Home Security Systems Market Outlook:

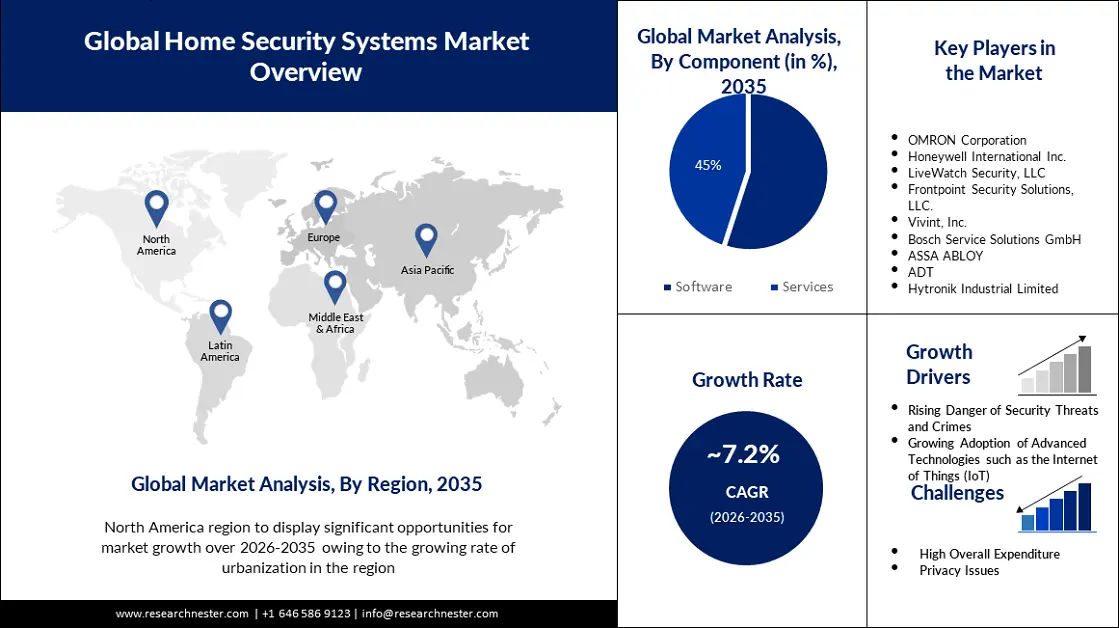

Home Security Systems Market size was over USD 59.75 billion in 2025 and is poised to exceed USD 119.75 billion by 2035, witnessing over 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of home security systems is estimated at USD 63.62 billion.

The growth of the market can be attributed to increasing demand for smart home security systems as well as the deployment of smart homes. For instance, a total of 257 million smart homes were installed around the world as of 2021. In the US 24 percent of households with three or more smart home devices. Smart homes are equipped with sensors, cameras, and other security devices that can be monitored and controlled remotely. With this technology, homeowners can monitor their homes from anywhere, receive alerts if something is amiss, and take action to protect their property. This has increased the demand for home security systems and is driving the market.

In addition to these, factors that are believed to fuel the market growth of home security systems include the emergence of new technologies such as wireless systems, artificial intelligence, and facial recognition that have made home security systems more accessible and convenient for consumers along with the increased focus on cybersecurity. More than 1,475 data breaches involving 163 million exposed records were reported in the United States in 2019. Cybersecurity measures such as encryption, firewalls, and malware protection can help protect homeowners from data breaches and malicious attacks. Additionally, home security companies are offering more comprehensive packages that include cybersecurity services to better protect their customers.

Key Home Security Systems Market Insights Summary:

Regional Highlights:

