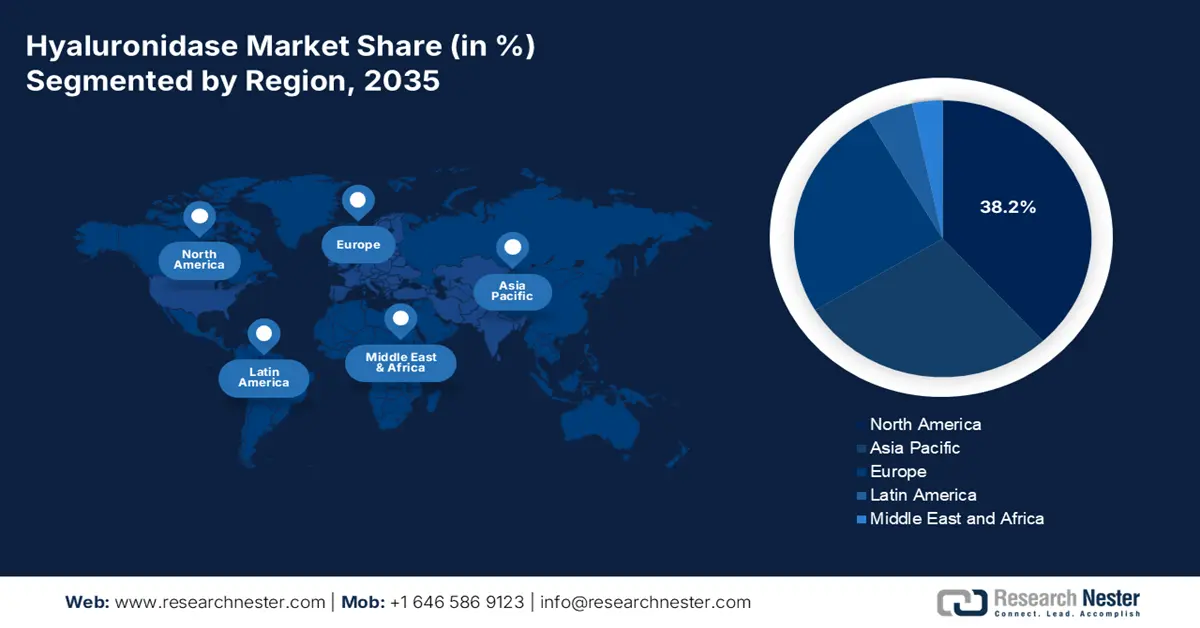

Hyaluronidase Market - Regional Analysis

North America Market Insights

North America market is predicted to account for the highest share of 38.2% by the end of 2035. The market’s growth in the region is extremely propelled by the paradigm transition from intravenous to subcutaneous monoclonal and biologics antibodies administration, the existence of a technological platform, the pivotal role of the U.S. Federal Reimbursement, and provincial health aspects. According to the August 2025 NLM article, there has been an increase in biologics, accounting for 170 in the past five years and 139 over 10 years, successfully approved by the FDA. Additionally, biologics catered to 32% of drug approvals, thereby making it suitable for the market’s growth.

Historical FDA Approval for Small Molecule, Antibodies, Non-Antibody Biologics, and CAR-T Drugs

|

Years |

Small Molecule |

Antibodies |

Non-Antibody Biologics |

CAR-T Drugs |

Total |

|

2014 |

31 |

9 |

7 |

- |

47 |

|

2015 |

33 |

10 |

7 |

- |

50 |

|

2016 |

11 |

6 |

3 |

- |

20 |

|

2017 |

34 |

10 |

3 |

2 |

49 |

|

2018 |

38 |

11 |

5 |

- |

54 |

|

2019 |

34 |

9 |

2 |

- |

45 |

|

2020 |

36 |

12 |

2 |

1 |

51 |

|

2021 |

33 |

10 |

5 |

2 |

50 |

|

2022 |

20 |

11 |

4 |

1 |

36 |

|

2023 |

33 |

12 |

6 |

- |

51 |

|

2024 |

30 |

15 |

1 |

1 |

47 |

Source: NLM

U.S. market is growing significantly, owing to the aspect of suitable reimbursement policies, federal research fund, rapid transition in the drug delivery system, reduced healthcare expenses, optimization of patient convenience, and Medicare Part B coverage for administered drugs. As per an article published by NLM in June 2025, a total of 9 biologics constituted approved hyaluronidase versions, and the Medicare spending for these drugs amounted to USD 10.3 billion as of 2022. In addition, hyaluronidase versions accounted for 5% to 83% of the overall Medicare expenditure for 4 of these drugs, thus creating a positive impact for the market.

