Halal Food Market Outlook:

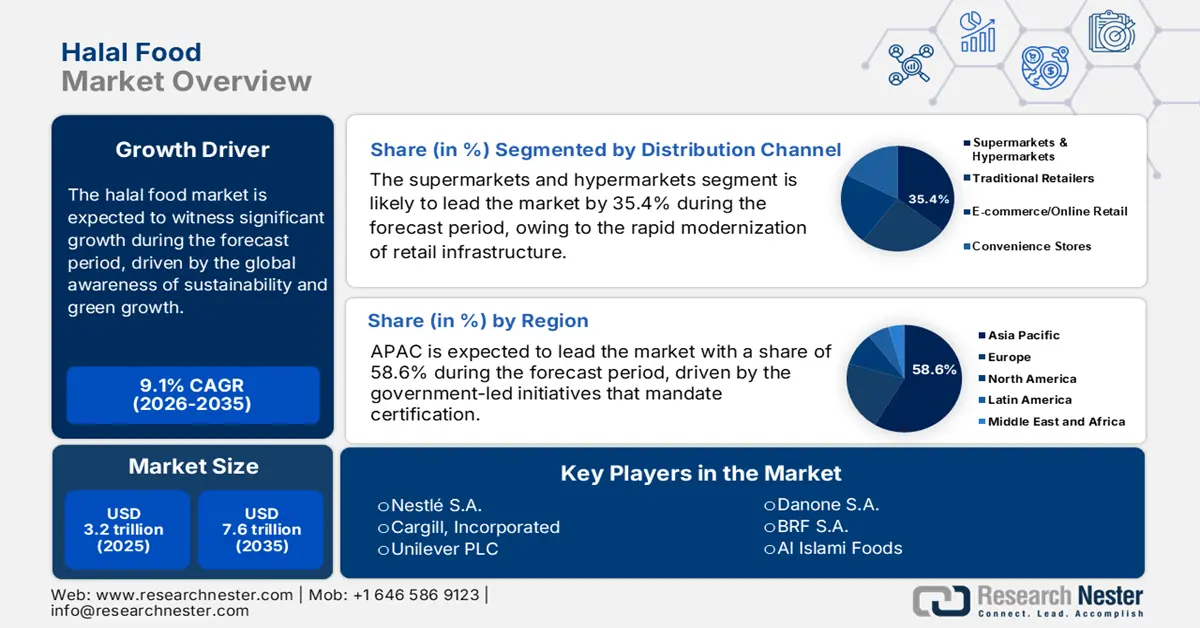

Halal Food Market size was valued at USD 3.2 trillion in 2025 and is projected to reach USD 7.6 trillion by the end of 2035, rising at a CAGR of 9.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of halal food is assessed at USD 3.4 trillion.

The global halal food market is driven by the rising population in the key regions where procurement decisions prioritize compliant supply chains. Further, increased global awareness of sustainability, green growth, and ethical consumption is driving the halal industry both in the OIC countries and around the globe. Mostly halal products and services are mainly established in niche markets such as food, tourism, lifestyle, and finance. The Statistical, Economic and Social Research and Training Centre for Islamic Countries data in December 2021 indicates that the global halal industry is set to be USD 6.0 trillion in 2024, highlighting the rising demand for the product. The Islamic finance sector signified the largest share in the halal industry with 60.8% followed by the halal food sector 24.6%, the Islamic lifestyle sector 13.4%, and Islamic tourism 1.2%. This positions the halal food segment as the core driver of the tangible consumer goods sector within the broader Islamic economy.

The continental halal food market is anticipated to expand annually, and the emerging markets such as Southeast Asia and Africa provide more opportunities for volume-based collaborations. According to the Malaysian International Food & Beverage Trade Fair data in February 2023, the food services sector is the largest component of the halal Economy in Malaysia, with the revenue in the sector reaching USD 31 billion in 2021, highlighting reliable demand for processed goods and fresh commodities. Further, exporters utilize this by aiming for compliance-aligned shipments as Philippines halal products imported hit USD 120 million in dairy, beef, and poultry products. Overall, the sector actively supports strategic alliances for cost-efficient sourcing, with OIC-led initiatives boosting the standardized procurement processes to streamline cross-border transactions and minimize supply disruptions.

