Green Ammonia Production Market Outlook:

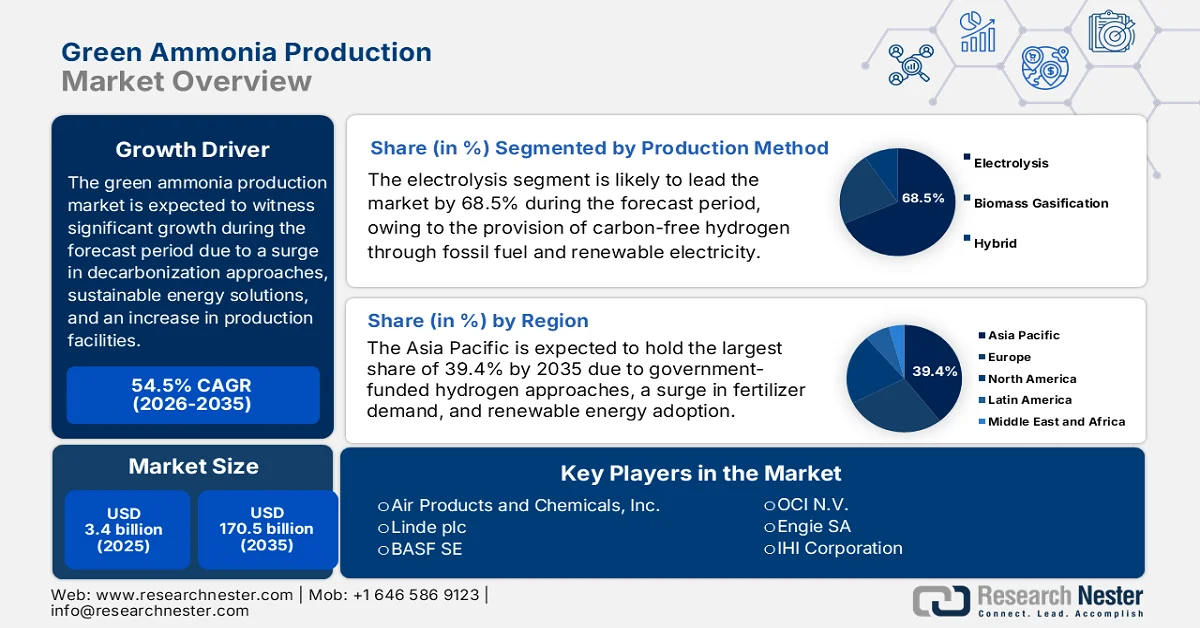

Green Ammonia Production Market size was over USD 3.4 billion in 2025 and is estimated to reach USD 170.5 billion by the end of 2035, expanding at a CAGR of 54.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of green ammonia is assessed at USD 5.2 billion.

The international market is rapidly evolving since investors, governments, and industries are readily aligning towards sustainable energy and decarbonization solutions. According to official statistics published by Heliyon in April 2024, by the end of 2030, China intends to diminish its emissions by 88.5% and 85.1%. In addition, India has recorded the highest reduction percentage, and meanwhile, Germany comprises the lowest percentage, with an expected decrease of 90.6% and 52.45 respectively. Likewise, carbon emissions in the U.S. are projected to be lowered by 83.0% and 79.8% by the end of 2050. Besides, the carbon budget to effectively stabilize international warming at 1.5 degrees Celsius is gradually increasingly constrained despite worldwide climate mitigation strategies, thereby making it suitable for boosting the market’s growth.

Furthermore, the integration with carbon capture and storage, digitalization of production facilities, financialization of green ammonia projects, and cross-sector collaboration are significantly fueling the market globally. According to official statistics published by the IEA Organization in 2026, nearly 45 commercial facilities are already in operation applying carbon capture, utilization, and storage (CCUS) to power generation, fuel transformation, and industrial processes. In this regard, there has been an increase in capture capacity by 35% for 2030, while this particular capacity also surged by 70%. This has resulted in constituting the overall amount of carbon dioxide capture to nearly 435 million tons per year by the end of 2030. Therefore, with this continuous increase in capacity, the market is continuously gaining increased exposure across different sectors.

