Immune Repertoire Sequencing Market Outlook:

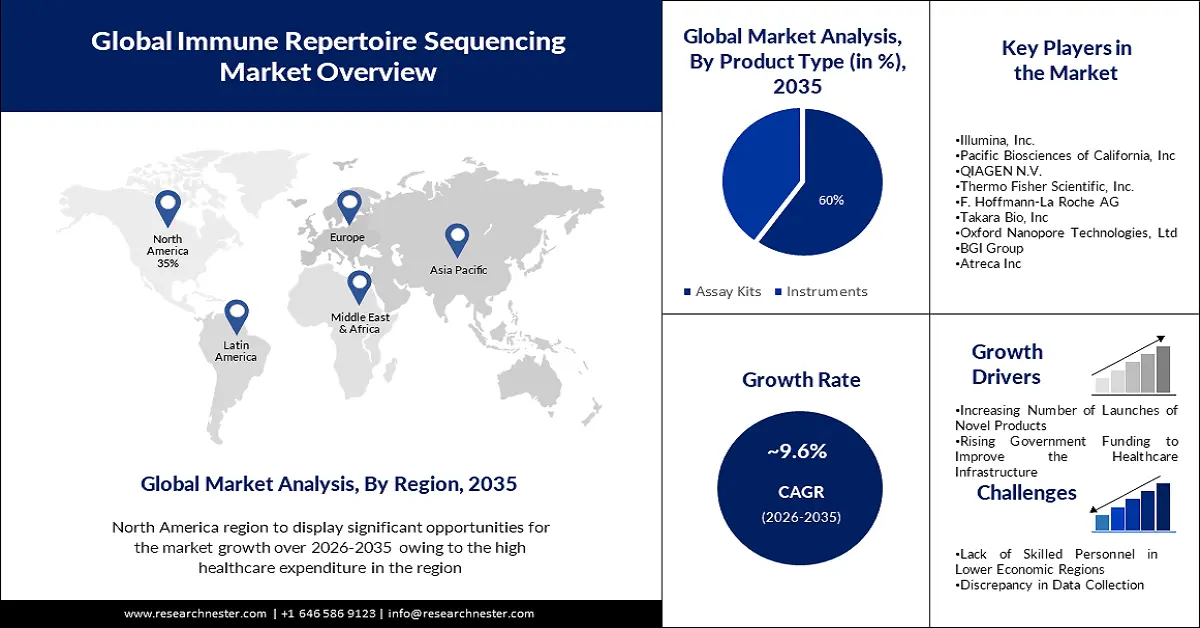

Immune Repertoire Sequencing Market size was valued at USD 366.11 million in 2025 and is set to exceed USD 915.62 million by 2035, expanding at over 9.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of immune repertoire sequencing is estimated at USD 397.74 million.

The market is primarily driven by the escalating government encouragement for pharmacogenomics-based drug recovery. Furthermore, growth in multiple therapeutic areas such as cardiology, pain management, oncology, infectious diseases, and others is estimated to boost the market expansion in the projected period.

Additionally, the industry has been driven by many organizations seeking answers to biomarkers of the immune system. Mergers and acquisitions are also driving the market. More collaboration, acquisition, and agreement among the market players are majorly contributing to the industry growth. In order to produce effective and creative immunotherapies ArcherDX and Ambry Genetics joined hands in March 2018.

Key Immune Repertoire Sequencing Market Insights Summary:

Regional Highlights:

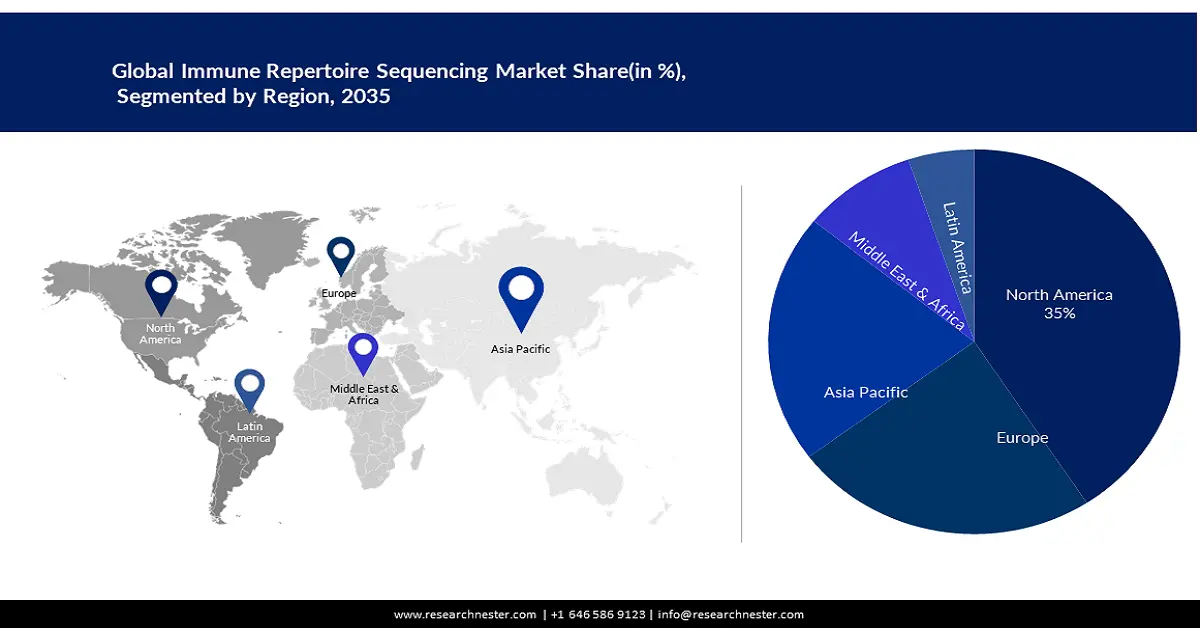

- North America immune repertoire sequencing market will hold around 40.8% share by 2035, driven by high healthcare spending and strong demand for immunotherapy.

