Horticulture Lighting Market Outlook:

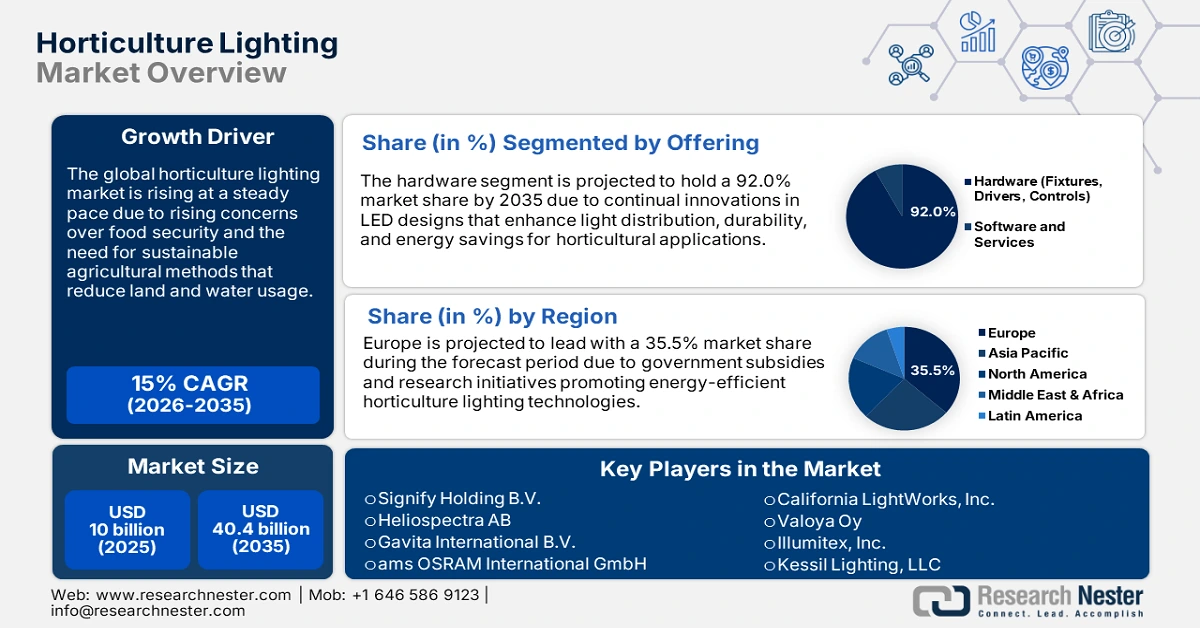

Horticulture Lighting Market size was valued at USD 10 billion in 2025 and is projected to reach a valuation of USD 40.4 billion by the end of 2035, rising at a CAGR of 15% during the forecast period, i.e., 2026-2035. In 2026, the industry size of horticulture lighting is assessed at USD 11.5 billion.

The market is experiencing exponential growth due to the increasing adoption of advanced LED technology in greenhouses and indoor agriculture. Companies are seeking energy-saving solutions that optimize light spectra for various crops, resulting in improved growth and quality. Some latest innovations feature dynamic and tunable lighting systems that enable growers to exert real-time control over light intensity and spectrum. Government initiatives towards sustainability include encouraging energy-efficient lighting and saving operational costs. The horticulture lighting market is also driven by the increasing number of vertical farming and urban agriculture operations worldwide. In July 2024, the USDA and the United States Department of Energy jointly began a joint Solid-State Lighting Program for horticulture applications with the aim of optimizing LED technologies to reduce horticultural lighting energy consumption while improving productivity.

Market players such as Signify, Heliospectra, and Gavita dominate the market through the development of new products and strategic partnerships. Collaborations with research institutions maximize light solutions for crop needs, enhancing productivity and sustainability. Governments worldwide implement policies and subsidies to encourage energy-efficient lighting. In September 2023, Signify Holding B.V. extended its partnership with Wageningen University & Research in the Innovation & Demonstration Center in Bleiswijk for Philips GreenPower LED lighting applications in horticulture. The partnership enables continuous research on energy- and cost-effective illumination methods for horticultural crops, focusing on dynamic grow lighting with varying spectra and light intensity. Growth in the industry comes from integrating automation and IoT technologies to yield smart greenhouse environments.

