Hydrogen Pipeline Market Outlook:

Hydrogen Pipeline Market size was over USD 11.44 billion in 2025 and is projected to reach USD 47.09 billion by 2035, witnessing around 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogen pipeline is evaluated at USD 13 billion.

The hydrogen pipeline market is expanding primarily due to the growing emphasis on hydrogen as a clean energy carrier and infrastructure construction to enable its production, use, and transportation. According to the International Energy Agency (IEA), hydrogen and hydrogen-based fuels could prevent up to 60 gigatons of CO2 emissions by the middle of the century, or 6% of all cumulative emissions reductions, as part of the Net Zero Emissions Scenario 2021–2050.

One of the most important worldwide efforts to lessen the effects of climate change and move toward more ecologically friendly and sustainable energy sources has propelled the demand for hydrogen pipelines. For several reasons, hydrogen is seen as a clean energy source, and its use is being investigated across industries to help create a low-carbon and more sustainable energy landscape.

Key Hydrogen Pipeline Market Insights Summary:

Regional Highlights:

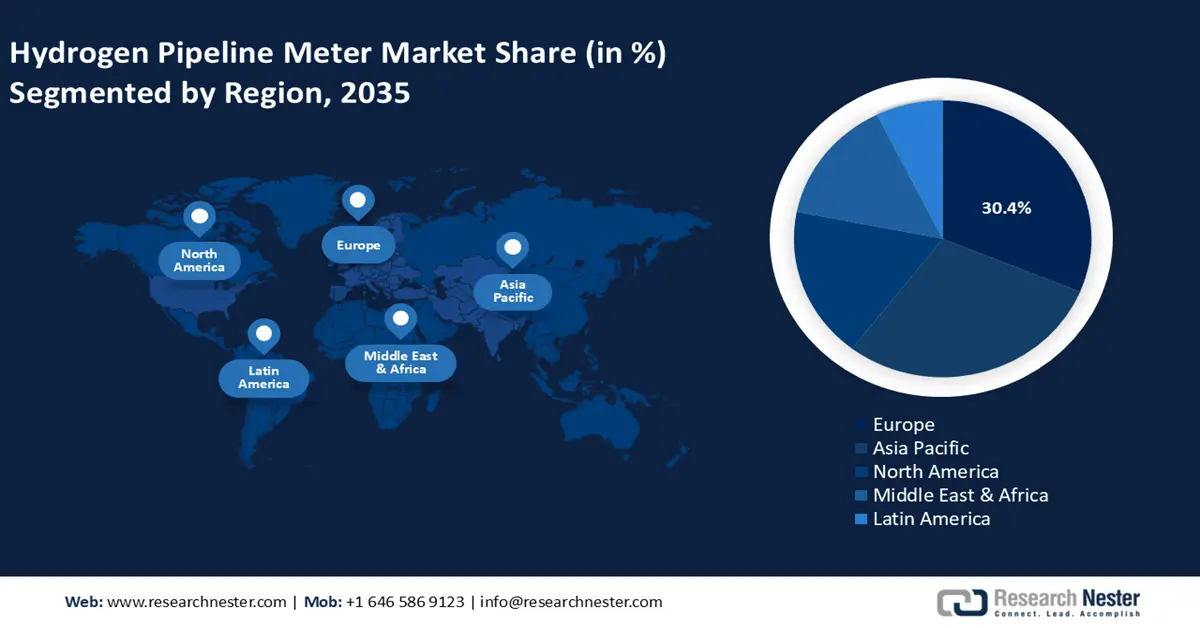

- Europe's 30.4% share in the Hydrogen Pipeline Market is driven by the European Union and individual nations aggressively incorporating hydrogen into their energy systems, ensuring its leadership in 2026–2035.

Segment Insights:

- The Onshore segment is anticipated to achieve more than 60.2% market share by 2035, propelled by growing hydrogen production and the need for efficient gas transportation.

- Repurposed pipelines segment are expected to achieve a significant share by 2035, fueled by cost-efficiency and seamless integration into existing gas infrastructure.

Key Growth Trends:

- Increased governmental efforts

- Retrofitting existing pipelines

Major Challenges:

- High costs of constructing hydrogen pipelines

- Safety concerns related to high flammability

- Key Players: Cenergy Holdings SA, SoluForce B.V., Welspun Corp., TotalEnergies SE, Salzgitter AG, Gruppo Sarplast S.r.l, Tenaris S.A., Hexagon Purus ASA, H2 Clipper Inc., NPROXX B.V.