Present and Planned Large-Scale Carbon Capture Projects Capacity Analysis (2020-2030)

|

Year |

Operating (million tons per year) |

Under Construction (million tons per year) |

Advanced Development (million tons per year) |

Concept and Feasibility (million tons per year) |

Gap to NZE (million tons per year) |

|

2020 |

46 |

- |

- |

- |

- |

|

2022 |

48 |

- |

- |

- |

- |

|

2024 |

50 |

7 |

7 |

1 |

- |

|

2026 |

50 |

33 |

48 |

37 |

- |

|

2028 |

50 |

38 |

117 |

90 |

- |

|

2030 |

50 |

38 |

142 |

205 |

589 |

Source: IEA Organization

Key Green Ammonia Production Market Insights Summary:

Regional Highlights:

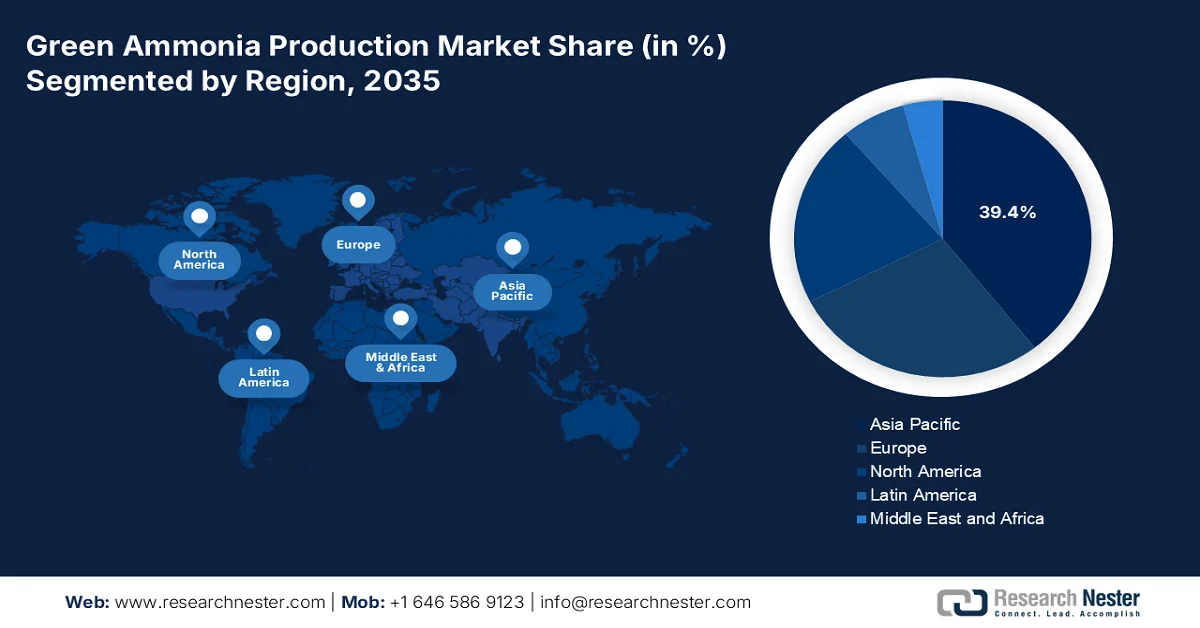

- Asia Pacific is expected to command a 39.4% share by 2035 in the green ammonia production market, supported by government-backed hydrogen strategies, accelerating renewable energy integration, and rising fertilizer demand.

- North America is projected to register the fastest growth over the forecast period 2026–2035, bolstered by escalating industrial demand, strong public funding initiatives, and expanding use of ammonia as a hydrogen carrier.

Segment Insights:

- The electrolysis segment under the production method category is forecast to account for a dominant 68.5% share by 2035 in the green ammonia production market, enabled by carbon-free hydrogen generation through renewable-powered water splitting.

- The fertilizer grade segment is anticipated to secure the second-largest share during 2026–2035, underpinned by its essential role in nitrogen-based fertilizers and the global push toward low-carbon agricultural inputs.

Key Growth Trends:

- Surge in industrial diversification mandates

- Increase in maritime decarbonization

Major Challenges:

- High production expenses and energy intensity

- Infrastructure and supply chain limitations

Key Players: Yara International ASA (Norway), CF Industries Holdings, Inc. (U.S.), Siemens Energy AG (Germany), Thyssenkrupp AG (Germany), Haldor Topsoe A/S (Denmark), Air Products and Chemicals, Inc. (U.S.), Linde plc (UK), BASF SE (Germany), OCI N.V. (Netherlands), Engie SA (France), IHI Corporation (Japan), Mitsubishi Heavy Industries, Ltd. (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Woodside Energy Group Ltd. (Australia), POSCO Holdings Inc. (South Korea), Samsung Engineering Co., Ltd. (South Korea), Reliance Industries Limited (India), Indian Farmers Fertiliser Cooperative Limited (India), Petronas Chemicals Group Berhad (Malaysia), Fertiberia S.A. (Spain).