Key Horticulture Lighting Market Insights Summary:

Regional Highlights:

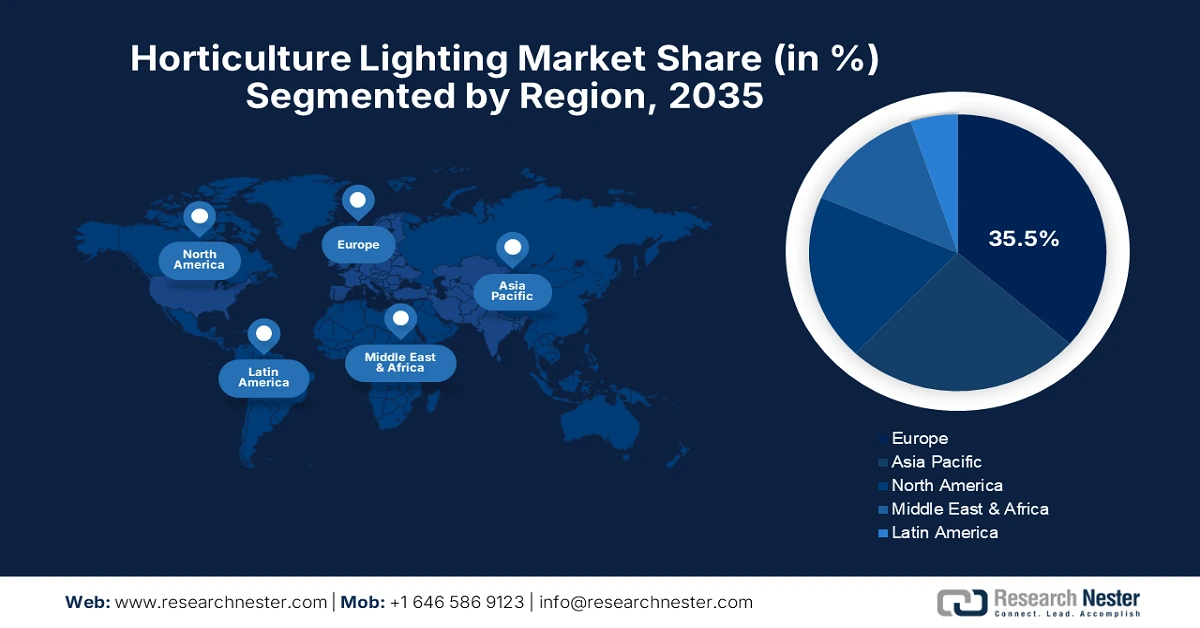

- Europe is projected to command a 35.5% share by 2035 in the Horticulture Lighting Market, underpinned by stringent environmental regulations and EU-wide energy-efficiency mandates.

- Asia Pacific is expected to post a 13% CAGR by 2035, stimulated by expanding urban agriculture initiatives, rising indoor farming penetration, and reinforced government investments in smart greenhouse infrastructure.

Segment Insights:

- The LED segment in the Horticulture Lighting Market is projected to secure an 81% share by 2035, bolstered by improved energy efficiency, longer lifespan, and enhanced spectral management capabilities.

- The hardware segment is expected to capture a 92% share through 2035, supported by continuous innovation in component design that enhances system integration and long-term performance.

Key Growth Trends:

- Spectral optimization and dynamic lighting technologies maximize crop performance

- Enhanced energy efficiency encourages eco-friendly crop culture

Major Challenges:

- Technology sophistication excludes mass penetration

- Infrastructure and energy demand constraints: Despite

Key Players: Signify Holding B.V., Heliospectra AB, Gavita International B.V., ams OSRAM International GmbH, California LightWorks, Inc., Valoya Oy, Illumitex, Inc., Kessil Lighting, LLC, Lumileds Holding B.V., Samsung Electronics Co., Ltd.

