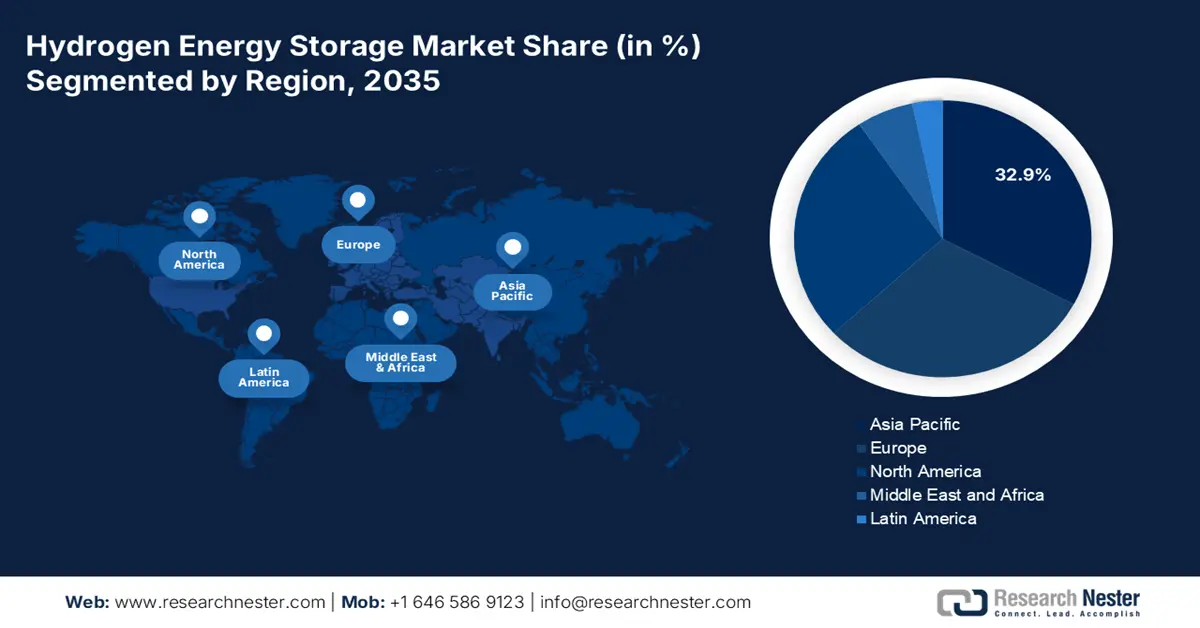

Hydrogen Energy Storage Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia-Pacific market is expected to hold 32.9% of the market share due to renewable integration strategies, hydrogen export ambitions, and increasing strategic commitments in Japan, China, India, and South Korea. By 2034, compressed gas storage will still represent the largest share, while liquid hydrogen storage will grow slightly, and solid-state storage technologies will expand significantly. The growing infrastructure, including hydrogen refueling and backup power systems development, continues to drive accelerated adoption.

India's hydrogen energy storage market will continue to see accelerated growth from 2026 to 2035 as green hydrogen initiatives begin to take effect from the National Green Hydrogen Mission, while the use of renewable energy is gaining popularity. The National Green Hydrogen Mission was initiated by India with a budget of Rs. 19,744 crores, with the goal of producing 5 million metric tons of green hydrogen annually. By 2030, the massive railway network aims to achieve "Net Zero." This program will result in an annual reduction of 60 million tons of emissions. Similarly, cutting emissions by 40 million tons a year due to the large LED bulb initiative.

By 2030, the Indian green hydrogen market is expected to be worth $8 billion, and by 2050, it will be worth $340 billion. The Indian government's policy think tank, NITI Aayog, estimates that the electrolyzer industry might reach $31 billion by 2050 and $5 billion by 2030. With the government's priority on decarbonizing industrial sectors and the energy security of the domestic steel market and ammonia sectors, investment in hydrogen production and storage infrastructure will increase private investment in India's hydrogen supply chain.

Europe Market Insights

The European market is expected to hold 30.3% of the market share by 2035, due to complete hydrogen strategies through the EU and a climate neutrality target by 2050. With the emphasis on investments in large-scale hydrogen hubs, renewable energy integration, and cross-border infrastructure, the supportive policies, pilot project funding, and partnership of public and private sectors enable hydrogen adoption with a focus on grid balancing, seasonal storage, and a resilient energy transition based on renewable energy.

Germany will continue to serve as a core hub for hydrogen energy storage in Europe through 2035, in large part driven by the National Hydrogen Strategy and the establishment of partnerships with industry. Russia supplied 55% of Germany's natural gas in 2020. Denmark, Norway, Belgium, and the Netherlands supplied 40% of Germany's residual natural gas consumption. The expected daily exports of 7.1 billion cubic feet of US LNG to EU nations in 2023 were worth more than $14.6 billion USD. About 48% of imports into the EU came from exports.

North America Market Insights

North America is expected to hold 27.5% of the market share due to sustained investment in clean hydrogen infrastructure and advanced storage technology, and the need for domestic commercial and industrial applications is strong and growing, particularly in the chemical sector and decarbonization policies. Significant infrastructure investment is underway to promote enhanced grid reliability.

In the U.S., the Department of Energy (DOE) intends to leverage the infrastructure investment of more than $62 billion under the Bipartisan Infrastructure Law for a wide variety of hydrogen hubs and hydrogen storage research, which is a major benefit to chemical manufacturing cluster investment and needs. Provide an additional $1.5 billion for clean hydrogen manufacturing and advancing recycling R&D. The U.S. Environmental Protection Agency (EPA) is developing its Clean Hydrogen Production Standard (CHPS) and working on the Hydrogen Shot project, which focuses on reducing costs for and driving deep decarbonization in high-emission industries, including chemicals. The American Chemistry Council (ACC) emphasized that hydrogen sources can provide climate-friendly alternatives that support the cleaner processing of chemicals, namely, ammonia, methanol, and ethylene.