Cochlear Implant Market Outlook:

Cochlear Implant Market size was over USD 3.5 billion in 2025 and is estimated to reach USD 6.1 billion by the end of 2035, expanding at a CAGR of 6.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of cochlear implant is evaluated at USD 3.7 billion.

The worldwide increase in hearing loss cases, which is highly attributed to aging, noise pollution, chronic ear infections, and ototoxic medications, is a major growth factor in the market. Testifying to the demography, in 2025, the World Health Organization (WHO) unveiled that more than 430 million people living across the globe require rehabilitation to address their disabling hearing loss. It also predicted this figure to reach 700 million by 2050, with 2.5 billion individuals suffering from some degree of hearing loss. As cochlear implants (CI) offer a highly effective solution for patients with such severe-to-profound impairment, this epidemiology is fueling demand in this sector.

Moreover, as more people seek treatment, especially in middle- and high-income countries, adoption in the market continues to rise. The current payers’ pricing dynamics for CI vary widely across public and private medical service and insurance providers. Displaying these substantial discrepancies, a 2023 NLM analysis revealed that the total cost of MED-EL CI devices in private payer-negotiated hospitals stood at USD 38,478 ± 2633. In contrast, the same for Cochlear Ltd. produced CI was USD 34,150 ± 2418, with an average sales price of USD 24,649. This scenario underscores the risk of restrictive financial burden on both patients and distribution channels, necessitating a standardized and equitable payers’ pricing structure in all settings.

Key Cochlear Implants Market Insights Summary:

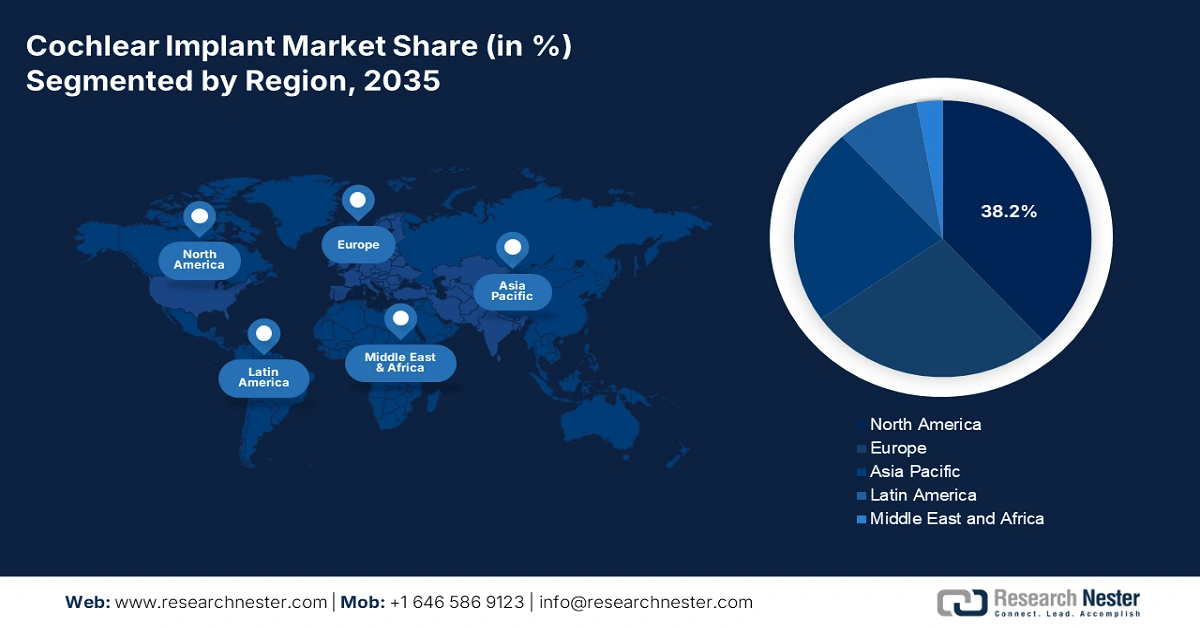

Regional Highlights:

- North America is anticipated to lead the cochlear implant market by capturing a 38.2% share by 2035, driven by a growing patient population, evolving reimbursement policies, and widespread awareness of advanced implant technologies.

- Asia-Pacific is projected to be the fastest-growing region by 2035, fueled by rising awareness of hearing loss, improving healthcare systems, favorable government initiatives, and the presence of global and regional implant manufacturers.

Segment Insights:

- In the components segment, the internal implant is forecast to hold the highest share of 58.7% by 2035, reinforced by technological complexity, ongoing innovation, and the cycle of surgical replacement.

- Within the patient group segment, the pediatric population is set to capture 65.9% of the market by 2035, propelled by early intervention requirements and high global demand for hearing rehabilitation.