Global Horticulture Lighting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10 billion

- 2026 Market Size: USD 11.5 billion

- Projected Market Size: USD 40.4 billion by 2035

- Growth Forecasts: 15% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Netherlands, Canada, Australia

Last updated on : 5 September, 2025

Horticulture Lighting Market - Growth Drivers and Challenges

Growth Drivers

- Spectral optimization and dynamic lighting technologies maximize crop performance: Sophisticated LED systems with programmable spectrum light significantly improve plant growth, morphology, and yield maximization in different crop categories. Dynamic lighting technology enables growers to manage light quality and duration according to specific crop requirements and growth cycle. Research by prestigious institutions confirms that precise control of spectra, particularly through the use of far-red light, can effectively manage plant stem elongation and improve quality. In June 2023, Signify Holding B.V. initiated the Philips GreenPower LED toplighting force with a variable far-red spectrum in collaboration with Van Wordragen Flowers BV, the first time the technology has been applied in the Netherlands. Research indicated that 30 minutes of end-of-day 20 μmol/m²/s far-red light can efficiently regulate chrysanthemum stem length and keep cultivation periods short.

- Enhanced energy efficiency encourages eco-friendly crop culture: The transition from traditional high-pressure sodium and fluorescent lighting to newer LED systems delivers substantial savings in electricity consumption while maintaining or improving crop yields. The new lighting systems feature smart control platforms that regulate energy use through automated intensity and timing adjustments in response to crop requirements. Improved efficiency reduces operation expense and carbon footprint while facilitating environmental compliance targets. In December 2024, Heliospectra AB launched Dynamic MITRA X multi-channel LED solutions with advanced 3-channel and 4-channel configurations delivering unprecedented accuracy and customization. The new light solutions integrate seamlessly with Heliospectra's HelioCORE software, further enhancing light management functionalities for commercial growers and researchers. At the center of this innovation is simplicity, allowing astute lighting tactics to be easily used and accessible to growers of all levels.

- Integration with automation and IoT platforms enables precision agriculture: Merging horticulture lighting with automation and IoT platforms gives growers sophisticated control features and data-driven decision-making tools for optimal crop management. Intelligent lighting management platforms integrate lighting with climate control systems to offer autonomous optimization in greenhouse and vertical farm settings. Integration like this optimizes crop consistency with reduced manual intervention and operational labor costs. In November 2023, Signify Holding B.V. partnered with Hoogendoorn Growth Management to achieve the full potential of dynamic lighting for vertical farming with the integration of Philips horticulture LED solutions and Hoogendoorn's IIVO Vertical climate computer. The collaboration brings together a market leader in horticulture lighting technology and a leader in greenhouse automation solutions. The partnership makes it simpler to integrate light into climate control systems, allowing for independent optimization in cultivating crops within closed environments.

Horticulture Production Trends & Implications for the Horticulture Lighting Market in India

|

Indicator |

Value / Trend |

Impact on Horticulture Lighting Market |

|

Total Horticulture Production (2022–23) |

351.92 Million Tonnes |

Rising production volumes signal increased demand for high-efficiency farming techniques, including controlled-environment agriculture where lighting plays a key role. |

|

Comparison with Foodgrains |

Exceeds foodgrain production (329.69 MT) |

Highlights the economic importance of horticulture, encouraging investment in technology such as energy-efficient LED grow lights to improve yield and quality. |

|

Global Rank |

2nd largest producer of fruits & vegetables |

Supports the need for advanced farming tools—including supplemental and full-spectrum lighting—to maintain competitiveness and export quality. |

|

Key Crops (Global Leader) |

Banana, Lime, Lemon, Papaya, Okra |

These high-value crops often benefit from season-extension technologies and protected cultivation using horticulture lighting. |

|

Government Scheme |

Mission for Integrated Development of Horticulture (MIDH) |

MIDH supports protected cultivation and modern infrastructure, directly creating opportunities for horticulture lighting solutions in greenhouses and polyhouses. |

|

Additional Funding Scheme |

Rashtriya Krishi Vikas Yojana (RKVY) |

State-level proposals for horticulture modernization may include subsidies or support for adopting artificial lighting systems. |

|

CAGR (Foodgrain, 2014–15 to 2022–23) |

3.41% |

Consistent growth reflects broader agricultural modernization trends, including the adoption of technology like horticulture lighting for year-round production. |

