High Frequency Ventilators Market Outlook:

High Frequency Ventilators Market size was valued at USD 117.8 million in 2025 and is projected to reach USD 213 million by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of high frequency ventilators is estimated at USD 125 million.

The global market is rising actively and is driven by clinical pressures and demographics, mainly with the rising incidence of neonatal respiratory distress syndrome. As per the WHO report in March 2024, 2.3 million neonatal deaths occurred globally. According to the CDC report in April 2025, in the U.S., nearly 10.41% infants are born preterm, requiring the demand for neonatal intensive care interventions, including HFV. Further, government-based programs in Europe and Japan have surged in the procurement and deployment of high-frequency ventilators.

On the supply chain side, the HFV is structured with the medical parts such as pressure transducers, valve systems, and microcontroller assemblies. These are predominantly imported or produced under bilateral arrangements with OEMs in nations such as Germany, the U.S., and China. In 2024, the U.S. exported medical instruments, including high-frequency ventilators worth USD 36.8 billion, to the Netherlands, Mexico, China, Canada, and Japan, based on the OEC report in June 2025. Additionally, national R&D expenditures in critical care device technologies have experienced a quantifiable rise toward respiratory device research.

Key High Frequency Ventilators Market Insights Summary:

Regional Highlights:

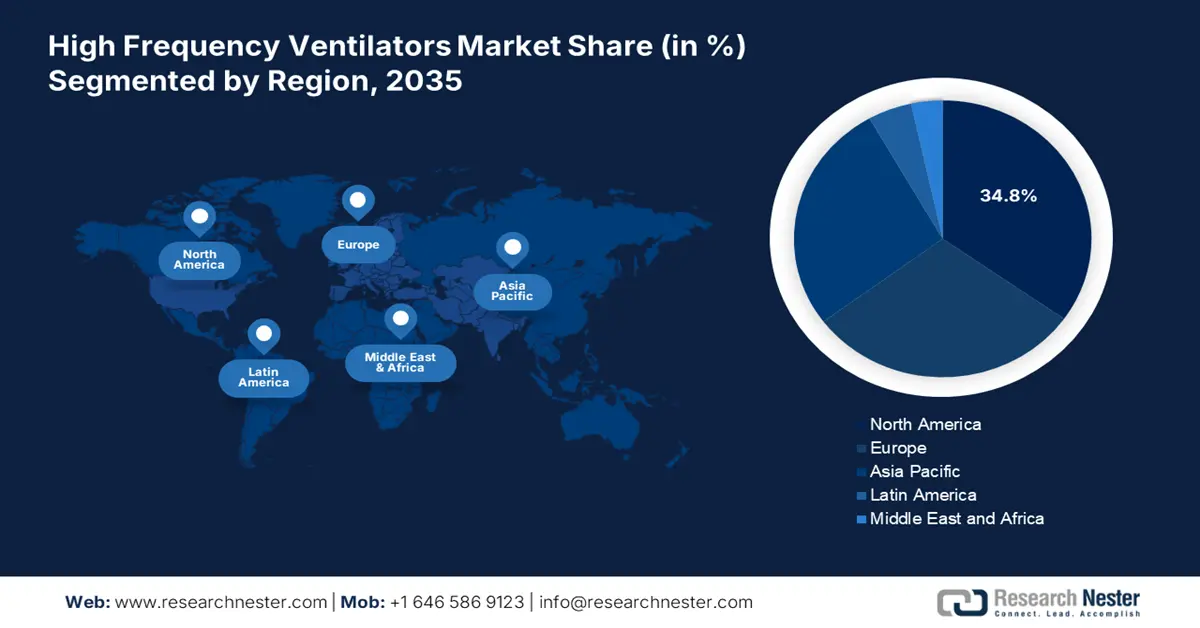

- The North America high frequency ventilators market is anticipated to command a 34.8% share by 2035, impelled by advanced healthcare infrastructure, robust government funding, and a growing prevalence of respiratory diseases.

