encouraged and fueled by the emergence of POC testing. Evidencing the same, the Observatory of Economic Complexity (OEC) reported that the value of globally traded other diagnostic reagents accounted for USD 38.3 billion in 2023 alone.

Technology Segment Analysis

Point-of-care testing (POCT) is estimated to account for a considerable share of 22.9% in the in-vitro diagnostics for cardiology and neurology market over the assessed period. The growing importance in delivering rapid and accessible diagnostic results are facilitating a notable momentum in this segment. POCT technologies, being a gold standard for healthcare service providers to perform critical tests near the patient, are becoming a mainstream practice in a majority of pathological laboratories, especially in emergency and outpatient settings. Moreover, the convenience, reduced turnaround time, and ability to operate in decentralized locations are key factors driving the adoption and expansion of POCT in this sector.

End user Segment Analysis

Hospitals are predicted to continue dominating the in-vitro diagnostics for cardiology and neurology market with a 45.6% share during the analyzed timeline. Due to having specialized in-house departments, workforce, and infrastructure, these facilities are considered as the primary point of contact for patients worldwide. Particularly, their ability to handle complex and emergency cases, requiring accessible, rapid, and reliable diagnosis, contribute to their dominance in this field. Furthermore, the rising volume of hospitalizations that seek continuous patient monitoring and wide availability of public reimbursements, position hospitals as the biggest consumer base in the market.

Our in-depth analysis of the in-vitro diagnostics for cardiology and neurology market includes the following segments:

|

Segment |

Subsegments |

|

Product & Service |

|

|

Technology |

|

|

Test Location |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-vitro Diagnostics for Cardiology and Neurology Market - Regional Analysis

North America Market Insights

The North America in-vitro diagnostics for cardiology and neurology market is anticipated to capture the largest share of 45.2% by the end of 2035. The landscape primarily benefits from the existing and sizable healthcare infrastructure, high volumes and exposure to testing, and increasing uptake of AI-based MedTech technologies. The explosive growth and advancement of the biotech and pathology industries is also responsible for the increasing deployment and utilization of IVD into the mainstream cardiac and CNS-related assessment ecosystem across North America.

The rise in outpatient cardiac and neurological monitoring is supporting the demand for rapid and high-sensitivity IVD tools in U.S.-based private diagnostic networks and academic hospitals. This can be displayed through the country’s internationally leading trade of other diagnostic reagents, accounting for USD 10.1 billion and USD 6.0 billion export and import values in 2023, as reported by the OEC. Besides, government-led initiatives promoting early detection and prevention for CVD, such as the launch of Million Hearts Cardiovascular Disease (CVD) Risk Reduction Model, are also prompting adoption in the U.S. in-vitro diagnostics for cardiology and neurology market.

Massive federal allocations and strategic public-private partnerships are creating lucrative opportunities for the in-vitro diagnostics for cardiology and neurology market in Canada. The nationwide efforts to cultivate novel biomarkers for early identification of cardiovascular and neurodegenerative conditions in hospital networks are expanding the existing pipelines in this sector. Further, ongoing reformation of regulatory bodies are supporting improvement in the pace of the validation of IVD tests.

APAC Market Insights

Asia Pacific is predicted to exhibit the highest CAGR in the global in-vitro diagnostics for cardiology and neurology market throughout the discussed timeframe. The concerning rise in the number of CVD and neurological disorders-afflicted residents, which is also amplified by rapidly aging populations, is fostering a substantial consumer base for the merchandise in this region. Besides, the growing trends of incorporating advanced diagnostics to achieve scalable laboratory workflow are prompting wide acceptance of AI and POCT technologies in remote locations and hospitals.

Government initiatives, such as the Healthy China 2030 program, are the major propelling factors behind the remarkable progress of China in the in-vitro diagnostics for cardiology and neurology market. The enlarging demography of CVD is also a prominent contributor to the nation’s strong foundation in this field. Testifying to the same, a 2024 study unveiled that the mortality rate of CVDs accounts for 46.7%-44.2% of all deaths in rural and urban areas in China. Besides, the country’s impressive emphasis on diagnostic tool production is solidifying its forefront position in APAC.