Source: PIB

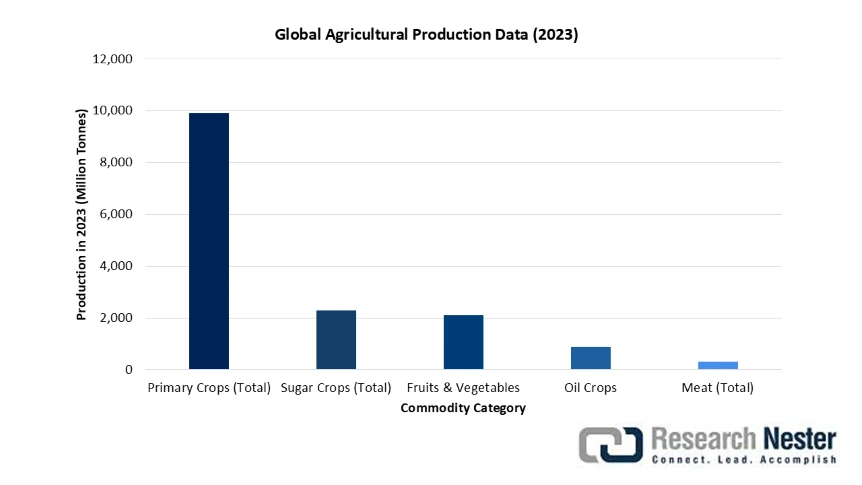

Global Agricultural Production Data (2023)

The steady rise in world fruit and vegetable production to 2.1 billion tonnes indicates a massive demand for higher yields and cultivation year-round, which directly translates into the demand for horticulture lighting in controlled-environment agriculture. This rise is particularly urgent for high-value crops, as supplemental lighting has the potential to significantly enhance photosynthesis, extend growing seasons, and improve crop quality and consistency in general. As weather uncertainty erodes traditional open-field farming, high-performance LED lighting technologies supply a reliable solution to level out yields and support increasing food supply chains. The growing horticulture market is therefore a key driver for the development of power-saving and spectrum-optimized lighting technology, which can enhance productivity sustainably.

Source: FAO

Challenges

- Technology sophistication excludes mass penetration: The advanced hardware and software integration of high-tech horticulture lighting systems necessitates expert installation, operation, and maintenance skills. Small producers or farmers from developing countries, in particular, struggle to manage complex lighting systems with multiple control parameters and spectral channels. Expert man-hours and lengthy technical courses necessitate spending large operating costs and complexity. In 2024, the U.S. Department of Energy, through the Integrated Lighting Campaign, highlighted horticultural lighting applications as establishing a new platform for LED lighting, calling on lighting makers to develop products meeting indoor agriculture needs. Research has indicated that, despite the increased efficiency of LED lighting, indoor horticulture remains extremely energy-demanding, with complexities, particularly since 2022, when energy prices skyrocketed. Managing complex spectrums and integrating software platforms pose ongoing challenges for growers who want to reap the maximum benefits of their systems.

- Infrastructure and energy demand constraints: Despite spectacular advances in LED efficiency, indoor horticulture lighting remains highly energy-intensive, posing significant challenges to the energy supply and electrical infrastructure of the grid, particularly in rural areas far from urban centers. Volatility in energy prices by season and electrical power availability limitations curtail scalability for facility expansion and operations for indoor cultivation companies. Limited access to reliable power infrastructure, along with huge upfront capital for updating electrical infrastructure, caps potential adoption. In March 2025, Design Lights Consortium (DLC) reported significant expansion in the Qualified Products List for horticultural lighting energy-efficient products, which experienced over 54% growth in listed fixtures since 2020. DLC verification focuses on the performance and efficiency of a wide range of products based on rigorous testing and standards. The business estimates that horticulture lighting optimization would save up to $350 million of energy annually if facilities embrace horticultural LED lighting.