- The Asia Pacific region is projected to record the fastest growth by 2035, attributed to rising respiratory disorder cases, expanding neonatal care infrastructure, and higher government healthcare investments.

Segment Insights:

- The distribution through merchants segment in the high frequency ventilators market is projected to maintain a 59.5% revenue share by 2035, propelled by deeper market access through independent distributors and regional sellers in developing economies.

- The hospitals segment is expected to dominate the end-user category by 2035, owing to the increasing demand for advanced respiratory support systems across adult and neonatal intensive care units.

Key Growth Trends:

- Import and export trade in HFV

- Manufacturers strategies and innovation

Major Challenges:

- Barriers in patient cost effectiveness

Key Players: Medtronic plc, GE HealthCare, Vyaire Medical, Drägerwerk AG & Co. KGaA, Hamilton Medical AG, Getinge AB, Philips Healthcare, Fisher & Paykel Healthcare, Smiths Medical, Schiller AG, Mindray Medical International Ltd., BPL Medical Technologies, Penlon Ltd., Aeonmed, Biocare Medical Systems, Japan Lifeline Co. Ltd., Nihon Kohden Corporation, Metran Co. Ltd., Fukuda Denshi Co. Ltd., Toitu Co. Ltd.

Global High Frequency Ventilators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 117.8 million

- 2026 Market Size: USD 125 million

- Projected Market Size: USD 213 million by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Africa, Indonesia, Mexico

Last updated on : 12 September, 2025

High Frequency Ventilators Market - Growth Drivers and Challenges

Growth Drivers

- Import and export trade in HFV: As per OEC report the global trade of medical instruments reached USD 36.4 billion from July 2024 to June 2025. The U.S. exports medical devices to China, Netherlands and Mexico. The use of such supply chains for high-frequency ventilator components influenced regional assembly and deployment policies. In 2024, India and Brazil surged the HFV imports, driven by multilateral healthcare financing. Those nations that have invested in local assembly, like Mexico and Malaysia, are also cutting reliance and enhancing last-mile availability via export-substitution strategies.

- Manufacturers strategies and innovation: In 2024, Germany's public hospital networks collaborated with Drägerwerk AG to introduce EU-supported contracts featuring AI-enabled HFOV devices. At the same time, Philips Healthcare in January 2025 introduced an AI enabled diagnostics and monitoring to Arab Health to minimize the radiation exposure. These developments align with hospitals' objectives of minimizing ICU burden while increasing ventilation accuracy. These strategic steps have helped firms gain higher market share in high frequency ventilators market in Europe and Asia-Pacific.

- Surging preterm birth patient pool: Globally, preterm births are increasing each year, as cited by the WHO, with high densities in India, Nigeria, and the U.S. The NLM report in June 2025 states that nearly 13.4 million preterm births were recorded (Destatis) over the past five years. These newborns have a high risk of respiratory distress syndrome (RDS), requiring HFV-based respiratory assistance directly. This burgeoning neonate population, particularly in middle-income countries, modernizing NICU facilities, creates volume-driven, long-term demand for HFVs.

U.S. Preterm Births and Infant Deaths (2021–2024) Requiring High Frequency Ventilators

|

Year |

Preterm Birth Rate (%) |

Total Births |

Infant Mortality (per 1,000 live births) |

|

2021 |

10.48 |

3,659,289 |

5.44 |

|

2022 |

10.38 |

3,661,220 |

5.6 |

|

2023 |

10.41 |

3,591,328 |

5.6 |

|

2024 |

10.41 |

3.6 million |

5.5 |

Source: CDC May 2022, CDC June 2023, CDC April 2024, CDC April 2025

Challenges

- Barriers in patient cost effectiveness: Out-of-pocket costs limit high-frequency ventilator treatment access due to the lack of universal coverage in some nations. As per the National Health Authority report, most of the patients are not capable of affording HFV treatment, and only few patients in India can afford HFV treatments due to the lack of adequate insurance coverage and cost. This constrains market growth unless affordable schemes are deployed. Government subsidy programs such as Ayushman Bharat have started covering partially HFV-related care, but access is still uneven across states.

