Hot Stamping Foils Market Outlook:

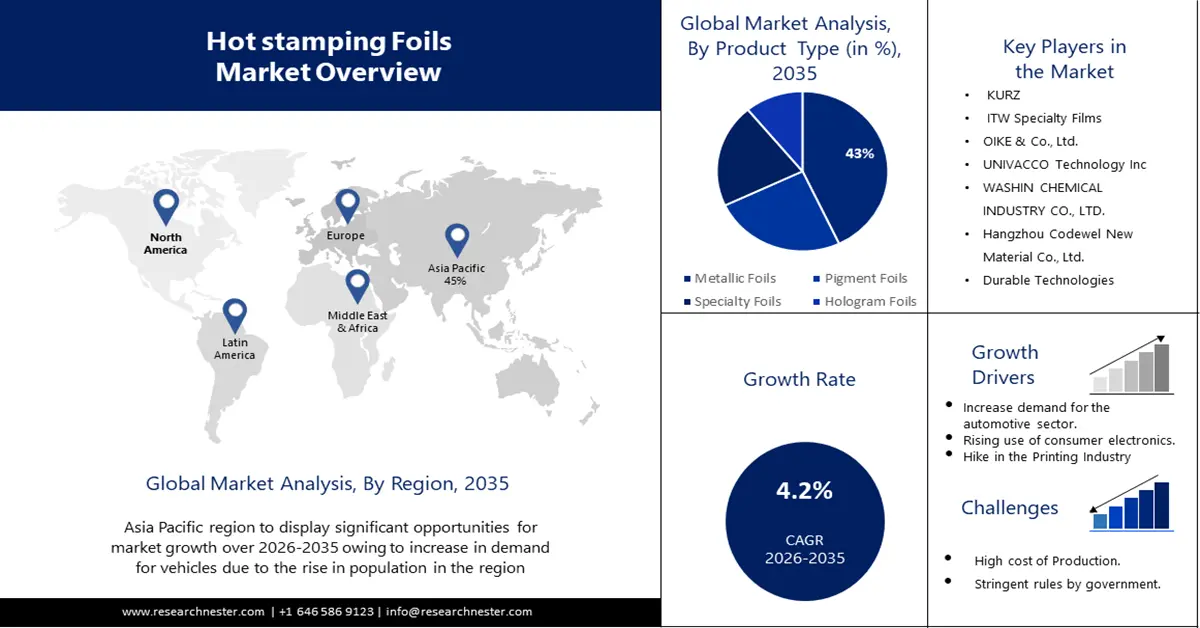

Hot Stamping Foils Market size was valued at USD 2.58 Billion in 2025 and is set to exceed USD 3.89 Billion by 2035, expanding at over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hot stamping foils is estimated at USD 2.68 Billion.

A proliferation of holograms, which are difficult to replicate, has become necessary given the growing need for greater security and reliability in currency notes as well as all banking and legal transactions. The use of high foil security patches in banknotes is useful. Access to credit cards and debit cards is expected to increase, given the growing global population. Given this, the demand for holograms is expected to rise over the forecast period which would make it a possible growth opportunity on the global market.

The packaging industry is expected to use hot stamping foils more frequently in the next years owing to their excellent qualities, such as heat distortion resistance and resistance to scrape, moisture, and abrasion. Hot stamping foils should find more uses in the packaging sector as a result of these numerous advantages. Thus, the increment in the demand for packaging around the globe is expected to ultimately push the industry growth during the forecast period. Between 2017 and 2022, the global demand for flexible packaging solutions grew from almost USD 200 billion to USD 250 billion.