The market in Canada is also growing due to the existence of provincial health technology assessment, standard care protocols, optimistic recommendations from agencies, such as the Canada-based Agency for Drugs and Technologies in Health (CADTH), an increase in health and medical spending, and provincial formularies. As stated in the August 2022 Government of Canada data report, Health Canada has effectively declared an estimated USD 40 million in funding for 73 advanced community-centric projects to combat illegal drug supply and delivery. In this regard, an overall USD 5,323,303 has been allocated in Alberta for AAWEAR's Peer Outreach Harm Reduction Teams Alberta Addicts, while USD 6,849,526 has been allocated in British Columbia through Burnaby Family Life Institute, thus uplifting the market’s growth.

Europe Market Insights

Europe market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is attributed to innovation in healthcare facilities, increased chronic disease prevalence, robust regulatory framework, and intense focus on patient-centric care and medical efficiency. Besides, in September 2025, the IHI EuropHeartPath constituted the intention of transforming care for people with cardiovascular diseases in the overall region. This has been possible by optimizing the complete care pathway, from diagnosis to early detection and monitoring, ailment and prevention, and also by adopting current-generation solutions and advancements.

The hyaluronidase market in Germany is also gaining increased exposure, owing to the rapid drug adoption process, an upsurge in health and medical spending, facilitation by the Federal Ministry of Health (BMG), the pivotal role of the German Institute for Drugs and Medical Devices (BfArM) for ensuring national market authorization, and the presence of a strong clinical research facility. For instance, in October 2024, Janssen-Cilag International NV, which is a part of Johnson & Johnson, declared the Type II variation application to the Europe Medicines Agency (EMA). The purpose was to gain clearance for extending DARZALEX for aiding patients with multiple myeloma, thus suitable for uplifting the market in the country.

UK market is also developing due to the NHS’s contribution towards community and outpatient-based care services, critical guidance, positive technology appraisals for subcutaneous formulations, integration of cost-effective technologies, and NICE’s guidance for modern medications in comparison to conventional IV formulations. As per the April 2025 UK Government article, the Medicines and Healthcare products Regulatory Agency (MHRA) cleared nivolumab, which is an under-the-skin injection of the cancer therapy. This particular subcutaneous formulation of nivolumab can be provided as a 3-to-5-minute injection instead of 30 to 60 minutes of IV infusion, suitable for treating neck, head, skin, bladder, kidney, and bowel, and lung cancers.

APAC Market Insights

Asia Pacific market is anticipated to grow steadily by the end of the predicted period. The market’s upliftment in the region is fueled by an increase in the aging population, particularly in South Korea and Japan, enhanced health and medical access in India and China, a rise in oncological and ophthalmic disorders, government initiatives, and strong healthcare facility extension. According to the 2022 UNESCAP Organization data report, 670 million people in the overall region were aged more than 60 years as of 2022, accounting for approximately 1 in every 7 people. In addition, the number is expected to double to 1.3 billion by the end of 2050, thus making it suitable for expanding the market in the overall region.

The hyaluronidase market in China is gaining increased traction, owing to the National Medical Products Administration’s (NMPA) acceleration in approving different subcutaneous biologics by readily utilizing hyaluronidase. This, in turn, reflects a tactical transition to effectively manage the healthcare demand of its huge population, while generous funding provision from the government, with support from regulatory bodies, are also bolstering the market. As per an article published by NLM in September 2024, there has been a surge in public financial resources to healthcare in the country from 141.8 billion yuan in 2007 to 2,254.2 billion as of 2023. During this period, the healthcare expenditure’s growth rate peaked at 47.5%, which denotes a positive impact on the market.

The hyaluronidase market in India is also bolstering due to the presence of generous government approaches, such as the Ayushman Bharat scheme, and the continuous growth in private healthcare. In addition to these, the overall budget for medical supplies and pharmaceuticals has also increased, which has optimized accessibility to ophthalmic and surgical care. Besides, the patient pool is immensely growing, which is effectively fueled by the increased incidence of ophthalmic and diabetes complications. Therefore, based on these factors, the market in the country is continuously expanding, leading to its enhanced demand.