Key Halal Food Market Insights Summary:

Regional Highlights:

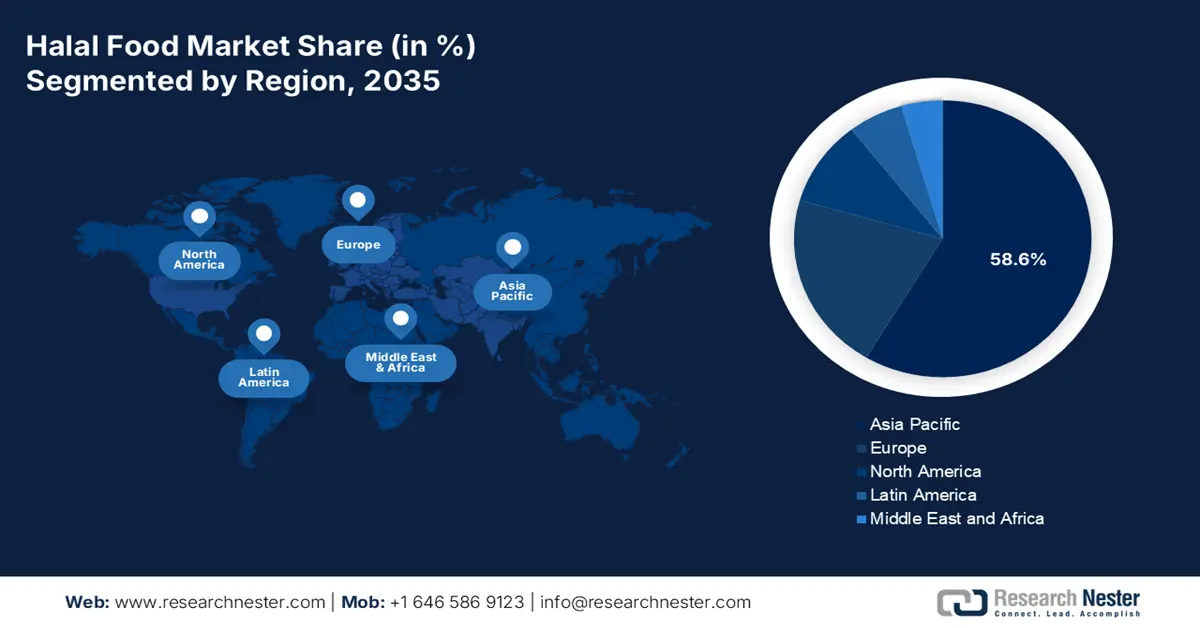

- Asia Pacific is projected to secure a 58.6% share by 2035 in the halal food market, supported by government-backed certification systems and rising adoption of digital traceability technologies.

- Europe is anticipated to grow at a 5.3% CAGR during 2026–2035 as halal increasingly serves as an ethical and quality benchmark driven by shifting demographics and rising consumer emphasis on transparency.

Segment Insights:

- By 2035, supermarkets and hypermarkets in the halal food market are expected to command a 35.4% share, bolstered by expanding modern retail infrastructure and strong cold-chain capabilities.

- Halal meat, poultry, and seafood are set to hold the largest share by 2035, propelled by poultry’s affordability, production efficiency, and national food-security programs.

Key Growth Trends:

- Government-driven standardization and investment

- Public investment in halal infrastructure and trade facilitation

Major Challenges:

- Complex and fragmented certification standards

- Cold chain infrastructure gaps

Key Players: Nestlé S.A. (Switzerland), Cargill, Incorporated (U.S.), Unilever PLC (UK/Netherlands), Danone S.A. (France), BRF S.A. (Brazil), Al Islami Foods (UAE), Midamar Corporation (U.S.), QL Foods Sdn Bhd (Malaysia), Saffron Road (U.S.), Kellogg Company (U.S.), Nissin Foods Holdings Co., Ltd. (Japan), Ajinomoto Co., Inc. (Japan), Allanasons Pvt. Ltd. (India), Al Kabeer Group (UAE), Prima Agri-Products (Singapore), Coco Ventures Pte Ltd (Singapore), Tahira Foods Ltd (UK), Ramly Food Processing Sdn Bhd (Malaysia), Beijing Shunxin Agriculture Co., Ltd. (China), Al-Falah Halal Foods (Australia)