With the ample AZ patient population, coupled with the world’s largest geriatric demography, Japan represents itself as an attractive landscape of profitable business and innovation in the in-vitro diagnostics for cardiology and neurology market. Additionally, the country’s next-generation healthcare infrastructure and strong adoption rates of AI-assisted medical devices are also marking strides in this field. On the other hand, the nation is strengthening its domestic supply chain of biomarkers and precision medicine, fueling local manufacturers.

Heart Failure (HF)-related Trends in APAC as Opportunities (2023)

|

Parameter |

Value |

Notes |

|

Overall economic cost of HF (annual) |

$25 billion |

Total cost in APAC |

|

Direct costs of HF |

$12 billion (48%) |

Medical expenses, hospital care |

|

Indirect costs of HF |

$13 billion (52%) |

Productivity loss, disability |

|

Crude prevalence of HF in 2050 |

74.5 million |

Projected number of cases in APAC |

|

Percentage increase in HF prevalence (2025–2050) |

127.60% |

Growth rate over 25 years |

Source: APACMed and NLM

Europe Market Insights

Europe is estimated to holds a considerable position in the global in-vitro diagnostics for cardiology and neurology market during the tenure between 2026 and 2035. The favorable government initiatives promoting early disease detection and widespread adoption of screening programs are also fueling growth in this landscape. In addition, the aging population and rising burden of chronic diseases contribute to the explosive demand for accurate and timely IVD solutions. Encouraged by such a progressive environment, in November 2023, Roche launched its LightCycler PRO System commercially. This bridged the gap between translational research and IVD technologies.

Ongoing regulatory reformation and increasing public-private collaboration in the UK support robust growth in the Europe in-vitro diagnostics for cardiology and neurology market. On the other hand, the massive capital influx from the National Health Servuce (NHS) and other government funding are fostering a suitable atmosphere for IVD-related innovation. Exemplifying the same, in May 2025, the National Institute for Health and Care Research (NIHR) set its aim to invest USD 58.6 million in funding to support country-wide CVD-associated research cohorts.

Germany is one of the leading country's in the Europe in-vitro diagnostics for cardiology and neurology market. The nation's forefront position in this sector is highly attributable to its robust medical system and strong emphasis on MedTech innovation. Germany is also home to a widespread network of hospitals and diagnostic laboratories, which ensures adequate patient access to cutting-edge IVD tests. Besides, the enlarging geriatric demography of the country heightens the occurrence and mortality of CVD and neurodegenrative disorders, prompting adoption of IVD as a rapid and scalable preventive measure.

Country-wise Trade of Other Diagnostic Reagents (2023)

|

Country |

Mode of Trade |

Values (in USD) |

|

Germany |

Export & Import |

8.5 billion & 4.0 billion |

|

UK |

Export & Import |

19.1 million & 55 million |

|

Ireland |

Export |

2.2 billion |

Source: OEC

Key In-vitro Diagnostics for Cardiology and Neurology Market Players:

- Roche Holding AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher Corp. (Beckman Coulter)

- Thermo Fisher Scientific

- QuidelOrtho Corporation

- Sysmex Corporation

- bioMérieux SA

- Diasorin S.p.A.

- Werfen

- Fujirebio

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Johnson & Johnson

- Quest Diagnostics

- Labcorp

- Randox Laboratories Ltd.

- Mindray Bio-Medical

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

The global IVD market, particularly in the areas of cardiology and neurology, is highly competitive. Companies such as Roche, Abbott, and Thermo Fisher are highly competitive based on innovations in diagnostics. Forces of innovation, such as Beckman Coulter's recent partnership with Fujirebio to facilitate the development of their assays to detect and diagnose neurodegenerative diseases, represent innovations that are securing future progress in this sector.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, Abbott launched a new laboratory-based blood test to evaluate mild traumatic brain injury (mTBI). The test runs on the company’s Alinity i and Architect i1000SR laboratory instruments, which have the potential to eliminate the need for a CT scan by up to 40% and deliver reliable results in just 18 minutes.

- In February 2025, Roche introduced its proprietary, breakthrough sequencing by expansion (SBX) technology. It is combined with an innovative sensor module, which offers ultra-rapid, high-throughput sequencing that is both flexible and scalable for a broad range of applications, including neurodegenerative conditions.

- Report ID: 3849

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-Vitro Diagnostics for Cardiology and Neurology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.