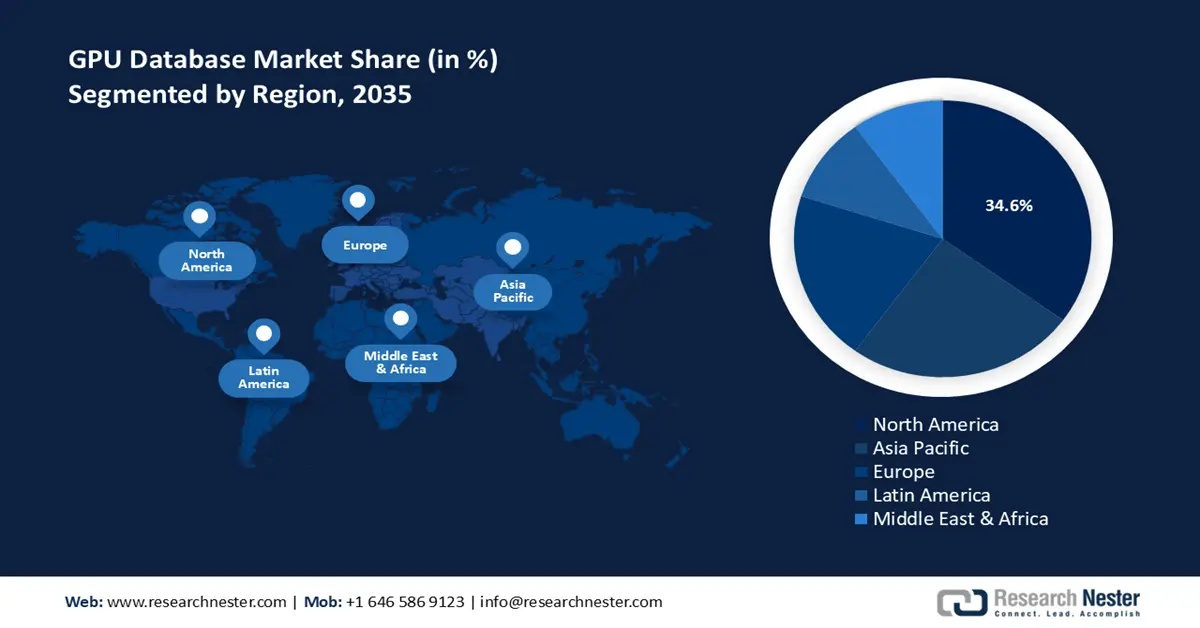

GPU Database Market - Regional Analysis

North America Market Insights

The North America GPU database sector is poised to hold a leading revenue share of 34.6% throughout the forecast period. A major factor driving the regional market’s growth is the heightened federal ICT investments in the region. Major tech hubs in the region are key end users of GPU databases. Additionally, the NTIA’s ongoing digital equity programs have expanded access to GPU-powered database services in rural communities across the region. In addition to these drivers, the heightened regulatory push for data security in the U.S. and Canada is expected to ensure the continued dominance of the North America market.

The U.S. GPU database market is estimated to maintain its revenue share throughout the forecast timeline. A key facet of the U.S. market is the heightened federal funding, as reported by the NTIA. The U.S. Department of Energy’s exascale computing projects rely on GPU technology for scientific simulations, which spurs commercial GPU database development. In addition, rising investments and expansion plays by tech giants in the U.S. is expected to fuel market growth. For instance, in April 2025, Nvidia reported the ongoing production of Blackwell chips at TSMC facilities in Phoenix, Arizona. NVIDIA has also announced plans to invest up to US$500 billion in AI infrastructure across the U.S. over the next four years. This showcases improved broadband connectivity, increasing the market penetration for GPU database solutions in various sectors in the U.S.

APAC Market Insights

The Asia Pacific GPU database market is expected to witness the fastest expansion throughout the anticipated timeline, attributed to accelerated digital transformation efforts across the region. APAC is experiencing considerable investments in cloud infrastructure, particularly in big data analytics. In 2023, government reports from Japan’s Ministry of Internal Affairs and Communications emphasized strong subsidies for AI adoption across various sectors, which in turn creates ample opportunities for the deployment of GPU databases. Additionally, Southeast Asian countries such as Malaysia and Indonesia are leveraging GPU databases against the backdrop of the expansion of digital payment ecosystems and e-commerce.

The China GPU databases market is slated to maintain a dominant revenue share throughout the forecast period. The government-driven digital sovereignty initiatives drive the China GPU database market. According to China’s Ministry of Industry and Information Technology (MIIT) report 2023, several investments were made to improve AI infrastructure. Such investments create favorable opportunities for GPU database deployment. For instance, Chinese tech giants including ByteDance, Alibaba Group, and Tencent Holdings have reportedly placed orders worth over $16 billion for Nvidia’s H20 server chips during the first quarter of this year. Additionally, China’s aggressive push for digital economy reforms is predicted to boost GPU database integration.

Europe Market Insights

The GPU market in Europe is likely to register rapid growth during the forecast period rising demand for high-performance computing and real-time data processing technologies across several sectors, including finance, telecom, energy, and IoT. Several data centers in Europe are also focused on expanding GPU compute capacity. This is expected to fuel the demand for GPU databases in the coming years. The European Commission and national programs are allocating major capital to build large GPU clusters and AI factories to reduce the reliance on overall foreign cloud providers and chips. Moreover, several banks, payment firms, and insurers are adopting GPU acceleration for fraud detection and risk models that require low latency.

Germany is at the forefront of GPU database adoption in Europe, with a robust digital economy and a strong emphasis on AI and cloud computing. In 2024, the market for developing, training, and operating AI platforms in Germany increased by 43% to USD 2.5 billion, as reported by Bitkom, Germany’s digital industry association. This surge reflects the growing integration of GPU databases to support AI-driven applications and real-time analytics in sectors such as manufacturing, finance, and telecommunications.