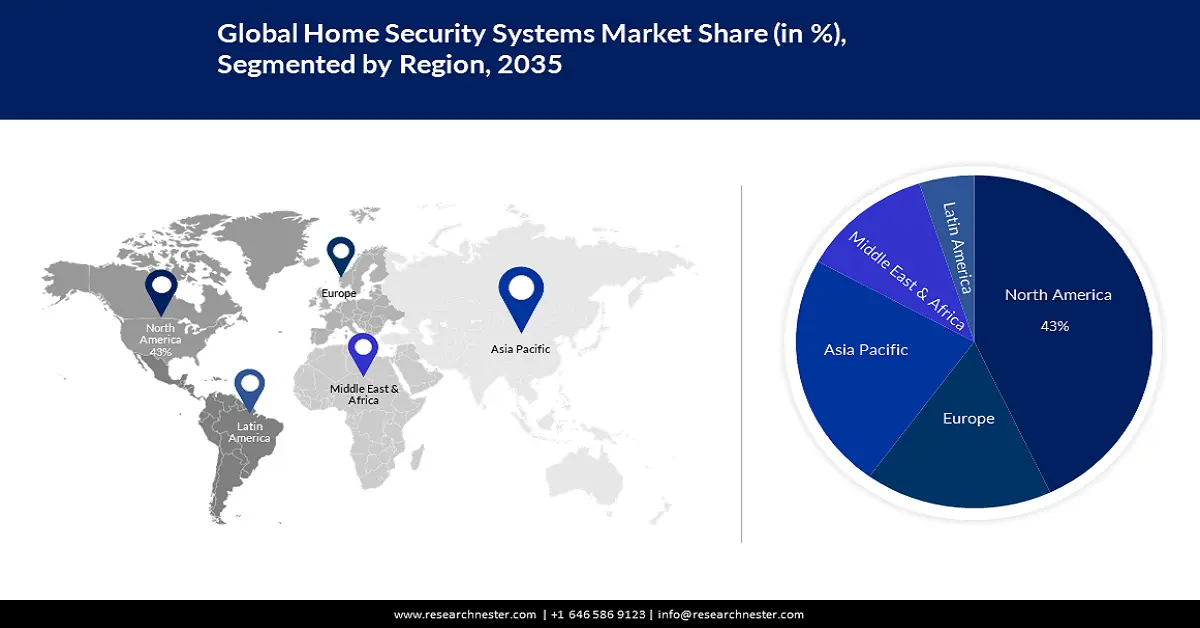

- The North America home security systems market is forecasted to hold a 38% share by 2035, driven by awareness and safety regulations.

- The Asia Pacific market is projected to achieve a 24% share by 2035, attributed to smart city initiatives and urban population growth.

Segment Insights:

- The software segment in the home security systems market is projected to hold a 42% share by 2035, fueled by increasing connected devices, cloud-based systems, and adoption of AI-enabled surveillance.

- The video surveillance system segment in the home security systems market is expected to hold a 34% share by 2035, driven by the widespread demand for efficient and low-cost surveillance in various sectors.

Key Growth Trends:

- Increasing Incidences of Theft and Robbery Across the World

- Increasing Number of Single-Parent Families

Major Challenges:

- Lack of awareness about the advantages of home security systems

- Inadequate exposure and the reluctance of consumers to adopt new technologies

Key Players: Rhythm Energy, Arlo Technologies Inc., Google LLC, ABB Ltd, Zmodo, ADT Inc., Johnson Controls, Inc., Nortek Security & Control LLC, Honeywell International Inc, Assa Abloy.

Global Home Security Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 59.75 billion

- 2026 Market Size: USD 63.62 billion

- Projected Market Size: USD 119.75 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Home Security Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Incidences of Theft and Robbery Across the World - Approximately 6k burglaries occur in the United States each day, according to the FBI, with one burglary occurring every 13 seconds, four burglaries occurring every 20 minutes, and 240 in an hour. Heists are also reported to occur in one in every three houses without security systems, compared to every 250 houses that have security systems. As criminal activities are on the rise, people are increasingly looking for ways to protect their homes and properties. Home security systems such as CCTV cameras, sensors, and alarms provide a quick and efficient way to detect and deter criminal activity. They also provide real-time alerts so homeowners can take quick action.

-

Increasing Number of Single-Parent Families - It is estimated that around 24% of children under the age of 18 in the United States live with one parent. Comparatively, 4% of Chinese children, 5% of Nigerian children, and 6% of Indian children live with only one parent. Single-parent families are more likely to feel the need for added security systems in their homes owing to their inability to have a second adult in the home at all times. This heightened sense of security can lead to increased demand for home security systems.

-

Growing Adoption of Home Security Devices - It is projected that more than 75% of Americans install some type of security system in order to ensure the safety of their homes. A security system is used by more than 1 in 4 Americans to protect their property and home

-

Emergence of Smart City Projects - The United States is the country with the largest number of smart cities, having adopted 50 smart city initiatives and technologies. Following closely behind is China with 45 smart cities, India with 25 smart cities, the United Kingdom with 10 smart cities, and Japan with 8. Also, global investment in smart city technology reached a total value of USD 150 billion by 2022. Smart city projects are designed to increase public safety and provide better services to citizens. As part of these projects, home security systems are being introduced to offer citizens better protection against intruders and other security threats.

-

Increased Consumer Expenditures on Smart Home Technology - Consumers are steadily spending more money on smart home technology each year. Global consumers were estimated to spend USD 130 billion on smart home systems as of 2022. The figure is expected to rise to USD 169 billion by 2025.

Challenges

-

High installation costs and system complexities - Home security systems involve the installation of sophisticated equipment and components, which can be cost-prohibitive for many consumers. Additionally, the complexity of the systems can make them difficult to use and may create a barrier to adoption for some individuals.