Global Hydrogen Pipeline Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.44 billion

- 2026 Market Size: USD 13 billion

- Projected Market Size: USD 47.09 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (30.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Hydrogen Pipeline Market Growth Drivers and Challenges:

Growth Drivers

- Increased governmental efforts: Numerous governments worldwide have unveiled plans involving hydrogen to increase gas independence and decarbonize economies. For instance, India set ambitious targets of 50% energy decarbonization and 500 GW of fossil fuel-free generating capacity by 2030 at COP26. Also, in the U.S., the Federal Sustainability Plan was set to attain net-zero emissions across Federal operations by 2050.

Furthermore, The World Economic Forum revealed over 30 projects utilizing green hydrogen have been produced using emissions-free renewable energy, and have been established since 2019. The majority of the nation's production is grey hydrogen, which is produced using fossil fuels like coal. Green hydrogen is produced via electrolysis, which uses electricity to divide water into hydrogen and oxygen while producing zero carbon emissions, to address this problem. The hydrogen pipeline market will expand due to investments in green hydrogen production and the related pipeline infrastructure. - Retrofitting existing pipelines: Using existing pipelines to transport gaseous hydrogen is an affordable way to distribute huge amounts of hydrogen. One of the main obstacles to expanding the hydrogen pipeline delivery infrastructure is the high initial capital expenditures associated with new pipeline construction. In addition, adapting a portion of the natural gas distribution infrastructure to handle hydrogen can expand the hydrogen delivery infrastructure. It might only be necessary to make minor changes to natural gas pipes to convert them to transport a mixture of natural gas and hydrogen (up to 15% hydrogen).

Major companies are investing and remodeling existing pipelines to meet the surging demand for hydrogen across nations. For instance, in January 2022, MosaHYc converted two existing pipelines into a 70-kilometer pure hydrogen infrastructure connecting Völklingen (Germany), Carling (France), Bouzonville (France), and Perl (Germany). The infrastructure can transport up to 20,000 m³/h (60 MW) of pure hydrogen. - Growing demand in end-use industries: The demand for a reliable and efficient hydrogen transportation infrastructure, such as pipelines, is being fueled by industries like manufacturing, chemicals, and refining, which are increasingly looking at hydrogen as a cleaner alternative for their operations. Petroleum refineries utilize hydrogen to lower the sulfur content in diesel fuels, as high sulfur levels can negatively impact engine emissions and violate environmental regulations. According to the International Energy Agency (IEA), the demand for hydrogen worldwide surpassed 95 million tons in 2022, a 3% increase over 2021.

Additionally, to reduce emissions, clean hydrogen-such as electrolytic hydrogen, which is produced using water and renewable electricity-can be integrated into the chemical manufacturing process. Therefore, the growing use of hydrogen in various processes will bolster the hydrogen pipeline market growth.

Challenges

- High costs of constructing hydrogen pipelines: Infrastructure for hydrogen pipelines requires large upfront expenditures for construction and installation. Both public and private organizations are considering hydrogen as a vital part of their energy infrastructure. Potential investors and stakeholders may be deterred from pursuing hydrogen projects due to the significant capital needed for designing, engineering, and building these pipelines. This factor may hinder the hydrogen pipeline market.

- Safety concerns related to high flammability: Since hydrogen molecules are so small, they can readily pass through pipeline flaws of any size. The creation of explosive hydrogen-air combinations may result from these leaks. At extremely low concentrations and with very little energy from sources like sparks or static electricity, hydrogen can burn. This implies that explosions can be caused by even minor mishaps or equipment failures. The expansion of the hydrogen pipeline market is being restrained by these accidents, which also influence safety procedures and regulatory considerations in the construction and operation of hydrogen pipelines and contribute to the cautious approach toward hydrogen's flammability.

Hydrogen Pipeline Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 11.44 billion |

|

Forecast Year Market Size (2035) |

USD 47.09 billion |

|

Regional Scope |

|

Hydrogen Pipeline Market Segmentation:

Type (Onshore, Offshore)

Onshore segment is projected to hold hydrogen pipeline market share of more than 60.2% by 2035. The purpose of the onshore pipelines is to move hydrogen gas from production locations such as electrolysis plants or steam methane reforming facilities to different consuming locations. These are essential for moving hydrogen from production sites to final consumers, such as power plants, industrial customers, and fuel cell car recharging stations. These are also made to make it easier to mix hydrogen with other gases, such as natural gas. According to IEA globally, there were 2.7 million public charging stations by the end of 2022, with over 900,000 of them having been installed in 2022. This represents a roughly 55% increase over 2021 stock and is equivalent to the 50% pre-pandemic growth rate between 2015 and 2019.

