High-Throughput Screening Market Outlook:

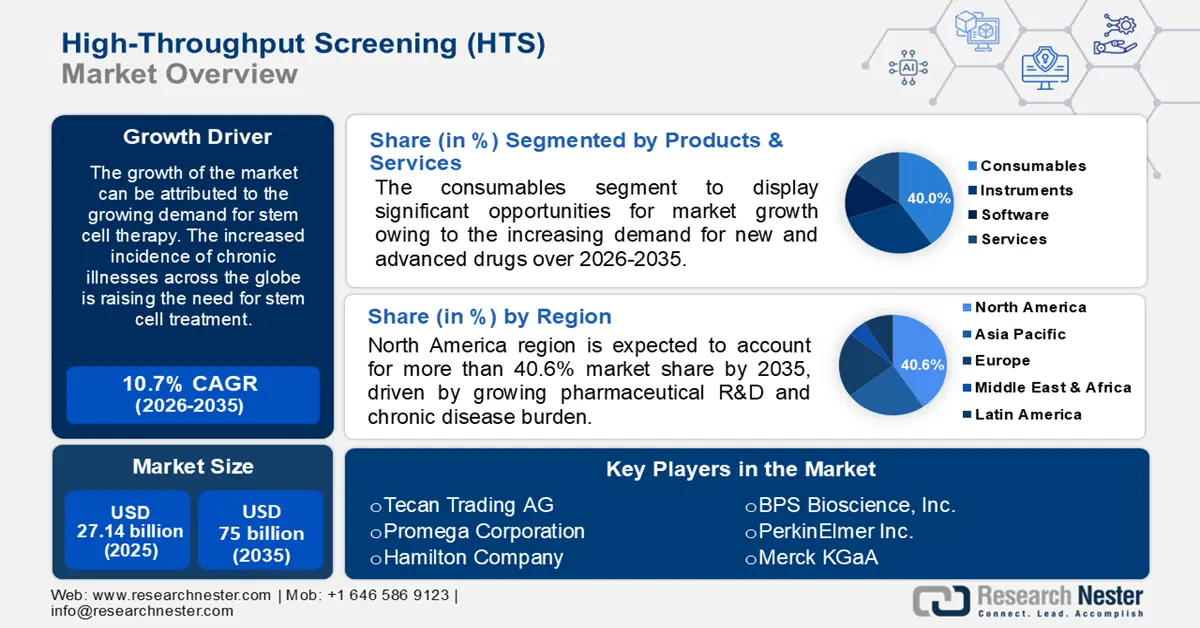

High-Throughput Screening Market size was over USD 27.14 billion in 2025 and is projected to reach USD 75 billion by 2035, growing at around 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-throughput screening is evaluated at USD 29.75 billion.

The growth of the market can be attributed to the growing demand for stem cell therapy. The increased incidence of chronic illnesses across the globe is rising the need for stem cell treatment. Further, researchers frequently utilize high-throughput screening (HTS) of stem cells to better understand the fundamental mechanisms governing stem cell destiny, which is also expected to add to the market growth. Over 20% of New York individuals have a chronic illness, and more than 22% of all hospitalizations in the state are brought on by these conditions.

In addition to these, factors that are believed to fuel the market growth of high-throughput screening (HTS) include the increasing number of drug targets being employed for screening. The identification of a novel therapeutic target is frequently the initial step in the research and development of medications. For instance, in drug development, phenotypic screening is a method for finding compounds that can change a cell's phenotype. Additionally, the increasing investments by the government and research institutes to develop new products are predicted to present the potential for market expansion over the projected period.

Key High-Throughput Screening Market Insights Summary:

Regional Highlights:

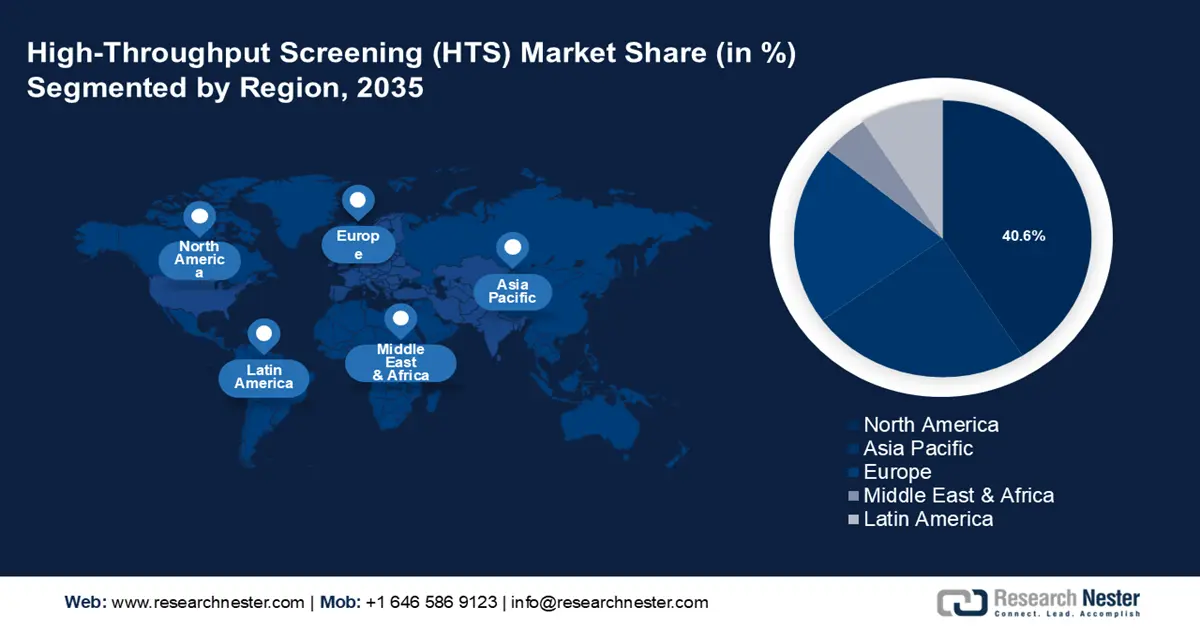

- North America high-throughput screening market will hold around 40.6% share by 2035, driven by growing pharmaceutical R&D and chronic disease burden.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, attributed to rising chronic diseases and drug development using HTS.

Segment Insights:

- The consumables segment in the high-throughput screening market is projected to achieve the largest share by 2035, driven by increasing drug discovery needs and advanced HTS trials.

- The pharmaceutical & biotechnology segment in the high-throughput screening market expects significant share by 2035, influenced by widespread use in discovering treatments for chronic diseases.

Key Growth Trends:

- Growing Demand for Drugs

- Rising Geriatric Population

Major Challenges:

- Difficulties in Assay Development

- Exorbitant Cost of HTS Instruments

Key Players: Carna Biosciences, Inc., Agilent Technologies, Inc., Thermo Fisher Scientific, Tecan Trading AG, Promega Corporation, Hamilton Company, BPS Bioscience, Inc., PerkinElmer Inc., Merck KGaA.

Global High-Throughput Screening Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.14 billion

- 2026 Market Size: USD 29.75 billion

- Projected Market Size: USD 75 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

High-Throughput Screening Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Drugs– On account of the increasing prevalence of chronic disorders across the globe has increased the demand for medicines for treatment. Further, the growing use of HTS for the drug development process is estimated to drive market growth. The number of drug users worldwide is expected to increase by over 10% by 2030.

-

Rising Geriatric Population – Owing to a weak immune system elderly population is more prone to various diseases such as dementia, high blood pressure, and diabetes, which is estimated to drive market growth. As of 2021, the elderly population in India is predicted to increase by over 9%.

-

Increasing Health Spending – Increased government programs and investments in medication research, are anticipated to drive the market growth According to the most recent expenditure data, in 2020, health spending in the US rose by over 9%.

-

Growing Pharmaceutical and Biotechnology Sectors – It is expected that the growing launch of new and advanced drugs, and strong investment in the biotech and pharmaceutical industries, are anticipated to drive market growth. According to estimates, the biotechnology sector in India has grown to a value of over USD 80 billion in 2022.

Challenges

- Difficulties in Assay Development – To create secondary assays, HTS goes through several difficult stages. It is more costly since the complexity of the assay affects both the time and cost, as a result, it is less adopted by some academic research laboratories.

- Exorbitant Cost of HTS Instruments– High maintenance costs, and other indirect expenses, increase the total cost of HTS instruments, which is one of the major factors predicted to slow down the market growth.

