Pregnancy Test Kit Market Outlook:

Pregnancy Test Kit Market size was valued at USD 2 billion in 2025 and is projected to reach USD 3.4 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pregnancy test kit is estimated at USD 2.1 billion.

The market is expanding rapidly and is driven by the rising awareness of early detection of pregnancy, affordable and reliable testing kits, and a rise in infertility cases. As per the NHSRC report in 2021, pregnancy test kits are mostly used by the female population between the ages of 18 to 35, and this age is considered the best timing for pregnancy. Pregnancy test kits are considered a feasible and acceptable option among couples who are expecting their pregnancies. Further, instead of totally depending on ultrasound these pregnancy test kits aid to confirm pregnancy, and are safety, effective, and acceptable among wide population.

The acceptance of pregnancy test kits rises YoY across the globe. Further, pregnancy test kits also support in identifying unintended pregnancies. As per the UNFPA article published in March 2022, nearly 121 million pregnancies in the world, which is half of the pregnancies are unplanned. Moreover, 60% of unintended pregnancies end in abortion, impacting the demand for pregnancy test kits. As these kits are cost-effective and ease to use, they also increase the kits sales. The Israel21c report published in March 2024 states that Salistick is the world’s first saliva-based pregnancy home test kit, in the market of Israel. The sales of the kit have crossed 285 branches in Israeli multinational pharmacy and on its website, at 24.90 NIS (USD 6.95).

Key Pregnancy Test Kit Market Insights Summary:

Regional Highlights:

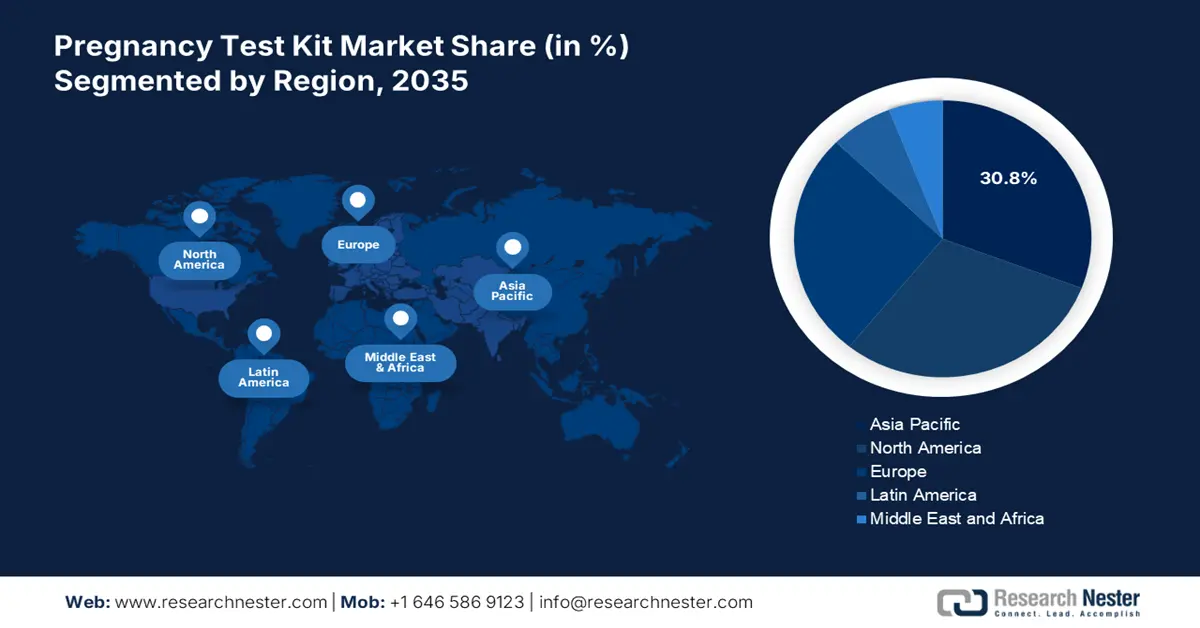

- By 2035, Asia Pacific is anticipated to capture 30.8% share in the pregnancy test kit market at a CAGR of 7.9%, underpinned by the increased incidence of unplanned pregnancies.