Key Growth Trends:

- Treatment-related economic impacts and advantages

- Integration of next-generation technologies

Major Challenges:

- Reimbursement complexities and limitations

- Budget and resource-constrained landscapes

Key Players: MED-EL, Advanced Bionics, Oticon Medical, Nurotron Biotechnology Inc., Listent Medical Co., Ltd.

Global Cochlear Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Cochlear Implant Market - Growth Drivers and Challenges

Growth Drivers

- Treatment-related economic impacts and advantages: Where the financial exhaustion and productivity loss from hearing impairment are amplifying, the remarkable recovery from timely intervention is collecting greater return-on-investment (ROI) for investors and manufacturers in the cochlear implant sector. As evidence, the WHO calculated the annual global cost of unaddressed hearing loss (HL) to be USD 1.0 trillion till 2023. The organization further presented the potential of investing USD 1.0 in ear and hearing care service escalation worldwide to produce USD 16.0 in ROI over a 10-year tenure.

- Integration of next-generation technologies: Ongoing R&D cohorts around the world in electrode arrays, signal processing, and biocompatibility are enabling better performance and patient outcomes for the existing pipeline of the cochlear implant market. Specifically, AI-oriented innovations are showing lucrative business opportunities by delivering improved sound processing, noise filtering, wireless connectivity, and speech recognition. For instance, in October 2024, Starkey developed an intelligent hearing technology, Edge AI, that can transform the approach to unparalleled patient care with G2 Neuro Processor, Bluetooth Low Energy (LE) Audio, and Auracast broadcast streaming.

- Expanding applications in geriatric populations: The rapid aging of the global demography is enlarging the consumer base of the market, as hearing loss (presbycusis) becomes highly prevalent and disabling among these individuals. Testifying to the same, a 2023 NLM study recorded over 80% incidence rate of hearing loss among individuals aged 80 and over. On the other hand, according to the WHO estimations, the population aged 60 and above is expected to reach 1.4 billion by 2030 and double by 2050. These figures indicate the growing need for improved implant technologies available in this sector to cater to the geriatric epidemiology.

Dynamics of the Patient Pool of the Key Landscapes in the Market

Availability Analysis of CI-related Services in the U.S.

(2021-2023)

|

Region Division |

Number of CI Candidates |

Number of O&N Providers |

Candidates Per Provider |

|

East North Central |

242,133 |

68 |

3,361 |

|

East South Central |

97,695 |

25 |

3,712 |

|

Mid Atlantic |

230,222 |

68 |

3,259 |

|

Mountain |

120,157 |

36 |

3,140 |

|

New England |

83,552 |

28 |

2,868 |

|

Pacific |

271,449 |

79 |

3,317 |

|

South Atlantic |

355,542 |

90 |

3,800 |

|

West North Central |

106,853 |

37 |

2,703 |

|

West South Central |

182,238 |

50 |

3,455 |

|

National |

1,613,178 |

481 |

3,354 |

Source: NLM

Comparative Analysis of Trends in Adoption Rates, Economy, and Clinical Advantages in the Market

Recent Clinical Studies on Cochlear Implants

|

Study Motive |

Study Focus / Design |

Key Outcomes or Notes |

Year |

|

Evaluating the Effectiveness of Fully Implanted Acclaim Cochlear Implant |

Prospective, pivotal trial of a totally implanted, microphone-free cochlear implant |

All 10 participants in the 1st stage completed a one-month follow-up; no serious adverse events reported; company accelerating expansion and commercialization plans |

2025 |

|

Dexamethasone-Eluting CI Electrodes (CIDEXEL) |

Obtain confirmatory data concerning the safety and performance of this investigational device |

Intended to improve hearing outcomes while reducing complications |

2024-2026 |

|

Effect of Cochlear Implants on Tinnitus |

Prospective mixed-longitudinal cohort study measuring CI effect on tinnitus |

58% and 44% reduction in tinnitus loudness and handicap inventory within 24 months of CI usage |

2024 |

|

The impact of Socioeconomic Status (SES) in CI Candidacy |

Retrospective cohort on socioeconomic status among CI candidates & surgery patterns |

Individuals with higher SES are less likely to qualify for CI; however, those who qualify are more likely to undergo surgery compared to those with lower SES |

2023 |

Source: Company Press Release, NLM, and Clinicaltrials.gov

Challenges

- Reimbursement complexities and limitations: Due to the high upfront costs of CI systems available in the cochlear implant industry, adequate financial backing networks are essential to attain maximum adoption. However, a majority of the public payers in the world offer limited coverage for these tools and services, restricting accessibility in this sector. In this regard, a 2024 NLM study unveiled that only 21% adults and 36% children in the U.S. requiring CI surgery are covered by Medicaid, where it only provides backing for 10% of the CI-related expenses, totaling USD 80-100 thousand.