Global Halal Food Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 trillion

- 2026 Market Size: USD 3.4 trillion

- Projected Market Size: USD 7.6 trillion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.6% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Indonesia, Saudi Arabia

- Emerging Countries: Malaysia, Turkey, UAE, Brazil, South Korea

Last updated on : 27 November, 2025

Halal Food Market - Growth Drivers and Challenges

Growth Drivers

- Government-driven standardization and investment: Governments are now actively formalizing the halal food market via various regulations and direct investment. Indonesia’s mandatory Halal certification law (BPJPH) creates a compulsory market, while Saudi Arabia’s Vision 2030 explicitly targets sector growth for economic diversification. The UAE government has established dedicated Halal industrial parks and a national certification authority. For example, the UAE’s Halal Products Development Company was launched with significant capital to boost the local manufacturing, demonstrating direct fiscal support that builds infrastructure and reduces the halal food market fragmentation for international players. Further, the companies can use these government-funded ecosystems to scale their operations efficiently across the Gulf Cooperation Council and Southeast Asian regions.

- Public investment in halal infrastructure and trade facilitation: The significant government-led program that has increased production and global trade capacity indicates that this is the key growth driver in the halal food sector. For instance, the USDA data in September 2024 states that the UAE government actively supports its domestic halal poultry industry, which increases the chicken meat production by 17% in 2025 via feed subsidies, advanced technology, and new facility construction. At the same time, the public-private partnerships, such as Dubai’s strategic creation of the world’s largest logistics hub for foodstuffs, boost the export capabilities and global halal food market access. These infrastructural and export-focused efforts help meet rising consumer demand and position the halal food sector as a key contributor to economic growth and food security.

2023 to 2025 Chicken Meat Production, Supply and Distribution Overview in UAE

|

Category (1,000 MT) |

2023 (New Post) |

2024 (New Post) |

2025 (Forecast) |

|

Beginning Stocks |

0 |

0 |

0 |

|

Production |

56 |

60 |

70 |

|

Total Imports |

375 |

385 |

400 |

|

Total Supply |

431 |

445 |

470 |

|

Total Exports |

0 |

0 |

0 |

|

Human Consumption |

431 |

445 |

470 |

|

Other Use / Losses |

0 |

0 |

0 |

|

Total Domestic Consumption |

431 |

445 |

470 |

|

Total Use |

431 |

445 |

470 |

|

Ending Stocks |

0 |

0 |

0 |

|

Total Distribution |

431 |

445 |

470 |

Source: USDA September 2024

- Increasing consumer awareness, globalization, and multiculturalism: Consumers today actively seek the healthy, ethical, and transparent food options that drive the demand for halal products beyond a specific community. Globalization has given way to the access of halal food in every part of the world, and multi-cultural societies, which have embraced different needs regarding diet, are also one of the main factors driving market expansion. E-commerce is also transforming the sector, as global e-commerce sales are accounted for USD 304.2 billion in Q2 of 2025, stated to the U.S. Census Bureau estimates in August 2025. These trends are supported by cultural diversity and global trade, hence continuously boosting the halal food market presence.

Challenges

- Complex and fragmented certification standards: The lack of a universal halal standard is the key constraint. Manufacturers face differing requirements for certifications in various countries and even within regions. This necessitates multiple and costly audits and segregated production lines. For example, a company in the halal food market must maintain distinct certified supply chains for its poultry exports in the UAE vs Malaysia. This difference surges the compliance costs and complexity, which slows down the market entry and scalability for global players trying to operate effectively across multiple majority markets.

- Cold chain infrastructure gaps: In many emerging halal food markets, inadequate cold chain infrastructure poses a major obstacle for perishable goods. This limits the distribution of high-value items such as chilled ready-to-eat meals, dairy, and other frozen products. For example, a company in Malaysia, such as Kawan Food, is a global leader in frozen halal products and has invested in its own cold chain logistics to ensure product integrity. The World Bank estimates that post-harvest food losses in emerging nations are comparatively high, indicating a critical need for such investments to unlock the full potential of the halal perishables market.

