Golf Cart Market Outlook:

Golf Cart Market size was valued at USD 3.3 billion in 2025 and is projected to reach USD 7.2 billion by the end of 2035, rising at a CAGR of 8.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of golf cart is assessed at USD 3.5 billion.

The global golf cart market is driven by factors beyond traditional recreational use. The demand indicators for the golf carts are closely linked to the golf facility expansions, public recreational infrastructure, and mobility programs managed by the government and non-profit institutions. According to the National Golf Foundation data in February 2024, the U.S. golf supply is holding relatively steady, with over 16,000 golf courses at approximately 14,000 facilities. This data indicates that there is an urgent requirement for extensive fleet management and replacement cycles. The participation has remained strong with NGF reporting that 3.4 million people played on a golf course in 2023, as per the Golf Industry Central data in November 2024. This data highlights the increased contribution of the higher utilization of the cart fleets at municipal and semi-public facilities.

On the regulatory side, the U.S. Department of Energy has indicated that the rising demand for the adoption of electric low-speed vehicles, which is a category that includes golf cart-type vehicles used for short-distance transportation across the federal campuses. DOE’s Alternative Fuels Data Center noted that various federal sites are adopting electric LSVs for operational transport, reinforcing institutional procurement momentum. The institutional and community-driven applications are also shaping the procurement volumes. The U.S. parks utilize the golf cart-type electric vehicles for maintenance operations, with the public data indicating carts for internal mobility and visitor service. Local governments are rapidly adopting the concept and have integrated electric vehicles and golf cart mobility assets into pedestrian priority zones to reduce emissions and manage short-distance circulation. The Council of Environmental Quality data in 2025 has aligned with broader electrification directives under the federal sustainability goals, where the Federal Sustainability Plan targets 100% zero-emission light-duty vehicles, indirectly encouraging the replacement of fuel-based utility carts.

Key Golf Cart Market Insights Summary:

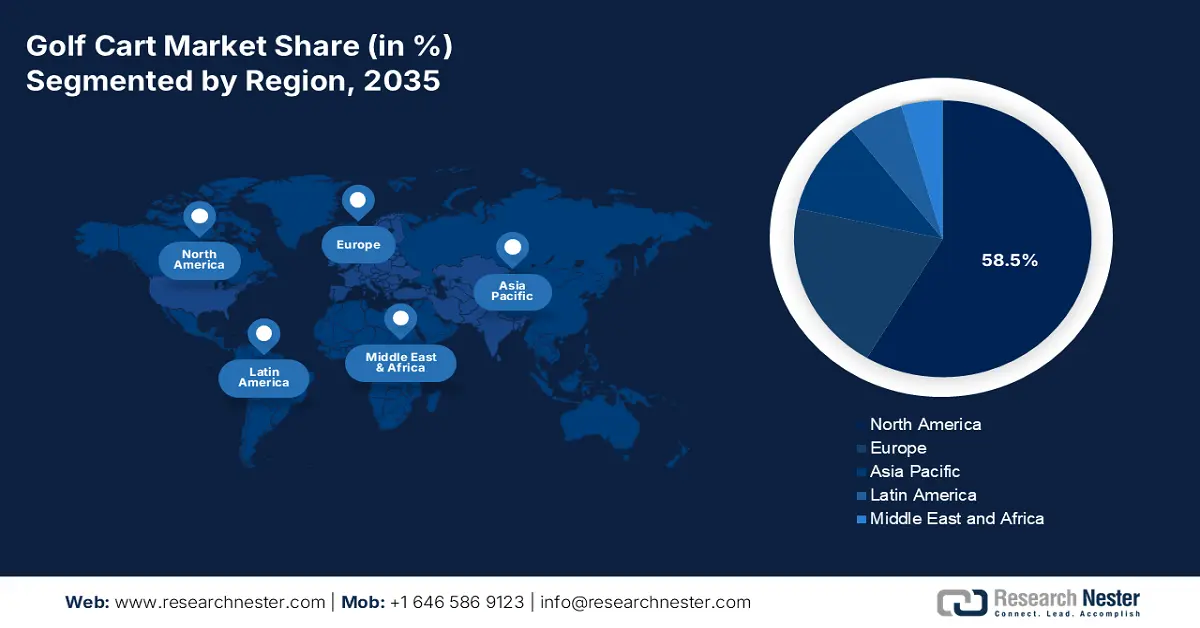

Regional Insights:

- By 2035, North America is projected to secure a 58.5% share of the golf cart market owing to the replacement of aging fleets and rising demand across non-golf commercial sectors.