Key Hot Stamping Foils Market Insights Summary:

Regional Highlights:

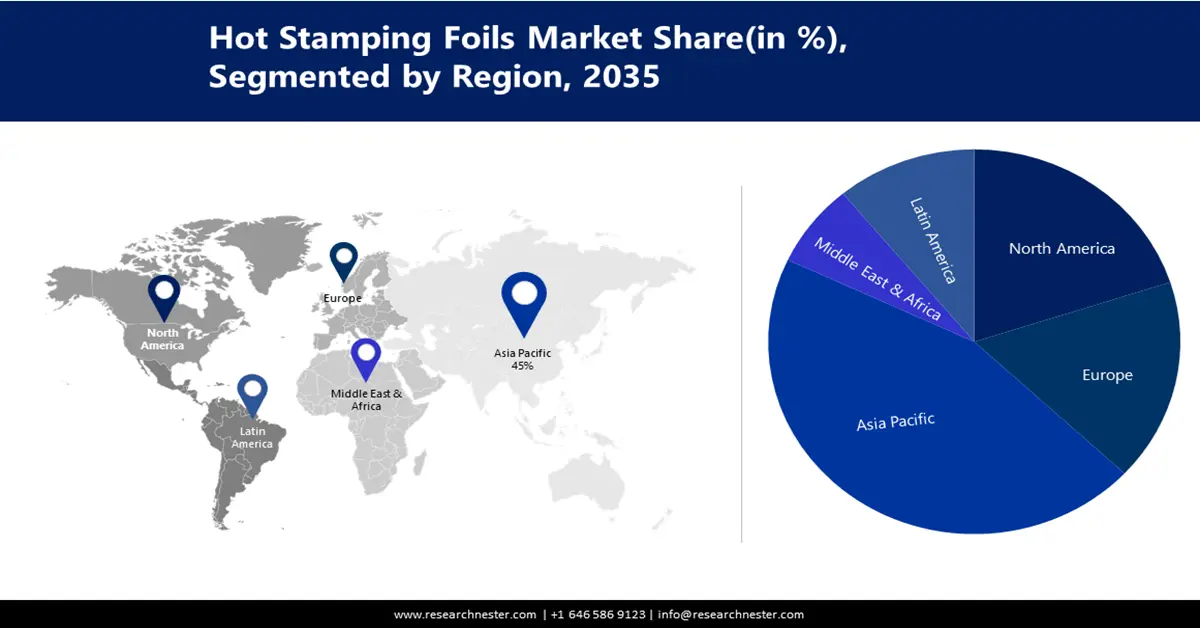

- Asia Pacific’s hot stamping foils market is predicted to capture 45% share by 2035, attributed to rising vehicle demand and disposable income across the region.

- North America market will achieve significant revenue share by 2035, driven by increasing demand from industrial and consumer packaging sectors.

Segment Insights:

- The metallic foils segment in the hot stamping foils market is projected to capture a 43% share by 2035, attributed to the popularity of metallic foils in packaging and promotional materials.

- The cigarettes & beverages (end user) segment in the hot stamping foils market is forecasted to experience rapid growth over 2026-2035, driven by growing usage of hot stamping foils for branding and anti-counterfeiting in packaging.

Key Growth Trends:

- Increasing Use in the Automotive Sector

- Emerging Prospects in Electronic Industry

Major Challenges:

- High Costs of Raw Materials

- Increased Costs of the Production Process

Key Players: KURZ, ITW Specialty Films, OIKE & Co., Ltd., UNIVACCO Technology Inc, WASHIN CHEMICAL INDUSTRY CO., LTD., Hangzhou Codewel New Material Co., Ltd., Durable Technologies, RASIK PRODUCTS PVT. LTD., Haining Longtime Industry Co., Ltd., NAKAJIMA METAL LEAF, POWDER Co., Ltd..

Global Hot Stamping Foils Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.58 Billion

- 2026 Market Size: USD 2.68 Billion

- Projected Market Size: USD 3.89 Billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 September, 2025

Hot Stamping Foils Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Use in the Automotive Sector- Hot stamping foils are used in the automotive industry to offer good stamp ability, adhesion, heat resistance, and improved performance in vehicles. The growth in the automotive industry is thus contemplated to raise the sales of hot stamping foils in the assessment period. In 2021, the revenue from the car manufacturing sector was estimated to be 2.86 trillion dollars.