Segment Insights:

- The assay kits segment in the immune repertoire sequencing market is projected to capture a significant share by 2035, driven by growing immunotherapy applications requiring advanced sequencing kits.

Key Growth Trends:

- Increasing Number of Launches of Novel Products

- Rising Government Funding to Improve the Healthcare Infrastructure

Major Challenges:

- Accuracy Differences and Partial Techniques Utilization

- Lack of Skilled Personnel in Lower Economic Regions

Key Players: Agilent Technologies, Inc, Illumina, Inc., Pacific Biosciences of California, Inc, QIAGEN N.V., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Takara Bio, Inc, Oxford Nanopore Technologies, Ltd, BGI Group, Atreca Inc.

Global Immune Repertoire Sequencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 366.11 million

- 2026 Market Size: USD 397.74 million

- Projected Market Size: USD 915.62 million by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: China, Japan, South Korea, India, Germany

Last updated on : 9 September, 2025

Immune Repertoire Sequencing Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Number of Launches of Novel Products – Escalating number of launches of novel products and a growing number of research and development activities carried out by key market players are estimated to propel the market demand in the predicted period. In order to characterize human B cells a company named ArcherDX launched Archer Immunoverse B cell Receptor assays in 2017. As per a Cold Spring Harbour Laboratory study, Stanford University researchers used immune repertoire sequencing to recognize the disease-associated symptom in the immune system of patients suffering from an autoimmune disease named systemic sclerosis-related pulmonary disease.

-

Rising Government Funding to Improve the Healthcare Infrastructure – Governments of various regions are offering investments and funding in order to improve the healthcare infrastructure all across the globe, which further boosts the growth of this market. As immune repertoire sequencing plays a vital role in a couple of therapeutic areas.

- High Demand for Personalized Medicines - Rising demand for personalized medicine is expected to have a positive impact on the growth of the global immune repertoire sequencing market. Moreover, promoting the role of next-generation immune repertoire sequencing for personalized immune regulation is expected to surely support the market growth.

Challenges

-

Accuracy Differences and Partial Techniques Utilization - Distinguishing biological changes from errors and biases introduced at various stages is a challenge in immune repertoire sequencing. Conventional and new bioinformatics techniques such as high-throughput screening and Haystack heuristics fall short due to their poor scalability and sensitivity and their limitations in providing sufficient and reliable data. Moreover, inconsistencies in data acquisition and processing in different laboratories, and barriers in immune repertoire sequencing systems are some of the significant reasons that may limit the growth of the immune repertoire sequencing market.

-

Lack of Skilled Personnel in Lower Economic Regions

- Discrepancies in Data Collection

Immune Repertoire Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 366.11 million |

|

Forecast Year Market Size (2035) |

USD 915.62 million |

|

Regional Scope |

|

Immune Repertoire Sequencing Market Segmentation:

Product Type Segment Analysis

The assay kits segment in the immune repertoire sequencing market is set to witness the highest revenue share of 60% by the end of 2035. Assay kits are distributed into TCR kits and BCR kits. The TCR is a significant part of the human adaptive immune system. With the help of this system pathogenic are being identified, recalled, and destroyed. Therefore, various companies are signing agreements and merging in order to offer repertoire sequencing kits for a specific type of immunotherapy.

End User Segment Analysis

The immune repertoire sequencing market from the pharmaceutical segment is poised to experience the largest demand throughout the projected period. Pharmaceutical companies primarily use immune repertoire sequencing to recognize and validate potential therapeutic targets. By knowing the functionality and diversity of immune cells and receptors they can make drugs that can modulate immune responses.

Moreover, pharmaceutical companies often collaborate with research organizations, academic institutions, and sequencing technology providers for advanced immune repertoire sequencing research.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immune Repertoire Sequencing Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 40.8% market share by 2035. This can be ascribed to the high health spending, and strong presence of market players in the region, especially in the United States and Canada. According to the Centers for Medicare & Medicaid Services (CMS), health spending in the United States grew by 9.7% in 2020, reaching a value of USD 4.1 trillion, or USD 12,530 per person. The market is also anticipated to grow with escalating demand for immunotherapy for cancer and other infectious diseases.

APAC Market Statistics Insights

The immune repertoire sequencing market in the Asia Pacific region is estimated to observe noteworthy market demand throughout the estimated period. This can be attributed on the back of the increasing number of international collaborations for immune repertoire sequencing in the region.

In addition, the focus of countries, namely China and Japan, on the integration of new technologies in the healthcare sector is also expected to drive market growth significantly in the coming years.

Immune Repertoire Sequencing Market Players:

- Agilent Technologies, Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Illumina, Inc.

- Pacific Biosciences of California, Inc

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche AG

- Takara Bio, Inc

- Oxford Nanopore Technologies, Ltd

- BGI Group

- Atreca Inc

Recent Developments

- BGI and Gencove announced the extension of the agreement for offering low-pass whole genome sequencing and analysis service to improve global health and sustainability.

- Thermo Fisher introduced a new suite of immune repertoire assays that will help identify potentially malignant clones of T-cells and B-cells.

- Report ID: 3997

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Immune Repertoire Sequencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.