HVAC Centrifugal Compressors Market Outlook:

HVAC Centrifugal Compressors Market size was over USD 931.78 million in 2025 and is projected to reach USD 1.09 billion by 2035, witnessing around 1.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of HVAC centrifugal compressors is evaluated at USD 945.2 million.

The booming infrastructure development activities across the world are creating a profitable environment for HVAC centrifugal compressor manufacturers. The urban and industrial growth is increasing the trade of heating, ventilation, and air conditioning technologies. The large-scale industries are investing heavily in advanced heating, ventilation, and air conditioning systems to enhance their daily operations. The G20 Outlook discloses that the global infrastructure investment need is projected to reach USD 4.0 trillion in 2032. The World Bank Group states that nearly 4.4 billion people across the world are living in city areas. The urban population is estimated to grow 2x by 2050.

The United Nations states that the most urbanized areas worldwide are North America (82%), Latin America and the Caribbean (81%), Europe (74%), and Oceania (68%). Asia Pacific is experiencing a boom, with 50.0% of its population living in urban areas, whereas Africa registers 43.0%. The global renewable energy sector is also contributing to the increasing sales of HVAC centrifugal compressors. The World Bank states that it has invested more than USD 13.0 billion in renewable energy production in the last 5 years. Such investments are boosting both the clean energy and HVAC solution trade.

Key HVAC Centrifugal Compressors Market Insights Summary:

Regional Highlights:

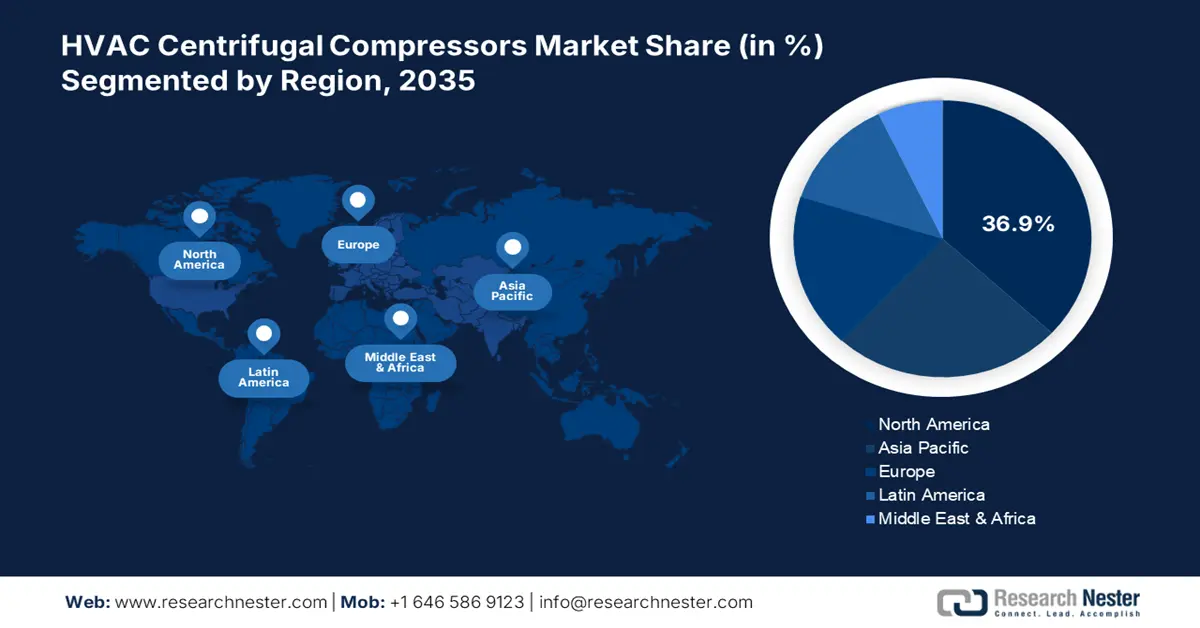

- North America leads the HVAC Centrifugal Compressors Market with a 36.90% share, fueled by the expanding energy and food processing sectors, positioning it for growth through 2035.

Segment Insights:

- The Medium-Capacity Compressors segment is projected to capture 57.9% market share by 2035, fueled by the perfect mix of efficiency and capacity driving their use in various sectors.

