Hydrogen Energy Storage Market Outlook:

Hydrogen Energy Storage Market size was estimated at USD 19.67 billion in 2025 and is expected to surpass USD 36.63 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hydrogen energy storage is estimated at USD 20.95 billion.

The main growth driver for hydrogen energy storage is the decreasing cost of low-temperature water electrolysis, which, as long as fluctuating natural gas prices continue to support it, along with the increasing competitiveness of hydrogen production. The National Renewable Energy Laboratory (NREL) estimates that the potential for serviceable use of hydrogen in the U.S. is predicted to be 106 MMT/year, a tenfold increase over the existing market size annually, with growth in city loads and demand from metals refining, biofuels, and methanol. Federal R&D budgets fund research on advanced materials mainly to enhance gravimetric and volumetric storage capacity through and for metal hydrides, sorbents, and composites.

In upstream supply chains, commodities such as carbon steel, aluminum, and nonferrous alloys, compressed gas infrastructure is important, with US electric utilities importing pipelines for compressed gases or tanks for storage. The global trade picture of hydrogen storage encompasses missing pieces (large-scale trade of liquid hydrogen and assemblage of storage modules in hydrogen hub sites). In July 2025, the Producer Price Index (PPI) for storage battery manufacturing was 205.657. Federal RDD included much of geology, and the advanced storage systems are still RDD with explicit target modeling for developing reservoir modeling and technologies for compressing material cycling.

Key Hydrogen Energy Storage Market Insights Summary:

Regional Highlights:

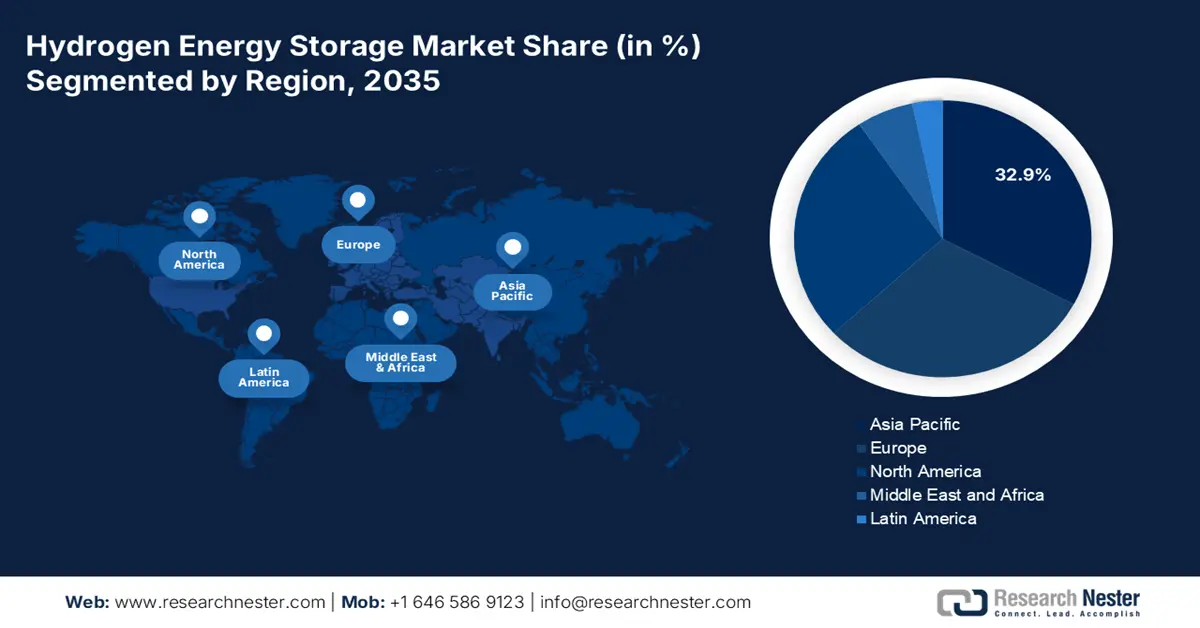

- The Asia-Pacific hydrogen energy storage market is projected to hold 32.9% share by 2035, owing to renewable integration strategies, hydrogen export ambitions, and increasing strategic commitments in Japan, China, India, and South Korea.

- Europe is expected to capture 30.3% share by 2035, impelled by EU hydrogen strategies, climate neutrality targets, and investments in large-scale hydrogen hubs.

