Hospital Capacity Management Solutions Market Outlook:

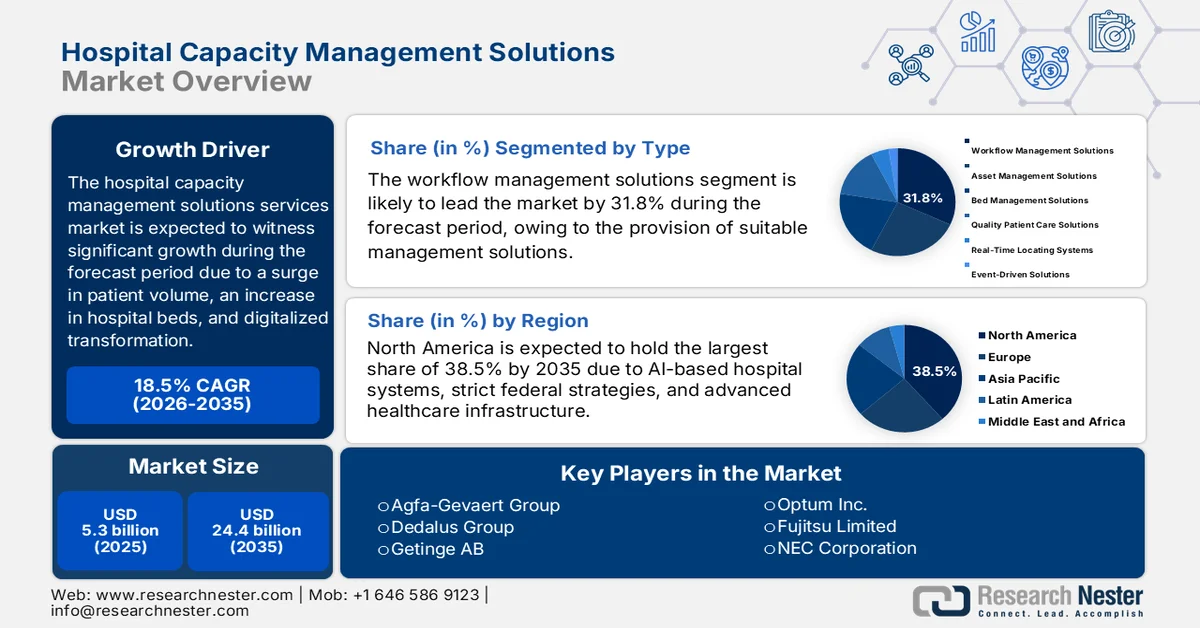

Hospital Capacity Management Solutions Market size was over USD 5.3 billion in 2025 and is estimated to reach USD 24.4 billion by the end of 2035, expanding at a CAGR of 18.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hospital capacity management solutions is estimated at USD 6.2 billion.

