Greenhouse Film Market Outlook:

Greenhouse Film Market size was valued at USD 9.2 billion in 2025 and is projected to reach USD 23.9 billion by the end of 2035, rising at a CAGR of 11.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of greenhouse film is evaluated at USD 10.2 billion.

The principal growth driver for the greenhouse film market is the expansion of protected agriculture, which includes greenhouses and controlled environment agriculture, and the increasing use of plastic covers in commercial crop production. As per the article published by the University of Copenhagen in June 2024, its study using satellite imagery and AI mapped global greenhouse cultivation, revealing 1.3 million hectares across 119 countries, nearly three times previous estimates. It also mentioned that China dominates with 60.4% of the total area, followed by Spain and Italy, whereas the greenhouses in the global south cover 2.7 times more land when compared to those in the global north. In addition, government subsidies and support, particularly in China and resource-scarce regions, have driven this rapid expansion, thereby enhancing year-round production, food security, and economic opportunities.

Furthermore, the increasing awareness of climate-resilient farming practices and the need to enhance crop yield throughout the year are driving adoption. Innovations in film technology, such as improved UV resistance, durability, and energy efficiency, are expanding its applications more than traditional greenhouse farming. According to the article published by the USDA in April 2024, U.S. imports of greenhouse bell peppers, both organic and conventional, increased by 6.2 million pounds in 2024, which represents a 1% rise when compared to the previous year, and accounted for 59% of all fresh bell pepper imports. On the other hand, monthly import volumes remained steady from January 2023 through February 2024, with red bell peppers comprising about 25% of total greenhouse bell pepper shipments, hence stimulating growth in the market.

Key Greenhouse Film Market Insights Summary:

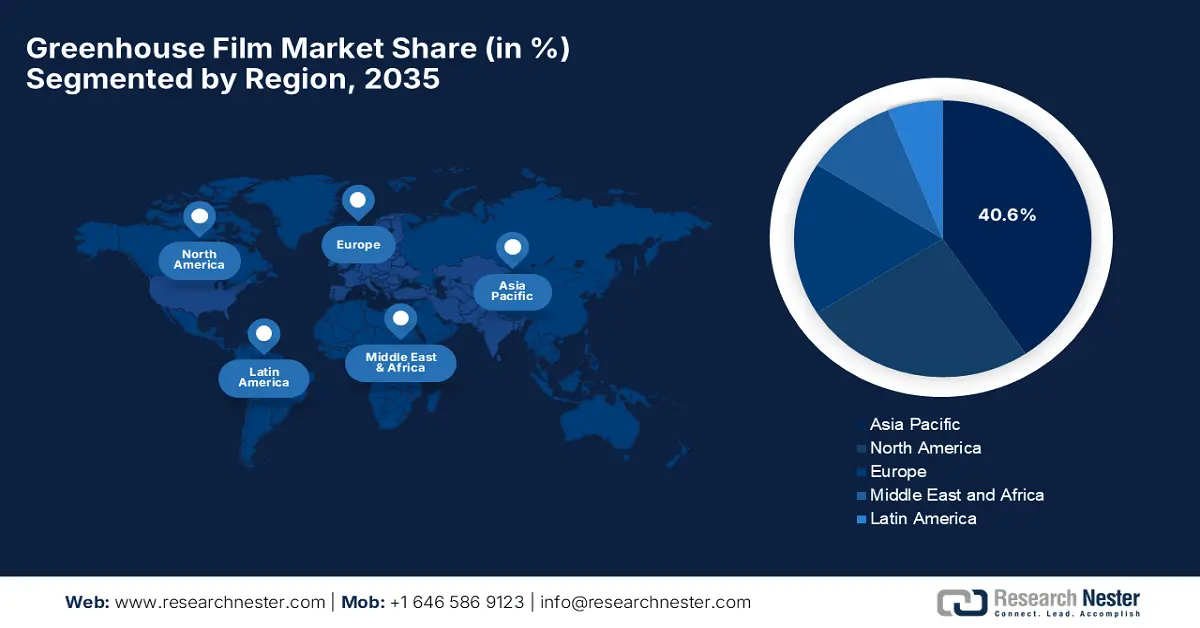

Regional Highlights:

- Asia Pacific is anticipated to command a 40.6% revenue share by 2035 in the greenhouse film market, fueled by rapid agricultural modernization and strong government support for protected cultivation.

