High Temperature Sealants Market Outlook:

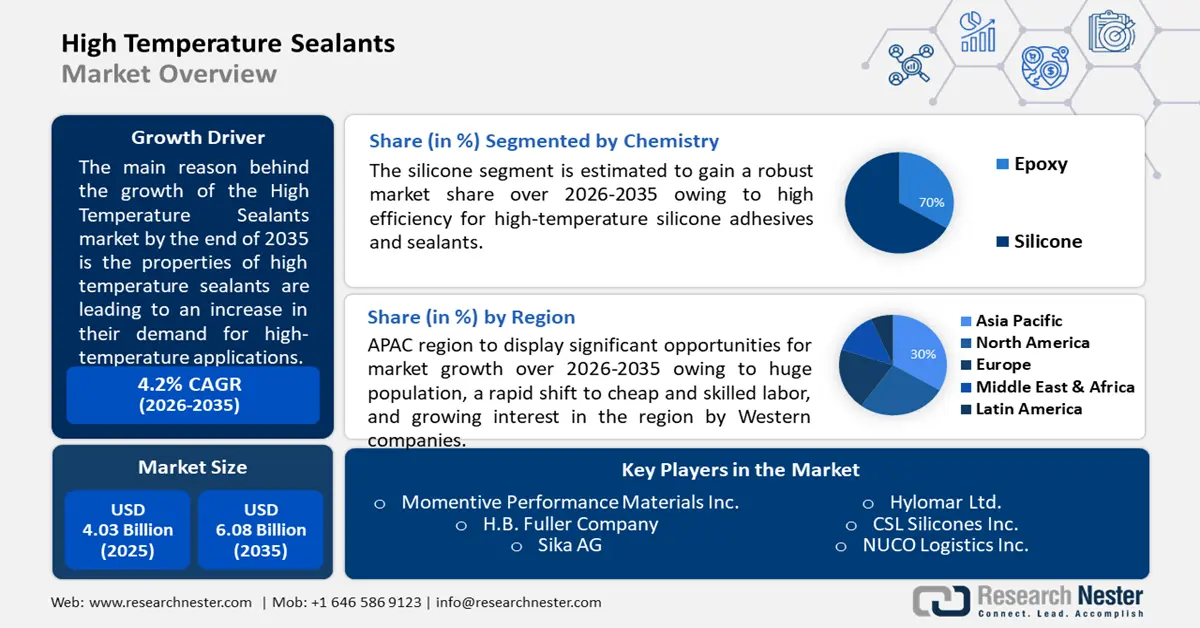

High Temperature Sealants Market size was valued at USD 4.03 billion in 2025 and is expected to reach USD 6.08 billion by 2035, expanding at around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high temperature sealants is evaluated at USD 4.18 billion.

The properties of high temperature sealants are leading to an increase in their demand for high-temperature applications. As a high-temperature sealant is an extreme-performance sealing substance created specifically for applications involving extremely high temperatures.

The majority of typical building materials may adhere to high temperature sealants and it maintains their flexibility over an extensive variety of surfaces and temperatures. Also, it is used for sealing, and fixing gaps in glass, metals, ceramics, and other materials, as it can bear high temperatures. In May 2023, the seasonally adjusted annual rate of privately-owned dwelling units authorized by building permits was 1,490,000 in the United States.

Key High Temperature Sealants Market Insights Summary:

Regional Highlights:

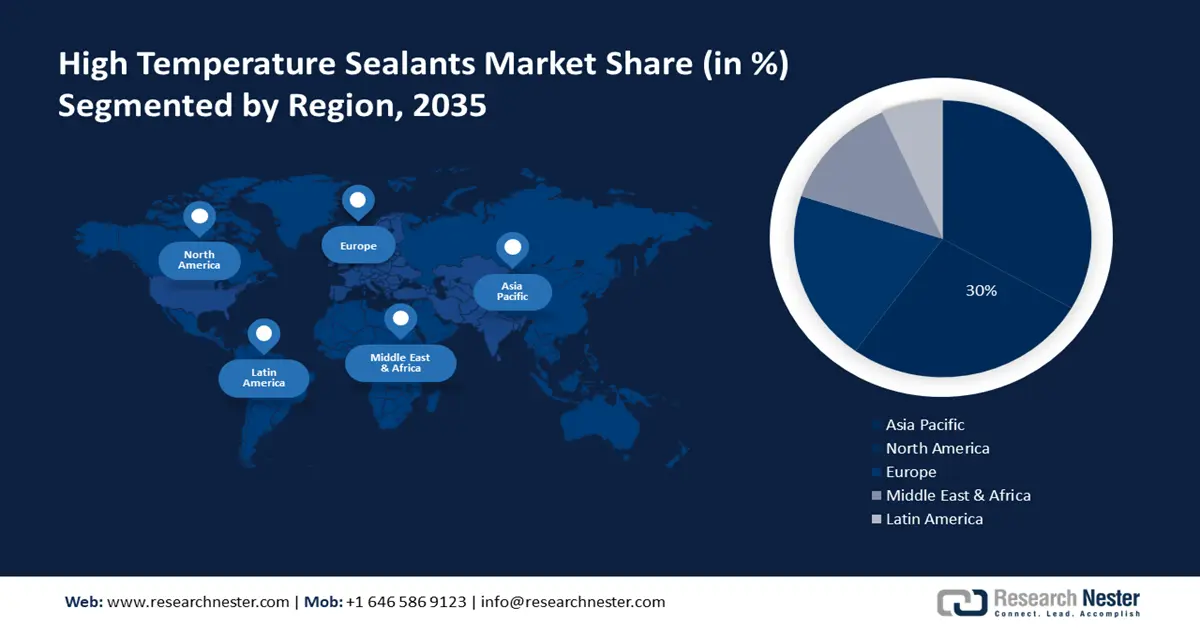

- Asia Pacific high temperature sealants market is predicted to capture 30% share by 2035, attributed to industrialization and infrastructure investment.

- North America market will account for 28% share by 2035, driven by material science investment and sealant innovation.

Segment Insights:

- The silicone chemistry segment in the high temperature sealants market is projected to capture a 71% share by 2035, driven by high efficiency and resistance properties of silicone-based sealants.

- The electronics & electrical application segment in the high temperature sealants market is forecasted to capture a 69% share by 2035, fueled by increasing demand in electrical and electronics industries worldwide.

Key Growth Trends:

- Escalating Production of Automobiles

- Surging Manufacturing of Medical Devices

Major Challenges:

- Disadvantages Associated with High Temperature Sealants

- Environmental Regulations Over VOC Emissions

Key Players: Agility PR Solutions LLC, Hylomar Ltd., CSL Silicones Inc., NUCO Logistics Inc., Sashco, Inc., Mcgill Airseal LLC, 3M, Momentive Performance Materials Inc., H.B. Fuller Company, Sika AG.

Global High Temperature Sealants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.03 billion

- 2026 Market Size: USD 4.18 billion

- Projected Market Size: USD 6.08 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

High Temperature Sealants Market Growth Drivers and Challenges:

Growth Drivers

- Escalating Production of Automobiles – In the past few years, automobile production across the world has increased at high rates which is expected to raise the high temperature sealants market growth in the near future. These adhesives are perfect for chain covers, axle housings, oil flow seals, & hot engines, and are mostly utilized in the automobile industry for gasket applications such as valve governs water pumps, automotive semiconductors, and oil pans. For instance, 57 million passenger vehicles were produced worldwide in 2021, a 2% rise over the 55.9 million vehicles produced in 2020, reported as by the International Organization of Motor Vehicle Manufacturers.

- Surging Manufacturing of Medical Devices- High temperature sealants provide great reliability to medical devices and are able to resist exposure to UV light or at room temperature.

- Increasing Construction Activities Around the Globe – As a result of the increasing urbanization, and other factors, residential, commercial, and industrial construction activities have increased which has raised the demand for advanced materials in the construction sector. High temperature sealants are made from a variety of materials, such as bitumen, silicate, epoxy resin, and silica gel. Thus, the demand for long-lasting items that can survive harsh weather conditions is growing as construction projects increase. According to the analysis, the global construction sector is predicted to grow by 32 percent by 2030.