- Across 2026–2035, Asia Pacific is set to expand at a 7.1% CAGR as the market accelerates on the back of growing industrial and commercial adoption.

Segment Insights:

- In the golf cart market, the electric segment is anticipated to command a 78.6% share by 2035, propelled by supportive government policy.

- Fleet ownership is expected to capture a considerable share by 2035, sustained by bulk procurement from commercial and institutional buyers.

Key Growth Trends:

- Growth of the U.S. golf facility network

- NHTSA safety standards for low speed vehicles

Major Challenges:

- High R&D and production costs

- Intense competition from the top brands

Key Players: Yamaha Golf Cars (Japan), E-Z-GO (U.S.), Garia (Denmark), Polaris (U.S.), HDK (U.S.), Textron Specialized Vehicles (U.S.), Hitachi (Japan), Toyota Motor Corporation (Japan), CitEcar Electric Vehicles (U.S.), STAR EV (U.S.), Goupil (France), GEM (USA), GHC (USA), GolfBoard (U.S.), GMS (U.S.), Nidec Motor Corporation (U.S.), Pihsiang Machinery (Taiwan), KT Pan Pacific (South Korea), Auto Power (India).

Global Golf Cart Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.5 billion

- Projected Market Size: USD 7.2 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (58.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Mexico, Brazil

Last updated on : 3 December, 2025

Golf Cart Market - Growth Drivers and Challenges

Growth Drivers

- Growth of the U.S. golf facility network: The National Golf Foundation data in 2025 depicts that the golf players in the U.S. is rising steadily, with 47.2 million players in 2024. This data demonstrates that there is a high demand for the golf facilities. The public access courses generally maintain a larger fleet of carts due to the higher visitor throughput, creating a recurring procurement cycle for electric and gasoline carts. Further, the increased participation boosts the cart usage volumes, requiring more frequent replacements. This contributes significantly to domestic fleet demand, mainly for course operators adopting electric carts to meet the sustainability targets. This steady demand from core golf operations provides a stable revenue base for manufacturers, allowing them to invest in the research and development of more advanced models for the higher-growth commercial and personal transportation segments.

- NHTSA safety standards for low speed vehicles: The National Highway Traffic Safety Administration regulates LSV under 49 CFR 571.500, defining required safety equipment for the street legal operation, based on the ECFR report in September 2025. This regulatory clarity enables a broader adoption of street-legal golf cards and LSVs in planned communities, universities, and municipal neighborhoods. As more local governments authorize the LSV usage on low-speed roads, demand rises for compliant carts equipped with mirrors, seat belts, lighting, and safety systems. These regulatory frameworks provide manufacturers with stable design paths and encourage fleet expansion.

- Federal and local adoption of electric utility vehicles: Government agencies are establishing a substantial non-cyclical market for the commercial electric golf carts. The U.S. National Park Service, for example, extensively deploys these vehicles for maintenance, logistics, and low-impact visitor transport across its units. The data from the NPS in January 2023 shows a concerted effort to green its fleet with over 425 national park units reporting the use of the light-duty electric vehicles, a category that includes the utility carts and LSVs. This public sector procurement is mirrored by the local governments integrating the LSVs into the pedestrian priority zones to minimize emissions and noise. These consistent procurement behaviors driven by the federal and municipal sustainability mandates create a reliable baseline demand for the manufacturers, insulating a portion of the market from the volatility of the recreational golf sector.

Challenges

- High R&D and production costs: Developing competitive and feature-rich golf carts, mainly on electric models with advanced battery systems, requires a huge capital investment. This includes costs for engineering safety testing and tooling for production lines. New entrants struggle to achieve the economies of scale enjoyed by incumbents such as Textron. For example, sourcing lithium-ion batteries that can constitute a rise in the electric vehicle cost presents a significant financial barrier. Startups must either secure substantial venture capital or accept slower, lower volume production, putting them at an immediate price and innovation disadvantage against the established players who have optimized their supply chains and manufacturing processes over decades.