- North America is projected to strengthen its market position through 2035, bolstered by advancements in UV-resistant and anti-condensation greenhouse films and investments in high-tech indoor farming infrastructure.

Segment Insights:

- The 100–200-micron segment is projected to secure a 50.4% market share by 2035, underpinned by its optimal balance of durability, light diffusion, and cost efficiency for growers.

- In the greenhouse film market, the LDPE resin segment is expected to lead in revenue share by 2035, supported by its high light transmission, flexibility, ease of processing, and broad applicability across greenhouse structures.

Key Growth Trends:

- Rising demand for food and global population growth

- Expansion of controlled environment agriculture

Major Challenges:

- High production and raw material costs

- Environmental and sustainability concerns

Key Players: Berry Global, Inc. (U.S.), RKW Group / RKW SE (Germany), Ginegar Plastic Products Ltd. (Israel), Plastika Kritis S.A. (Greece), POLIFILM EXTRUSION GmbH (Germany), Armando Álvarez Group (Grupo Armando Álvarez) (Spain), Agripolyane (France), A. Politiv Ltd. (Israel), Trioplast Industries AB (Sweden), FVG Folien‑Vertriebs GmbH (Germany), Mitsubishi Chemical Corporation (Japan), Agriplast Tech India Pvt Ltd (India), Tuflex India (India), Thai Charoen Thong Karntor Co. Ltd. (TCT) (Thailand), Lumite, Inc. (U.S.)

Global Greenhouse Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.2 billion

- 2026 Market Size: USD 10.2 billion

- Projected Market Size: USD 23.9 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.6% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: South Korea, Spain, Netherlands, Australia, Brazil

Last updated on : 15 January, 2026

Greenhouse Film Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for food and global population growth: The worldwide population continues to grow rapidly, increasing the demand for food production and food security. Greenhouse films support year-round cultivation and higher yields, making them highly essential for meeting this demand. In December 2025, the Governments of Canada and Alberta announced that they had launched the growing greenhouses program, which is a three-year, USD 10-million initiative under the Sustainable Canadian Agricultural Partnership, to expand Alberta’s greenhouse and vertical farm sector. Besides, the program aims to increase local production of fresh fruits and vegetables, reduce reliance on seasonal imports, and support Alberta’s Buy Local initiative by providing consumers with locally grown produce year-round. It will fund new construction, expansions, and the adoption of advanced technologies such as energy-efficient systems, automation, and lighting improvements to enhance production and sustainability, benefiting the greenhouse film market.

- Expansion of controlled environment agriculture: Farmers across most nations are adopting controlled environment agriculture, which includes greenhouse cultivation, to produce stable and predictable yields irrespective of season or weather. This increases greenhouse film usage as a key CEA component, driving business in the market. As per the article published by USDA in February 2024, in a span of ten years, controlled environment agriculture in the U.S., including greenhouses, vertical farms, hydroponics, and aquaponics, more than doubled in operations, rising from 1,476 to 2,994, whereas the production volumes increased 56% to 7.86 million hundredweight. It also mentioned that CEA systems allow growers to control temperature, light, wind, and precipitation, addressing adverse weather and pests, which boosts both yield and crop quality, benefiting the greenhouse film industry.