-

Lack of awareness about the advantages of home security systems

-

Inadequate exposure and the reluctance of consumers to adopt new technologies

Home Security Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 59.75 billion |

|

Forecast Year Market Size (2035) |

USD 119.75 billion |

|

Regional Scope |

|

Home Security Systems Market Segmentation:

Services Segment Analysis

The global home security systems market is segmented and analyzed for demand and supply by service into the video surveillance system, alarm system, access control system, fire protection services, remote monitoring services, and others. Out of these, the video surveillance system segment is estimated to gain the largest market share of about 34% in the year 2035. The growth of the segment can be attributed to the increasing demand for video surveillance systems by residential, commercial, and industrial establishments owing to their superior efficiency and low cost of installation. According to estimates, approximately 1 billion surveillance cameras are estimated to have been installed worldwide as of 2021, with 53% of the world's surveillance cameras being installed in China. Additionally, the advancements in technology and the emergence of artificial intelligence-based solutions are expected to drive the demand for video surveillance security cameras.

Type Segment Analysis

The global market is segmented and analyzed for demand and supply by type into hardware, software, and service. Out of these, the software segment is estimated to gain a significant market share of about 42% in the year 2035. The growth of the segment can be attributed to the rapid adoption of connected devices and the need for sophisticated surveillance systems, as well as the increasing demand for cloud-based surveillance systems. The rise of internet-connected devices has enabled more complex surveillance systems, and cloud-based storage solutions make it much easier for businesses to store and access surveillance footage. Moreover, the increasing use of facial recognition technology and the development of artificial intelligence-based security systems are also expected to drive segment growth. Facial recognition technology has become increasingly prevalent, and with the development of AI-enabled security systems, businesses can now monitor their premises more effectively while also responding more quickly to potential threats.

Our in-depth analysis of the global market includes the following segments:

|

By Home Type |

|

|

By Installation |

|

|

By Type |

|

|

By Services |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Security Systems Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 38% by 2035. The growth of the market can be attributed majorly to the increasing awareness about home safety and security, coupled with the growing adoption of advanced technologies such as artificial intelligence and machine learning. In addition, there are many mandatory fire protection and safety regulations in the region, such as those issued by the National Fire Protection Association and the U.S. Consumer Product Safety Commission in response to the increasing number of fires in the recent past. Every year, approximately 4,800 - 5,000 people in this country die as a result of fire, with another 25,000 being injured. Over 1,317,000 fires were reported in the United States in 2018 by public fire departments. These regulations enforce the installation of smoke detectors, fire extinguishers, and emergency exits in all residential and commercial properties. The regulations also require regular inspections to ensure that all safety systems are in proper working order.

APAC Market Statistics Insights

The Asia Pacific home security systems market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the growing awareness among consumers about home security systems and the increasing number of smart city initiatives across the region. These initiatives promote the use of home security systems in the Asia Pacific region, providing an impetus to the growth of the market. Moreover, rising concerns over security and surveillance, and the increasing urban population are further projected to drive regional market growth. The urban population of the Asia Pacific region has been increasing in recent years owing to a combination of factors, such as economic development, migration patterns, and population growth. As cities become more populated, the need for security systems increases. People are more inclined to install security systems in their homes in densely populated areas to protect their property from theft and vandalism.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the increasing concerns about personal and property security, coupled with the rising demand for advanced and reliable security systems in Europe. Additionally, government initiatives to promote the adoption of home security systems such as the EU Strategy for a Secure Information Society are also expected to further boost the market growth in Europe. The strategy is aimed at enhancing the security of citizens’ online activities, protecting them from cyber threats and criminal activities, and ensuring the safety of their data. This includes the implementation of home security systems in both residential and commercial buildings. Additionally, rising levels of urbanization, and the increasing preference for home automation systems, are also contributing to the growth of the market in the region.

Home Security Systems Market Players:

- Rhythm Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arlo Technologies Inc.

- Google LLC

- ABB Ltd

- Zmodo

- ADT Inc.

- Johnson Controls, Inc.

- Nortek Security & Control LLC

- Honeywell International Inc

- Assa Abloy

Recent Developments

- Rhythm Energy has announced the Simply Secure 24 bundle, featuring a fixed-rate energy plan and a full-featured home security system from SimpliSafe. The bundle offers customers a discounted rate for their energy and also includes a state-of-the-art home security system from SimpliSafe.

- An innovative smart home security system has been introduced by Arlo Technologies Inc. The All-in-One Multisensor system is recognized as a 2022 CES Innovation Award winner. The system uses motion and temperature sensors to detect and alert users of any possible security threats in home.

- Report ID: 4862

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Home Security Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.