- By 2035, North America is projected to hold 30% share at a CAGR of 6.6%, fostered by strong awareness among reproductive women.

Segment Insights:

- The home care setting segment in the pregnancy test kit market is projected to secure a 63% share by 2035, propelled by increasing awareness of self-testing.

- By 2035, urine-based pregnancy test kits are anticipated to command a 57.4% share, supported by rising awareness and education.

Key Growth Trends:

- Ease use of kits

- Rising pregnancy rates

Major Challenges:

- Mistrust in the accuracy

Key Players: SPD Swiss Precision Diagnostics GmbH, Church & Dwight Co., Inc., ACON Laboratories, Inc., Piramal Healthcare, Rohto Pharmaceutical Co., Ltd., Prestige Brands Holdings, Inc., JAL Innovation (JAL Group), Artron Laboratories Inc., BioSure (UK) Ltd., BTNX Inc., InTec Products, Inc., Atlas Medical, Nulife Care, Everlywell, Inc., PTS Diagnostics, Hangzhou AllTest Biotech Co., Ltd., Medisign Diagnostic, Green Cross Medical Science, LifeSign LLC, Abon Biopharm Co., Ltd.

Global Pregnancy Test Kit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Mexico, South Korea, Turkey

Last updated on : 26 September, 2025

Pregnancy Test Kit Market - Growth Drivers and Challenges

Growth Drivers

- Ease use of kits: Pregnancy test kits are ease to use, and most of the women find and prefer them a convenient technique to check and analyze their pregnancy status at the initial stage. Most of the women, both in developed and developing countries, prefer pregnancy test kits as the initial and a comfort method, and hence avoid hospital visits and save time. According to the NLM article published in August 2023, the pregnancy test kits provide 99% accurate results, and some test kit brands provide the number of weeks of in pregnancy. This test at home usually takes less than 3 minutes to check the results, as per the first response pregnancy kit product.

- Rising pregnancy rates: As per the World Family Planning 2022 report, in 41 countries, nearly half of women who want to avoid pregnancies use modern pregnancy test kits. Further in Sub-Saharan Africa, 22 countries are exhibiting this modern method, contributing to the demand for the market. Further, the awareness of the intended pregnancies among the female population drives the demand for the use of these kits. Government-led initiatives and campaigns are promoting awareness and surging the adoption of test kits in emerging regions.

- Increased accessibility driving market: The pregnancy test kits are available in pharmacies, supermarkets, and e-commerce platforms, hence surging the market growth. Companies like Amazon, Walmart, and CVS provide options for online purchases. Further, most of the women feel compelled to buy pregnancy test kits online. As per the WRC report published in May 2024, the cost of pregnancy test kits usually ranges from USD 1 to USD 15. Further, in developing countries, low-cost test kits are provided to the local market in pharmacies to increase access among the young and rural population.

Annual Growth Rate of Female Population Demanding the Market

|

Year |

Rural |

Urban |

Total Population |

Average Annual Exponential Growth Rate |

|

2001 |

360.95 |

135.57 |

496.51 |

1.99 |

|

2011 |

405.97 |

181.62 |

587.58 |

1.69 |

|

2016 |

422.80 |

204.09 |

626.89 |

1.30 |

|

2021 |

436.25 |

226.13 |

662.38 |

1.10 |

|

2026 |

446.47 |

247.36 |

693.83 |

0.93 |

Source: MOSPI,2024

Challenges

- Mistrust in the accuracy: As per the frontiers report, many illiterate women and a lack of trust in the accuracy issues were not motivated to use the pregnancy test kits. The report has also stated that trust issue is a great barrier to self-testing. Some women also think that the kits give abnormal results and don’t give an exact response. Further, cultural beliefs and a lack of awareness about how the kits work further contribute to disbelief. Without proper education and reassurance from healthcare providers, women may not rely completely on home pregnancy tests to confirm their pregnancies.

