HVAC Controls Market Outlook:

HVAC Controls Market size was valued at USD 24.44 billion in 2025 and is likely to cross USD 64.55 billion by 2035, expanding at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of HVAC controls is assessed at USD 26.68 billion.

The reason behind the growth is impelled by the increasing ratio of smart homes throughout the world. Smart homes have an impact on daily routines which utilizes a smart home system that can be operated remotely and automate operations to assure constant comfort in the home. This can lead to higher adoption of HVAC systems that can be integrated into home automation systems.

For instance, the proportion of smart homes surpassed around 178 million across the globe in the year 2022.

The globally rising construction of residential buildings is believed to fuel market growth. A radical increase in worldwide population has been observed which has doubled the construction of residential buildings within the past few decades in various regions of the world. Urban areas have been densely populated as a result of such a massive increase in the construction of residential buildings. Such an increase has been influencing the rise in the demand for HVAC control systems for the smooth functioning of several heating, ventilation, and cooling devices.

For instance, new residential construction in the United States was predicted to soar by approximately USD 89 billion in 2022.

Key HVAC Controls Market Insights Summary:

Regional Highlights:

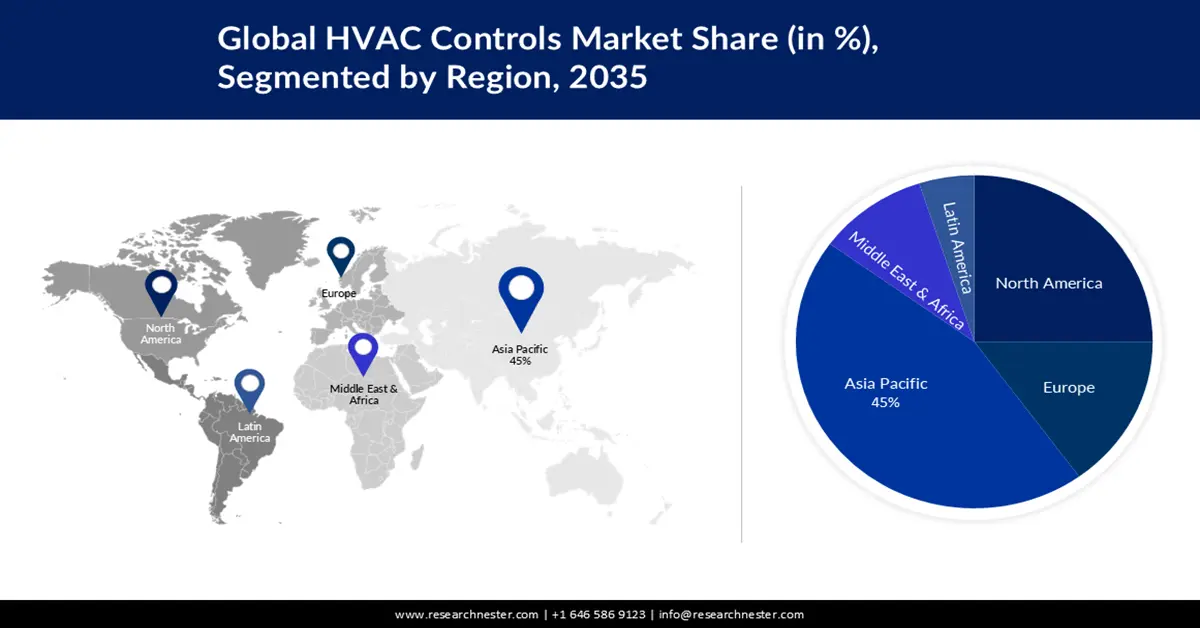

- Asia Pacific HVAC controls market is poised to capture 45% share by 2035, driven by expanding industrialization increasing the need for efficient temperature regulation.

- North America market will secure 25% share by 2035, attributed to increasing commercial construction activities requiring sufficient ventilation.

Segment Insights:

- The commercial segment in the hvac controls market is anticipated to capture a 50% share by 2035, driven by rapid globalization increasing demand for HVAC systems in commercial settings.

- The temperature & humidity control segment in the hvac controls market is anticipated to achieve a 48% share by 2035, driven by the increasing adoption of heating and cooling systems globally.

Key Growth Trends:

- Global Effect of Climate Change

- Escalating Adoption of Smart Thermostats

Major Challenges:

- Associated Complexities in Upgradation of HVAC Control Systems

- High Cost of HVAC Controls

Key Players: Schneider Electric SE, Honeywell International Inc., Siemens AG, Carrier Global Corporation, Emerson Electric Co., Lennox International Inc., Delta Controls Inc., Johnson Controls International plc, Danfoss A/S.