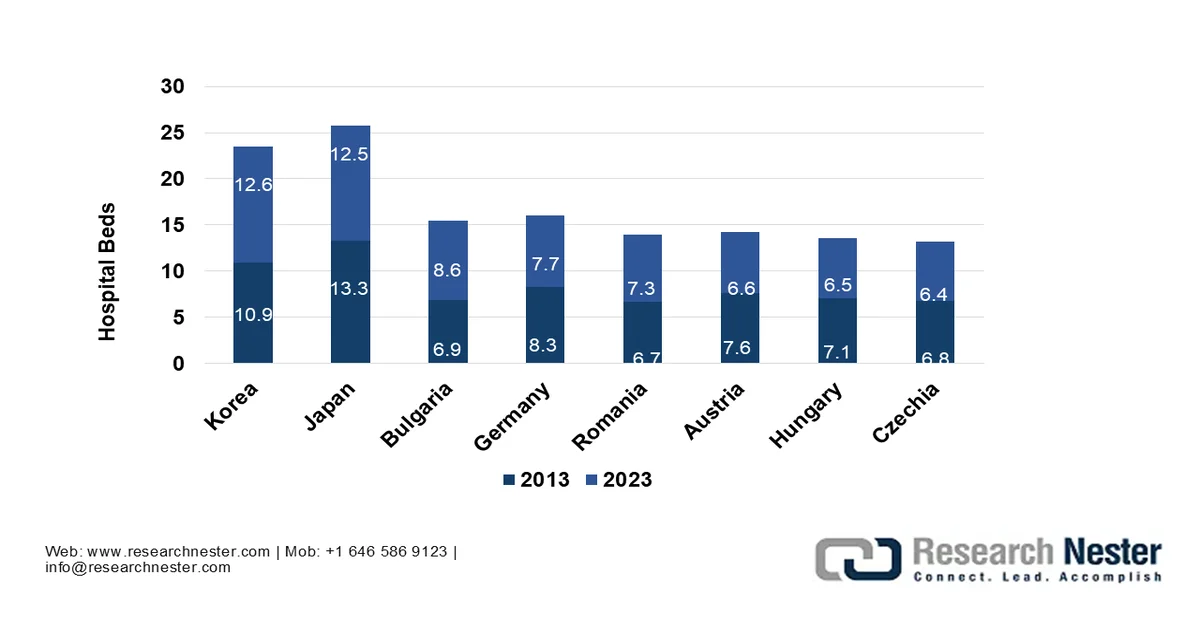

The international market is rapidly evolving since healthcare systems globally confront a rise in patient volumes, a surge in hospital beds, resource constraints, and an increase in the demand for digital transformation. Besides, according to official statistics published by OECD in November 2025, there exists an average of 4.2 hospital beds per 1,000 population as of 2023. Regarding this, these rates have been extremely high in Korea, accounting for 12.6 beds per 1,000 population, which is followed by 12.5 per 1,000 in Japan. Besides, more than 2/3rd of countries have reported between 3 and 8 hospital beds per 1,000 population, which is creating an optimistic outlook for the overall market across different nations.

Global Hospital Beds Presence Between 2013 and 2023

Source: OECD

Furthermore, the presence of AI-based predictive staffing models, micro-hospital adoption, and blockchain for hospital-based data integrity are certain trends that are driving the hospital capacity management solutions market globally. As per an article published by NLM in September 2023, the industry for blockchain technology is estimated to be worth USD 339.5 million internationally, which further increased to USD 2.3 trillion. Additionally, by the end of 2030, blockchain is projected to offer USD 3.1 trillion in economic valuation. Moreover, the international expenditure on blockchain has increased from almost USD 1.5 billion to USD 2.9 billion, and the anticipated yearly growth rate accounted for 73.2%. Besides, the healthcare sector in the U.S. is considered the world’s largest and amounts to over USD 1.7 trillion every year, thus boosting the market’s growth and expansion internationally.

Key Hospital Capacity Management Solutions Market Insights Summary:

Regional Highlights:

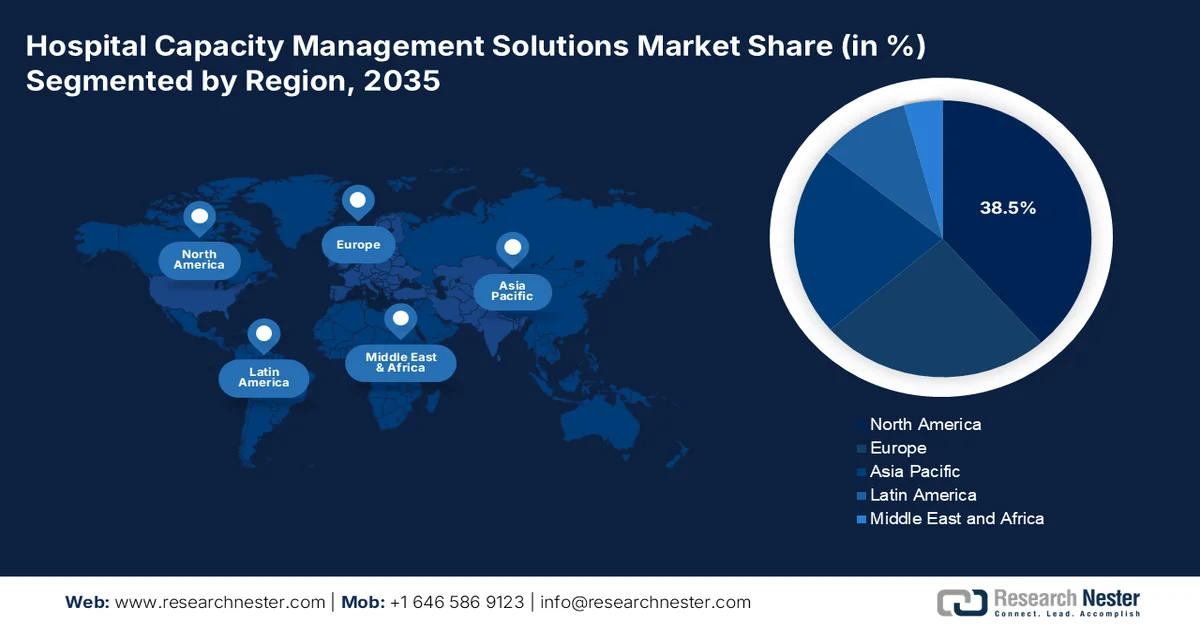

- North America in the hospital capacity management solutions market is anticipated to command a 38.5% share by 2035, attributed to rapid adoption of AI-driven hospital systems, strong federal funding, and advanced healthcare infrastructure.

- Asia Pacific is poised to register the fastest growth in the hospital capacity management solutions market through 2035, propelled by rising patient volumes, supportive government policies, and accelerating healthcare digitalization.

Segment Insights:

- The workflow management solutions sub-segment of the type segment in the hospital capacity management solutions market is projected to account for a 31.8% share by 2035, fueled by its critical role in automating and streamlining business processes to improve operational efficiency and reduce costs.

- The integration solutions segment under applications in the hospital capacity management solutions market is expected to secure the second-largest share by 2035, stimulated by its capability to deliver real-time cross-departmental visibility and optimize patient flow, resource allocation, and staff utilization.

Key Growth Trends:

- Government incentives for digitalized health infrastructure

- Rise in chronic disease burden

Major Challenges:

- Data privacy and cybersecurity risks

- Integration complexity with legacy systems

Key Players:GE Healthcare, Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, McKesson Corporation, TeleTracking Technologies Inc., Oracle Health, Siemens Healthineers, Philips Healthcare, Agfa-Gevaert Group, Dedalus Group, Getinge AB, Optum Inc., Fujitsu Limited, NEC Corporation, Samsung Medison, Infosys Limited, Wipro Limited, Telstra Health, IHH Healthcare Berhad

Global Hospital Capacity Management Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 24.4 billion by 2035

- Growth Forecasts: 18.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: - United States, Germany, United Kingdom, Japan, China

- Emerging Countries: - India, South Korea, Singapore, Australia, Canada

Last updated on : 11 February, 2026

Hospital Capacity Management Solutions Market - Growth Drivers and Challenges

Growth Drivers

- Government incentives for digitalized health infrastructure: Governments across different nations are providing grants and subsidies for hospitals for adopting integrated digital platforms, this escalating the market penetration. As per an article published by Invest India in February 2026, the healthcare industry in India comprises more than 1.3 billion people, along with the industry spanning medical devices, hospitals, clinical trials, telemedicine, medical tourism, and health insurance. Besides, the 2023-2024 Union Budget significantly emphasized healthcare, effectively allocating generous funds to the Ayushman Bharat Scheme, which is the world’s largest government-based healthcare approach, aiming to cover more than 500 million people, thus contributing towards the market’s growth.

- Rise in chronic disease burden: The international increase in chronic disorders, including cardiovascular and diabetes conditions, is fueling the need for long-lasting hospital stays, thus pushing hospitals to adopt innovative capacity management solutions internationally. As stated in an article published by NLM in January 2024, the approximate expense of chronic disease is projected to reach USD 47 trillion globally by the end of 2030. Likewise, the expense of chronic disease in the America-based medical system is enormous, significantly accounting for over USD 1 trillion every year. Besides, cancer and heart disease account for almost 40% of all deaths in the U.S. as of 2022. Therefore, with the increase in deaths and health expenses, there is a huge demand for the hospital capacity management solutions market to expand across different nations.