- Increasing Use for Fire Protection –The high temperature sealants are designed for assembling and designing ovens, stoves, heaters, and others. It helps to limit the spread of fire, because of which they are used in extremely high temperatures for the sealing of fireplaces. Different sealants provide resistance up to different levels such as 1300 degrees C, 1500 degrees C, and others. For instance, Vitcas Heat Resistant Sealant by Vitcas Ltd. is utilized in various materials, thus, providing resistance up to 1300 degrees C.

Challenges

- Disadvantages Associated with High Temperature Sealants – As discussed above high temperature sealants have a couple of benefits but they also do have a few disadvantages with it, such as it is a sensitive and high cost for a few surfaces. Also, epoxy-based sealants have slow curing, and epoxy cred sealants are brittle nature-wise. Also, silicone-based sealants offer less chemical resistance, cannot handle heavy loads, and has less resistance to aggressive fluids.

- Environmental Regulations Over VOC Emissions

- Availability of Alternatives

High Temperature Sealants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 4.03 billion |

|

Forecast Year Market Size (2035) |

USD 6.08 billion |

|

Regional Scope |

|

High Temperature Sealants Market Segmentation:

Application Segment Analysis

The electronics & electrical segment is expected to dominate 69% high temperature sealants market share by 2035. The high-temperature sealants have a wide range of uses in the electrical and electronics industry, including printed circuit panels, semiconductor connections, pyrolytically deposited films, microelectronic surfaces, electrical connections, high-power resistors, ceramic-filled cartridge furnaces, and others. Thus, the increasing demand and supply of electrical and electronics are estimated to boost the segment’s growth. The National Policy on Electronics 2019 has been adopted by the Indian Cabinet, which sets a target of USD 400 billion in domestic electronics manufacturing revenue by 2025 for the country's Electronics System Design and Manufacturing (ESDM) sector.

Chemistry Segment Analysis

The silicone segment in the high temperature sealants market is expected to hold 71% share by the end of 2035. The silicone-based sealants have high efficiency for high-temperature silicone adhesives and sealants. High-temperature silicone sealants are resistant to shock, vibration, and temperatures as high as 600 degrees Fahrenheit. Furthermore, its easy application in plastics, glass, and ceramics has led to its superiority over epoxy. They are specially designed to enclose and seal industrial seals, and heating elements.

Our in-depth analysis of the global market includes the following segments:

|

Chemistry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Temperature Sealants Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 30% by 2035. This is due to its huge population, a rapid shift to cheap and skilled labor, and growing interest in the region by Western companies. China and India are major contributors to the growth of the market in the Asia-Pacific region. This growth is primarily due to the increasing industrialization, and the surging spending upon infrastructure developments in countries such as India, China, and Others. According to the data, the average infrastructure spending in China was around 9 times more than in the United States in the year 2021.

The growing agriculture sector is increasing the demand for agriculture machinery including tractors for heavy-duty applications. The domestic sales in the Indian tractor industry reached roughly 678,869 units by the middle of 2020, and they first exceeded 900,000 units annually in that same year.

North American Market Insights

The high temperature sealants market in the North American region is expected to register 28% share by the end of the forecast period. Manufacturers in the North America region are constantly striving to improve the properties and performance of sealants, such as chemical resistance, thermal stability, adhesion, and others. Moreover, rising investment for advancements in material science and manufacturing technologies contributes to the development of innovative high-temperature sealant solutions in the region.

The rising demand for smartphones in the region requires silicone sealants for fingerprint sensor assemblies to help achieve an IP waterproofing rating. There have been 298 million smartphone users in the United States, as of 2021.

High Temperature Sealants Market Players:

- Agility PR Solutions LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hylomar Ltd.

- CSL Silicones Inc.

- NUCO Logistics Inc.

- Sashco, Inc.

- Mcgill Airseal LLC

- 3M

- Momentive Performance Materials Inc.

- H.B. Fuller Company

- Sika AG

Recent Developments

- Sika AG plans to open a technical center in Pune in December 2021 to expand its adhesives and sealants production in India. The center focuses on manufacturing high-quality adhesives and sealants for construction and transportation applications.

- In December 2020, 3M launched a new silicone adhesive for medical devices called 2480 3M High Tack Silicone Adhesive.

- Report ID: 4801

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Temperature Sealants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.