- Climate change and weather volatility: Increasing variabilities in climatic conditions, such as extreme heat, droughts, and heavy rains, encourage farmers to utilize greenhouse films to protect crops from environmental stresses. In this context, RKW Group in January 2025 reported that it showcased its wide range of films, nonwovens, and packaging solutions at Fruit Logistica 2025 by covering the entire supply chain from plant cultivation to transport. Their offerings include greenhouse and early harvesting films, durable crop cover nonwovens, and innovative packaging solutions such as FruitPads, MDO-PE lamination films, and stretch hoods, all of which are especially designed for sustainability, efficiency, and crop protection. RKW also mentioned that its products aim to enhance plant growth, extend shelf life, and reduce material use, supporting both agricultural productivity and eco-friendly practices, driving consistent growth in the market.

Challenges

- High production and raw material costs: The greenhouse film market relies on polyethylene and other polymers for which prices are volatile owing to fluctuations in terms of crude oil and petrochemical sectors. These rising raw material costs affect the factor of affordability of films for growers, especially in emerging nations. In addition, manufacturing films with UV stabilization, anti-drip, anti-fog, and light-diffusing properties also necessitates specialized machinery, energy, and skilled labor, thereby increasing production costs. In this context, smaller manufacturers in this field mostly find it challenging to achieve economies of scale. Furthermore, these cost pressures can limit adoption, particularly for resource-constrained farmers, in turn compelling companies to balance affordability with technological performance, durability, and environmental considerations.

- Environmental and sustainability concerns: This is yet another factor hindering growth in the greenhouse film market. Greenhouse films are primarily made from plastics, which create environmental challenges at the end of their lifecycle. Also, disposal, recycling, and biodegradability are considerable concerns as governments and consumers are opting for sustainable agricultural practices. The aspect of any improper disposal can lead to soil and water contamination, whereas the recycling options are limited due to contamination with pesticides, soil, and organic residues. Manufacturers are under severe pressure to develop eco-friendly, recyclable, or biodegradable films. In addition to compliance with environmental regulations and certifications, maintaining performance and competitive pricing is a critical challenge for pioneers.

Greenhouse Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 9.2 billion |

|

Forecast Year Market Size (2035) |

USD 23.9 billion |

|

Regional Scope |

|

Greenhouse Film Market Segmentation:

Thickness Segment Analysis

The 100–200-micron segment is expected to capture a commanding share of 50.4% in the market during the analyzed timeframe. The subtype strikes a balance between durability, light diffusion, and cost efficiency for growers, making it a highly preferred choice for both commercial and smallholder producers. On the other hand, their proper balance between performance and replacement cost is also efficiently driving adoption of the segment. Agriplast is one of the prominent suppliers of polyhouse and greenhouse cover films that are advanced 5-layer polyethylene solutions designed to support both small farmers and large commercial growers. It also mentioned that drip lock clear and drip lock diffused films feature anti-drip, anti-dust, and anti-virus properties that prevent condensation damage, improve photosynthesis, reduce pest and disease pressure, and promote higher yield quality, allowing increased uptake among farmers.

Resin Type Segment Analysis

In terms of resin type, LDPE will lead to capturing a significant revenue share in the greenhouse film market by the conclusion of 2035. The subtype is the most widely used greenhouse film resin owing to its high light transmission, flexibility, ease of processing, lower cost, and suitability for a wide range of greenhouse structures worldwide. As per the article published by NIH in January 2025, it underscores the increasing utilization of LDPE and the potential of microbial biodegradation using bacteria, fungi, algae, and insect larvae, with processes as biodeterioration, biofragmentation, assimilation, and mineralization used to break down LDPE under optimized environmental conditions. Despite the presence of advances in analytical techniques such as SEM, GC-MS, HPLC, and FTIR, most of the research studies concentrated in Asia and Europe, underscoring the need for international collaboration to develop sustainable, effective strategies for LDPE management in agriculture.