- Shift toward private and public partnerships: The aspect of collaboration between private technological providers and governments is deliberately fueling investment in hospital modernization, especially in emerging economies, wherein infrastructure barriers are significant. For instance, in May 2025, Oracle Health, the Cleveland Clinic, and G42 declared a tactical partnership to create an outstanding AI-driven healthcare delivery platform. This strategy has aimed to optimize public health management and patient care by leveraging intelligent clinical applications, nation-scale data analytics, and artificial intelligence (AI) for creating accessible, scalable, and secure care models that constitute the intention of positively impacting people’s longevity and health, thereby denoting an optimistic outlook for the market’s expansion.

Challenges

- Data privacy and cybersecurity risks: Hospitals handle highly sensitive patient information, making cybersecurity a critical challenge in the market. With the adoption of IoT devices, cloud-based platforms, and AI-driven analytics, the attack surface for cyber threats has expanded significantly. Healthcare data breaches are among the costliest, with average costs exceeding per incident according to industry reports. Compliance with regulations such as HIPAA in the U.S. and GDPR in Europe requires hospitals to implement stringent safeguards, but many facilities struggle with legacy IT systems that lack modern security features. Cyberattacks can disrupt hospital operations, compromise patient safety, and erode trust in digital solutions.

- Integration complexity with legacy systems: One of the most significant barriers to the hospital capacity management solutions market adoption is the difficulty of integrating new solutions with existing hospital IT infrastructure. Many hospitals still rely on outdated electronic health record (EHR) systems, fragmented patient databases, and siloed operational tools. Implementing advanced capacity management platforms requires seamless interoperability across departments, such as emergency, surgery, inpatient, and outpatient care. However, legacy systems often lack standardized APIs, making integration costly and time-consuming. Hospitals face challenges in data migration, workflow redesign, and staff retraining, which can delay implementation timelines.

Hospital Capacity Management Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.5% |

|

Base Year Market Size (2025) |

USD 5.3 billion |

|

Forecast Year Market Size (2035) |

USD 24.4 billion |

|

Regional Scope |

|

Hospital Capacity Management Solutions Market Segmentation:

Type Segment Analysis

The workflow management solutions sub-segment, which is part of the type segment, is anticipated to garner the largest share of 31.8% in the market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance in automating, optimizing, and organizing business processes to enhance efficiency and diminish expenses. For instance, in December 2025, Accenture and Anthropic declared the expansion of their partnership to assist enterprises in moving from AI pilots to full-scale deployment. Both these organizations formed the Accenture Anthropic Business Group, with an estimated 30,000 professionals, to gain training. Therefore, with such organizational partnerships, there is increased focus on co-developed industrial solutions, which is positively impacting the sub-segment’s demand globally.

Applications Segment Analysis

By the end of the forecast period, the integration solutions segment under applications is projected to garner the second-largest share in the hospital capacity management solutions market. The segment’s growth is highly propelled by enabling real-time visibility across departments, including emergency, inpatient, outpatient, and surgical units, allowing administrators to optimize patient flow, resource allocation, and staff utilization simultaneously. Besides, by the end of 2035, integrated solutions are expected to dominate due to their scalability and ability to reduce operational silos. Hospitals increasingly face challenges of overcrowding, rising patient volumes, and regulatory reporting requirements. Moreover, integrated platforms leverage AI, IoT, and predictive analytics to forecast demand, automate workflows, and enhance compliance with government mandates.