Global Green Ammonia Production Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 5.2 billion

- Projected Market Size: USD 170.5 billion by 2035

- Growth Forecasts: 54.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.4% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Australia, Canada, Brazil, Saudi Arabia, South Korea

Last updated on : 5 February, 2026

Green Ammonia Production Market - Growth Drivers and Challenges

Growth Drivers

- Surge in industrial diversification mandates: The green ammonia production market is increasingly utilizing synthetic fuels, hydrogen storage, and power generation, deliberately diversifying its applications. According to official statistics published by the IEA Organization in 2025, there has been an increase in the international electricity demand by 4.3% as of 2024, a suitable step modification from the 2.5% growth as observed in 2023. In addition, the average electricity pace demand as of 2023 accounted for 2.7%, almost double the rate of overall energy demand growth within the same duration. Besides, internationally, the electricity consumption increased by 1,080 TWh, almost twice the yearly average of the past decade, thereby denoting an optimistic outlook for the market’s growth.

- Increase in maritime decarbonization: The International Maritime Organization (IMO) regulations are readily pushing the aspect to ship organizations to integrate ammonia as a zero-carbon fuel. As per an article published by the UNEP Organization in November 2023, governments across different nations have planned to produce nearly 110% increased fossil fuels by the end of 2030, ensuring consistency with restricted warming to 1.5 degrees Celsius, along with 69% more than consistency with 2 degrees Celsius. Besides, as per the June 2023 Department of Energy data report, there has been a rapid growth in countries pledging to achieve net-zero emissions that presently caters to nearly 70% of international carbon dioxide emissions, thus creating a positive impact on the market’s expansion.

- Government-funded research and development programs: The existence of large-scale funding strategies, including Japan’s NEDO projects and Europe’s Horizon Europe program, is driving advancement in ammonia synthesis and electrolyzer efficiency. As stated in an article published by the Ammonia Energy Organization in August 2024, the government in Canada is expected to allocate almost CAD 300 million for hydrogen as well as derivative exports to Europe through the H2Global auction scheme. Based on this scheme, Fertiglobe is expected to be committed to ammonia exports from Egypt to Europe between 2027 and 2033. This overall contracts-for-difference amount paid as subsidies is poised to amount to €397 million, thus denoting a huge growth opportunity for the market.

Challenges

- High production expenses and energy intensity: The market relies heavily on renewable electricity to power electrolyzers, which split water into hydrogen before synthesizing ammonia. This process is significantly more expensive compared to conventional ammonia derived from natural gas. The expense of renewable electricity, electrolyzer technology, and infrastructure remains high, making green ammonia less competitive in the short term. For instance, the levelized cost of green ammonia is often higher than that of fossil-based ammonia. Additionally, the energy intensity of the Haber-Bosch process, even when powered by renewables, creates efficiency challenges. Without large-scale cost reductions in renewable energy and electrolyzers, widespread adoption will be limited.

- Infrastructure and supply chain limitations: The global infrastructure for ammonia production, storage, and transport is largely designed for traditional ammonia. Besides, transitioning to green ammonia requires significant upgrades, including renewable-powered plants, specialized storage facilities, and safe transport systems. Ammonia is toxic and requires stringent safety protocols, which complicates scaling. Furthermore, the lack of established supply chains for renewable hydrogen, which is the precursor to green ammonia creates bottlenecks in the market. Many regions lack pipelines, terminals, and distribution networks capable of handling large-scale green ammonia flows. For instance, maritime shipping hubs are still in the early stages of developing ammonia bunkering facilities, thus limiting the industry’s growth.

Green Ammonia Production Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

54.5% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 170.5 billion |

|

Regional Scope |

|

Green Ammonia Production Market Segmentation:

Production Method Segment Analysis

The electrolysis segment, which is part of the production method, is anticipated to garner the largest share of 68.5% in the green ammonia production market by the end of 2035. The segment’s upliftment is highly fueled by the provision of carbon-free hydrogen by effectively splitting water through renewable electricity and readily combating reliance on fossil fuels. According to official statistics published by the IEA Organization in 2026, the electrolysis capacity for dedicated hydrogen production has been continuously growing and successfully reached an installed capacity of 1.4 GW by the end of 2023. Simultaneously, the electrolyzer manufacturing capacity has also doubled, reaching 25 GW per year in the same year, thereby significantly proliferating the segment’s growth and expansion, which is also positively impacting the overall market’s development internationally.