- Intense competition from the top brands: The market is dominated by the legacy brands with a deep customer loyalty and extensive distribution networks. Club Car, Yamaha, and E-Z-GO have long-term relationships with golf courses and commercial fleets, making it difficult for new suppliers to even be considered for large tenders. A new company must compete not just on the price but on superior technology or a unique value proposition, such as Garia’s success in targeting the luxury resort and personal concierge market with the high-end customizable vehicles, a niche it carved out against the giants.

Golf Cart Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 7.2 billion |

|

Regional Scope |

|

Golf Cart Market Segmentation:

Product Type Segment Analysis

The electric dominates the segment and is poised to hold the share value of 78.6% by 2035. The dominance is driven by lower operating costs, quieter operation, and alignment with the global sustainability mandates. The key driver is the supportive government policy. For example, the U.S Internal Revenue Service provides a clear financial incentive for commercial adoption via the Qualified Plug-In Electric Drive Motor Vehicle Tax Credit. Specifically, for vehicles acquired in 2023, the credit included motorcycles and low-speed vehicles with a credit of 10% of the cost up to USD 2,500, making the initial investment in electric utility fleets more viable for businesses and stimulating the transition from gasoline-powered models, as per the IRS January 2025. This policy-driven financial advantage is further amplified by municipal regulations in many cities that are increasingly mandating zero-emission vehicles for use in controlled zones, creating a regulatory push that complements the financial pull.

Ownership Segment Analysis

Fleet ownership is the leading sub-segment and is estimated to hold a considerable share value by 2035. The segment is driven by the bulk purchases by commercial and institutional entities such as golf courses, resorts, municipalities, and airports. These organizations prioritize total cost of ownership and operational efficiency over individual consumer preferences. The U.S. General Services Administration, which manages the federal vehicle fleet, actively promotes the adoption of alternative fuel vehicles. According to the GSA February 2024 data, GSA has ordered over 5,800 zero-emission vehicles, which is an increase of 63% from FY 2022. This data demonstrates the scale of institutional procurement that characterizes and sustains the fleet ownership model.

Application Segment Analysis

By 2035, commercial services are driving the application segment and are led by the fundamental shift from recreational golf to diverse industrial and service uses. Vehicles are deployed for logistics in manufacturing plants, passenger transport at airports, and security patrols in large complexes. The U.S. Bureau of Labor Statistics data highlights the scale of one key sector is the rising number of ground maintenance workers employed in the U.S. This large workforce often utilizes the utility vehicle for tasks across parks, campuses, and industrial sites, exemplifying the extensive non-golf commercial demand that underpins the segment’s growth. This trend is further accelerated by post-pandemic investments in infrastructure and tourism, with federal acts like the Bipartisan Infrastructure Law funneling capital into public works and airports, sectors that are major procurers of utility vehicle fleets.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Vehicle Type |

|

|

Ownership |

|

|

Seating Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Golf Cart Market - Regional Analysis

North America Market Insights

North America is dominating the market and is expected to hold a revenue share of 58.5% by 2035. The market is transitioning from recreational use to diversified commercial and municipal applications. The key drivers include the replacement of the aging fleets in the golf industry and the rising demand from the non-golf sectors. These sectors include airports, hospitality, university campuses, and industrial complexes for internal logistics. A primary trend is the shift toward electric low-speed vehicles supported by municipal sustainability goals and federal initiatives such as the U.S. Department of Energy’s focus on clean transportation technology. Regulatory standards from the National Highway Traffic Safety Administration ensure vehicle safety for on-road use, further enabling the adoption in planned communities and urban settings. The market is defined by the technological integration with the rising focus on fleet management software and enhanced battery systems to improve the operational efficiency and total cost of ownership for the B2B clients.

The U.S. golf cart market is defined by the robust demand from both the traditional golf and the expanding non-golf sectors. A primary trend is the rapid adoption of street-legal low-speed vehicles, which is driven by their utility in planned communities, urban environments, and campus settings. The trend is supported by the clear federal regulations from the National Highway Traffic Safety Administration that govern the LSV safety standards. The shift towards electrification is the viral trend supported by the federal initiatives. For example, the Biden-Harris administration announced a USD 400 million grant program to fund clean school buses that reduce emissions and protect children’s health, based on the EPA 2023 report. This data indirectly supports the development and adoption of efficient electric powertrains for specialized vehicles such as golf carts and LSVs. This broader federal emphasis on zero-emission mobility boosts the institutional confidence in electric light-duty platforms, stimulating the procurement cycles for modernized golf carts and LSV fleets across public and private sectors.