- The chillers segment is forecasted to secure a 58.9% share by 2035, driven by widespread use in residential and industrial settings.

Key Growth Trends:

- Rising demand for green and smart HVAC solutions

- Innovative HVAC centrifugal compressors are gaining traction

Major Challenges:

- Monopolistic competition

- High installation and maintenance costs

Key Players: Copeland, FS-ELLIOTT Co., LLC, Atlas Copco AB, Danfoss, and SKF.

Global HVAC Centrifugal Compressors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 931.78 million

- 2026 Market Size: USD 945.2 million

- Projected Market Size: USD 1.09 billion by 2035

- Growth Forecasts: 1.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

HVAC Centrifugal Compressors Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for green and smart HVAC solutions: The strict environmental regulations and climate commitments are fueling the demand for modern heating, ventilation, and air conditioning solutions. The stringent policies aimed at reducing greenhouse gas emissions are accelerating the adoption of energy-efficient HVAC centrifugal compressors. Considering these trends, manufacturers are developing sustainable HVAC solutions for both residential and commercial settings.

-

Innovative HVAC centrifugal compressors are gaining traction: Continuous technological advancements are leading to the development of oil-free HVAC centrifugal compressors. To align with the environmental standards, both manufacturers and users are focusing on sustainable HVAC technologies. Technological booms are creating new application areas for HVAC centrifugal compressors. For instance, in October 2024, Daikin Industries, Ltd, announced the launch of Magnitude WME-D, a next-generation water-cooled centrifugal chiller. This product features an oil-free compressor and low-global warming potential (GWP) R-515B refrigerant. Magnitude WME-D is offering enhanced performances and aiding in meeting decarbonization goals.

Challenges

-

Monopolistic competition: The strong presence of numerous HVAC centrifugal compressor manufacturers is creating a challenging environment for small-scale companies and start-ups. This factor is mitigating the earning chances from new HVAC centrifugal compressors market entries. Further, this leads to pricing pressures and reduced profit margins. To compete in this monopolistic market, many manufacturers are focusing on strategies such as digital marketing and continuous technological innovations.

-

High installation and maintenance costs: The significant upfront installation and maintenance costs are lowering the sales of HVAC centrifugal compressors. The end users in the price-sensitive markets often prefer cost-effective products, which hinders the adoption of the latest innovations. HVAC centrifugal compressor manufacturers face intense competition and low profit margins in regions with budget-constrained consumers. The competitive pricing strategy is expected to help manufacturers sustain in these HVAC centrifugal compressors markets.

HVAC Centrifugal Compressors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

1.6% |

|

Base Year Market Size (2025) |

USD 931.78 million |

|

Forecast Year Market Size (2035) |

USD 1.09 billion |

|

Regional Scope |

|

HVAC Centrifugal Compressors Market Segmentation:

Type (Chillers, Heat Pumps)

The chillier segment is poised to capture 58.9% of HVAC centrifugal compressors market share between 2026 to 2035. Chillers are widely used in both residential and industrial settings, owing to the need for a temperature-controlled environment. The small-sized HVAC solutions are highly demanded in residential and commercial settings to maintain a cool temperature. The growing industrial sector is estimated to offer double-digit percent earning opportunities to HVAC chiller manufacturers. The sectors such as healthcare, manufacturing, and food & beverage are pushing the sales of chillers. Ongoing technological innovations are set to enhance the capabilities of chillers and expand their application areas.

Capacity (Low-Capacity, Medium-Capacity, High-Capacity)

The medium-capacity compressors segment is anticipated to capture 57.9% of the global HVAC centrifugal compressors market share by 2035. Medium-capacity compressors maintain a perfect balance between low- and high-capacity, which contributes to their sales growth. The perfect mix of efficiency and capacity is fueling the use of medium HVAC centrifugal compressors in residential & commercial settings and industries such as pharmaceuticals and food processing. The favorable government policies and the energy efficiency trend are perfectly contributing to the increasing sales of medium-capacity compressors.