Horticulture Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15% |

|

Base Year Market Size (2025) |

USD 10 billion |

|

Forecast Year Market Size (2035) |

USD 40.4 billion |

|

Regional Scope |

|

Horticulture Lighting Market Segmentation:

Lighting Technology Segment Analysis

The LED segment is predicted to maintain an 81% market share during the forecast period, driven by improved energy efficiency, longer lifespan, and better spectral tailoring capabilities compared to traditional lighting technologies. LEDs offer precise management of light intensity, spectrum, and timing to enable growers to shape plant growth conditions to specific crop types and growing stages. Ongoing innovations in LED chip technology and smart control systems are driving widespread applications in various agricultural sectors. Gavita International B.V. launched the highly efficient Gavita Pro RS 2400e LED light in March 2023 via Hawthorne Gardening Company for controlled environment growers. The fixture is the most efficient of any full-spectrum DLC-listed LED with 3.0 μmol/J efficiency at 2400 μmol/s and 3.15 μmol/J efficiency at 1700 μmol/s. Built on patented technology, the fixture has increased light intensity to support higher yields, and embedded sensors monitor fixture parameters like power usage and temperature.

Offering Segment Analysis

The hardware segment is expected to hold a 92% market share through 2035, encompassing basic components such as LED devices, drivers, control devices, and mounting accessories that form the core of horticulture lighting systems. Hardware quality and reliability have a direct influence on system performance, energy efficiency, and grower expenditure in the long term. Continual hardware design innovation supports extended lifespan, higher efficiency, and better integration with automated greenhouse control systems. For instance, ams OSRAM International GmbH in June 2023 introduced fifth fifth-generation OSLON Square Hyper Red horticulture LED with a wall plug efficiency of 78.8% industry-high, in accordance with robust chip technology developed in-house that enables an exceptionally long Q90 lifetime of 102,000 hours. The LED is designed to reduce the grower's energy consumption and costs without compromising crop yields, enabling fast plant growth and system cost optimization. The new LED is designed for all horticultural lighting applications, including greenhouse toplighting, interlighting, sole-source lighting, and vertical farming.

Installation Type Segment Analysis

The retrofit segment is projected to account for 59% market share by 2035, reflective of growing demand to replace existing greenhouse and indoor farming infrastructures with newer LED lighting technologies. Retrofit installations are more cost-effective than new construction projects and facilitate quicker return on investment by reducing energy consumption and improving productivity in crops. Government rebate schemes and utility incentives to lighting retrofit programs facilitate quicker market adoption in different cultivation conditions. In August 2024, Heliospectra AB collaborated with Tomatoworld of the Netherlands to replace aged HPS light setups with MITRA X LED luminaires featuring 40%, 60%, 80%, and 90% red spectra options with an efficacy up to 3.8 μmol/J. The configuration is mounted with a helioCORE wireless LoRa-based system that offers wireless control of LEDs while minimizing installation costs and energy consumption. Partnership also involves more than lighting solutions, like 3-year cooperative field testing to improve greenhouse performance.

Our in-depth analysis of the horticulture lighting market includes the following segments:

|

Segment |

Subsegments |

|

Lighting Technology |

|

|

Offering |

|

|

Installation Type |

|

|

Cultivation |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Horticulture Lighting Market - Regional Analysis

Europe Market Insights

Europe is projected to dominate the industry with a 35.5% market share during the forecast period due to strict environmental regulations and strict energy efficiency standards in member nations of the European Union. Growth in the horticulture lighting market is supported by regulatory measures, such as the Ecodesign Directive, which promotes energy-efficient lighting products while phasing out inefficient fixtures and systems. Producers counterattack with continuous innovation in LED chip performance, smart lighting control systems, and integrated automation platforms, responding to shifting regulatory requirements. The sector targets research collaboration and massive government subsidies for horticulture sustainability initiatives and the uptake of cutting-edge technology. Continued emphasis on tech sovereignty and cross-border collaboration enables technology advancement while promoting standardized implementation protocols.

