Hydrocarbon Analyzers Market Outlook:

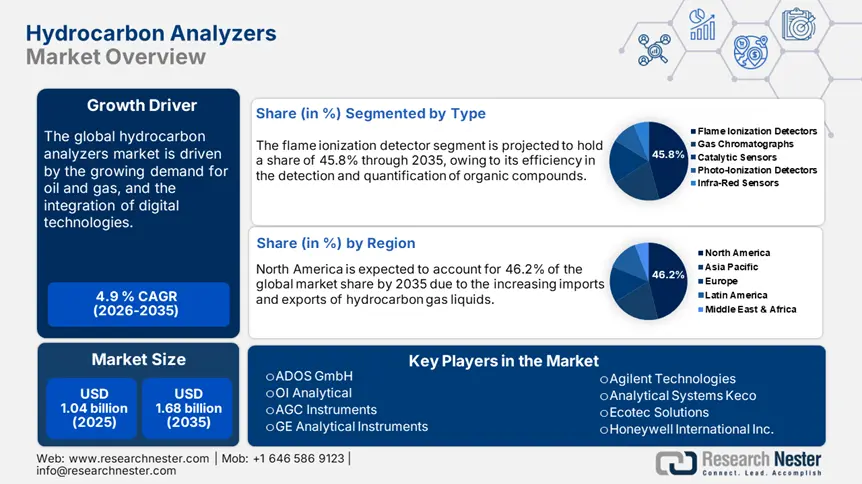

Hydrocarbon Analyzers Market size was over USD 1.04 billion in 2025 and is anticipated to cross USD 1.68 billion by 2035, growing at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrocarbon analyzers is assessed at USD 1.09 billion.

The rapid industrialization and urbanization in both developed and developing economies are propelling a high demand for hydrocarbon gas liquids. The high initial CAPEX requirement for installing renewables is driving a robust consumption of oil and gas for energy production. The countries are forming cross-border partnerships to increase the production of hydrocarbons within the standards limits. The domestic exploration of onshore and offshore hydrocarbons, backed by government support, is likely to increase the sales of analyzers and other technologies. Asia Pacific, the Middle East & Africa, and Latin America are estimated to offer high gains, owing to the swift rise in hydrocarbon gas liquids production activities.

The International Energy Agency (IEA) states that the total oil supply to the world in 2022 amounted to 187,902,349 TJ. The U.S. leads the oil supply with 16.9%, followed by China (15.2%), India (5.4%), and Russia (3.7%). According to the same source, the offshore generation of oil and natural gas is poised to cross 27.4 mboe/d and 29.6 mboe/d, respectively, by 2040. Furthermore, the study by Global Energy Monitor explains that the new oil and gas extraction projects are mainly explored in the oceans. As per their detailed analysis, the new offshore discoveries are anticipated to generate 8.0 billion barrels of oil equivalent (bboe) of resources. The two biggest offshore projects are in Kuwait and Namibia, namely Nokhatha and Mopane. Thus, the increasing exploration activities are set to double the revenue percentage of the hydrocarbon analyzer manufacturers in the years ahead.

Key Hydrocarbon Analyzers Market Insights Summary:

Regional Highlights:

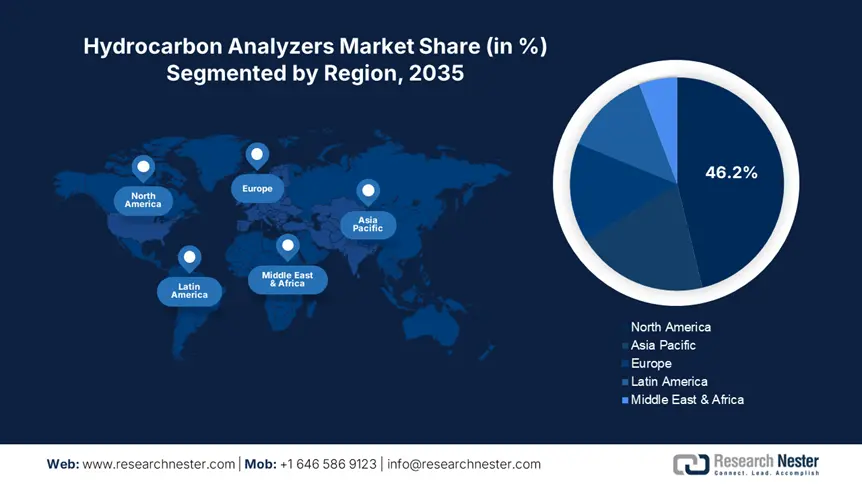

- North America dominates the Hydrocarbon Analyzers Market with a 46.20% share, fueled by strong oil and gas exploration and public-private investments, ensuring robust growth by 2035.

- The Asia Pacific region is anticipated to experience robust growth in the Hydrocarbon Analyzers Market from 2026 to 2035, driven by rising oil & gas production, urban activity, and deepwater exploration.

