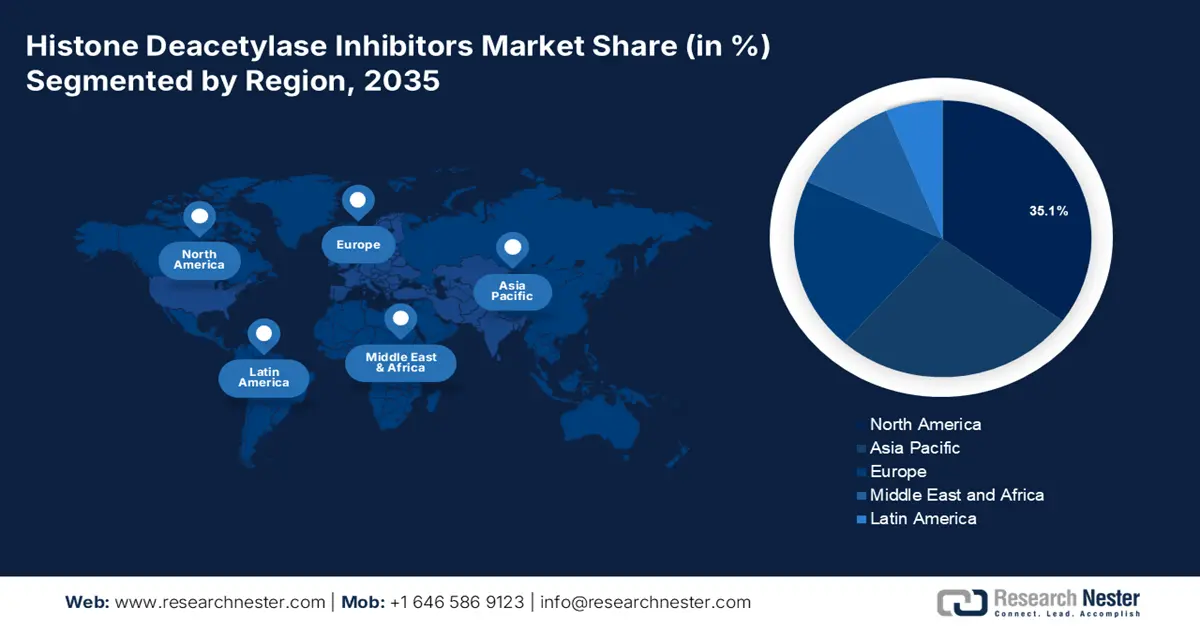

Histone Deacetylase Inhibitors Market - Regional Analysis

North American Market Insights

North America is predicted to account for the largest revenue share of 35.1% in the histone deacetylase inhibitors market by 2035. The rising investment in healthcare technology and clinical R&D is fostering a progressive trading environment for this landscape. This has led to an escalation in the scale distribution and availability across the region, ensuring continuous capital influx and participant engagement. For instance, in August 2022, Regenacy Pharmaceuticals announced the initiation of a phase II study on its oral selective histone deacetylase 6 (HDAC6) inhibitor, ricolinostat, in treating painful diabetic peripheral neuropathy. The company also secured a series B funding of USD 9.3 million to support this clinical development program.

In 2021, 3.2% of the new malignancy incidences in the U.S. originated from leukemia, accounting for 61,090 (the Surveillance, Epidemiology, and End Results (SEER) database). On the other hand, by 2025, the numbers of new and death cases of cancer in the U.S. are projected to reach 2,041,910 and 618,120 (NLM). This demography showcases an enlarging patient pool and a heightened surge in the market. Besides, the accelerated regulatory approvals are cultivating a favorable business environment for global leaders, inspiring other biotech pioneers to invest and participate in this sector. For instance, in March 2024, the Muscular Dystrophy Association offered foundational research leads funding to accelerate the FDA approval for Duvyzat (givinostat) for children and adolescents with DMD.

APAC Market Insights

The Asia Pacific histone deacetylase inhibitors market is estimated to be the second largest shareholder and to witness a notable pace of growth throughout the analyzed timeframe. The increasingly supporting governmental initiatives are spreading awareness about the associated ailments and available treatment options for them. For instance, in January 2025, the Department of Biotechnology highlighted its efforts in exploring the potential of molecular biology in treating B-cell- and T-cell-based hematological carcinomas. The governing body also mentioned that it is serving this purpose by establishing a dedicated Technical Expert Committee on Cancer Research Biology. Moreover, such research programmes promote wide adoption and investment in this sector.

Japan is steadily becoming a hub of innovation and a large consumer base for the market. According to NLM, the occurrence of cancer in this country is projected to surpass 3,665,900 thousand by 2050, exhibiting a 13.1% increase from 2020. Among this figure, the colorectal, female breast, prostate, lung, and stomach segments are expected to be the most prevalent cases. Similarly, the influence of technological advancements is helping companies introduce new lines of therapeutics, such as HDACis, expanding the territory of this landscape. For instance, in June 2021, Meiji Seika Pharma gained marketing clearance from the Ministry of Health, Labour and Welfare in Japan for its HBI-100, treating T-cell leukemia-lymphoma.