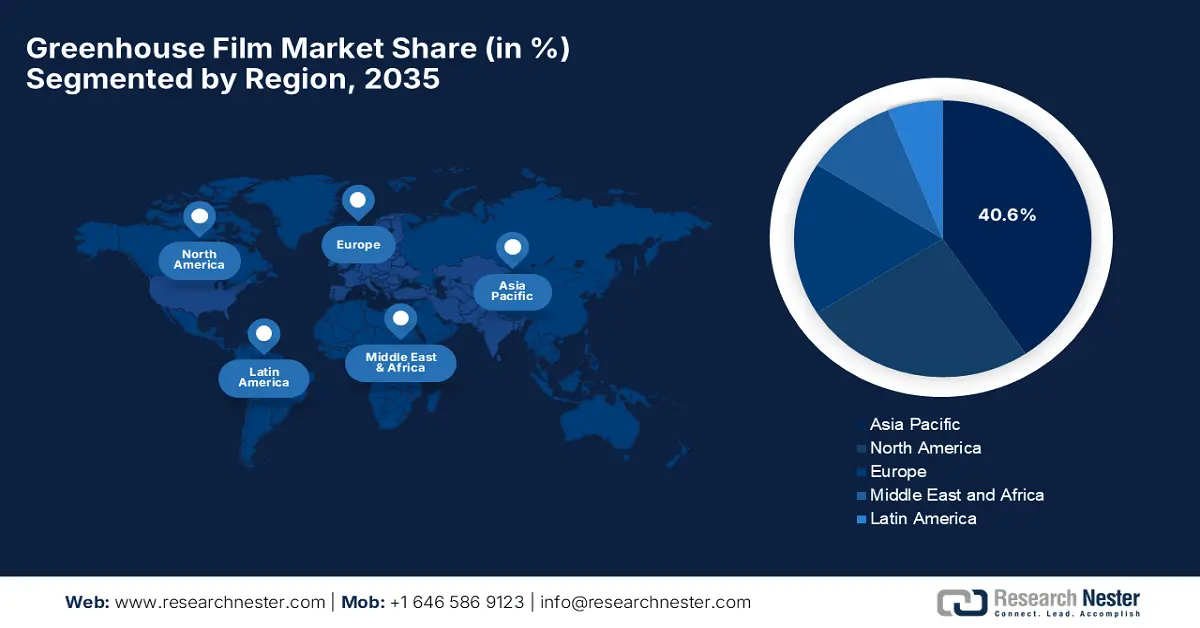

Greenhouse Film Market - Regional Analysis

APAC Market Insights

The Asia Pacific greenhouse film market is expected to lead the entire global dynamics, capturing the largest revenue share of 40.6% by the end of 2035. The region’s leadership is mainly propelled by rapid agricultural modernization and expansion in China, India, Japan, and South Korea, nations. The region’s market also benefits from government policies that promote protected agriculture and large greenhouse acreage. In May 2024, Murata Manufacturing reported that it made an investment in R PLUS JAPAN, which is a joint venture developing advanced chemical recycling technology for plastics, including PET film. It also notes that this initiative aims to establish a closed-loop recycling system and promote sustainable resource use across industries. By enabling the efficient recycling of plastic materials, it efficiently supports demand for high-quality recycled films. In addition, the technology reduces CO₂ emissions and energy use when compared to conventional recycling methods, making it environmentally sustainable.

China’s market is efficiently progressing by prioritizing films that extend the growing season and increase crop density in response to the country’s high domestic food demand. Local manufacturers in the country are making investments in polymer modification technologies to produce films with superior tensile strength and longevity. In this regard, in November 2025, Helio Agricultural Technology reported that it had participated in the 23rd China Greenhouse Horticulture Industry Conference in Zhengzhou to showcase its high-performance greenhouse films and advanced agricultural protection materials. In addition, the company also highlighted its products, which are especially designed for improved light transmission, weather resistance, and crop yield, supporting smarter and more controllable greenhouse environments. Therefore, this participation underscores China’s prime focus on modernizing protected agriculture and expanding the adoption of advanced greenhouse technologies.

India greenhouse film market is growing on account of increased adoption, positively influenced by water conservation needs and protection against erratic monsoon patterns. Films are especially designed for high heat and humidity resilience, along with innovations that combine UV protection with pest resistance. In this regard, in September 2024, Coromandel International reported that it inaugurated a polyhouse at its R&D farm in Telangana, which is equipped for advanced trials that include hydroponics, cocopeat systems, and precision nutrient calibration. It also mentioned that the facility enables testing of innovative agri-inputs such as nano fertilizers, biostimulants, and controlled-release fertilizers, while also fostering collaboration with government bodies and farmers to improve crop yields. Hence, this initiative reflects the country’s push for a very modernized, climate-resilient protected agriculture and supports the adoption of greenhouse technologies to enhance both productivity and sustainability.