Segment Insights:

- The Flame Ionization Detector (FID) segment is projected to achieve around 45.8% share by 2035, fueled by growing use in gas chromatography and demand from key industries.

- The Petroleum Refineries segment of the Hydrocarbon Analyzers Market is forecasted to hold over 42.1% share by 2035, driven by increasing liquid fuel consumption and refining activity in key regions.

Key Growth Trends:

- Integration of advanced technologies

- High demand from multiple sectors

Major Challenges:

- High CAPEX requirements

- Technological complexity and recalls

Key Players: AMETEK MOCON, VUV Analytics, Inc., Thermo Fisher Scientific, Inc., GOW-MAC Instrument, and Siemens Process Analytics.

Global Hydrocarbon Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.04 billion

- 2026 Market Size: USD 1.09 billion

- Projected Market Size: USD 1.68 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Hydrocarbon Analyzers Market Growth Drivers and Challenges:

Growth Drivers

-

Integration of advanced technologies: Advanced technologies are often in high demand by big companies, owing to the automation trends. The integration of digital technologies such as data analytics, artificial intelligence, machine learning, and the Internet of Things uplifts the capabilities of hydrocarbon analyzers and contributes to their sales growth. Manufacturers are increasingly investing in these technologies owing to the improved performance of their products and high profitability ratio. The companies are targeting the oil and gas industry for the sales of advanced hydrocarbon analyzers due to the high need for automated control, predictive analysis, and effective decision-making in this field. Thus, the growth in the trade of hydrocarbon gas liquids is likely to augment the sales of analyzers in the years ahead.

- High demand from multiple sectors: The expanding applications of hydrocarbon analyzers in various sectors such as tobacco, chemical, research, and power generation are likely to boost the revenues of key producers during the projected period. The hydrocarbon analyzers are estimated to exhibit a high demand in the tobacco industry for the detection of polycyclic aromatic hydrocarbons (PAHs), and to ensure safety and quality control. The continuous advancements in tobacco production are set to offer high-earning opportunities to the hydrocarbon analyzer manufacturers. Furthermore, in the ethylene production plants, the hydrocarbon analyzers, particularly chromatographs and laser-based analyzers, find high applications for monitoring purity and optimizing processes.

Challenges

-

High CAPEX requirements: The high initial investment in the production of hydrocarbon analyzers is a major barrier for small-scale hydrocarbon analyzers market players. The huge upfront capital requirement for advanced infrastructure and manufacturing technologies, and the ongoing cost for research and development, act as a financial burden for small companies. Thus, budget constraints are likely to deter small companies from expanding their business operations and earning lucrative gains.

- Technological complexity and recalls: Technological complexity and product failure significantly hinder the goodwill of the hydrocarbon analyzer manufacturers. The product recalls often hamper the hydrocarbon analyzers market value of the company and lead to major profit loss. This also adds extra costs to the budget, calling back the products and offering free services. The aftereffects of a product recall also lead to low sales of other products, creating a misconception among consumers at large.

Hydrocarbon Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 1.04 billion |

|

Forecast Year Market Size (2035) |

USD 1.68 billion |

|

Regional Scope |

|

Hydrocarbon Analyzers Market Segmentation:

Type (Flame Ionization Detectors (FID), Gas Chromatographs (GCs), Catalytic Sensors, Photo-Ionization Detectors (PID), Infra-Red (IR) Sensors)

Flame ionization detector (FID) segment is anticipated to dominate around 45.8% hydrocarbon analyzers market share by the end of 2035. The flame ionization detectors are finding high applications in gas chromatography for the detection and quantification of organic compounds. The growth in industrial processes across the world is anticipated to increase the sales of flame ionization detectors. The growth in the oil and gas industry represents a high demand for flame ionization detectors for hydrocarbon exploration. Continuous technological advancements are poised to amplify the sales of improved flame ionization detectors in the coming years. The chemical manufacturing sector is also contributing to the increasing production and commercialization of flame ionization detectors.

End use (Petroleum Refineries, Tobacco Industry, Ethylene Production Plants, Environmental Monitoring Station, Academic Research Institutes & Laboratories, Others)

By the end of 2035, petroleum refineries segment is projected to hold over 42.1% hydrocarbon analyzers market share. The U.S Energy Information Administration (EIA) states that the worldwide liquid fuels production is set to expand by 1.4 million b/d and 1.6 million b/d in 2025 and 2026, respectively. The same source also states that the global refining capacity was calculated at 103.5 million b/d in 2023. Furthermore, the petroleum and other liquid fuels consumption is forecast to reach 105 million b/d by 2028. The demand is likely to be concentrated across Asia Pacific and the Middle East owing to a rise in transportation activities in these regions.