Application Segment Analysis

In the greenhouse film market, flowers & ornamentals are anticipated to grow at a considerable share over the forecasted years. The growth of the subtype is highly attributable to the need for precise climate control, light diffusion, and protection against pests and diseases, which are highly essential for high-value ornamental crops. Greenhouse films with properties such as UV stabilization, light diffusion, anti-drip, and thermal regulation encourage growers to maintain consistent flowering cycles, enhance color and quality, and extend the growing season, especially in regions with variable climates. In addition, the increasing worldwide demand for cut flowers, decorative plants, and nursery plants, coupled with the expansion of commercial floriculture in Asia Pacific, Europe, and North America, is driving continued adoption of specialized greenhouse films that are suitable for ornamental production.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Thickness |

|

|

Resin Type |

|

|

Application |

|

|

Functional Type |

|

|

Width Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Greenhouse Film Market - Regional Analysis

APAC Market Insights

The Asia Pacific greenhouse film market is expected to lead the entire global dynamics, capturing the largest revenue share of 40.6% by the end of 2035. The region’s leadership is mainly propelled by rapid agricultural modernization and expansion in China, India, Japan, and South Korea, nations. The region’s market also benefits from government policies that promote protected agriculture and large greenhouse acreage. In May 2024, Murata Manufacturing reported that it made an investment in R PLUS JAPAN, which is a joint venture developing advanced chemical recycling technology for plastics, including PET film. It also notes that this initiative aims to establish a closed-loop recycling system and promote sustainable resource use across industries. By enabling the efficient recycling of plastic materials, it efficiently supports demand for high-quality recycled films. In addition, the technology reduces CO₂ emissions and energy use when compared to conventional recycling methods, making it environmentally sustainable.

China’s market is efficiently progressing by prioritizing films that extend the growing season and increase crop density in response to the country’s high domestic food demand. Local manufacturers in the country are making investments in polymer modification technologies to produce films with superior tensile strength and longevity. In this regard, in November 2025, Helio Agricultural Technology reported that it had participated in the 23rd China Greenhouse Horticulture Industry Conference in Zhengzhou to showcase its high-performance greenhouse films and advanced agricultural protection materials. In addition, the company also highlighted its products, which are especially designed for improved light transmission, weather resistance, and crop yield, supporting smarter and more controllable greenhouse environments. Therefore, this participation underscores China’s prime focus on modernizing protected agriculture and expanding the adoption of advanced greenhouse technologies.

India greenhouse film market is growing on account of increased adoption, positively influenced by water conservation needs and protection against erratic monsoon patterns. Films are especially designed for high heat and humidity resilience, along with innovations that combine UV protection with pest resistance. In this regard, in September 2024, Coromandel International reported that it inaugurated a polyhouse at its R&D farm in Telangana, which is equipped for advanced trials that include hydroponics, cocopeat systems, and precision nutrient calibration. It also mentioned that the facility enables testing of innovative agri-inputs such as nano fertilizers, biostimulants, and controlled-release fertilizers, while also fostering collaboration with government bodies and farmers to improve crop yields. Hence, this initiative reflects the country’s push for a very modernized, climate-resilient protected agriculture and supports the adoption of greenhouse technologies to enhance both productivity and sustainability.

North America Market Insights

North America Market strongly emphasizes innovation in UV-resistant and anti-condensation films to optimize crop yield in controlled environments. Manufacturers in the region are mainly focused on integrating sustainable materials that can withstand severe climatic variations. Adoption in the region is also driven by advanced greenhouse infrastructure and government initiatives that are promoting energy-efficient farming processes. In this regard, BrightFarms in June 2025 announced that it had inaugurated its high-tech greenhouse in Macon, Georgia, consisting of eight acres of hydroponic production with plans to expand by 24 acres. The company is a part of Cox Farms, whereas the facility produces fresh lettuce locally, reduces food miles, and enhances food security and supporting workforce development in the region. Thus, this investment showcases the significance of advanced greenhouse technology and indoor farming can scale sustainably to meet regional demand for fresh produce, contributing to overall market growth.