Segment Insights:

- The utilities segment is anticipated to account for 42.8% share by 2035, driven by hydrogen use in grid-scale storage, peak shaving, and sector coupling.

- The stationary power segment is projected to hold 38.8% share by 2035, owing to increasing interest in resilient grid storage and integration with renewable energy sources.

Key Growth Trends:

- Government decarbonization targets

- Growing industrial hydrogen demand

Major Challenges:

- Lack of standardization

- Limited renewable hydrogen supply

Key Players: Linde plc, Plug Power Inc., NEL ASA, Toho Gas Co. Ltd., Hydrogenics (Cummins Inc.), ITM Power plc, Sungrow Hydrogen, Hazer Group Limited, Reliance Industries Limited (RIL), Sime Darby Berhad (GreenTech unit), Ballard Power Systems Inc., Iwatani Corporation, Mitsubishi Heavy Industries Ltd., Toshiba Energy Systems & Solutions.

Global Hydrogen Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.67 billion

- 2026 Market Size: USD 20.95 billion

- Projected Market Size: USD 36.63 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (32.9% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: Japan, China, Germany, United States, South Korea

- Emerging Countries: India, Australia, Canada, France, Netherlands

Last updated on : 25 September, 2025

Hydrogen Energy Storage Market - Growth Drivers and Challenges

Growth Drivers

- Government decarbonization targets: Around the world, countries are beginning to adopt hydrogen storage as a strategy to fulfill their targets for net-zero emissions. The goal of the 2022 REPowerEU Strategy was to produce 10 million tons and import 10 million tons by 2030. About 10% of the EU's energy demands are expected to be met by renewable hydrogen by 2050, greatly reducing the carbon footprint of energy-intensive industrial operations and the transportation sector. These supportive policies will stimulate further investment in new hydrogen storage infrastructures as part of a clean energy system and the decarbonization of industry.

- Growing industrial hydrogen demand: Industrial decarbonization is the overarching driver for investment in hydrogen storage. The demand for hydrogen worldwide increased to about 97 million tons in 2023 and nearly 100 million tons in 2024. The demand corresponding to oil refining and ammonia production, and as companies transition from grey hydrogen to low-carbon hydrogen, storage solutions will ensure supply reliability and that there is energy available to maintain industrial operations. For example, in 2023, the production of low-emission hydrogen stayed below 1% of the total hydrogen produced worldwide. The transition will require hydrogen storage solutions at scale to include compressed gas tanks, liquid hydrogen storage, and underground caverns, with the continuous nature of industrial energy demands.

- Growth of hydrogen mobility and fuel cells: As hydrogen mobility grows across fuel cell vehicles, buses, trucks, trains, and ships, hydrogen storage opens new opportunities for those looking to capitalize on hydrogen. Hydrogen refueling stations have a need for efficient storage solutions, which can manage these quantities of hydrogen while ensuring a reliable fuel supply. With the energy potential for hydrogen and transportation quickly accelerating hydrogen adoption, especially in heavy-duty transport, the ability to provide widespread hydrogen storage opportunities is enabling rapid market growth.

Emerging Trade Dynamics in the Market

Trade Data for Containers for Compressed or Liquefied Gas

|

Country |

Export Value (1,000 USD) |

Quantity (Kg) |

|

Qatar |

23,855.72 |

4,903,240 |

|

Brazil |

23,516.07 |

5,562,420 |

|

Slovak Republic |

22,966.97 |

3,327,140 |

|

Estonia |

22,423.03 |

1,758,110 |

|

Hungary |

19,771.49 |

15,746,800 |

|

Luxembourg |

19,054.93 |

15,327,400 |

|

Vietnam |

18,891.07 |

4,268,850 |

|

Denmark |

18,056.05 |

2,960,670 |

|

Norway |

16,290.06 |

15,031,700 |

|

Other Asia, nes |

15,298.93 |

2,641,690 |

Source: WITS

Challenges

- Lack of standardization: In the hydrogen storage sector, there are no commonly agreed-upon technical norms and rules. The lack of consistent regulations impedes cross-border trade and technology transfer, and unfavorable infrastructure investment. Inconsistency in purity requirements for various applications is also a barrier when considering logistics. Establishing standards, which will enable interoperability of markets, is important to scaling the hydrogen economy.