- Emerging Prospects in Electronic Industry- Among a wide variety of technical consumer goods in households, electrical appliances are one of the most widely penetrated products. Television sets with larger screen sizes have gained popularity on the one hand, but the miniaturization of electrical components such as personal mobility devices is gaining momentum on the other. In response to growing demand, manufacturers are concentrating their efforts on the development of high-quality and convenient devices for use, this is providing prospective opportunities for the hot stamping foils market as it provides for a long-lasting decoration that is very adherent and resistant to abrasion.

- Growth in the Printing Industry - The market for hot stamping foils is expected to grow based on its high durability and working characteristics. It is therefore projected that the sales of hot stamping fuel will increase in recent years, as a result of continued printing industry expansion. The latest survey suggested that the global printing industry is growing at a significant rate and is set to attain a revenue of USD 834 billion by 2026.

Challenges

-

High Costs of Raw Materials -Hot stamping foils are made of aluminium, pigments, adhesives, and others. These materials are not cost-effective which can result in the requirement for the high initial investment and people might look for alternative solutions in the hot stamping foils market, hence this factor can be projected to hamper the growth of the market over the forecast period.

-

Increased Costs of the Production Process

- Stringent Rules by Government

Hot Stamping Foils Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 2.58 Billion |

|

Forecast Year Market Size (2035) |

USD 3.89 Billion |

|

Regional Scope |

|

Hot Stamping Foils Market Segmentation:

Product Type

The metallic foils segment is anticipated to hold 43% share of the global hot stamping foils market during the forecast period, One of the key factors contributing to the segment's expansion is the growing usage of metallic foils to enhance the value and spark interest in graphic arts items, paper, and plastic packaging, and promotional materials. However, it is anticipated that during the projection period, holographic foils will be the segment with the fastest growth. The market is developing because of the increasing importance of hologram foils in products including greeting cards, packaging, promotional items, and layouts for advertisements.

End User

Hot stamping foils market from the cigarettes and beverages segment is expected to witness rapid growth during the forecast period. The growing use of hot stamping foils in a wide range of cigarettes & beverage products such as tobacco, wine, beer, and spirits to create decorative finishes and anti-counterfeiting measures is propelling the segment growth.

Our in-depth analysis of the global hot stamping foils market includes the following segments:

|

Product Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hot Stamping Foils Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 45% by 2035. The market’s growth in the region is attributed to an increase in demand for vehicles due to the rise in population in the region, backed by the exponential increase in disposable income. It is expected that within Asia-Pacific, about 37.5 million passenger cars will be sold by 2022. This is propelling the market for hot stamping foils, due to the demand for automotive parts. Further, the market for hot stamping foils is finding new prospects to due a booming printing industry.

North American Market Insights

The North American hot stamping foils market is anticipated to hold a significant revenue share by 2035. The implementation of several stringent energy-saving rules and rising demands in the consumer base are responsible for the market’s growth. Moreover, an expanding industrial sector and a rising need for packaging solutions are providing prospective market opportunities. The region's expanding use of smart homes and appliances is another factor driving the demand for smart hot stamping foil products. Innovative technologies like IoT and ML are being incorporated by manufacturers to create more alluring and practical products.

Hot Stamping Foils Market Players:

- APi Group.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KURZ

- ITW Specialty Films

- OIKE & Co., Ltd.

- UNIVACCO Technology Inc

- WASHIN CHEMICAL INDUSTRY CO., LTD.

- Hangzhou Codewel New Material Co., Ltd.

- Durable Technologies

- RASIK PRODUCTS PVT. LTD.

- Haining Longtime Industry Co., Ltd.

Recent Developments

- The recent installation of a hot stamper and embossing machine was announced by the Maryland-based label converter, Hub Labels. To replace its current equipment, Hub selected a Grafik Maskinfabrik GM HOTFB330 separate printed stamp unit.

- Recently UNIVACCO Technology Inc., one of the world's largest producers of transfer films and stamping foils, said that it had developed a foil that could be produced out of recycled paper. UNIVACCO is the first foil manufacturer to successfully achieve closed-loop recycling of stamping foil and has its patent application in process.

- Report ID: 4348

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hot Stamping Foils Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.