Product Type Segment Analysis

The fertilizer grade segment is projected to hold the second-largest market share during the forecast period. The segment’s growth is highly attributed to its critical role in agriculture. Ammonia is a key input for nitrogen-based fertilizers, which are essential for enhancing crop yields and ensuring food security. With global population growth and rising demand for sustainable farming practices, fertilizer-grade green ammonia is increasingly preferred over conventional ammonia derived from fossil fuels. Besides, governments internationally are mandating decarbonization in agriculture, creating strong incentives for farmers and fertilizer producers to transition to low-carbon alternatives. For instance, India’s SIGHT program aggregates demand for hundreds of thousands of tons of green ammonia annually, ensuring long-term adoption in the fertilizer sector.

Purity Type Segment Analysis

By the end of the stipulated duration, the exceptional purity sub-segment, part of the purity type segment, is expected to grab the third-largest share in the green ammonia production market. The sub-segment’s development is highly fueled by its requirement in industries such as pharmaceuticals, electronics, and specialty chemicals, where contamination-free inputs are essential. The rise of semiconductor manufacturing and advanced materials, including gallium arsenide wafers, has intensified demand for ultra-pure ammonia as a feedstock. Countries such as Japan and South Korea, with strong electronics and chemical industries, are investing heavily in high-purity ammonia production facilities powered by renewable energy. For instance, Japan’s NEDO programs support research and development in ultra-pure chemical synthesis, ensuring competitiveness in global semiconductor supply chains.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Production Method |

|

|

Product Type |

|

|

Purity Type |

|

|

End use Industry |

|

|

Application |

|

|

Energy Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Ammonia Production Market - Regional Analysis

APAC Market Insights

The Asia Pacific green ammonia production market is anticipated to garner the highest share of 39.4% by the end of 2035. The market’s upliftment in the region is primarily attributed to the existence of government-funded hydrogen strategies, renewable energy integration, and an increase in fertilizer demand. According to official statistics published by the IEA Organization in 2026, the share of modernized renewables in finalized energy consumption in the region accounts for 13.0%, along with a growth trend of more than 135%. Besides, the overall final consumption of waste and biofuels significantly accounts for 58% in the overall region. In addition, this particular consumption caters to 34.0% in terms of industry, 5.1% in transport, along with 1.9% in commercial and public services, while renewable expansion across different countries is deliberately boosting the market’s exposure.

Modern Renewables in Final Energy Consumption in the Asia Pacific Share Analysis (2022)

|

Countries |

Share % |

|

Laos |

32.4 |

|

Sri Lanka |

31.6 |

|

New Zealand |

30.4 |

|

Cambodia |

27.5 |

|

Vietnam |

22.7 |

|

Nepal |

19.3 |

|

India |

18.4 |

|

Thailand |

16.2 |

|

Indonesia |

14.0 |

|

Australia |

13.5 |

Source: IEA Organization

The green ammonia production market in China is growing significantly, owing to strong government expenditure, industrial scale, and the presence of a massive fertilizer demand. As per an article published by NLM in June 2022, the country’s initiative has gained some success, with the average valuation of fertilizer utilization efficacy in domestic grain productivity increased by 2.5% points. Besides, based on the National Bureau of Statistics of China, the discounted amount of agricultural fertilizer per unit area utilized in the country was 446.1 kg/hm2, successfully exceeding the globally approved upper limit of 225 kg/hm2. Besides, the country’s Ministry of Agriculture and Rural Affairs issued the Zero Growth Action Plan for Fertilizer Use, along with the Implementation Opinions of the Ministry of Agriculture on Fighting the Battle against Agricultural Surface Source Pollution, thus uplifting the market’s growth.

The aspects of industrial decarbonization, agricultural demand, government-funded tenders, a surge in long-lasting adoption, and the presence of the National Hydrogen Mission are readily responsible for bolstering the green ammonia production market in India. Based on government estimates published by the PIB Government in June 2024, the Ministry of New & Renewable Energy (MNRE) has readily implemented the National Green Hydrogen Mission (NGHM), with a generous target to gain production capacity of 5 million tons per annum of green hydrogen by the end of 2030. Besides, the capacity available for effectively bidding under Tranche I of Mode 2Areadily accounts for 5,50,000 tons per annum of green ammonia. Additionally, this has further increased to 7,50,000 tons per annum, denoting a significant approach towards the need creation of green hydrogen as well as its derivatives in the overall nation.