Halal Food Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 3.2 trillion |

|

Forecast Year Market Size (2035) |

USD 7.6 trillion |

|

Regional Scope |

|

Halal Food Market Segmentation:

Distribution Channel Segment Analysis

By 2035, supermarkets and hypermarkets are expected to dominate the distribution channel segment and are poised to hold a share value of 35.4%. The segment is driven by the rapid modernization of retail infrastructure in some countries that offers consumers a trusted, one-stop-shop experience with a wide variety of certified products. Further, the extensive cold chain capabilities are vital for distributing perishable halal items such as fresh meat and dairy. Supermarkets make up 53% of retail sales in Malaysia, according to data from the New Zealand Trade and Enterprise from July 2024. This percentage is far greater than that of other retail businesses and indicates that the channel’s expanding dominance and consumer preference directly benefit the organized halal food sector. This retail model's ability to assure product integrity at scale makes it the primary gateway for global halal brands to reach mass consumers.

Type Segment Analysis

Under the type segment, halal meat, poultry, and seafood are projected to hold the largest share by 2035. The segment is driven by poultry’s status as a primary affordable protein source. Its versatility and shorter production cycle compared to red meat make it a staple in both the household consumption and food service sectors. The growth is further fueled by the strategic government focus on food security. For example, the primary driver is the considerable investment in the domestic production, as per the U.S. Department of Agriculture data in September 2021, the poultry production in Saudi Arabia in 2021 was 910,000 metric tons, as part of its strategic goal to increase self-sufficiency, directly stimulating the halal poultry market segment. This concerted effort is replicating across other OIC member nations, creating a powerful, sustained demand driver for the entire segment.

Our in-depth analysis of the halal food market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Halal Food Market - Regional Analysis

APAC Market Insights

Asia Pacific is the epicenter of the halal food market and is expected to hold a revenue share of 58.6% by 2035. The market is defined by the immense scale and diverse growth drivers. The demand is mainly due to the growing populations and government-led initiatives that mandate certification and support the sector as a key economic pillar. Countries such as China, Japan, and South Korea are driven by the rising domestic demand from a certain population and the increasing exports of halal products. A regional trend is the incorporation of technology for supply chain integrity, with blockchain pilots for traceability gaining traction. The halal food market is also seeing rapid premiumization with the rising demand for health, functional, organic, and ready-to-eat halal products.

India halal food market is driven by the substantial domestic consumer base. The market is driven by the gradual formalization of the traditionally fragmented sector. A key trend is the expansion of certified products beyond meat into dairy, snacks, and ready-to-eat meals, increasingly available in organized retail. The USDA March 2022 report depicts that the halal trade in India is estimated to be USD 80 billion, which is the total trade in agri-food products. Further, the Export Import data in April 2025 states that India exports meat to more than 100 nations across the globe, among which Malaysia is the key marketer for halal meat products. This export momentum is supported by a network of federally inspected and Halal-certified slaughterhouses. Concurrently, domestic demand is being reshaped by the entry of major food brands launching certified product lines to capture the urban, brand-conscious consumer.

Top Export Destinations for India’s Meat

|

Destination Country |

Total Value (Billion USD) |

Total Value (%) |

|

Vietnam |

15 |

36.5 |

|

Malaysia |

4 |

11.3 |

|

Egypt |

4 |

9.8 |

|

Indonesia |

2 |

5.3 |

|

Iraq |

1 |

4.3 |

|

Saudi Arabia |

1 |

4.3 |

|

Philippines |

1 |

3.3 |

|

United Arab Emirates |

1 |

2.8 |

|

Hong Kong |

1 |

2.7 |

Source: Export Import April 2025

China’s halal food market is strategically oriented towards becoming a global export hub. The market serves the dietary needs of its significant population concentrated in regions such as Ningxia. The market is characterized by strong state involvement in standardization and certification to ensure compliance for international trade. An important trend is the integration of halal production in the large-scale sectors, state modernized agriculture and food processing complexes. The Carnegie Endowment for International Peace data in 2024 reported that in 2021, China was the leading exporter of halal goods and services to the 57 member states, with in trade value of USD 40.4 billion. Moreover, this strategic focus aligns with the broader national food security and economic development goals, which ensure a continued state-backed investment in the sector.