- Need for a Large Capital Investment

- Lack of Skilled Professionals

High-Throughput Screening Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 27.14 billion |

|

Forecast Year Market Size (2035) |

USD 75 billion |

|

Regional Scope |

|

High-Throughput Screening Market Segmentation:

Products & Services Segment Analysis

The consumables segment is estimated to gain the largest market share over the projected time frame, attributed to the increasing demand for new and advanced drugs. The adoption of HTS for developing new drugs is anticipated to create numerous opportunities for the growth of the segment. For instance, microplates, pipette tips, and assay plates are consumables that are essential to the HTS workflow. In addition, improvements in HTS technology that enable more intricate and varied screening trials rises the demand for consumables. Furthermore, the need for specialized consumables will probably increase as HTS technologies develop further. By 2026, over 200 new medications are anticipated to be released across the globe.

End-user Segment Analysis

The pharmaceutical & biotechnology firms segment is expected to garner a significant share, attributed to the increasing creation of new compounds to cure many chronic diseases. High-throughput screening (HTS) is widely used in the pharmaceutical and biotechnology industries to find new drugs. Further, the drug development process has been transformed by HTS technology, which allows scientists to quickly screen millions of molecules. As a result, several novel medications have been created to treat a variety of illnesses and ailments, such as cancer, cardiovascular, and infectious diseases. This, as a result, is anticipated to create numerous opportunities for the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Products & Services |

|

|

By Technology |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-Throughput Screening Market Regional Analysis:

North American Market Insight

North America region is expected to account for more than 40.6% market share by 2035, attributed majorly to the growing pharmaceutical industry owing to the rise in chronic illnesses in the region. The creation and manufacture of new and unique drugs for a variety of life-threatening illnesses such as cancer, cardiovascular disorders, metabolic disorders, immunological disorders, and neurological disorders are a focus of both large and small pharmaceutical businesses in the region. This as result will rise the demand for high throughput screening as it is required for screening novel chemical entities with more efficiency. Further, the rising investment in R&D by pharmaceutical and biotechnology, and increasing technological developments in high-throughput screening (HTS), are also anticipated to contribute to the market growth in the region. Almost half of adult Americans suffer from chronic illnesses, which accounts for over 60% of all fatalities in the United States.

APAC Market Insight

The Asian Pacific in high-throughput screening (HTS) market is projected to grow with the highest CAGR during the forecast period, attributed majorly to the growing cases of chronic diseases in the region. The main causes of mortality and disability in the area are chronic illnesses including diabetes, cancer, heart disease like heart attack, and many more, caused by the growing usage of tobacco and being around smoke. The usage of medicine is one of the most popular techniques to manage chronic illness. The use of HTS in the drug development process allows for the subsequent identification of candidates for the treatment of chronic illnesses including cancer, HIV, and cardiovascular ailments, which is anticipated to contribute to the market growth in the region. In addition, the region's growing healthcare industry and adoption of innovative technology to raise the quality of medication, are also anticipated to boost the market growth during the forecast period. By 2045 India is predicted to have over 130 million people with diabetes.

Europe Market Insight

Europe region is projected to observe substantial growth through 2035, attributed majorly to the growing technologically advanced products in the high throughput screening. For instance, the pharmaceutical and biotech sectors have a significant interest in using AI in HTS. The majority of the biggest biopharmaceutical firms in the region are working together to build AI platforms for enhancing the research capacity of immuno-oncology medications, metabolic disease medicines, cancer treatments, and many other therapeutic targets. In addition, high-throughput screening is also in higher demand since it is necessary to screen novel chemical entities, which in turn is anticipated to contribute to the market growth in the region.

High-Throughput Screening Market Players:

- Carna Biosciences, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilent Technologies, Inc.,

- Thermo Fisher Scientific

- Tecan Trading AG

- Promega Corporation

- Hamilton Company

- BPS Bioscience, Inc.

- PerkinElmer Inc.

- Merck KGaA

Recent Developments

-

PerkinElmer Inc. introduced EnVision Nexus system, which enables researchers to screen millions of samples with greater accuracy, speed, and sensitivity. Further, it is developed for demanding high-throughput screening (HTS) applications and to speed up drug development efforts.

-

Thermo Fisher Scientific teamed up with Celltrio to introduce a fully automated cell culture system. The collaboration will fill a major need in the market for high-throughput automated cell line culture and maintenance.

- Report ID: 3521

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High-Throughput Screening Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.