North America Market Insights

The North America green ammonia production market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by an increase in the industrial demand, robust government funding, and the presence of fertilizer feedstock and a critical hydrogen carrier. According to official statistics published by the Journal of Environmental Chemical Engineering in June 2023, there are a few research and development projects in the U.S., including the combination of hydrogen in natural gas pipelines to almost 20% in Southeast and California, the development of a 20 MW green hydrogen power facility in Florida, as well as 5% hydrogen natural gas plant in North Carolina, and 15% to 20% of a similar plant in Ohio, thereby denoting a huge growth opportunity for the market in the overall region.

The green ammonia production market in the U.S. is gaining increased traction, owing to the provision of federal clean energy funding, the EPA green chemistry program, and a surge in agricultural demand. Based on government estimates published by the Department of Energy in September 2022, this administrative department effectively signed the Infrastructure Investment and Jobs Act, which is also referred to as the Bipartisan Infrastructure Law (BIL), providing USD 62 billion, which includes USD 9.5 billion for clean hydrogen. In addition, as of August 2022, the country’s President significantly signed the Inflation Reduction Act (IRA), offering suitable incentives and policies for hydrogen, such as a production tax credit for boosting the clean hydrogen energy in the country, thereby making it suitable for the market’s development.

The provision of federal budget allocations for clean energy, green bond financing, as well as export and agricultural potential are also bolstering the green ammonia production market in Canada. As per an article published by the Clean Energy Canada Organization in March 2023, the Chemistry Industry Association of Canada has estimated that more than 70,000 regular consumer-based products in the country comprise chemicals, with over 95% of all manufactured products heavily reliant on chemistry. Besides, the International Energy Agency has forecasted suitable growth in the need for products from the chemicals industry in its Net-Zero by 2050 scenario, including an expected 25% upsurge in the requirement by the end of 2030, assuming increased levels of plastic recycling. Therefore, based on all these developments, the market is gradually progressing in the country.

Europe Market Insights

Europe green ammonia production market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by sustainable chemical advancements, immense support from the Horizon Europe and Green Deal funding, and an increase in emphasizing ammonia’s role in decarbonizing fertilizers and shipping fuels. According to official statistics published by Europe Commission in December 2025, the consumption of hazardous chemicals has reduced substantially, reducing by 47 million tons. Additionally, the production of the most harmful substances for human health has gradually decreased from 55 million tons to 45 million tons as of 2024. Moreover, the substances of concern witnessed a reduction from 27 million tons to 19 million tons within the same period, while there has also been a reduction of hazardous substances, lowering from 154 million tons to 109 million tons, thereby bolstering the market’s exposure.

Chemical Production Analysis in Europe (2014-2024)

|

Year |

Hazardous and Non-Hazardous (million tons) |

Hazardous to Health (million tons) |

Hazardous to the Environment (million tons) |

|

2014 |

89.2 |

86.8 |

89.4 |

|

2015 |

88.2 |

85.0 |

86.4 |

|

2016 |

89.5 |

85.8 |

86.6 |

|

2017 |

93.8 |

90.8 |

94.9 |

|

2018 |

92.9 |

88.0 |

90.5 |

|

2019 |

89.0 |

85.5 |

87.8 |

|

2020 |

85.1 |

83.1 |

85.1 |

|

2021 |

88.0 |

86.1 |

91.7 |

|

2022 |

79.3 |

77.3 |

79.5 |

|

2023 |

71.3 |

70.1 |

77.4 |

|

2024 |

75.7 |

72.9 |

79.9 |

Source: Europe Commission

The green ammonia production market in Germany is gaining increased exposure, owing to the existence of government-funded decarbonization programs, a robust industrial base, and an increase in prioritizing hydrogen and ammonia. Based on government estimates published by the ITA Government in August 2025, the Federal Ministry of Economics is projected to import almost 259,000 tons of green ammonia through the H2Global Foundation program between 2027 and 2023. As stated in an article published by Applied Energy in March 2023, the levelized pricing for green ammonia in the country’s harbor is 109.3 €/MWh. In addition, with the production expenses of 30.43 € per MWh electricity supply, green hydrogen is readily produced at 59.4 €/MWh, and meanwhile, 88.39 €/MWh of the overall levelized cost of delivered green ammonia has resulted from the total electricity supply, thus proliferating the market’s growth in the nation.