The Canada golf cart market demonstrates steady growth and is fueled by the demand from the tourism, industrial, and agricultural sectors, with an increasing focus on all-weather utility vehicles. A significant trend is the alignment of the market evolution with the federal green infrastructure investments, and government spending programs are actively promoting the transition to zero-emission vehicles, including the specialized categories. Notably, via the Electric Mobility Canada data in April 2024, the government has invested USD 608 million over two years starting in 2024-2025, on the iZEV. This funding directly supports the purchase of the incentive program for zero-emission vehicles, such as a golf cart, that includes eligible low-speed electric models used in the commercial and municipal fleets. The businesses and local governments are increasingly incentivized to electrify their internal transport fleets from the resort shuttles to industrial utility vehicles.

APAC Market Insights

Asia Pacific is experiencing a rapid growth in the golf cart market and is expected to grow at a CAGR of 7.1% during the forecast period 2026 to 2035. The market is shifting from the traditional golf-centric model seen in the West. The main driver is the industrial and commercial adoption, where these vehicles are deployed as cost-effective utility vehicles and low-speed transport solutions. In South Korea and China, massive manufacturing complexes, airports, and tech campuses utilize golf carts for internal logistics and personal transport. A significant trend is that the region’s dominance is in battery production, which directly lowers the costs and stimulates the adoption of electric models. Government initiatives are also significant; for example, India’s faster adoption and manufacturing of electric vehicles scheme provides subsidies that make electric utility vehicles more financially viable for businesses and municipalities.

The golf cart market in China is the largest in the APAC and is driven by the commercial and industrial applications rather than recreational golf. These vehicles are deployed extensively as essential utility transport within the country’s vast industrial parks, sprawling airports, tourist zones, and new urban developments. The market’s rapid electrification is heavily supported by the national policy and manufacturing dominance in battery production. The government's spending on the new energy vehicle infrastructure creates a favorable ecosystem. For example, the EIA data in May 2025 depicts that China’s dominance in the global battery exports accounted for 74% of battery pack/component exports and battery cell production for 85% of global capacity, which is closely tied to the golf cart and low-speed vehicle market because electric golf carts rely heavily on imported lithium-ion battery systems. This domestic production advantage significantly lowers costs and accelerates the adoption of electric models across commercial sectors.

The Japan golf cart market is uniquely shaped by its super-aging society and advanced industrial sector. The demand is based on the specialized vehicles for senior mobility in controlled communities and the utility vehicles for large-scale manufacturing plants and logistics hubs. A key driver is the government policy aimed at aiding the elderly and promoting universal design that encourages the use of low-speed personal mobility vehicles to improve independence. This trend relies on demographic pressure. According to the World Economic Forum report in September 2023, the population aged above 65 was 36.23 million in 2023; this number continues to increase. Further, this demographic reality, combined with the stringent industrial efficiency standards, fuels the steady demand for reliable, electric utility vehicles beyond the traditional golf course.

Europe Market Insights

The environmental regulations and a strong shift towards sustainable mobility solutions are defining Europe’s golf cart market. The market is driving the demand beyond the traditional golf course. The prime drivers include the adoption of electric utility vehicles in sectors such as tourism, municipal services, and healthcare. The European Green Deal, aiming for climate neutrality by 2050, incentivizes the replacement of internal combustion engines with zero-emission alternatives in localized transport. This regulatory push is complemented by the substantial public investment. For example, the European Union’s Cohesion Policy sustainable urban mobility projects which is often include the procurement of electric utility vehicles for public transport in restricted zones. Furthermore, major tourist destinations are adopting these vehicles to reduce congestion and emissions in historic city centers and large resorts.

Germany is projected to hold the highest share in the Europe market and is driven by its robust industrial and automotive sector. The primary growth factor is the integration of the utility vehicles for logistics within the large-scale manufacturing complexes, such as the chemical plants and the automotive where zero local emissions are prioritized. According to the European Golf Association report in September 2024, Germany saw a hike in the registered golf players, moving from 683,000 to 725,000. This data highlights the rising demand for golf carts and to promote automation and efficient internal logistics. This focus on optimizing the large-scale industrial operations to ensure a consistently high demand for specialized, electric utility vehicles far exceeds the needs of the traditional golf sector.