The UK horticulture lighting market is expanding significantly, driven by widespread government-sponsored efforts focused on sustainability, innovation, and the development of indoor agriculture across various agricultural sectors. Strategic policy formulation and substantial financial investments drive technological advancements, enabling the widespread implementation of energy-efficient lighting solutions. The UK Government announced in January 2023 plans to lead the world in lighting efficiency in an effort to reduce energy bills through minimum energy performance standards for lighting in Welsh and English non-domestic and domestic properties and Scottish non-domestic and domestic buildings. Market participants focus on developing adaptive spectrum and intensity adjustment products specifically designed for vertical farm operations and advanced greenhouse operations.

European horticulture lighting development in Germany is driven by substantial research and development expenditures, as well as a significant regulatory focus on environmental responsibility and energy efficiency. The German Federal Ministry of Food and Agriculture provides excellent finance assistance for plant factory innovation and LED light studies programs. In 2023, the German Federal Government actively funded research and innovation in horticultural lighting and controlled environment systems. Funding was mainly provided by the Federal Ministry of Food and Agriculture (BMEL) and the Federal Ministry of Education and Research (BMBF), with a special emphasis on sustainable and energy-efficient agriculture technology. Players emphasize innovation for modular light fixtures and high-end sensor integration capabilities, and for enabling precision agriculture applications.

North America Market Insights

North America is anticipated to experience constant growth from 2026 to 2035, owing to the adoption and innovation of horticulture lighting technology. The region benefits from highly advanced R&D ecosystems, pro-government policies, and enormous industry investments in the development of LED tech. Strong government campaigns and comprehensive incentive frameworks encourage mass conversion schemes for LEDs by commercial greenhouse farms and indoor agriculture facilities. Industry players employ sophisticated automation technology and data platforms to optimize illumination solutions for optimal crop harvest and power conservation.

The U.S. horticultural lighting market leads in advancing horticultural lighting innovation, with an active government role through the Department of Energy and USDA programs that promote the energy-efficient adoption of LEDs and green agricultural practices. Large-scale federal programs offer significant funding opportunities for research, technology development, and infrastructure renewal initiatives that drive the transition to next-generation lighting systems. Delaware's Department of Natural Resources and Environmental Control began the Energy Efficiency Investment Fund (EEIF) program funding for horticultural lighting projects by commercial indoor agriculture growers in July 2024. The program helps growers achieve maximum savings and improved productivity through the replacement of high-watt fixtures with long-run-hour (16+ hours/day) fixtures in year-round indoor growing operations. Commercial horticultural lighting applications include putting in energy-efficient LED lighting equipment for grow houses, greenhouses, and propagation lighting, with incentives provided for retrofit and new construction.

Canada horticulture lighting market continues to expand, backed by widespread government funding programs for energy-efficient lighting retrofits and collaborative research studies. Provincial and federal initiatives provide substantial funding for technology adoption, promoting sustainability goals and reducing greenhouse gas emissions. In July 2024, the Ontario and Canadian Governments invested up to $23.55 million under the Sustainable Canadian Agricultural Partnership in horticultural research and innovation activities, as well as commercialization, for the Vineland Research and Innovation Centre. Regional programs target energy-hungry agri-food industries, while also providing extensive technical assistance and training support for growers who adopt cutting-edge lighting technologies.

APAC Market Insights

Asia Pacific horticultural lighting market is anticipated to register a CAGR of 13% by 2035, driven by increased growth in urban agriculture projects, expansion of indoor cultivation, and end-to-end sustainability efforts across various regional economies. Market growth is aided by increasing government investments in LED lighting technology and smart greenhouse infrastructure development schemes. These nations, including China, Japan, and South Korea, possess massive investment schemes that finance state-of-the-art lighting technology and the growth of controlled environment agriculture. Public-private collaborations enable extensive technology uptake and inclusive infrastructure development and upgrade.