Pregnancy Test Kit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

Pregnancy Test Kit Market Segmentation:

End user Segment Analysis

In the end user segment, the home care setting leads the segment and is expected to hold the share value of 63% by 2035. The segment is driven by increasing awareness of self-testing, user-friendly devices that can be checked at home, early detection of results, and the preference for confidentiality. According to the NLM article published in February 2022 on self-testing for pregnancy states that nearly 76.7% of women prefer to use home-based pregnancy test kits, and 84.9% suggest both home pregnancy test kits and hospital visits. Further, with the advancement in technology, with integration of Bluetooth in these kits surge the adoption of home care settings by providing real-time results and tracking features.

Product Type Segment Analysis

In the product type segment, urine-based pregnancy test kits fuel the segment and are expected to hold the share value of 57.4% by 2035. The segment is driven by the rising awareness and education, early detection and accuracy, cost-effectiveness, and easily accessible. Further, innovations such as rapid detection strips and digital readouts, are further boosting convenience. As per the UT South Western Medical Center article published in June 2022, in modern days, women validate their pregnancy results via urine-based pregnancy test kits and provide 70% accuracy in detecting human chorionic gonadotropin (hCG).

Technology Segment Analysis

Under the technology segment, lateral flow assay dominates the segment and is expected to hold a share value of 54.5% by 2035. Lateral flow assays are mostly used due to their low cost, ease of use, and rapid format, as stated in ACS publications in February 2021. Lateral flow assays are paper-based POC devices used as an effective testing method for on-site detection and quantification of biomarkers, such as proteins, small molecules, nucleic acids, or any other specific substance from a range of biological materials, including blood, urine, saliva, and many other types.

Our in-depth analysis of the pregnancy test kit market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Product Type |

|

|

Distribution Channel |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pregnancy Test Kit Market - Regional Analysis

APAC Market Insights

The pregnancy test kit market is dominating the Asia Pacific region and is anticipated to hold the market share of 30.8% at a CAGR of 7.9% by 2035. The market is inspired by the increased incidence of unplanned pregnancies, affordability, and accessibility. The importance of early pregnancy detection in reducing maternal health risks is underscored by the WHO report in April 2025 that every 2 minutes, a maternal death takes place. According to the UNICEF report in November 2024, almost 2.2 million births in the region are among adolescent girls as a result of unwanted pregnancies. Governments in APAC are encouraging affordable home testing options to fill gaps in healthcare infrastructure.

The pregnancy test kit market in India is growing rapidly due to the at-home testing solutions, and 1 in 7 pregnancies in India are unplanned pregnancies in the population of 12.1 crore, as depicted by the UNFPA report in 2022. The report also depicts that most of the pregnancies, almost 60% of it, end in abortion, and they are due to unintended pregnancies. Further, government initiatives under NGOs and the National Health Mission are enhancing the affordability of pregnancy kits in rural areas. People also suggest the kits for accurate results. The market is also driven by various emerging online sites and digital health platforms to broaden the distribution and enhance accessibility.

Fertility Rate per Women

|

Country |

2021 |

2022 |

2023 |

|

India |

2 |

2 |

2 |

|

China |

1.1 |

1 |

1 |

|

Japan |

1.3 |

1.3 |

1.2 |

|

Malaysia |

1.6 |

1.6 |

1.6 |

Source: World Bank Data, 2025

North America Market Insights

North America in the pregnancy test kit market is the fastest-growing region and is projected to hold the market share of 30% at a CAGR of 6.6% by 2035. The region is driven by strong awareness among reproductive women and advancements in technology. The government agencies and non-profit organizations in the region are promoting people to use FDA-approved home test kits for pregnancy detection. The pregnancy age and knowledge among women drive the pregnancy self-testing widely. As per the NLB article published in February 2022, the survey report states that 99% of the people in the survey are acceptable and aware of the pregnancy test kits. The region is also driven by the advancements in healthcare infrastructure, allowing distribution via supermarkets, pharmacies, and other platforms.