Component Segment Analysis

The software sub-segment is expected to account for the third-largest market share by the end of the stipulated timeline. The sub-segment’s development is primarily attributed to forming the intelligence layer that powers hospital capacity management, enabling predictive analytics, workflow automation, and real-time monitoring. Software solutions include bed management applications, asset tracking modules, patient flow optimization tools, and integrated dashboards. Their value lies in flexibility and cloud-based deployments, permitting hospitals to scale rapidly, while modular architectures enable customization for specific needs. The growing demand for interoperability across hospital systems drives investment in advanced software platforms that can integrate seamlessly with electronic health records (EHRs) and government reporting systems.

Our in-depth analysis of the hospital capacity management solutions market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Applications |

|

|

Component |

|

|

Delivery Mode |

|

|

End use |

|

|

Functionality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hospital Capacity Management Solutions Market - Regional Analysis

North America Market Insights

North America is anticipated to account for the highest market share of 38.5% by the end of 2035. The market’s upliftment is highly attributed to an increase in the rapid adoption of AI-driven hospital systems, stringent federal funding, and innovative healthcare infrastructure. According to official statistics published by the Health System Tracker Organization in January 2026, the health expenditure in the U.S. amounted to USD 74.1 billion, gradually increasing to USD 1.4 trillion, and ultimately to USD 5.3 trillion in 2024. In addition, the healthcare expenditure also increased by 7.2% from 2023 to 2024, and similarly, accounting for 7.4% increase from 2022 to 2023. Besides, the growth in overall healthcare spending between 2023 and 2024 is effectively well above the average yearly growth of 4.2%, thus denoting an optimistic outlook for the market in the region.

Total National Health Expenditures in the U.S. Per Capita (2014-2024)

|

Year |

Total NHE per capita |

Constant Dollars |

|

2014 |

USD 11,996 |

USD 9,421 |

|

2015 |

USD 12,532 |

USD 9,860 |

|

2016 |

USD 12,871 |

USD 10,229 |

|

2017 |

USD 13,086 |

USD 10,582 |

|

2018 |

USD 13,381 |

USD 11,042 |

|

2019 |

USD 13,724 |

USD 11,487 |

|

2020 |

USD 14,931 |

USD 12,637 |

|

2021 |

USD 14,908 |

USD 13,137 |

|

2022 |

USD 14,581 |

USD 13,689 |

|

2023 |

USD 14,962 |

USD 14,580 |

|

2024 |

USD 15,474 |

- |

Source: Health System Tracker Organization

An increase in reimbursement policies, federal budget allocations, as well as a demand for digitalized hospital efficiency solutions, are factors that are fueling the market in the U.S. As per an article published by the Health Affairs Organization in January 2026, the healthcare spending in the country has reached USD 5.3 trillion and further increased by 7.2% as of 2024, which is similar to 7.4% in 2023. Besides, the insured population share effectively remained relatively high in 2024 at 91.8% after its peak of 92.5% in 2023. Moreover, the healthcare expenditure growth continued to outpace the overall country’s economic growth as of 2024, resulting in an increased health share from 17.7% to 18.0% in 2024, thereby denoting an optimistic outlook for the market’s growth and expansion in the overall region.

The hospital capacity management solutions market in Canada is growing significantly, owing to the offering of healthcare spending and federal investments, along with a significant focus on emergency department efficiency and surgical waitlists. Based on government estimates published by the Government of Canada in October 2025, the Budget 2024 offered USD 150 million for more than 3 years for an emergency treatment fund for indigenous communities and municipalities. This particular investment is suitable for assisting these communities to provide rapid responses to emergent and critical demands in relation to the overdose crisis and substance use. Besides, the country’s decentralized healthcare system also ensures suitable province investments, thereby making it suitable for bolstering the market in the overall country.

APAC Market Insights

The Asia Pacific hospital capacity management solutions market is expected to emerge as the fastest-growing region during the forecast period. The market’s development is highly propelled by a rise in patient volumes, government policies, and rapid healthcare digitalization. According to official statistics published by NLM in January 2025, the population in the Southeast Asia region comprises 21.6%, which is the second-highest probability of dying ages ranging between 30 and 70, owing to chronic respiratory diseases, diabetes, cancer, and cardiovascular disorders. Besides, as of 2023, 5 out of 11 member nations in the overall region have significantly prioritized investments in digital health. Therefore, with an increase in diseases and a rise in investments, there is a huge growth opportunity for the overall market in the region.

