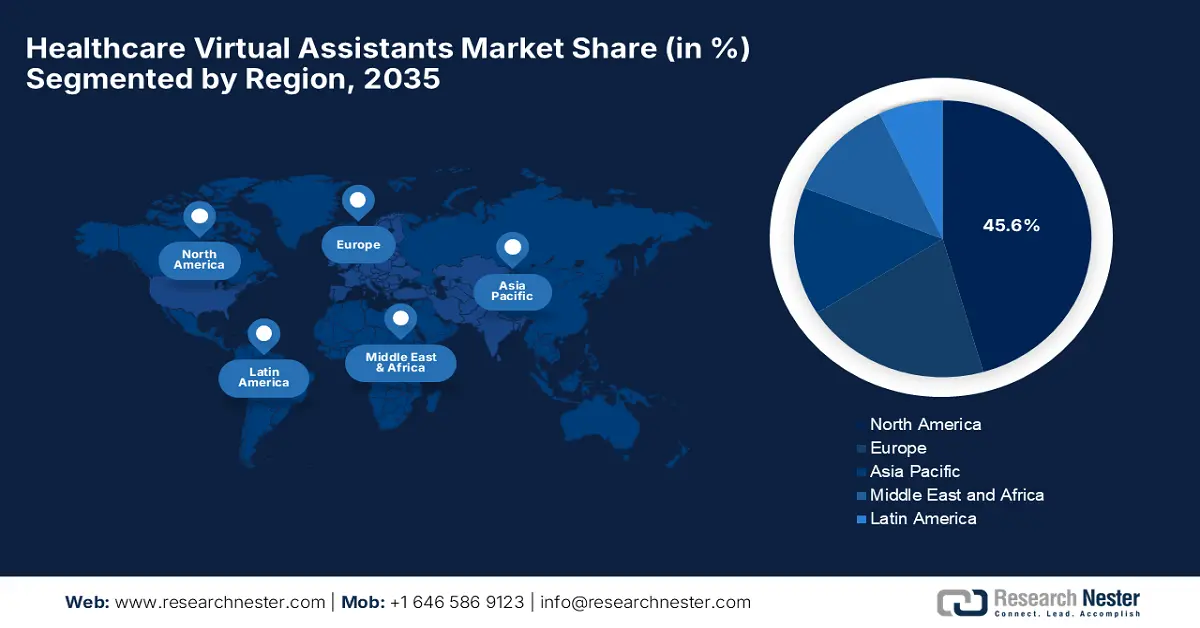

Healthcare Virtual Assistants Market - Regional Analysis

North America Market Insights

North America is the dominating region in the healthcare virtual assistants market, which is expected to capture the largest revenue share of 45.6% by the end of 2035. The region’s digital health infrastructure, widespread AI adoption, and high telehealth emergence are key factors behind this dominance. For instance, in July 2025, Google Research introduced new multimodal models in its MedGemma collection, which are especially designed to advance health AI development. The firm further stated that these lightweight, open models support complex medical text and imaging tasks while preserving privacy and efficiency, hence a positive market outlook.

The U.S. is showcasing its leadership in the regional healthcare virtual assistants market, which is effectively supported by the presence of major pioneers. In July 2025, the White House declared its initiative with pioneers such as Amazon, Google, and Apple to create a patient-centric healthcare ecosystem. Besides, the plan focuses on improving data interoperability, enabling secure sharing, and user-friendly digital health tools. Hence, such initiatives reinforce the country’s captivity in this field, thereby fostering a favourable business environment.

Medicare Telehealth Services Originating Site Facility Fee (Q3014)

|

Year |

Medical Economic Index (MEI%) |

Facility Fee Amount |

|

2025 |

3.5% |

$31.01 |

|

2024 |

4.6% |

$29.96 |

|

2023 |

3.8% |

$28.64 |

|

2022 |

2.1% |

$27.59 |

Source: Centers for Medicare & Medicaid Services

Canada in the healthcare virtual assistants market is gaining enhanced traction as a result of technological adoption and substantial funding grants for digital health integration. In January 2025, Cboe Canada Inc. declared that the public listing of a diagnostic software company, Light AI. Besides, the Vancouver-based firm develops AI-powered software to detect bacterial and viral infections. Therefore, such milestones support Light AI’s growth and innovation in healthcare diagnostics, hence creating an optimistic market opportunity.

APAC Market Insights

Asia Pacific in the healthcare virtual assistants market is likely to exhibit the fastest growth during the forecast period. The increasing digital health adoption and government support for healthcare innovation are key factors behind this leadership. For instance, in August 2022, Carlyle stated that it acquired a significant minority stake in CureApp through a JPY 7 billion Series G investment, bringing its total funding to JPY 13.4 billion. The company further stated that this is the first prescription digital therapeutic for hypertension, hence benefiting the overall market.

China in the healthcare virtual assistants market is gaining enhanced momentum owing to its push toward digital health transformation. Besides the huge investments in AI technologies and the development of smart hospitals is fueling assets of this landscape. In June 2025, Ant Group launched its new AI healthcare app called AQ that offers over 100 AI-powered features, such as doctor recommendations, report analysis, and personalized health advice. Besides, it also connects users to services from more than 5,000 hospitals and nearly 1 million doctors, hence facilitating greater revenue in this field.

India is rapidly growing in the healthcare virtual assistants market due to rising healthcare digitization and the government's emphasis on improving access to care across diverse regions. In August 2025, the Government of India proclaimed that over 79.91 crore (799.1 million) Ayushman Bharat Health Accounts have been created, enabling citizens to securely access and share digital health records. Also, the ABDM has established a strong digital health infrastructure with 4.18 lakh (~4.19 million) health facilities and 6.79 lakh (~6.80 million) healthcare professionals registered, hence emphasizing privacy, consent, and digital empowerment.

eSanjeevani National Telemedicine Service: Key Performance Metrics (2025)

|

Metric |

Value |

|

Total Patients Served |

402,865,185 |

|

Providers Onboarded |

224,967 |

|

Health Centers (Spokes) |

134,577 |

|

Speciality Hubs Established |

17,663 |

|

Medical Specialities Covered |

150 |

Source: MoHFW

Europe Market Insights

Europe is also displaying notable progress in the global market, with extended support from investments and growing adoption of technologies in the healthcare systems. As per a WHO report published in October 2024, all 53 member states adopted the Regional Digital Health Action Plan, making progress across 18 key focus areas. The report further underscored that over 100 institutions from 24 countries joined the Strategic Partners’ Initiative, wherein more than 30 countries participated in capacity-building programs on telemedicine, big data, and health information systems, hence suitable for market expansion.

German market is poised for sustainable upliftment, highly attributed to its push for hospital digitization and improved patient engagement. In this regard, Bayer in December 2024 announced its plan to acquire HiDoc Technologies and commercialize the Cara Care app, which is a digital, evidence-based therapeutic option for irritable bowel syndrome (IBS). This application deliberately integrates pharmacological, dietary, and psychological treatments in a patient-centered approach, thereby benefiting the country’s market.

The U.K. also holds a strong position in the healthcare virtual assistants market, which is gaining recognition as a result of the National Health Service (NHS) and private providers looking to modernize services through AI and automation. In June 2025, the country’s government announced that the NHS App is being transformed to give every patient equal access to personalized healthcare information and choices, helping to reduce health inequalities across the country’s territory. The report also stated that since the middle of 2024, these innovations have saved millions of clinical hours and over £600 million by improving efficiency and reducing missed appointments.