- Limited renewable hydrogen supply: The production of green hydrogen is extremely limited, especially if it is produced through renewable energy. According to the WTO, 96% of hydrogen produced globally is produced from fossil fuels (i.e., gray hydrogen). In addition, electrolyzer capacity is limited (total installed capacity was approximately 1.4 GW in 2023). The gap will limit the amount of low-carbon hydrogen available for storage. For as long as affordable renewable hydrogen is not widely available, the storage of clean hydrogen will be limited.

Hydrogen Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 19.67 billion |

|

Forecast Year Market Size (2035) |

USD 36.63 billion |

|

Regional Scope |

|

Hydrogen Energy Storage Market Segmentation:

End use Segment Analysis

The utilities segment is anticipated to constitute the most significant growth by 2035, with 42.8% hydrogen energy storage market share, due to hydrogen use in applications such as grid-scale storage, peak shaving, and sector coupling, as they leverage hydrogen for seasonal energy storage, a necessity for assemblies wanting to push aggressive renewable penetration. IRENA identifies similar pilot and demonstration programs, including hydrogen gas turbines and fuel cells for the regeneration of electricity. Such projects increase a utility's flexibility, with possible tax incentives.

Storage Application Segment Analysis

The stationary power segment is predicted to gain the largest hydrogen energy storage market share of 38.8% during the projected period by 2035, due to increasing interest in storage applications related to the resilience of the grid, integrating renewable energy technologies, and, recently, long-duration energy storage. The function of hydrogen can serve in balancing renewable resources like wind and solar that present intermittent resource challenges. The use of hydrogen as a medium for storing excess electricity and retrieving it back from there during peak demand times, all part of the decarbonization chain, is a very important component in the overall decarbonization plan. As of January 2020, about 550 megawatts (MW) of stationary fuel cells had been deployed in the US, supplying clean, dependable, distributed power to consumers nationwide, according to FCHEA's tracking and surveys.

Storage Form Segment Analysis

The compressed gas segment is anticipated to constitute the most significant growth by 2035, with 35.2% hydrogen energy storage market share, due to its maturity within the technology, low cost, and applicability in both short- and long-duration applications. The current high-stress, high-pressure tanks for compressed hydrogen are rising and are used both in stationary systems and in vehicles with fuel cells. The U.S. Department of Energy (DOE) has funded advancements in Type IV carbon composite tanks that reduce system weight and improve durability. Compressed hydrogen is the most common form of hydrogen fuel storage because it is very easy and does not require extensive infrastructure, according to the Hydrogen and Fuel Cell Technologies Office (HFTO).

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Storage Form |

|

|

End use |

|

|

Storage Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Energy Storage Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia-Pacific market is expected to hold 32.9% of the market share due to renewable integration strategies, hydrogen export ambitions, and increasing strategic commitments in Japan, China, India, and South Korea. By 2034, compressed gas storage will still represent the largest share, while liquid hydrogen storage will grow slightly, and solid-state storage technologies will expand significantly. The growing infrastructure, including hydrogen refueling and backup power systems development, continues to drive accelerated adoption.

India's hydrogen energy storage market will continue to see accelerated growth from 2026 to 2035 as green hydrogen initiatives begin to take effect from the National Green Hydrogen Mission, while the use of renewable energy is gaining popularity. The National Green Hydrogen Mission was initiated by India with a budget of Rs. 19,744 crores, with the goal of producing 5 million metric tons of green hydrogen annually. By 2030, the massive railway network aims to achieve "Net Zero." This program will result in an annual reduction of 60 million tons of emissions. Similarly, cutting emissions by 40 million tons a year due to the large LED bulb initiative.

By 2030, the Indian green hydrogen market is expected to be worth $8 billion, and by 2050, it will be worth $340 billion. The Indian government's policy think tank, NITI Aayog, estimates that the electrolyzer industry might reach $31 billion by 2050 and $5 billion by 2030. With the government's priority on decarbonizing industrial sectors and the energy security of the domestic steel market and ammonia sectors, investment in hydrogen production and storage infrastructure will increase private investment in India's hydrogen supply chain.