High Frequency Ventilators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 117.8 million |

|

Forecast Year Market Size (2035) |

USD 213 million |

|

Regional Scope |

|

High Frequency Ventilators Market Segmentation:

Trade Type Segment Analysis

Distribution through merchants is leading the segment and is anticipated to maintain the revenue share of 59.5% by 2035. The segment facilitates deeper market penetration through independent distributors and regional sellers to assist low-to middle-income nations. According to the WTO report in May 2023, in 2022, the personal protective equipment totaled USD 200 billion, indicating a strong growth in the ventilators market. India, South Africa, and Brazil are greatly reliant on third-party distributors in providing public and private hospitals with specialized ventilation equipment.

End user Segment Analysis

Hospitals dominate the end-user segment and are driven by the need for advanced respiratory support in adult and neonatal ICUs. According to the AHA report of June 2023, CMS reported that the national spending on hospital care increased by 0.8% in 2022. In Europe, EU4Health put special emphasis on the capacity of hospital ventilation, primarily in Spain and Italy, through targeted public funding. Hospitals have the facilities to support high-tech ventilator units and the trained clinical staff to use high-frequency ventilation, making them the most important for acute and chronic respiratory intervention.

Product Type Segment Analysis

High-frequency oscillatory ventilators are leading the segment and is expected to hold the largest share by 2035. The segment is mainly driven by their potential in treating neonatal respiratory failure. HFOV enables ultra-low tidal volume delivery, keeping at bay risks of barotrauma and volutrauma in sensitive neonates. Based on the National Institutes of Health (NIH), HFOV has shown better clinical results for cases of neonatal RDS and meconium aspiration syndrome, particularly when traditional ventilation does not work. U.S., Japan, and Germany hospitals with Level III NICUs increasingly turn to HFOV as a standard practice, backed by government reimbursement programs and clinical practice guidelines.

Our in-depth analysis of the global high frequency ventilators market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

|

Trade |

|

|

Technology Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Frequency Ventilators Market - Regional Analysis

North America Market Insights

North America is the dominating region in the high frequency ventilators market and is projected to hold the market share of 34.8% at a CAGR of 6.3% by 2035. Extra funding from the federal government supports ICU upgradation, emphasizing HFV utilization in adult critical care and neonatal care. The market is prompted by the sophisticated healthcare infrastructure, strong government support, and high incidence of respiratory disease. Technological advancements enhance patient outcomes and operational efficacy through AI-powered ventilators and an integrated monitoring system.

U.S. is growing consistently, fueled by increasing cases of chronic respiratory ailments and neonatal respiratory distress. The OEC report in 2023 stated that the U.S. exported medical instruments worth USD 36.8 billion, including high-frequency ventilators. Technological advancements enhance patient outcomes and operational efficacy through AI-powered ventilators and an integrated monitoring system. The increasing aging population and chronic disease require the market. Regulatory agencies maintain stringent approval processes but facilitate expedited pathways for novel HFV technologies.

Import and Export Data on Medical Ventilators in 2022

|

Country |

Trade Flow |

Product Description |

Trade Value 1000USD |

|

U.S. |

Import |

Medical ventilators; CPAP; BiPap; Oxygen concentrators; |

3,464,341.08 |

|

Canada |

Import |

Medical ventilators; CPAP; BiPap; Oxygen concentrators; |

298,188.77 |

|

U.S. |

Export |

Medical ventilators; CPAP; BiPap; Oxygen concentrators; |

1,395,233.45 |

|

Canada |

Export |

Medical ventilators; CPAP; BiPap; Oxygen concentrators; |

146,759.41 |

Sources: WITS, 2022

APAC Market Insights

The Asia Pacific is the fastest-growing region in high frequency ventilators market and is poised to hold a significant share by 2035. The region is driven by rising incidence of respiratory disorders, increasing government healthcare investment, and expanding neonatal intensive care infrastructure. India and China are leading the region with the surge in the patient pool requiring advanced ventilation. As per the WITS 2022 report, India has exported medical ventilators trade value worth USD 17,233.58 (1000 USD) in 2022. Regional demand is also driven by chronic respiratory care technologies and rising awareness of neonatal care among the aging population.