An expansion in healthcare infrastructure, increased focus on government reforms, technological advancement, and a surge in patient demand growth are factors driving the hospital capacity management solutions market in China. Based on government estimates published by the ITA in September 2025, the healthcare industry valuation in the country has exceeded USD 1 trillion as of 2024, and is further projected to reach more than USD 1.5 trillion by the end of 2029, denoting 60% of present healthcare spending originating from the government. Besides, the country comprised more than 40,000 hospitals, providing over 8 million beds as of 2024. Additionally, among these, public facilities offered 70.2% of hospital beds and gained 83.4% of patient visits, thereby making it suitable for ensuring the market’s growth and expansion in the overall country.

The hospital capacity management solutions market in India is gaining increased traction, owing to the presence of government healthcare strategies, an upsurge in patient volumes, growth in budget allocation, and technological adoption. As per an article published by the IBEF Organization in November 2025, the healthcare industry employed 7.5 million people, making it one of the country’s largest employment-generating industries. Besides, the AI integration is projected to develop almost 3 million new employment opportunities by the end of 2028, further bolstering the industry’s role in inclusive growth. In addition, by the end of 2025, India achieved 3 million additional hospital beds, 1.5 million doctors, and 2.4 million nurses to meet the rising demand, thus denoting an optimistic outlook for the market’s upliftment in the overall country.

Europe Market Insights

Europe market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by regional regulatory policies, digitalized health initiatives, and the presence of strict government investments. Based on government estimates published by the UK Government in June 2022, more than 28 million people, particularly in the UK, comprise the NHS application, and over 40 million people have an NHS login, and the majority of NHS-based trusts constitute an electronic patient record system. Additionally, this is on top of unprecedented investment in digitalizing adult social care, comprising £150 million of funding for digital adoption. Besides, this particular strategy comprises £2 billion of funding for supporting electronic patient records and assisting more than 500,000 people to utilize digital tools, thus driving the market’s exposure.

The aspects of advanced hospital infrastructure, robust government expenditure, increased focus on prioritizing modernization, and allocating generous funding to digitalized hospital systems are factors that are driving the hospital capacity management solutions market in Germany. As per a data report published by the Europe Medicines Agency in December 2025, the fee amount for assessment of periodic safety update was EUR 21,958,550 as per Budget 2025. This is effectively followed by EUR 258,699 for the assessment of the post-authorization safety study, EUR 376,933 for the assessment of referrals initiated due to the evaluation of pharmacovigilance data, and EUR 10,305,043 for the pharmacovigilance yearly flat rate fee. Besides, the fee structure for medicinal products is also focused on boosting the market’s expansion in the overall country.

Medical Products Fee Structure in Germany Based on Budget 2025 and 2026 Comparative Analysis

|

Components |

Budget 2025 |

Budget 2026 |

|

Medicinal Products for Human Utilization and Consultations on Medical Devices |

EUR 203,492,000 |

EUR 200,124,000 |

|

Veterinary Medicinal Products |

EUR 10,997,000 |

EUR 10,912,000 |

|

Yearly Fee for Medicinal Products for Human Utilization |

EUR 259,434,000 |

EUR 270,844,000 |

|

Yearly Fee for Veterinary Medicinal Products |

EUR 14,752,000 |

EUR 16,077,000 |

|

Yearly Pharmacovigilance Fee for Medicinal Products for Veterinary Medicinal |

EUR 30,608,000 |

EUR 31,147,000 |

|

Inspections in Relation to Medicinal Products for Human Utilization and Veterinary Medicinal |

