High Purity Alumina Market Outlook:

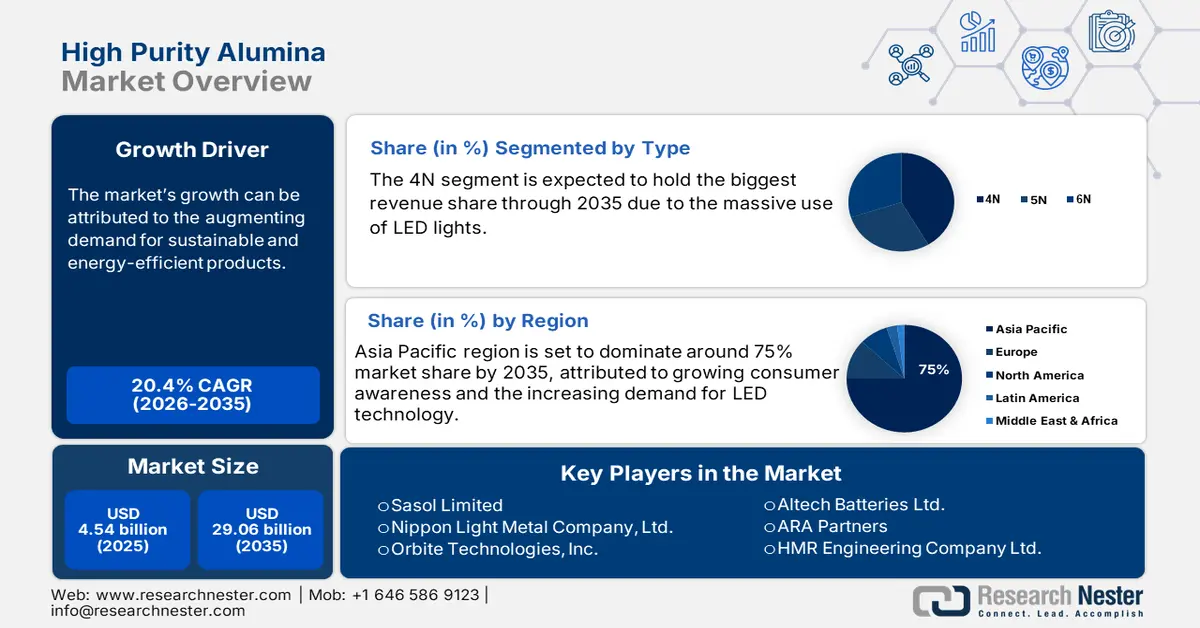

High Purity Alumina Market size was valued at USD 4.54 billion in 2025 and is set to exceed USD 29.06 billion by 2035, registering over 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high purity alumina is estimated at USD 5.37 billion.

The growth of the market can be attributed to growing demand for sustainable and energy efficient product. As a result of their usage of energy-intensive home equipment, households continue to be one of the leading sources of dangerous greenhouse gases today. About 70% of the world's greenhouse gas emissions are caused by household use (with the remainder coming from public and nongovernmental and financial sources). Hence, their preference for conventional alternatives is growing further boosting the market growth.

Additionally, energy-efficient appliances not only reduce greenhouse gas emissions and also help customers save money by lowering the home energy costs. Moreover, the growing government initiatives in order to make people aware about the growing harm caused to the environment owing to greenhouse gases is also estimated to boost the market growth. With the huge demand for items containing carbon, it is challenging to minimize the amount of carbon emissions. The government of UK is working to lower this demand through environmentally friendly home improvements, such as the installation of smart metres (which make it easier for consumers to monitor usage) and the rollout of the "Green Deal," a government programme designed to help businesses and homeowners adopt green technologies.

Key High Purity Alumina Market Insights Summary:

Regional Highlights:

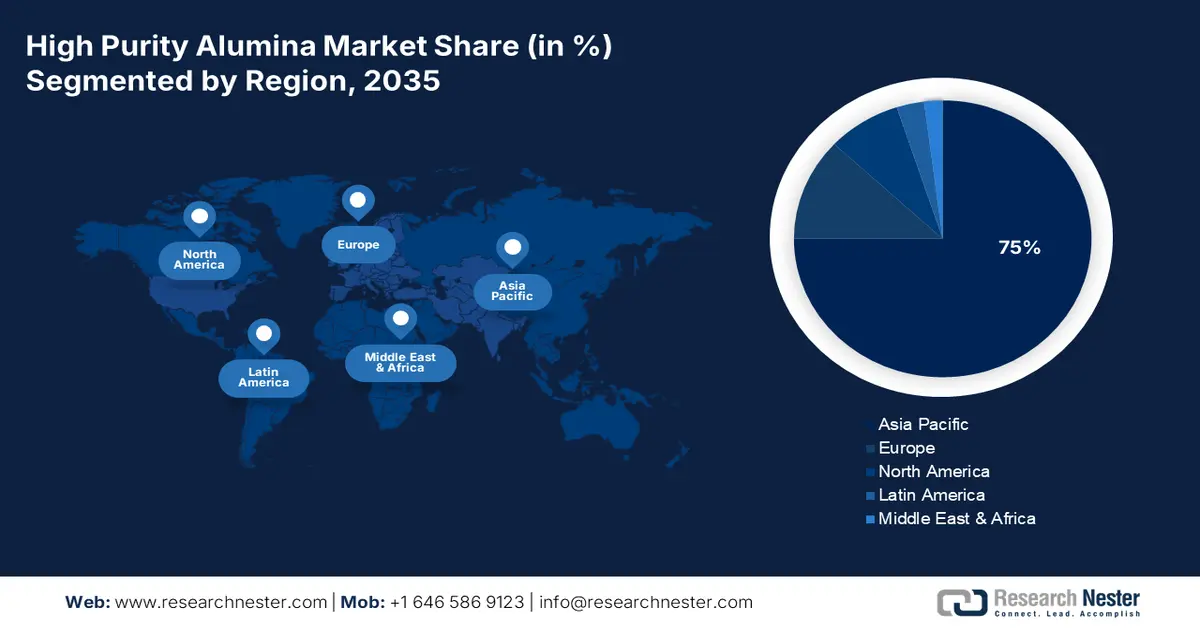

- Asia Pacific high purity alumina market dominates with a 75% share by 2035, attributed to growing consumer awareness and the increasing demand for LED technology.

- North America market will secure the second largest share by 2035, driven by rising LED bulb adoption and expanding electronics and semiconductor industries.

Segment Insights:

- The 4N high purity alumina segment in the high purity alumina market is projected to experience significant growth over 2026-2035, driven by growing use in LED lighting and government initiatives promoting LED adoption.

- The li-ion batteries segment in the high purity alumina market is anticipated to exhibit the highest CAGR through 2035, attributed to growing adoption of electric vehicles and investment in EV battery manufacturing facilities.

Key Growth Trends:

- Growing Demand for LED Lights

- Rise in Demand for Automobiles

Major Challenges:

- High Production Cost

- Stringent Government Regulations

Key Players: Sasol Limited, Nippon Light Metal Company, Ltd., Orbite Technologies Inc., Xuancheng Jing Rui New Material Co., Ltd., Altech Batteries Ltd, Ara Partners, Baikowski SA, HMR Engineering Company Ltd, Hebei Hengbo New Material Technology Co., Ltd., Polar Performance Material.

Global High Purity Alumina Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.54 billion

- 2026 Market Size: USD 5.37 billion

- Projected Market Size: USD 29.06 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (75% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 10 September, 2025

High Purity Alumina Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for LED Lights - With only about 3% of US homeowners choosing LED as their primary lighting option in 2019, the technology was still in its infancy. In just five years, this situation radically improved, and by 2020, approximately 46% of US houses were using LED lamps as their primary source of lighting. LED lights are more efficient than traditional lights. Most of the energy in LED is converted into light and least is wasted, as less energy is used. Thus, they are known to be the eco-friendliest solution. Hence, owing to this factor the market is estimated to grow.

-

Rise in Demand for Automobiles - In the United States, the percentage of people who own cars is rising. In 2020, about 90% of American households had access to at least one automobile, up from approximately 89% in 2015.

- Surge in Adoption of Smartphones - By 2023, there was estimated to be about 5 billion smartphone users worldwide, which would mean that approximately 85 percent of people would be smartphone owners. This number is significantly more than it was in 2016, when there were just about 2 billion users, or approximately 48% of the world's population.

- Growth in Government Initiatives in Order to Adopt Electric Vehicles - Phase 2 of the FAME INDIA project was launched by the Indian government in 2022 for a five-year period with a budgetary support of USD 121 Billion. The Indian government seeks to promote the electrification of public transportation. To this end, 7090 electric buses, 10,000 electric two-wheelers, and 5,000 electric four-wheelers have been purchased with subsidies. Electric vehicles consist of lithium-ion batteries, and high purity alumina is extensively used in these batteries. Therefore, with growing government initiatives the demand for electric vehicles is estimated to increase which would further also boost the market growth for high purity alumina.

- Upsurge in Demand for Electricity - For the previous 50 years, the amount of electricity consumed worldwide has increased steadily, and in 2021, it was expected to be over 25,299 terawatt hours. Electricity usage increased by more than thrice between 1980 and 2021. Since the demand for electricity demand is growing the urge to conserve energy is also growing. Hence, the demand for energy-efficient lighting solution such as LED is estimated to boost the growth of the market.

Challenges

-

High Production Cost

-

Leads to Rise in Carbon Emission During Manufacturing - It is generally known that the traditional alkaloid process used to make HPA is a notorious "energy hog," producing an average carbon footprint of about 11 ton of CO2 per ton of high purity alumina. Reducing the energy needed for manufacturing operations is the first step in lessening the HPA industry's carbon footprint and environmental effects. The creation of the production facility and the procedures themselves is the first step in this process which requires huge investment. The high purity alumina alkaloid technique also uses pricey, carbon-intensive aluminium metal as its feedstock, which is obviously unacceptable in the long run. Hence this factor is estimated to hinder the growth of the market.

