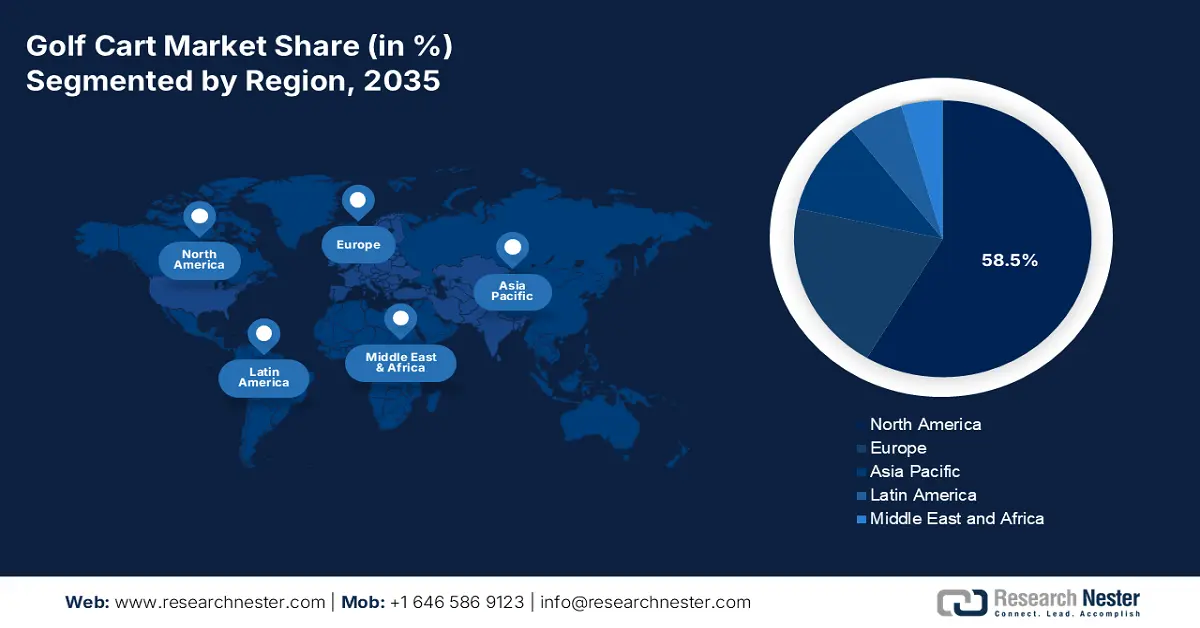

Golf Cart Market - Regional Analysis

North America Market Insights

North America is dominating the market and is expected to hold a revenue share of 58.5% by 2035. The market is transitioning from recreational use to diversified commercial and municipal applications. The key drivers include the replacement of the aging fleets in the golf industry and the rising demand from the non-golf sectors. These sectors include airports, hospitality, university campuses, and industrial complexes for internal logistics. A primary trend is the shift toward electric low-speed vehicles supported by municipal sustainability goals and federal initiatives such as the U.S. Department of Energy’s focus on clean transportation technology. Regulatory standards from the National Highway Traffic Safety Administration ensure vehicle safety for on-road use, further enabling the adoption in planned communities and urban settings. The market is defined by the technological integration with the rising focus on fleet management software and enhanced battery systems to improve the operational efficiency and total cost of ownership for the B2B clients.

The U.S. golf cart market is defined by the robust demand from both the traditional golf and the expanding non-golf sectors. A primary trend is the rapid adoption of street-legal low-speed vehicles, which is driven by their utility in planned communities, urban environments, and campus settings. The trend is supported by the clear federal regulations from the National Highway Traffic Safety Administration that govern the LSV safety standards. The shift towards electrification is the viral trend supported by the federal initiatives. For example, the Biden-Harris administration announced a USD 400 million grant program to fund clean school buses that reduce emissions and protect children’s health, based on the EPA 2023 report. This data indirectly supports the development and adoption of efficient electric powertrains for specialized vehicles such as golf carts and LSVs. This broader federal emphasis on zero-emission mobility boosts the institutional confidence in electric light-duty platforms, stimulating the procurement cycles for modernized golf carts and LSV fleets across public and private sectors.