EUR 20,394,000 |

EUR 22,508,000 |

|

Transfer of a Marketing Authorization |

EUR 264,000 |

EUR 281,000 |

|

Pre-Submission Activities |

EUR 1,393,000 |

EUR 1,222,000 |

|

Administrative Services |

EUR 7,986,000 |

EUR 10,080,000 |

Source: Europe Medicines Agency

The hospital capacity management solutions market in the UK is gaining increased traction, owing to government-funded digitalized health strategies, NHS-based administrative reforms, and generous budget allocation for hospital capacity management services. Based on government estimates published by the ITA in February 2026, the AI Action Plan has declared the development of an AI Growth Zone (AIGZ) scheme to readily promote the emergence of data centers, significantly granting USD 675 million to the newest entity for generous investments in private firms, AI talent development, and creation of AI assets. Moreover, based on this, the research and development funding is expected to reach USD 30 billion by the end of 2035, along with expansion in the government’s AI Research Resource (AIRR) by 2000% by the end of 2030, thereby readily contributing to the market’s development in the country.

Key Hospital Capacity Management Solutions Market Players:

- GE Healthcare (U.S.)

- Cerner Corporation (U.S.)

- Epic Systems Corporation (U.S.)

- Allscripts Healthcare Solutions (U.S.)

- McKesson Corporation (U.S.)

- TeleTracking Technologies Inc. (U.S.)

- Oracle Health (U.S.)

- Siemens Healthineers (Germany)

- Philips Healthcare (Netherlands)

- Agfa-Gevaert Group (Belgium)

- Dedalus Group (Italy)

- Getinge AB (Sweden)

- Optum Inc. (U.S.)

- Fujitsu Limited (Japan)

- NEC Corporation (Japan)

- Samsung Medison (South Korea)

- Infosys Limited (India)

- Wipro Limited (India)

- Telstra Health (Australia)

- IHH Healthcare Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- GE Healthcare is a leading provider of hospital workflow and asset management solutions, leveraging advanced analytics and IoT technologies. Its platforms focus on improving patient throughput, bed utilization, and predictive hospital operations.

- Cerner Corporation specializes in integrated hospital management systems, offering solutions that connect electronic health records (EHRs) with real-time capacity management. Its innovations emphasize interoperability and compliance with U.S. healthcare regulations.

- Epic Systems Corporation is a dominant player in hospital IT, with strong capabilities in patient flow optimization and integrated dashboards. Its solutions are widely adopted across large U.S. hospital networks, driving efficiency and data-driven decision-making.

- Allscripts Healthcare Solutions provides software-driven hospital management platforms, focusing on workflow automation and patient engagement. Its solutions are designed to reduce operational bottlenecks and enhance hospital resource allocation.

- McKesson Corporation offers hospital logistics and supply chain management solutions, integrating asset tracking with patient care workflows. Its focus is on improving hospital efficiency through streamlined distribution and digital infrastructure.

Here is a list of key players operating in the global market:

The international market is highly competitive, dominated by U.S. players such as GE Healthcare, Cerner, and Epic Systems, alongside Europe-specific leaders, such as Siemens Healthineers and Philips. Asia-based firms, including Fujitsu, NEC, and Samsung Medison, are expanding aggressively, while Indian IT majors Infosys and Wipro leverage digital transformation expertise. Strategic initiatives include mergers and acquisitions, AI-driven predictive analytics integration, cloud-based deployments, and partnerships with government health agencies. Besides, in January 2026, Fujitsu declared that its Social Medical Corporation Genshukai project has successfully aimed at effectively promoting sustainable hospital management through AI-based profitability improvement and innovative management, thereby boosting the hospital capacity management solutions industry globally.

Corporate Landscape of the Hospital Capacity Management Solutions Market:

Recent Developments

- In February 2026, PureHealth Holding PJSC declared its plan to distribute a cash dividend of AED 600 million, which is subject to shareholder and regulatory approvals, further supported by robust performances across its healthcare sectors.

- In July 2025, Philips partnered with majority of device organizations, including B.Braun Melsungen AG, Getinge, Hamilton Medical, and Dräger to fuel operational optimizations and enhance hospital experiences for both clinicians and patients.

- In February 2025, WellSky notified the unveiling of WellSky Resource Manager, which is an outstanding new solution, that has been significantly designed for transforming patient scheduling and workforce management processes.

- Report ID: 8393

- Published Date: Feb 11, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hospital Capacity Management Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.