The U.S. pregnancy test kit market is fueled by the rate of convenience, increasing digital health technologies developments, and home testing options. The availability of test kits in pharmacies, supermarkets, and online sites has opened up a wider reach. In addition, digital technologies like connected devices and app-based monitoring are gaining popularity. The Public health campaigns propel awareness, primarily among young females, whereas technologies like smartphone-connected tests are increasingly broadening their application. The main goal of the program is to improve self-test kit’s availability and affordability.

Fertility Rate per Women

|

Country |

2021 |

2022 |

2023 |

|

U.S. |

1.7 |

1.7 |

1.6 |

|

Canada |

1.4 |

1.3 |

1.3 |

Source: World Bank Data, 2025

Europe Market Insights

The pregnancy test kit market in Europe is projected to hold a market share of 26.5% at a CAGR of 6.2% by 2035. The home-enabled test kits in Europe have seen a drastic surge post COVID-19, including pregnancy test kits. The market in Europe is fueled by the awareness and early family planning. As per the University of Helsinki, published in January 2022 depicts that in Europe, nearly 65 million home pregnancy test kits are sold every year. This surge is further supported by EU4Health and national programs promoting self-care diagnostics to reduce strain on primary healthcare systems.

The UK pregnancy test kit market is demanding the market by rising advancements in test kits, awareness of early detection, and user-friendliness to consumers. The modern testing methods have improved the sensitivity and reliability, resulting in an accurate outcome with human chorionic gonadotropin hormones. Modern innovations such as on July 2022, Hoopsy launched a recyclable pregnancy test kit made of 99% paper, providing 99% accurate results and being plastic-free. People in the UK mostly depend on this eco pregnancy test. By providing enhanced features and support in monitoring and awareness, people totally rely on these kits and demand the market.

Key Pregnancy Test Kit Market Players:

- SPD Swiss Precision Diagnostics GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Church & Dwight Co., Inc.

- ACON Laboratories, Inc.

- Piramal Healthcare

- Rohto Pharmaceutical Co., Ltd.

- Prestige Brands Holdings, Inc.

- JAL Innovation (JAL Group)

- Artron Laboratories Inc.

- BioSure (UK) Ltd.

- BTNX Inc.

- InTec Products, Inc.

- Atlas Medical

- Nulife Care

- Everlywell, Inc.

- PTS Diagnostics

- Hangzhou AllTest Biotech Co., Ltd.

- Medisign Diagnostic

- Green Cross Medical Science

- LifeSign LLC

- Abon Biopharm Co., Ltd.

The global pregnancy test kit market is very competitive and led by the key players such as SPD Swiss Precision Diagnostics and Church & Dwight Co., Inc. The market is aided by domestic manufacturers. Strategic initiatives by the manufacturers, such as AI-powered mobile integration, digital pregnancy test development, public health procurement integrations, and direct-to-consumer expansions, enable them to be competitive. Leading companies are actively investing in high-sensitivity kits and e-commerce channels to retain urban and semi-urban customers. Players in Malaysia and India are aiming for cost-effective, large-scale distribution in rural healthcare programs.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, Abingdon Health plc joined with Salignostics and Crest Medical to launch a saliva pregnancy self-test in the UK and online. The launch has allowed people to experience a new way to confirm their pregnancy and is expected to reach USD 56.7 million by 2033.

- On January 2024, Invitae sold its reproductive health assets to Natera. Further, Natera has paid USD 52.5 million on reproductive health sales, including carrier screening and noninvasive prenatal screening.

- Report ID: 97

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pregnancy Test Kit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.