- Stringent Government Regulations

High Purity Alumina Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 4.54 billion |

|

Forecast Year Market Size (2035) |

USD 29.06 billion |

|

Regional Scope |

|

High Purity Alumina Market Segmentation:

Application Segment Analysis

The global high purity alumina market is segmented and analyzed for demand and supply by application into LED blubs, semiconductor substrate, li-ion batteries (lithium ion battery), optical lenses, and bio medical devices. Out of which, the li-ion batteries segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing adoption of electric vehicles. Additionally, the construction of new EV battery manufacturing facilities is receiving significant investment from automakers all across the world, which is expected to increase HPA usage. Moreover, other than electric vehicles the li-ion batteries are used in wireless headphones. Therefore, growing demand for wireless headphones is also estimated to boost the segment growth. By 2021, sales of true wireless hearables (TWS) had risen to slightly about 299 million units globally. As of 2021, Apple had over 39% of the market among TWS vendors, leading the industry. Further, with the growing trend of smartphones, bluetooth has become new standard in transmitting audio. Hence, this could be the major factor boosting the demand for wireless earphones.

Type Segment Analysis

The global high purity alumina market is also segmented and analyzed for demand and supply by type into 4H high purity alumina, 5N high purity alumina, and 6N high purity alumina. Amongst which, the 4N high purity alumina segment is anticipated to grow significantly over the forecast period, backed by its growing use in LED light. Additionally, there has been growing government initiatives to make people adopt LED light, hence further boosting the segment growth. Moreover, throughout the projected period, the segment is expected to be driven by growth in the lighting and EV industries. Moreover, growing demand for electric vehicles and rising government policies to boost its adoption is estimated to increase the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Technology |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Purity Alumina Market Regional Analysis:

APAC Market Insights

Asia Pacific region is set to dominate around 75% market share by 2035, attributed to growing consumer awareness and the increasing demand for LED technology. In 2021, about 50 percent of respondents in Hong Kong owned wearables in their households. Moreover, light emitting diode (LED) bulb acceptance is growing, which is a key market driver in this region. The value-adding characteristics of LED products, such as longevity, dependability, brightness, and low radiated heat, contributed to their expanding popularity and helped to change the industry for the better. Technology using Light Emitting Diodes (LEDs) is what has largely caused this transformation. Many factors, including macroeconomic conditions, which affect new construction and, as a result, the quantity of new lighting installations, have an impact on the Asia Pacific market. Regulations requiring energy efficiency and growing consumer awareness are further boosting demand for LED lamps.

North American Market Insights

The North America high purity alumina market is estimated to be the second largest, to grow at a highest share over the forecast period. The growth of the market in this region can be attributed by the rising LED bulb adoption and expanding electronics & semiconductor industries. Moreover, high purity alumina is widely utilized in non-metallurgical applications such as refractories, abrasives, high aluminum cements, aluminum chemicals and activated bauxite and alumina. Additionally, the high purity alumina has a wide range of uses in the production of sapphire substrates. Sapphire substrates are favoured window materials despite their remarkable chemical and mechanical characteristics, such as their resistance to thermal shock, high temperatures, minimum dielectric loss, and sand and water erosion, among others. Additionally, it has a wide range of uses in things such as semiconductors, electric & hybrid cars, LED lights, smartwatches, smartphones, li-ion battery separators, optical lenses, sodium lamps, and plasma displays. Hence, growing demand for electronics and EV vehicles in this region is estimated to boost the growth of the market.

Europe Market Insights

Additionally, the market in Europe region is also anticipated to have a significant growth over the forecast period, backed by consumer electronics' rising popularity and a number of non-metallurgical industrial uses. Also, the rise of the market would be fueled by growth in Europe's electronic manufacturing industry, particularly in Germany, the UK, and France. Moreover, there has been growing technology advancement in LED technology which is estimated to decreased electricity use is also estimated to drive the market growth in this region.

High Purity Alumina Market Players:

- Sasol Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nippon Light Metal Company, Ltd.

- Orbite Technologies Inc.

- Xuancheng Jing Rui New Material Co., Ltd.

- Altech Batteries Ltd

- Ara Partners

- Baikowski SA

- HMR Engineering Company Ltd

- Hebei Hengbo New Material Technology Co., Ltd.

- Polar Performance Material

Recent Developments

-

Polar Sapphire has concluded a controlling investment from Ara Partners, a private equity firm that specializes in investments in industrial decarbonization. Polar Sapphire was anticipated to get immediate and ongoing funds from the investment to support its expansion. In order to address end customer markets that are expanding quickly, Ara Partners and the Polar Sapphire management team were expected to speed the company's expansion plans.

-

In order to achieve the Sustainable Development Goals (SDGs), Nippon Light Metal Holdings Company, Ltd. engaged in research and technical development pertaining to the development of industrial products and methods of manufacturing industrial products capable of contributing to the reduction of environmental impact, based on our Group's Management Policy. To contribute to building a sustainable society, their group would actively work towards achieving carbon neutrality.

- Report ID: 4757

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Purity Alumina Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.