Our in-depth analysis of the global HVAC centrifugal compressors market includes the following segments:

|

Type |

|

|

Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

HVAC Centrifugal Compressors Market Regional Analysis:

North America Market Forecast

The North America HVAC centrifugal compressors market is expected to account for 36.9% of the global revenue share through 2035. The expanding energy and food processing sectors are boosting the demand for HVAC centrifugal compressors. The strong presence of leading companies is positively influencing the sales of HVAC centrifugal compressors. The cool temperature states of the U.S. and Canada is offering lucrative gains to HVAC centrifugal compressor companies. The high use of HVAC technologies in the region is necessitating companies to invest heavily in technological advancements.

The sustainability trend is driving the attention of individuals in Canada from fossil fuel boilers and furnaces to energy-efficient HVAC centrifugal compressor technologies. The report by the government of Canada states that the ventilation, heating, air-conditioning, and commercial refrigeration equipment export and import trade stood at USD 2.0 billion and USD 5.8 billion, in 2023, respectively. The high import trade represents the robust demand for HVAC technologies in the country. Thus, Canada is the most profitable marketplace for HVAC centrifugal compressor manufacturers in North America.

The high demand for next-gen heating and cooling technologies in the food processing HVAC centrifugal compressors market of the U.S. is poised to double the revenues of HVAC centrifugal compressor manufacturers in the years ahead. The pharma and food processing markets of the country are likely to propel the sales of HVAC centrifugal compressors during the forecast period. The expanding demand for food at home and food away from home is directly fueling the installations of HVAC chillers in restaurants and manufacturing plants.

APAC Market Statistics

The Asia Pacific HVAC centrifugal compressors market is likely to expand at the fastest pace during the forecast period. The rapidly increasing industrial and urban activities are propelling the sales of HVAC centrifugal compressors in the region. The strong manufacturing base is attracting many HVAC centrifugal compressor manufacturers to increase their operations in APAC countries. China and India are high-earning marketplaces, while Japan and South Korea are leading in innovations. Investing in Asia Pacific is foreseen to double the revenues of HVAC centrifugal compressor producers in the years ahead.

The robust rise in the expansion of renewable energy projects in China is estimated to fuel the sales of HVAC centrifugal compressors in the coming years. The report by the International Energy Agency (IEA) states that the clean energy sector of China accounted for 40.0% of the global share in 2024. The supportive government policies and decarbonization goals are increasing green energy capacity in the country. The 14th Five-Year Plan of the country is also contributing to the growth of the HVAC centrifugal compressors HVAC centrifugal compressors market.

India’s food processing and pharmaceutical sectors are directly fueling the sales of HVAC centrifugal compressors. The high demand for temperature-controlling devices in these fields is augmenting the sales of HVAC technologies. The India Brand Equity Foundation (IBEF) report highlights that the food processing market of the country is expected to reach USD 700.0 billion by 2030. The same source also estimates that India’s pharmaceutical market is likely to cross USD 450.0 billion by 2047.

Key HVAC Centrifugal Compressors Market Players:

- Copeland

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FS-ELLIOTT Co., LLC

- Atlas Copco AB

- Danfoss

- SKF

- Celeroton AG

- Howden Group

- Ingersoll Rand Inc.

- GFA Compressors

- GMCC Company

- Elliott Group

- Baker Hughes Company

- Siemens Energy AG

- GE Electric

- MAN, Energy Solutions

- Flowserve

- ELGi-compressor

- Kametstal

- Kaishan

The top players in the HVAC centrifugal compressors market are employing several organic and inorganic marketing strategies to earn high profits and maximize their reach. They are continuously focusing on new product launches, technological innovations, mergers & acquisitions, partnerships & collaborations, and regional expansions. Consistent introduction of innovative solutions is aiding the industry giants to stand out from the crowd. To earn higher gains, HVAC centrifugal compressor manufacturers are also targeting untapped markets. The organic sales are poised to offer a double-digit percent growth to HVAC centrifugal compressors market players in the coming years.

Some of the key players include:

Recent Developments

- In March 2024, Copeland revealed the launch of its new oil-free centrifugal compressor with frictionless Aero-lift bearing technology. This solution is designed as a worry-free alternative to existing magnetic levitation bearings and refrigerant-lubricated ceramic compression technology.

- In August 2023, FS-ELLIOTT Co., LLC introduced its latest compressor edition, P400HPR. This new solution achieves pressures of up to 250 PSIG with three compression stages.

- Report ID: 7598

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

HVAC Centrifugal Compressors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.