China's high frequency ventilators market is expanding rapidly. According to the NLM report in August 2025, China had 1,641,809 hospital admissions receiving mechanical ventilation across 2,837 hospitals; of these, invasive mechanical ventilation (IMV) accounted for 64.4%, and non-invasive ventilation (NIV) 29.0%. The regulatory speed has drawn domestic and global manufacturers, intensifying competition and innovation. Furthermore, Healthy China 2030 has given top priority to critical care capacity and invested heavily in upgrading ICUs and purchasing high-frequency ventilators.

Europe Market Insights

Europe’s market is growing steadily and the region is driven by aging populations, increased prevalence of respiratory diseases, and heavy healthcare expenditures. The European Medicines Agency (EMA) and the European Commission encourage innovation by investing heavily in research funds and harmonized regulations that ease product approvals. Greater adoption of portable and AI-enabled ventilators, coupled with COVID-19 recovery efforts, has also driven market demand further.

Germany is expected to have the highest revenue share by 2035. The market is driven by substantial healthcare budget investment in respiratory technologies and widespread ICU facilities. As per the International Trade Administration report in August 2025, the medical device market in Germany which includes the high frequency ventilors is accounted to USD 44 billion in revenue annually. Germany's high regulatory level guarantees superior product quality, prompting producers to invest in AI-capable and precision ventilators. Germany's dominance in clinical investigation, supported by institutions such as BÄK, also reinforces its market lead.

Medical goods imported by the EU27 in 2021

|

Medical Product |

Extra-EU Import Values |

Intra-EU Import Values USD billions (%) |

Total EU Import Values USD billions |

% Change in Intra-EU share of Total EU27 Imports |

|

Ventilator |

1.495 (49.1%) |

1.553 (50.9%) |

3.047 |

12.11 |

Source: NLM, February 2024

Key High Frequency Ventilators Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare

- Vyaire Medical

- Drägerwerk AG & Co. KGaA

- Hamilton Medical AG

- Getinge AB

- Philips Healthcare

- Fisher & Paykel Healthcare

- Smiths Medical

- Schiller AG

- Mindray Medical International Ltd.

- BPL Medical Technologies

- Penlon Ltd.

- Aeonmed

- Biocare Medical Systems

- Japan Lifeline Co., Ltd.

- Nihon Kohden Corporation

- Metran Co., Ltd.

- Fukuda Denshi Co., Ltd.

- Toitu Co., Ltd.

The high frequency ventilators market is led by multinational and regional players. Firms are focusing on integrating AI and digital health technologies to optimize patient monitoring and ventilator effectiveness. Collaboration with healthcare providers and government agencies is common to optimize regulatory clearance and increase the market. Further, manufacturers also spend on R&D to improve portability, compatibility, and intuitive devices for pediatric, neonatal, and adult respiratory care. Regional players in the APAC region are gaining fast pace with low-cost solutions and rapid growth in emerging markets.

Here is a list of key players operating in the market:

Recent Developments

- In July 2024, Mindray launched a new line of transport ventilators, the TV50 and TV80, which is designed to ensure designed reliability, optimal performance, and ease of use during patient transport.

- In January 2025, FDA granted premarket approval for a new version of the Zoll Medical Corporation High Frequency Ventilator. This product is listed under Premarket Approval number P890057S029.

- Report ID: 8101

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Frequency Ventilators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.