France will be the next leading market in Europe and is fueled by the national sustainability policy and public sector procurement. The country’s France Nation Verte ecological planning framework includes a mandate for public authorities to lead by example in the clean vehicle transition. This is creating a consistent demand from the municipalities, airports, and tourist destinations for electric utility vehicles. For example, the French Ecological Transition Agency manages the funding for the local authorities to renew their vehicle fleets with clean alternatives. The data from ADEME shows funding streams specifically for the acquisition of low-emission vehicles, which encompasses the electric utility vehicles used for municipal maintenance, security patrols, and public space management, ensuring a stable and policy-driven market.

Key Golf Cart Market Players:

- Club Car (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Yamaha Golf Cars (Japan)

- E-Z-GO (U.S.)

- Garia (Denmark)

- Polaris (U.S.)

- HDK (U.S.)

- Textron Specialized Vehicles (U.S.)

- Hitachi (Japan)

- Toyota Motor Corporation (Japan)

- CitEcar Electric Vehicles (U.S.)

- STAR EV (U.S.)

- Goupil (France)

- GEM (USA)

- GHC (USA)

- GolfBoard (U.S.)

- GMS (U.S.)

- Nidec Motor Corporation (U.S.)

- Pihsiang Machinery (Taiwan)

- KT Pan Pacific (South Korea)

- Auto Power (India)

- Club Car is dominating the golf cart market and uses its reputation for durability by focusing on the commercial and utility clients. Their key strategy involves integrating smart technologies and fleet management software into their vehicles. This allows the golf courses, resorts, and large facilities to optimize their operations, track vehicle health, and reduce the costs of securing long-term B2B contracts and reinforcing their premium brand positioning.

- Yamaha’s strategy in the golf cart market capitalizes on its global engineering and manufacturing prowess. They focus on continuous innovation in the powertrain efficiency, introducing quieter and more powerful electric motors. By expanding their product line to include a wider range of utility and personal vehicles, they diversify their revenue streams beyond the traditional golf courses. The revenue increased by 4.1% YoY due to the increased sales of golf cars.

- E-Z-GO is a key player in the market and is aggressively pursuing market expansion via product diversification and technology integration. Their strategic initiatives include developing street-legal low-speed vehicles and improving the user experience with digital displays and connectivity features. By targeting both the consumer retail market and the commercial fleet, the company builds brand loyalty and adapts to the demand for personal transportation.

- Garia in the golf cart market has a unique strategy that is aimed at the premium and luxury segments. They differentiate their products via high-end customization, superior materials, with a unique design, including the renowned Garia Mansory edition. This approach targets affluent consumers and exclusive resorts, creating a niche that commands higher margins and is less susceptible to price-based competition from mass market manufacturers.

- Textron Specialized Vehicles is a vital player in the golf cart market and uses its powerful brand portfolio, which includes industry giants, to execute a multi-faceted growth strategy. Their key initiatives aim at deep vertical integration and technological innovation to enhance vehicle connectivity, battery life, and software-driven fleet management solutions for commercial clients. The company’s revenue was approximately USD 13.7 billion in 2024.

Here is a list of key players operating in the global market:

The global golf cart market is very competitive and is dominated by the established players in Japan and the U.S., such as the E-Z-GO and Yamaha. The competitive environment is defined by the intense rivalry with key players adopting strategic initiatives to expand their market share. These strategies include significant investment in research and development to launch more efficient connected and autonomous vehicles. There is a strong focus on diversifying into the burgeoning low-speed electric vehicle and personal utility markets beyond the golf course. Furthermore, the key players are pursuing strategic acquisitions, expanding their global distribution networks, and forming technology partnerships to improve their product portfolios and geographic reach. For example, in December 2024, Cart Mart, Inc. announced its acquisition of Rainbow Custom Cars (RCC), which is an established golf car and utility vehicle dealership doing business in Southern California since 1998.

Corporate Landscape of the Golf Cart Market:

Recent Developments

- In March 2025, Club Car’s next‑generation Tempo golf car was announced with upgraded features such as an automatic park brake, redesigned dash, and enhanced storage.

- In September 2024, MadJax has announced the launch of the APEX Brush Guard, which is designed for the EZGO RXV (2008-2022). This latest innovation sets the standard for golf cart accessories by combining aggressive styling and durability.

- Report ID: 1216

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Golf Cart Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.