The U.S. greenhouse film market is augmenting its leadership owing to the strong research ecosystem for biodegradable and recyclable greenhouse films. The market is positively influenced by technological collaboration between agritech startups and established greenhouse equipment providers. Regional climate diversity encourages the development of films that are suitable for specific microclimates, supporting year-round cultivation in both arid and temperate zones. In March 2024, UbiQD, Inc. announced that it had won the SXSW Innovation Award and received a USDA SBIR Phase I grant to develop a glass-based version of its UbiGro quantum dot greenhouse technology. Besides, the technology utilizes fluorescence to optimize light spectra for crops, enhancing yield in both plastic and glass greenhouses. Hence, such instances position the country as a predominant leader, allowing steady cash influx in this sector.

The Canada greenhouse film market is focused mainly on frost-resistant and multi-layered films to address long winters as well as the short growing seasons. Firms in the country are continuously making innovations to maximize light diffusion and retention of heat, particularly for greenhouse vegetable and berry production. On the other hand, partnerships between academic institutions and industry players readily accelerate pilot projects to test high-performance films in northern climates. The greenhouse film shipments are mainly driven by the expanding protected agricultural sector, especially in provinces such as Ontario and British Columbia. These shipments are primarily regulated through the Canada Border Services Agency, and the product standards are regulated by Agriculture and Agri-food Canada and Health Canada for material safety. Furthermore, the provincial agriculture ministries support programs through grants and technology adoption incentives.

Europe Market Insights

The Europe greenhouse film market has acquired a prominent position owing to the emphasis on sustainability and regulatory compliance, with an increasing shift toward bio-based polymers and recyclable multilayer films. The regional market is also shaped by different types of climatic zones, which are driving suitable solutions for heat retention, light diffusion, and seasonal insulation. In May 2025, the ERDE initiative in Europe expanded its collection and recycling system to include used greenhouse films, allowing farmers to return them in an environmentally responsible manner. In this context, the films are processed by specialized regional recycling partners into high-quality recyclate that can be reused in new greenhouse films or other applications, thereby promoting a circular economy. Furthermore, this collaboration among manufacturers, distributors, collection partners, and farmers reduces plastic waste, cuts greenhouse gas emissions, and strengthens sustainable practices in terms of protected agriculture.

Germany market is maintaining a strong position in the regional landscape due to the focus on precision farming with films that integrate sensor compatibility for automated greenhouse monitoring systems. The country’s market also benefits from collaboration with research institutions ensures continuous improvement in film transparency, durability, and environmental sustainability. In this regard, RKW Group in November 2023 showcased its sustainable agricultural films and nets at Agritechnica 2023 in Hannover with innovations such as polydress twista green, which is a recyclable 2-in-1 silage and vacuum film, and Rondotex Wizard, which is a UV-resistant round bale net with material and time-saving features. The firm also notes that these products combine high functionality with environmental benefits by using recycled materials and improving efficiency for farmers. In addition, RKW’s portfolio also includes greenhouse films, early harvesting films, nonwovens, and silage tubes, supporting productive agriculture in the years ahead.

UK greenhouse film market is growing exponentially due to the growing trend of films that support organic farming practices and reduce chemical dependency. Market growth is also stimulated by grants and subsidies for sustainable greenhouse infrastructure and low-carbon farming technologies. Besides, the heightened demand for high-performance films with enhanced UV protection and thermal insulation is driving innovation in material technology. Rising consumer awareness of food safety and traceability also boosts the adoption of greenhouse films. Integration of smart greenhouse systems with energy-efficient films is becoming increasingly common, encouraging more players to establish their footprint in the country. Furthermore, the collaborations between manufacturers and research institutions are accelerating the development of biodegradable and recyclable film solutions, hence making it suitable for standard market growth.

Key Greenhouse Film Market Players:

- Berry Global, Inc. (U.S.)

