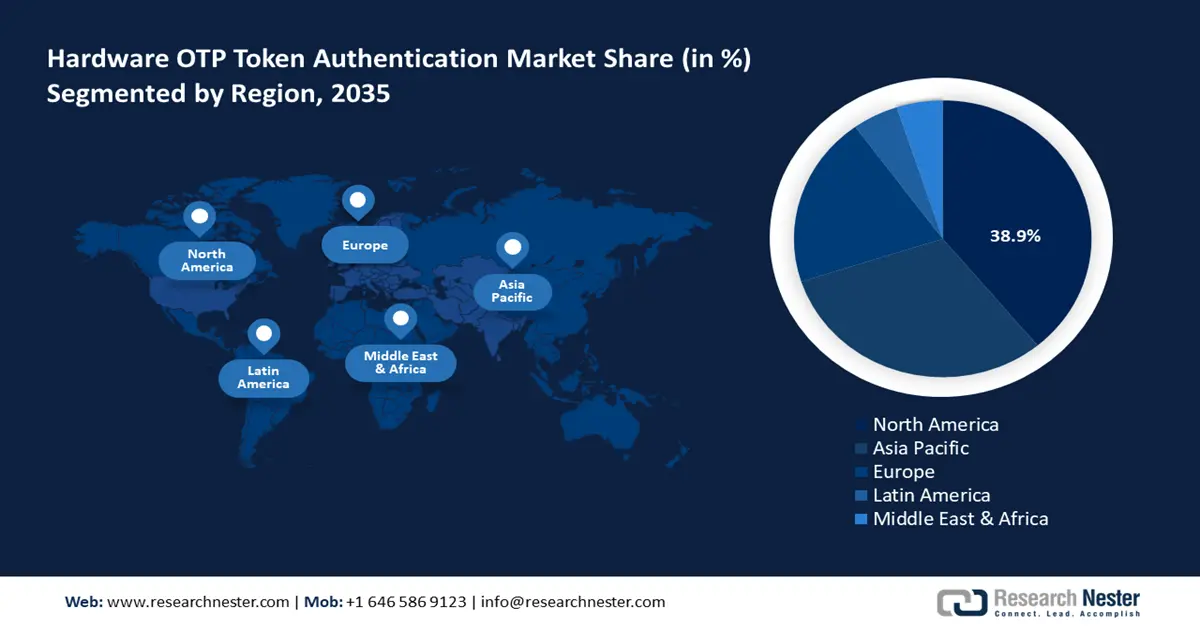

Hardware OTP Token Authentication Market - Regional Analysis

North America Market Insights

The North America hardware OTP token authentication market is projected to hold a leading revenue share of over 38.9% by 2035. The region’s leading share is estimated to be attributed to how embedded these tokens are in government agencies, defense systems, and banking networks that run under strict regulations. Another key reason for this growth is the push for digital identity programs supported by the government. The U.S. Department of Homeland Security, for example, keeps investing in identity systems that follow FIPS 201-3 rules. These systems require hardware-based multi-factor authentication for federal employees and contractors, which keeps demand strong.

The U.S. hardware OTP token authentication market is predicted to expand its revenue share throughout the anticipated timeline. A key feature is that hardware tokens are being embedded into operations to boost cybersecurity. The regulatory mandates are pushing companies to tighten their cybersecurity vulnerabilities. A major driver of the increase is the push to keep ransomware in check. Additionally, the government has been proactive in pushing for Zero Trust setups, which is tied to Executive Order 14028. The order highlights that an additional security layer is necessary for verification via physical tokens, leading to high demand for hardware token OTP solutions.

The hardware OTP token authentication market in Canada is expected to increase at a high pace, owing to the country’s growing emphasis on cybersecurity and data privacy. The digital transformation initiatives are also contributing to the increasing sales of hardware OTP token authentication solutions. The report by Payments Canada disclosed that in 2023, the total payment transaction volume of the country was calculated at 21.7 billion, out of which credit cards accounted for 33%, debit cards (31%), and online transfers (6%). This indicates that the banks, credit unions, and government agencies are the primary adopters of hardware OTP tokens.

Asia Pacific Market Insights

APAC is poised to be the market exhibiting the fastest expansion, with a CAGR of 18.2% throughout the anticipated timeline. The market's growth curve is fueled by the rise of cybersecurity regulations across lucrative markets in Japan, South Korea, and Singapore. Another factor supporting the expansion is the expansion of digital banking, along with government e-identity programs. In terms of measurable regulatory support, the Digital Personal Data Protection Act of 2023 in India mandated the application of strong user authentication, prompting a surge in the adoption of hardware OTP solutions. Similarly, the My Number identity program in Japan has supported the greater use of hardware token-based identity confirmation.

The China hardware OTP token authentication market is expected to maintain its dominance throughout the forecast timeline. The market is backed by the digital finance ecosystem of China that emphasizes strict security standards. Additionally, the data localization laws of China, along with domestic tech firms integrating authentication hardware, bolster growth opportunities. In 2025, the Cyberspace Administration of China (CAC) announced revisions to its data protection frameworks. The rework has pushed for hardware-based user verification mechanisms, evident in the heightened deployment of USB tokens and smart cards under the aegis of e-government initiatives.

The India hardware OTP token authentication market is estimated to increase at a high pace from 2026 to 2035. The banking and financial services sector is primarily fueling the sales of hardware OTP token authentication solutions. According to the India Brand Equity Foundation (IBEF) report, digital payments have grown significantly due to teamwork between the government and the Reserve Bank of India (RBI). In the financial year 2025 (up to June), Unified Payments Interface (UPI) transactions reached 2,762 in volume, with India making up nearly 46% of all digital transactions worldwide, and as of July 2024, 602 banks were actively using UPI. Thus, investing in India is projected to double the revenues of key players.

Europe Market Insights

The Europe market is anticipated to capture the second-largest revenue share throughout the forecast period. The strict regulatory frameworks and rising cybercrimes are boosting the demand for hardware OTP token authentication solutions. The General Data Protection Regulation (GDPR) and the EU’s Network and Information Security Directive (NIS2) have raised the bar for data protection and identity verification, which directly push organizations to adopt strong multi-factor authentication methods. The digitalization trend is also supporting the overall market growth.

Germany leads the sales of hardware OTP token authentication solutions, owing to its strict regulatory environment and strong industrial base. The rigorous cybersecurity standards enforced by the German Federal Office for Information Security (BSI) are also contributing to the increasing demand for hardware OTP token authentication systems. The rising number of mobile users is also fueling digital transactions and the multi-factor authentication method.

The U.K. hardware OTP token authentication market is foreseen to be driven by the strict financial regulations and cybersecurity concerns. The Financial Conduct Authority (FCA) has mandated stronger authentication for digital banking and payment services, which is directly fueling the widespread application of OTP token authentication. The digital shift in the BFSI sector is further estimated to drive the attention of several international companies in the years ahead.