Europe Market Insights

The European market is expected to hold 30.3% of the market share by 2035, due to complete hydrogen strategies through the EU and a climate neutrality target by 2050. With the emphasis on investments in large-scale hydrogen hubs, renewable energy integration, and cross-border infrastructure, the supportive policies, pilot project funding, and partnership of public and private sectors enable hydrogen adoption with a focus on grid balancing, seasonal storage, and a resilient energy transition based on renewable energy.

Germany will continue to serve as a core hub for hydrogen energy storage in Europe through 2035, in large part driven by the National Hydrogen Strategy and the establishment of partnerships with industry. Russia supplied 55% of Germany's natural gas in 2020. Denmark, Norway, Belgium, and the Netherlands supplied 40% of Germany's residual natural gas consumption. The expected daily exports of 7.1 billion cubic feet of US LNG to EU nations in 2023 were worth more than $14.6 billion USD. About 48% of imports into the EU came from exports.

North America Market Insights

North America is expected to hold 27.5% of the market share due to sustained investment in clean hydrogen infrastructure and advanced storage technology, and the need for domestic commercial and industrial applications is strong and growing, particularly in the chemical sector and decarbonization policies. Significant infrastructure investment is underway to promote enhanced grid reliability.

In the U.S., the Department of Energy (DOE) intends to leverage the infrastructure investment of more than $62 billion under the Bipartisan Infrastructure Law for a wide variety of hydrogen hubs and hydrogen storage research, which is a major benefit to chemical manufacturing cluster investment and needs. Provide an additional $1.5 billion for clean hydrogen manufacturing and advancing recycling R&D. The U.S. Environmental Protection Agency (EPA) is developing its Clean Hydrogen Production Standard (CHPS) and working on the Hydrogen Shot project, which focuses on reducing costs for and driving deep decarbonization in high-emission industries, including chemicals. The American Chemistry Council (ACC) emphasized that hydrogen sources can provide climate-friendly alternatives that support the cleaner processing of chemicals, namely, ammonia, methanol, and ethylene.

Key Hydrogen Energy Storage Market Players:

- Air Liquide S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Linde plc

- Plug Power Inc.

- NEL ASA

- Toho Gas Co., Ltd.

- Hydrogenics (Cummins Inc.)

- ITM Power plc

- Sungrow Hydrogen

- Hazer Group Limited

- Reliance Industries Limited (RIL)

- Sime Darby Berhad (GreenTech unit)

- Ballard Power Systems Inc.

- Iwatani Corporation

- Mitsubishi Heavy Industries Ltd.

- Toshiba Energy Systems & Solutions

The hydrogen energy storage market is currently characterized by a combination of more established energy giants and tech-savvy innovators. Companies like Air Liquide, Linde, and Plug Power are worldwide players with vertically integrated hydrogen ecosystems in Japan. Four players - Toho Gas, Iwatani, Mitsubishi Heavy Industries, and Toshiba - are active in both hydrogen infrastructure and fuel cells. U.S. and European businesses are focused on grid storage and mobility applications, while emerging players from India, Australia, and Malaysia also benefit from their respective abundance of green hydrogen projects. Competition from these players is based on partnerships, scaling electrolyzers, and government pilot project support through 2034.

Some of the key players operating in the market are listed below:

Recent Developments

- In May 2024, ITM Power unveiled the NEPTUNE V, a 5 MW PEM electrolyser in a container, costing in the region of £4.36 million. By November, the company had contracted a 15 MW system to be shipped to Germany, and a 2 MW unit was operating in Tokyo. In addition, Yara's 24 MW green-ammonia facility also employed ITM's TRIDENT technology. These projects demonstrate that the market is gaining traction with announced global capacity for electrolysis now close to 520 GW, expected to support a projected level of 49 Mtpa of low-emission hydrogen by 2030.

- In 2024, Pure Hydrogen Corporation opened a green hydrogen micro-hub at Archerfield Airport, Australia, with a production capacity of 421 kg/day. The facility is aimed at commercial trucks and drones and contains modular, scalable units for an electrolyser, storage, and compression systems. This approach creates a distributed infrastructure and is designed for economic and local availability of hydrogen to be part of a cost-effective, distributed hydrogen supply and ultimately to replicate this in transportation corridors. It is a significant step towards "CAPEX-light" models that enable decarbonization and provide pathways for the adoption of green hydrogen within the logistics and aviation ecosystem as a sector-wide focus for decarbonization.

- Report ID: 3811

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.