Our in-depth analysis of the hydrocarbon analyzers market includes the following segments:

|

Type |

|

|

Modularity |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrocarbon Analyzers Market Regional Analysis:

North America Market Forecast

North America in hydrocarbon analyzers market is expected to dominate around 46.2% revenue share by the end of 2035. The strong oil and gas exploration activities in its jurisdiction are directly fueling the sales of hydrocarbon analyzers. The adequacy of oil reserves in the form of sands and deepwater is increasing the demand for hydrocarbon technologies, including analyzers, detectors, and sensors. The public-private investments in the hydrocarbon exploration activities are also helping the region to capture a dominant position in the global landscape.

Technological innovation in drilling and exploring technologies is boosting U.S. oil and natural gas production, which is further fueling the sales of hydrocarbon analyzers. The EIA study states that the country’s oil and natural gas production reached 12.2 million b/d and 121.1 billion cubic feet per day (Bcf/d) in 2022, respectively. In 2023, the production surpassed 13.3 million b/d for oil and 128.8 Bcf/d for natural gas. Thus, the swift rise in hydrocarbon exploration is anticipated to propel the demand for hydrocarbon analyzers in the U.S.

Canada’s strong chemical industry is augmenting the applications of hydrocarbon analyzers and other technologies. The growing ethylene and gas liquids production is expected to drive the sales of flame ionization detectors, gas chromatographs, and catalytic sensors in the years ahead. In the country, Alberta’s 4 petrochemical plants produce 4.1 million tonnes of ethylene per year. Furthermore, the report by the World Integrated Trade Solution (WITS) states that Canada imported around 154,804 kg of ethylene in 2022. Thus, the increasing ethylene production is foreseen to drive the market growth in the coming years.

Asia Pacific Market Statistics

The Asia Pacific hydrocarbon analyzers market is estimated to rise at a robust pace from 2026 to 2035. The increasing industrial and urban activities in the region are propelling high energy demand, which is further contributing to the hydrocarbon analyzer sales. The shift towards deepwater hydrocarbon exploration is also anticipated to propel the demand for hydrocarbon analyzers. China and India’s rising oil and gas production, coupled with a healthy chemical trade, is creating a profitable environment for hydrocarbon analyzer companies. Ahead in technological innovation, Japan and South Korea are expected to lead the production and commercialization of advanced hydrocarbon analyzers.

The hydrocarbon analyzer manufacturers are forming strategic collaborations with high-tech companies to drive innovations in China’s hydrocarbon analyzers market. The partnerships with hydrocarbon exploration companies are also estimated to increase the hydrocarbon analyzer trade in the country. For instance, in March 2025, the China National Offshore Oil Corporation announced the discovery of deepwater hydrocarbons in the Beibu Gulf of the South China Sea. Such exploration activities are set to directly increase the employment of hydrocarbon analyzers and other related technologies.

The supportive government policies and investments are likely to fuel the hydrocarbon trade in India. For instance, to increase the domestic production of hydrocarbons, the government introduced the Hydrocarbon Exploration and Licensing Policy (HELP). In 2023-2024, the eastern offshore of the country contributed 1.46 MMT of the total oil production, states the Directorate General of Hydrocarbons (DGH). Furthermore, the booming chemical sector is likely to increase the trade of hydrocarbon analyzers during the foreseeable period. The India Brand Equity Foundation (IBEF) study highlights that the chemicals and petrochemical demand is projected to cross USD 1.0 trillion by 2040.

Key Hydrocarbon Analyzers Market Players:

- AMETEK MOCON

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VUV Analytics, Inc.

- Thermo Fisher Scientific, Inc.

- GOW-MAC Instrument

- Siemens Process Analytics

- ADOS GmbH

- OI Analytical

- AGC Instruments

- GE Analytical Instruments

- Servomex Group

- ABB Group

- Advanced Micro Instruments

- Agilent Technologies

- Analytical Systems Keco

- Ecotec Solutions

- Honeywell International Inc.

- Modcon Systems

- Nova Analytical Systems

- PerkinElmer

- Teledyne Analytical Instruments

- VIG Industries

The leading hydrocarbon analyzer companies are employing several organic and inorganic marketing strategies to double their revenues and reach. They are investing heavily in research and development activities to enhance their product portfolio. Industry giants are also collaborating with high-tech companies to introduce next-gen hydrocarbon analyzers. Partnership with other players is aiding them in expanding their customer base. Key players are also employing a regional expansion strategy to boost their production cycle and earn high profits from untapped hydrocarbon analyzers markets.

Some of the key players include:

Recent Developments

- In July 2024, AMETEK MOCON revealed the launch of the BASELINE series of continuous hydrocarbon analyzers. With superior performance and a new, simplified interface, these analyzers are designed for measuring ambient or process hydrocarbon gases in environmental or industrial settings.

- In August 2023, VUV Analytics, Inc. announced its achievement in determining hydrocarbon types in waste plastic process oil using gas chromatography with vacuum ultraviolet absorption spectroscopy (GC-VUV). This is the world’s first method to accurately characterize WPPO generated from chemical or thermal recycling of waste plastics.

- Report ID: 7523

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrocarbon Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.