The Canada golf cart market demonstrates steady growth and is fueled by the demand from the tourism, industrial, and agricultural sectors, with an increasing focus on all-weather utility vehicles. A significant trend is the alignment of the market evolution with the federal green infrastructure investments, and government spending programs are actively promoting the transition to zero-emission vehicles, including the specialized categories. Notably, via the Electric Mobility Canada data in April 2024, the government has invested USD 608 million over two years starting in 2024-2025, on the iZEV. This funding directly supports the purchase of the incentive program for zero-emission vehicles, such as a golf cart, that includes eligible low-speed electric models used in the commercial and municipal fleets. The businesses and local governments are increasingly incentivized to electrify their internal transport fleets from the resort shuttles to industrial utility vehicles.

APAC Market Insights

Asia Pacific is experiencing a rapid growth in the golf cart market and is expected to grow at a CAGR of 7.1% during the forecast period 2026 to 2035. The market is shifting from the traditional golf-centric model seen in the West. The main driver is the industrial and commercial adoption, where these vehicles are deployed as cost-effective utility vehicles and low-speed transport solutions. In South Korea and China, massive manufacturing complexes, airports, and tech campuses utilize golf carts for internal logistics and personal transport. A significant trend is that the region’s dominance is in battery production, which directly lowers the costs and stimulates the adoption of electric models. Government initiatives are also significant; for example, India’s faster adoption and manufacturing of electric vehicles scheme provides subsidies that make electric utility vehicles more financially viable for businesses and municipalities.

The golf cart market in China is the largest in the APAC and is driven by the commercial and industrial applications rather than recreational golf. These vehicles are deployed extensively as essential utility transport within the country’s vast industrial parks, sprawling airports, tourist zones, and new urban developments. The market’s rapid electrification is heavily supported by the national policy and manufacturing dominance in battery production. The government's spending on the new energy vehicle infrastructure creates a favorable ecosystem. For example, the EIA data in May 2025 depicts that China’s dominance in the global battery exports accounted for 74% of battery pack/component exports and battery cell production for 85% of global capacity, which is closely tied to the golf cart and low-speed vehicle market because electric golf carts rely heavily on imported lithium-ion battery systems. This domestic production advantage significantly lowers costs and accelerates the adoption of electric models across commercial sectors.

The Japan golf cart market is uniquely shaped by its super-aging society and advanced industrial sector. The demand is based on the specialized vehicles for senior mobility in controlled communities and the utility vehicles for large-scale manufacturing plants and logistics hubs. A key driver is the government policy aimed at aiding the elderly and promoting universal design that encourages the use of low-speed personal mobility vehicles to improve independence. This trend relies on demographic pressure. According to the World Economic Forum report in September 2023, the population aged above 65 was 36.23 million in 2023; this number continues to increase. Further, this demographic reality, combined with the stringent industrial efficiency standards, fuels the steady demand for reliable, electric utility vehicles beyond the traditional golf course.

Europe Market Insights

The environmental regulations and a strong shift towards sustainable mobility solutions are defining Europe’s golf cart market. The market is driving the demand beyond the traditional golf course. The prime drivers include the adoption of electric utility vehicles in sectors such as tourism, municipal services, and healthcare. The European Green Deal, aiming for climate neutrality by 2050, incentivizes the replacement of internal combustion engines with zero-emission alternatives in localized transport. This regulatory push is complemented by the substantial public investment. For example, the European Union’s Cohesion Policy sustainable urban mobility projects which is often include the procurement of electric utility vehicles for public transport in restricted zones. Furthermore, major tourist destinations are adopting these vehicles to reduce congestion and emissions in historic city centers and large resorts.

Germany is projected to hold the highest share in the Europe market and is driven by its robust industrial and automotive sector. The primary growth factor is the integration of the utility vehicles for logistics within the large-scale manufacturing complexes, such as the chemical plants and the automotive where zero local emissions are prioritized. According to the European Golf Association report in September 2024, Germany saw a hike in the registered golf players, moving from 683,000 to 725,000. This data highlights the rising demand for golf carts and to promote automation and efficient internal logistics. This focus on optimizing the large-scale industrial operations to ensure a consistently high demand for specialized, electric utility vehicles far exceeds the needs of the traditional golf sector.

France will be the next leading market in Europe and is fueled by the national sustainability policy and public sector procurement. The country’s France Nation Verte ecological planning framework includes a mandate for public authorities to lead by example in the clean vehicle transition. This is creating a consistent demand from the municipalities, airports, and tourist destinations for electric utility vehicles. For example, the French Ecological Transition Agency manages the funding for the local authorities to renew their vehicle fleets with clean alternatives. The data from ADEME shows funding streams specifically for the acquisition of low-emission vehicles, which encompasses the electric utility vehicles used for municipal maintenance, security patrols, and public space management, ensuring a stable and policy-driven market.