North America Market Insights

North America Market strongly emphasizes innovation in UV-resistant and anti-condensation films to optimize crop yield in controlled environments. Manufacturers in the region are mainly focused on integrating sustainable materials that can withstand severe climatic variations. Adoption in the region is also driven by advanced greenhouse infrastructure and government initiatives that are promoting energy-efficient farming processes. In this regard, BrightFarms in June 2025 announced that it had inaugurated its high-tech greenhouse in Macon, Georgia, consisting of eight acres of hydroponic production with plans to expand by 24 acres. The company is a part of Cox Farms, whereas the facility produces fresh lettuce locally, reduces food miles, and enhances food security and supporting workforce development in the region. Thus, this investment showcases the significance of advanced greenhouse technology and indoor farming can scale sustainably to meet regional demand for fresh produce, contributing to overall market growth.

The U.S. greenhouse film market is augmenting its leadership owing to the strong research ecosystem for biodegradable and recyclable greenhouse films. The market is positively influenced by technological collaboration between agritech startups and established greenhouse equipment providers. Regional climate diversity encourages the development of films that are suitable for specific microclimates, supporting year-round cultivation in both arid and temperate zones. In March 2024, UbiQD, Inc. announced that it had won the SXSW Innovation Award and received a USDA SBIR Phase I grant to develop a glass-based version of its UbiGro quantum dot greenhouse technology. Besides, the technology utilizes fluorescence to optimize light spectra for crops, enhancing yield in both plastic and glass greenhouses. Hence, such instances position the country as a predominant leader, allowing steady cash influx in this sector.

The Canada greenhouse film market is focused mainly on frost-resistant and multi-layered films to address long winters as well as the short growing seasons. Firms in the country are continuously making innovations to maximize light diffusion and retention of heat, particularly for greenhouse vegetable and berry production. On the other hand, partnerships between academic institutions and industry players readily accelerate pilot projects to test high-performance films in northern climates. The greenhouse film shipments are mainly driven by the expanding protected agricultural sector, especially in provinces such as Ontario and British Columbia. These shipments are primarily regulated through the Canada Border Services Agency, and the product standards are regulated by Agriculture and Agri-food Canada and Health Canada for material safety. Furthermore, the provincial agriculture ministries support programs through grants and technology adoption incentives.

Europe Market Insights

The Europe greenhouse film market has acquired a prominent position owing to the emphasis on sustainability and regulatory compliance, with an increasing shift toward bio-based polymers and recyclable multilayer films. The regional market is also shaped by different types of climatic zones, which are driving suitable solutions for heat retention, light diffusion, and seasonal insulation. In May 2025, the ERDE initiative in Europe expanded its collection and recycling system to include used greenhouse films, allowing farmers to return them in an environmentally responsible manner. In this context, the films are processed by specialized regional recycling partners into high-quality recyclate that can be reused in new greenhouse films or other applications, thereby promoting a circular economy. Furthermore, this collaboration among manufacturers, distributors, collection partners, and farmers reduces plastic waste, cuts greenhouse gas emissions, and strengthens sustainable practices in terms of protected agriculture.

Germany market is maintaining a strong position in the regional landscape due to the focus on precision farming with films that integrate sensor compatibility for automated greenhouse monitoring systems. The country’s market also benefits from collaboration with research institutions ensures continuous improvement in film transparency, durability, and environmental sustainability. In this regard, RKW Group in November 2023 showcased its sustainable agricultural films and nets at Agritechnica 2023 in Hannover with innovations such as polydress twista green, which is a recyclable 2-in-1 silage and vacuum film, and Rondotex Wizard, which is a UV-resistant round bale net with material and time-saving features. The firm also notes that these products combine high functionality with environmental benefits by using recycled materials and improving efficiency for farmers. In addition, RKW’s portfolio also includes greenhouse films, early harvesting films, nonwovens, and silage tubes, supporting productive agriculture in the years ahead.

UK greenhouse film market is growing exponentially due to the growing trend of films that support organic farming practices and reduce chemical dependency. Market growth is also stimulated by grants and subsidies for sustainable greenhouse infrastructure and low-carbon farming technologies. Besides, the heightened demand for high-performance films with enhanced UV protection and thermal insulation is driving innovation in material technology. Rising consumer awareness of food safety and traceability also boosts the adoption of greenhouse films. Integration of smart greenhouse systems with energy-efficient films is becoming increasingly common, encouraging more players to establish their footprint in the country. Furthermore, the collaborations between manufacturers and research institutions are accelerating the development of biodegradable and recyclable film solutions, hence making it suitable for standard market growth.