Global HVAC Controls Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.44 billion

- 2026 Market Size: USD 26.68 billion

- Projected Market Size: USD 64.55 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

HVAC Controls Market Growth Drivers and Challenges:

Growth Drivers

-

Global Effect of Climate Change– The massive rise in industrialization and urbanization has increased the ratio of carbon emissions in the environment. The issue of carbon has doubled the problem of climatic change within the past few decades. Owing to rising temperatures and the unpredictability of the weather, HVAC equipment has become a utility rather than a luxury, which is anticipated to fuel the market growth during the projected time frame. For instance, the earth's surface temperature in 2020 was about 0.97 Celsius degrees higher than it was on average during the 20th century.

-

Escalating Adoption of Smart Thermostats- A smart thermostat is completely a Wi-Fi-enabled device that can manage and control the heating and cooling of a smart home for optimal performance and tracking of energy consumption. As of these multiple advantages the integration of smart thermostats has been growing in residential, and commercial spaces, which is also projected to skyrocket market growth in the coming years. According to a survey statistic, in Germany, approximately 18% of homes had fitted smart thermostats by 2021.

Challenges

-

Associated Complexities in Upgradation of HVAC Control Systems - HVAC controls have varied types of sensors and equipment that regulate airflow, temperature, and so on. Such complex configuration is also very sensitive to electrical issues. Thus, such complexities make it difficult to upgrade the existing HVAC control systems, which is estimated to hinder market growth in the coming years.

-

High Cost of HVAC Controls

- Lack of Skilled Professionals for Appropriate Installation and Retrofitting of HVAC Controls

HVAC Controls Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 24.44 billion |

|

Forecast Year Market Size (2035) |

USD 64.55 billion |

|

Regional Scope |

|

HVAC Controls Market Segmentation:

Type Segment Analysis

The temperature & humidity control segment is estimated to hold 48% share of the global HVAC controls market in the coming years owing to the increasing adoption of heating and cooling systems such as air conditioners, furnaces, storage water heaters, and so on throughout the world. The ability of an HVAC system to remove humidity, maintain ideal indoor air quality, and guard against health and safety risks, has led to a higher demand for HVAC temperature & humidity control systems.

Moreover, it helps in efficiently regulating the temperature and also results in energy savings by lowering the need for excessive usage of heating and cooling systems. For instance, in the United States, the total shipments of gas-warm air furnaces reached approximately 379,295 units in December 2020. Whereas, the worldwide demand for room air conditioners grossed nearly 96.5 million units in 2021.

End-User Segment Analysis

The commercial HVAC controls market is set to garner a notable share of 50% shortly on the account of rapid globalization. As a result, there is more demand for HVAC systems in commercial settings since they are essential to control the environment in a business building to maintain comfortable working conditions. Moreover, commercial structures need to function well during their full lifespan, therefore they require HVAC control systems to optimize energy management in commercial buildings, which lowers running costs and ensures occupant comfort and health.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Implementation |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

HVAC Controls Market Regional Analysis:

APAC Market Insight

Asia Pacific industry is set to dominate majority revenue share of 45% by 2035, impelled by the expanding industrialization in the various countries. This would increase the need for efficient temperature regulation in residential and commercial spaces which may increase the demand for HVAC control in the region to ensure sustainable operations Bangladesh's industrial sector expanded by around 7.2% in 2020. In contrast, Vietnam saw a nearly 5% boost in the same.

North American Market Insight

The North America HVAC controls market is estimated to hold the second largest of 25%, during the forecast timeframe led by the increasing frequency of commercial construction activities. HVAC systems are a crucial component of contemporary structures since large-capacity buildings require sufficient ventilation, this may increase the demand for HVAC control systems in the region to make sure that people who spend a lot of time in business buildings may do so in a relaxed and controlled setting. For instance, in 2020, the proportion of commercial buildings in the United States increased to around 6 million.

HVAC Controls Market Players:

- Schneider Electric SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Siemens AG

- Carrier Global Corporation

- Emerson Electric Co.

- Lennox International Inc.

- Delta Controls Inc.

- Johnson Controls International plc

- Danfoss A/S

Recent Developments

- Honeywell International Inc. has collaborated with DunAn Environment Co., Ltd. to facilitate the adoption of the non-flammable, low-GWP refrigerant Solstice N41 for the HVAC industry. Solstice N14 is a substitution for R-410A in static air conditioning systems, with global warming mitigation at almost 65%.

- Lennox International Inc. introduced the Lennox S40 Smart Thermostat and accessories, along with the Lennox Smart Air Quality Monitor and the Lennox Smart Room Sensor, to its industry-leading portfolio of smart devices.

- Report ID: 3477

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

HVAC Controls Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.