China horticulture lighting market is advancing with comprehensive government policies supporting the utilization of clean energy and advancement in smart agriculture technology in rural and urban agriculture sectors. Mass-scale policy measures in the form of tax exemptions and big subsidies encourage farmers and producers to shift to power-efficient LED lighting systems. Research and development activities focus on reducing spectral composition to accommodate different crop types and merging light technologies with complete digital farm management platforms. In February 2025, the China Central Government articulated technology innovation priorities for the development of new quality productive forces in rural areas through the No. 1 central document, with a focus on development in smart agriculture and the application of AI. Government support policies promote sustainable urban agriculture practices while addressing food security concerns and environmental sustainability goals through the application of advanced lighting technologies.

India horticulture lighting market is a reflection of rapid growth with large government efforts in the direction of digitalization, energy efficiency improvement, and green technology integration in agriculture businesses. Strategic investment promotes LED lighting retrofitting programs and new building construction, while also fostering the development of future indoor cultivation and precision agriculture practices. In December 2024, the Government of India introduced the Atmanirbhar Clean Plant Programme (ACPP) as a new-age initiative to enhance the country's horticulture sector. Initiated in the Union Budget 2023-24, the scheme will enhance the availability of disease-free, high-quality planting material of horticulture crops. Joint projects involve research institutions, technology startups, and large manufacturing companies collaborating on spectral control technologies and IoT applications to enhance farm productivity and resource utilization.

Key Horticulture Lighting Market Players:

- Signify Holding B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Heliospectra AB

- Gavita International B.V.

- ams OSRAM International GmbH

- California LightWorks, Inc.

- Valoya Oy

- Illumitex, Inc.

- Kessil Lighting, LLC

- Lumileds Holding B.V.

- Samsung Electronics Co., Ltd.

The horticulture lighting market has intense rivalry among well-known industry players such as Signify Holding B.V., Heliospectra AB, Gavita International B.V., California LightWorks Inc., Valoya Oy, and renowned electronics manufacturers such as Panasonic Corporation and Samsung Electronics Co. Firms are concentrated on continuous innovation in spectral control technology, improvement in energy efficiency, and sophisticated automation features to maintain competitive advantages. Strategic partnerships, acquisition plans, and technology licensing agreements augment product portfolios with expanded global channels of distribution and geographic expansion. Key industry players invest substantial resources in research and development programs to create LED chip technology, smart control systems, and platform integration technologies.

Latest market trends indicate a widespread expansion of innovation and strategic collaboration throughout the horticulture lighting market, resulting in increased innovation and market opportunities. Industry players are constantly rolling out new products and forming strategic partnerships to enhance their technology capabilities and position in the market. For instance, in February 2024, at Light + Building 2024, Nichia, a leading producer of LEDs and a blue and white high-brightness LED innovator, launched groundbreaking products like the Nichia Light Cluster Type L and a new Cube Direct Mountable Chip. They yield higher-quality, soft, low-glare light and also allow luminaire manufacturers to reduce the thickness and weight of their lighting fixtures significantly.

Here are some leading companies in the horticulture lighting market:

Recent Developments

- In June 2025, Signify Holding B.V. introduced 4-channel Philips GreenPower LED toplighting force offering growers precise control over red, blue, white, and far-red spectra through integration with GrowWise control platform. The new fixtures enable real-time adjustment of light recipes responding to crop stage, external sunlight, and energy pricing with beam outputs up to 5,150 µmol/s and efficacies reaching 4.3 µmol/J.

- In December 2024, Valoya Oy launched Lumi-VF spectrum meticulously designed for effective vertical farming optimized to maximize yield, enhance plant quality, and promote smarter energy use. The LED lighting solution is especially suited for vertical farming incorporating broad spectrum of wavelengths unlike traditional grow lights focusing solely on red and blue wavelengths.

- Report ID: 4070

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Horticulture Lighting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.