Europe Market Insights

Europe is expected to be the fastest growing halal food market and is expected to grow at a CAGR of 5.3% during the forecast period 2026 to 2035. The market is primarily driven by the rising consumer base and the mainstreaming of halal as a quality and ethical assurance. Demographic changes with the young and growing population that adheres to halal dietary laws and increasing concern about animal welfare and food safety are the primary drivers of the market growth. Regulatory harmonization remains be challenge, but the private certification bodies have established a strong framework. The market is also seeing a growth in e-commerce platforms that are dedicated to halal products, therefore improving accessibility. As per the European Commission data, the food safety and sustainability, consumer demand for transparent and ethically sourced food products is a key priority, which is boosting the halal market.

The UK is projected to hold the largest revenue share in Europe by 2035, and is driven by its well-established, diverse consumer base and a robust private certification ecosystem. The Office for National Statistics continues to report on population growth in line with Halal dietary adherence, highlighting a stable demand. As per the UK Parliament data in June 2025, nearly 1.035 billion animals were processed in English and Welsh slaughterhouses in 2024, and a part of 214.6 million animals (20.7%) were slaughtered to produce halal meat. This data highlights the segment's deep integration into the national food supply chain. the market is further evolving beyond the raw meat with a strong growth in the value-added products categories, such as ready-to-eat meals and certified snacks that are increasingly distributed via mainstream retail channels.

Germany will maintain a leading market share in the halal food market in Europe, which is fueled by having the largest consumer population opting for halal products. The growth is primarily propelled by the retail sector’s strategic inclusion of certified private label products and the expansion of halal options within the food service industry, including the fast food and delivery services. According to the USDA data in November 2022 on Germany: Halal and Kosher Food Market in the Making depicts that the country has more than 83 million of the world’s wealthiest consumers and is by far the biggest market in the EU. The country's strong regulatory environment for food labeling and safety, enforced by authorities like the Federal Office of Consumer Protection and Food Safety (BVL), provides a trusted foundation that benefits the Halal segment.

North America Market Insights

The North America is experiencing a rapid growth in the halal food market, which is fueled by the combination of demographic shifts and its alignment with the prevailing consumer trends. The certification is highly recognized by a broad consumer base as a marker of ethical production, animal welfare, and strong food safety protocols. These perceptions drive the demand beyond the traditional retail channels into mainstream supermarkets and food service, where product diversification into ready-to-eat, premium, and organic categories is surging. The market expansion is further promoted by the significant investments in the supply chain logistics and third-party certification bodies that ensure product integrity, positioning halal as a significant value-added segment within the broader food industry in North America.

The demand for the halal food in the U.S. is supported by certain demographic expansion, increased institutional procurement, and strengthened federal oversight of food imports. The USDA’s Production, Supply, and Distribution data depicts that there is a sustained reliance on imported poultry and beef from compliant suppliers, mainly for value-added foodservice segments. The FDA 2024 data highlights that the food safety budget of USD 7.2 billion is allocated, a part of which is to reinforce national inspection systems, benefitting halal certified meat processors and imported product flows by enhancing the residue monitoring, traceability, and facility compliance. The U.S. Census Bureau population data shows that a continued growth of certain communities increases the household purchasing of certified meat, packaged foods, and bakery products. Federal school meal programs and correctional facility procurement increasingly incorporate halal options in certain areas. The Department of Commerce trade data shows rising imports of prepared foods, providing growth opportunities for certified exporters meeting U.S. labeling requirements.

Growth in Canada’s halal food market is driven by immigration trends, expanded certification capacity, and federal investment in food safety systems. Statistics Canada reports sustained immigration inflows from South Asia, MENA, and Southeast Asia, surging the demand for certified poultry, beef, frozen foods, and confectionery. The halal and the CFIA Beef Watch report in April 2024 indicate that the halal beef production follows Islamic slaughter requirements, while the CFIA applies strict animal welfare rules under the Safe Food for Canadians Regulations. This ensures the animals are not suspended until unconscious. Canada regulates halal labeling mandates verified certification and also audits via Preventive Control Plans to prevent fraud and maintain compliance with halal and welfare standards. As the consumer base surges, the market is estimated to be nearly USD 1 billion; the certification agencies play a vital role in supporting the producers and expanding the market.