Classification (New, Repurposed)

The repurposed segment in hydrogen pipeline market is expected to hold a significant share by 2035. The pipelines entail transforming pre-existing natural gas pipelines to carry hydrogen. They facilitate this blending process, which supports the growth of hydrogen infrastructure by facilitating a seamless shift toward a larger hydrogen content in the gas grid. Compared to constructing new infrastructure, these are more economical. By promoting the shift to a hydrogen economy and enabling the gradual integration of hydrogen into the current natural gas infrastructure, blending boosts business statistics.

Our in-depth analysis of the global hydrogen pipeline market includes the following segments:

|

Type |

|

|

Classification |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Pipeline Market Regional Analysis:

Europe Market Statistics

Europe hydrogen pipeline market is predicted to hold revenue share of more than 30.4% by 2035. As part of larger decarbonization initiatives, the European Union (EU) and individual European nations have been aggressively seeking methods to incorporate hydrogen into their energy systems, which is driving the market growth. Moreover, the ongoing creation of national hydrogen strategies across economies, which generally set goals, regulations, and investments to encourage the use of hydrogen will propel the hydrogen pipeline market growth. The World Economic Forum stated that the goal of the SoutH2 Corridor is to help the continent's clean energy aspirations by serving as a component of a European Hydrogen Backbone. According to the Backbone plan, Europe will have around 40,000 hydrogen pipelines by 2040 and 11,600 km by 2030. Additionally, the growth of cross-border hydrogen pipes will be fueled by cooperative efforts among the nations.

The Government of the UK claims hydrogen is a low-carbon option essential to the country's Sixth Carbon Budget objective by 2035 and its transition to net zero by 2050. Low-carbon hydrogen offers flexible energy for transportation, heating, and power and is a flexible alternative to high-carbon fuels, expanding its demand in various industries. The nation wants to encourage investment and assist innovation to build the necessary supply chains and skills, and provide employment and export opportunities, to reap the financial rewards of the expanding hydrogen economy.

Given the numerous climate benefits of moving away from current fossil fuel sources, Germany is committed to accelerating the adoption of hydrogen. Due to its superiority in manufacturing capacity and research and development (R&D), the region has become a leader in the hydrogen industry. According to the IEA, Germany is the country with the second-highest number of patents worldwide (12%), after the U.S., in the field of hydrogen energy production. Numerous public and commercial sector organizations in Germany have been instrumental in the advancement of hydrogen technology, which is escalating the market expansion.

APAC Market Analysis

Asia Pacific will hold a notable share of the hydrogen pipeline market. The market is anticipated to grow due to the government's increased investment in several technologies meant to increase the efficiency of hydrogen extraction. The growing focus on utility projects and distributed electricity is anticipated to support market growth.

To meet the demands of a growing population and uphold its green transition objectives, India must find a reliable supply of electricity. Policymakers and the energy sector are employing every available instrument to address this issue, including low-carbon alternatives like hydrogen, clean natural gas, and biofuels. As reported by the National Portal of India, in 2023, the country aims to achieve a green hydrogen production capacity of at least 5 MMT million metric tons annually, alongside a renewable energy capacity boost of approximately 125 GW.

In China, industries that are difficult to decarbonize, such as heavy manufacturing, transportation, and energy storage, green hydrogen is seen as an essential part of this approach. Ongoing funding of large-scale green hydrogen initiatives and the execution of pilot projects to replace coal-based processes in the manufacturing of steel is accelerating the hydrogen pipeline market growth.

Key Hydrogen Pipeline Market Players:

- Cenergy Holdings SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SoluForce B.V.

- Welspun Corp.

- TotalEnergies SE

- Salzgitter AG

- Gruppo Sarplast S.r.l

- Tenaris S.A.

- Hexagon Purus ASA

- H2 Clipper Inc.

- NPROXX B.V.

Leading market players invest heavily in R&D to extend their product lines, driving additional growth in the hydrogen pipeline market. Furthermore, market players are launching a variety of strategic measures to expand their global footprint, including introducing new products, contracts, M&A transactions, increased investment, and collaboration with other businesses.

Recent Developments

- In August 2024, Tata Steel, a leading global steel company, and Welspun Corp, one of the world's largest line pipe manufacturers, achieved a significant milestone by developing Hydrogen compliant API X65 grade pipes that successfully passed all critical sour service and fracture qualification tests for transportation of 100% pure gaseous hydrogen under high pressure (100 bar) at RINA in Italy.

- In May 2024, TE H2, a joint venture between TotalEnergies and EREN Groupe, and VERBUND, Austria's top energy utility, signed a Memorandum of Understanding with the Republic of Tunisia to explore the implementation of a large green hydrogen project named, the H2 Notos project is a big green hydrogen project that will export to Central Europe via pipeline.

- Report ID: 6830

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Pipeline Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.