- RKW Group / RKW SE (Germany)

- Ginegar Plastic Products Ltd. (Israel)

- Plastika Kritis S.A. (Greece)

- POLIFILM EXTRUSION GmbH (Germany)

- Armando Álvarez Group (Grupo Armando Álvarez) (Spain)

- Agripolyane (France)

- A. Politiv Ltd. (Israel)

- Trioplast Industries AB (Sweden)

- FVG Folien‑Vertriebs GmbH (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Agriplast Tech India Pvt Ltd (India)

- Tuflex India (India)

- Thai Charoen Thong Karntor Co. Ltd. (TCT) (Thailand)

- Lumite, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Berry Global, Inc. is a leading manufacturer of polymer-based products that include greenhouse films. The company is focused on high-performance polyethylene films that offer durability, light diffusion, UV protection, and mechanical strength. In addition, Berry strongly leverages large-scale production capacity and extensive R&D to serve different agricultural markets by providing lightweight alternatives to glass and acrylic.

- RKW Group is based in Europe and is considered to be a major producer of plastic films, which include greenhouse and agricultural films. Its products range from silage and crop protection films to advanced greenhouse coverings consisting of anti-drip, anti-fog, and UV-stabilized properties. The company is focused mainly on continued innovation, sustainability, and consolidation, and invests in R&D to optimize light transmission, durability, and mechanical performance.

- Ginegar Plastic Products Ltd. is best known for specialized greenhouse films that have high light diffusion, anti-drip coatings, and selective light spectrum technologies. The company serves both commercial and high-value horticultural growers, and it focuses on improving crop yields, pest management, and climate control. Furthermore, international partnerships, product customization, and research on polymer performance to maintain a competitive edge in controlled-environment agriculture are a few strategies opted for by Ginegar.

- Plastika Kritis S.A. is a central player in this field that produces a wide range of polyethylene greenhouse films designed for energy efficiency, light optimization, and crop protection. Besides, the company emphasizes innovation, climate adaptability, and international distribution, collaborating with partners to expand reach. In addition, strategic efforts focus on enhancing light diffusion, anti-drip, anti-fog, and anti-UV properties, thereby supporting growers in different types of climatic regions.

- POLIFILM EXTRUSION GmbH is a predominant leader in greenhouse films, offering high-performance PE films for light management, UV stabilization, and mechanical durability. Their portfolio is suitable for both commercial greenhouses and specialty crop producers. POLIFILM emphasizes advanced extrusion technology, multilayer films, and sustainability, producing films with long service life and reduced environmental footprint.

Below is the list of some prominent players operating in the global market:

The global greenhouse film market is leveraging both large-scale polymer manufacturers and specialized agricultural film producers, which are constantly vying in terms of innovation, sustainability, and regional presence. Major players in this field, such as Berry Global and RKW Group, are focused on extensive product portfolios and mass production, whereas companies such as Ginegar and Plastika Kritis emphasize advanced technologies such as UV stabilization and light diffusion. In this regard, in August 2023, DENSO Corporation announced that it had acquired a full stake in Certhon Group, which is a leading horticultural facility operator, to accelerate its global expansion in agricultural production. Certhon specializes in advanced greenhouse technologies and integrated horticultural solutions, whereas DENSO leads in automation and process design from the automotive sector. Therefore, this acquisition aims to develop innovative farm models, address labor shortages, and create climate-independent cultivation systems, combining both companies’ technologies to provide sustainable, region-specific agricultural solutions worldwide.

Corporate Landscape of the Market:

Recent Developments

- In February 2025, RKW Agri GmbH & Co. KG was merged into RKW SE to unify operations and strengthen the company’s market position, supporting sustainable growth. The agricultural segment, including silage films, greenhouse films, round bale nets, early harvesting films, and crop cover nonwovens, is a core focus.

- In 2025, Harnois Greenhouses, in partnership with Plastika Kritis, announced that it had launched its 2025 lineup of high-performance polyethylene greenhouse films, including Suncooler, Polydispersive, EVO AC AR, and CHAMELEON, designed to optimize light, climate, and crop productivity.

- Report ID: 4318

- Published Date: Jan 15, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Greenhouse Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.