Key halal food Market Players:

- Nestlé S.A. (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated (U.S.)

- Unilever PLC (UK/Netherlands)

- Danone S.A. (France)

- BRF S.A. (Brazil)

- Al Islami Foods (UAE)

- Midamar Corporation (U.S.)

- QL Foods Sdn Bhd (Malaysia)

- Saffron Road (U.S.)

- Kellogg Company (U.S.)

- Nissin Foods Holdings Co., Ltd. (Japan)

- Ajinomoto Co., Inc. (Japan)

- Allanasons Pvt. Ltd. (India)

- Al Kabeer Group (UAE)

- Prima Agri-Products (Singapore)

- Coco Ventures Pte Ltd (Singapore)

- Tahira Foods Ltd (UK)

- Ramly Food Processing Sdn Bhd (Malaysia)

- Beijing Shunxin Agriculture Co., Ltd. (China)

- Al-Falah Halal Foods (Australia)

- Nestlé S.A. has established its dominant presence in the competitive halal food market via its Nestlé Halal master brand. This is a strategic initiative that consolidates trust across a vast product portfolio. The company has aggressively followed halal food market penetration in key regions such as the Middle East and Southeast Asia by customizing products to local tastes. The company achieved an impressive 88.9% return on net worth.

- Cargil is a global leader in the halal food market and is leading in the supply chain, providing certified halal proteins, starches, and oils to other manufacturers and food service providers. Their strategic initiatives mainly focus on vertical integration and securing end-to-end halal certification across their massive production facilities, which is vital for the B2B clients.

- Unilever PLC in the halal food market is driven by the deep local consumer insight and the strength of its iconic brands, such as Walls and Knorr. The company reformulates and certifies its extensive range of products, from seasonings to soups, and ice cream, to meet the specific halal requirements in countries such as Malaysia and Indonesia. The company has made a turnover of €13.4 billion in the food category in 2024.

- Danone S.A. is a dominating competitor and uses its strong heritage in dairy and early life nutrition to capture significant value in the halal food market. The company certifies its flagship in infant formula and milk-based products that are often considered to be essential and trusted categories for certain people. Their initiative includes targeted marketing, which highlights nutritional science and product purity aligned with halal values.

- BRF S.A. has made the halal food market a central pillar of its international expansion strategy, mainly via its Sadia and Perdix brands. The company’s most significant initiative is operating some of the world’s largest halal-certified production plants that are fully incorporated from farm to export. This allows BRF to achieve immense scale and cost efficiency, making it a primary supplier of frozen poultry and other meat products to the Middle East.

Below is the list of some prominent players operating in the global halal food market:

The global halal food market is highly competitive and fragmented. Key multinational giants such as Nestlé and Unilever are competing with specialized regional players. The competitive ecosystem is intensifying as companies pursue growth via strategic acquisitions and partnerships to enter new markets. A key initiative is the extensive product diversification beyond the traditional meat into dairy, ready-to-eat meals, and confectionery to capture a broader demand. The main players are investing heavily in securing and promoting robust halal certification and ensuring end-to-end supply chain integrity. This focuses on the traceability, and digital marketing is important to build the consumer trust and brand loyalty required to succeed in this rapidly expanding, values-driven market. Further, companies' expansion also boosts the market growth. For example, in July 2022, Tanmiah Food Company and Tyson Foods signed a strategic partnership agreement. This partnership will take the company to the next phase in the global halal food market.

Corporate Landscape of the Halal Food Market:

Recent Developments

- In October 2025, MBRF has announced its partnership with HPDC and created Sadia Halal, a multi-protein powerhouse in the Halal market. This partnership will be the largest halal chicken company in the world.

- In January 2025, Halal meat brand Isla Délice Group has announced that it has acquired Gürkan, a premium halal business based in Germany specializing in the beef product Pastirma. The acquisition has increased the sales to over €155 million.

- In July 2024, GoodLife Foods announced that it had signed an agreement to acquire Pure Ingredients, a leading manufacturer in the halal frozen food market. The combination will result in a highly complementary group producing and selling innovative frozen snacks and meal components across Europe.

- Report ID: 6076

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Halal Food Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.