The presence of circular economy strategies, ecological planning, as well as the energy transition programs, and a robust commitment to sustainable chemicals are bolstering the market in France. As per a data report published by the Institute for Climate Economics in May 2023, the investment demand for decarbonizing the ammonia production ranges from €3 billion in frugal generation to €14 billion for the green technologies scenario. Besides, €14 billion is expected to be the most investment-intensive scenario by the end of 2050. In addition to this, the 2030 decarbonization targets and the provision of free allowances in the Europe-based Emissions Trading System are a suitable incentive to significantly invest rapidly to decarbonize the overall industry, which in turn is bolstering the market’s growth in the country.

Key Green Ammonia Production Market Players:

- Yara International ASA (Norway)

- CF Industries Holdings, Inc. (U.S.)

- Siemens Energy AG (Germany)

- Thyssenkrupp AG (Germany)

- Haldor Topsoe A/S (Denmark)

- Air Products and Chemicals, Inc. (U.S.)

- Linde plc (UK)

- BASF SE (Germany)

- OCI N.V. (Netherlands)

- Engie SA (France)

- IHI Corporation (Japan)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Woodside Energy Group Ltd. (Australia)

- POSCO Holdings Inc. (South Korea)

- Samsung Engineering Co., Ltd. (South Korea)

- Reliance Industries Limited (India)

- Indian Farmers Fertiliser Cooperative Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Fertiberia S.A. (Spain)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Yara International ASA is one of the world’s largest fertilizer producers and a pioneer in green ammonia projects, leveraging renewable energy to decarbonize fertilizer production. The company is actively developing large-scale green ammonia facilities in Norway and Australia to serve both the agriculture and shipping fuel markets.

- CF Industries Holdings, Inc. is a leading U.S. ammonia producer investing heavily in clean hydrogen and green ammonia technologies. The company is expanding its production capacity to meet agricultural demand while aligning with U.S. Department of Energy initiatives for decarbonization.

- Siemens Energy AG plays a critical role in enabling green ammonia production through advanced electrolyzer technology and renewable integration. Its partnerships across Europe support large-scale projects that align with regional Green Deal targets for sustainable chemicals.

- Thyssenkrupp AG is a major technology provider for ammonia synthesis, offering scalable solutions for green hydrogen-to-ammonia conversion. The company collaborates with global partners to deploy industrial-scale plants, reinforcing Germany’s leadership in chemical decarbonization.

- Haldor Topsoe A/S specializes in catalysts and process technologies essential for efficient ammonia synthesis. The company is advancing green ammonia projects worldwide, focusing on reducing production costs and enabling widespread adoption in fertilizers and energy applications.

Here is a list of key players operating in the global market:

The international green ammonia production market is highly competitive, with leading players adopting strategies such as long-term offtake agreements, government-backed partnerships, and large-scale renewable integration. Europe-based firms such as Yara and Thyssenkrupp are leveraging regional Green Deal funding, while U.S. companies such as CF Industries and Air Products benefit from DOE hydrogen hub initiatives. Asia-specific manufacturers, including IHI in Japan and Reliance in India, are scaling production through national hydrogen missions. Besides, in July 2025, YamnaCo Ltd notified the successful signing of a Memorandum of Understanding (MoU) with the New and Renewable Energy Development Corporation of Andhra Pradesh (NREDCAP). This particular MoU deliberately denotes a huge step in the organization’s plans to create a large-scale green ammonia and hydrogen project in Andhra Pradesh, thereby boosting the green ammonia production industry globally.

Corporate Landscape of the Green Ammonia Production Market:

Recent Developments

- In July 2025, Envision has effectively commissioned the world’s most advanced and largest green ammonia and hydrogen production infrastructure. This is readily powered by the highest off-grid renewable energy system, the first of its kind to be completely AI-enabled and gain stability and real-time optimization.

- In June 2025, Marubeni has effectively signed a long-lasting offtake deal with international green technological organization, Envision Energy Co., Ltd., for the ammonia production from renewable energy in China.

- In May 2025, BASF made an expansion of its sustainable product portfolio by emerging as the first-ever producer of renewable ammonia in Central Europe, accounting for 24.5% of share at its Verbund site in Ludwigshafen by feeding hydrogen into the ammonia facility.

- Report ID: 8384

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Ammonia Production Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.