- Budget and resource-constrained landscapes: Most of the public healthcare settings, particularly in low- and middle-income countries (LMICs), are unable to afford the advanced diagnostic and surgical infrastructure and workforce. This financial reality forces governing authorities of these landscapes to make difficult prioritization decisions, often leaving products and services from the market underfunded. As a solution, the 2023 cross-sectional NLM study suggested centralized distribution of CI devices in hospitals to achieve a USD 5000 reduction in negotiated pricing.

Cochlear Implant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 6.1 billion |

|

Regional Scope |

|

Cochlear Implant Market Segmentation:

Component Segment Analysis

The internal implant component is expected to retain the highest share of 58.7% in the cochlear implant market by the end of 2035. The technologically complex nature, high material cost, and the necessity for surgical replacement after a certain time create a cycle of revenue generation for this component. Moreover, the involvement of a wide range of biocompatible elements broadens the scope of securing profitable cash inflow in this segment. Currently, the trend of miniaturization is pushing the merchandise for ongoing innovation in internal components that enable more precise neural stimulation and reduced invasiveness, contributing to the consolidation of a forefront position in this field.

Patient Type Segment Analysis

The pediatric group of patients is predicted to dominate the consumer base of the cochlear implant market with a 65.9% share throughout the assessed timeframe. The large population of this demography, where approximately 34 million children worldwide required rehabilitation to address their disabling hearing loss in 2025, presents a strong testimony against its leadership in this sector. Besides, early intervention being critical to restore or prevent deafness cultivates a non-discretionary demand and adoption of CI in this category. As evidence, a 2025 NLM study unveiled that CI utilization is predominantly observed among children, accounting for 50% compared to 10% in adults.

End user Segment Analysis

Hospitals & ENT clinics are poised to maintain their dominance over the cochlear implant market over the discussed timeline, while accounting for 72.5% share. These healthcare facilities serve as the central body of hearing-related assessments, including diagnosis, surgical implantation, and post-operative rehabilitation. As a result, these service providers become the biggest source of revenue procurement in this sector by offering specialized expertise and infrastructural support. Moreover, the concentration of experienced audiologists, surgeons, and associated staff in hospitals and ENT clinics solidifies its proprietorship in this field with high-quality care and comprehensive patient management.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Patient Type |

|

|

End user |

|

|

Technology |

|

|

Sound Processor Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cochlear Implant Market - Regional Analysis

North America Market Insights

North America is anticipated to stand as the leading region in the global cochlear implant market during the analyzed tenure by capturing the highest share of 38.2%. The enlarging patient population and evolving reimbursement policies are collectively securing the forefront region’s position in this sector. The widespread awareness of advanced implant technologies, accomplished through comprehensive newborn hearing screening programs, is also widening the domestic consumer base in this category. The improved regulatory pathway further cultivates a favorable atmosphere for the merchandise in North America, which can be exemplified by the FDA clearance for a new indication of MED-EL hearing implants for adults with bilateral moderate-to-profound sensorineural hearing loss in November 2024.

Extension of public insurance coverage and increased adoption are the major factors that position the U.S. at the forefront of the regional market. In this regard, the recent updates from the A.T. Still University (ATSU) revealed that around 118,100 adults and 65,000 children nationwide already implanted these prostheses in 2022. It further mentioned that approximately 1 in 1,000 and 2-3 in 1,000 babies bron in the U.S. had profound deafness and partial hearing loss, respectively, in 2025. This epidemiology contributes to substantial demand for easier access and affordability in this sector, fueling consistent growth in this landscape.

Continuous public investments in the enhancement of national elderly and infant care facilities are the primary growth engine of the Canada cochlear implant market. Besides, the large pool of experienced ENT specialists and audiologists solidifies a strong consumer base for his sector. Further, evidence of government efforts includes the promising milestones from the nationwide initiative to establish universal newborn hearing screening (UNHS) programs in 2023, where Ontario and British Columbia attained commendable 94% and 97% screening rates for hearing loss.

APAC Market Insights

Asia Pacific is estimated to become the fastest-growing region in the global cochlear implants market by the end of 2035. Particularly in emerging economies, such as China and India, the rising awareness of hearing loss, improving healthcare systems, and favorable government initiatives are establishing a lucrative business environment for this sector. Besides, a large pediatric and elderly patient population is contributing to higher demand for CI systems and accessories. On the other hand, the presence of both global and regional implant manufacturers is improving accessibility and affordability, positioning APAC as a key growth engine of the global market.

China is one of the biggest landscapes in the Asia Pacific cochlear implant market, which is backed by strong government healthcare initiatives and a large untreated demography of hearing loss. On the other hand, national programs, such as the Neonatal Hearing Screening Project, and public subsidies are escalating early diagnosis rates and treatment access, particularly in urban and semi-urban areas. The country also hosts several domestic manufacturers, making implants more affordable compared to imported systems.

India is presenting itself as the most promising opportunity for robust expansion in the regional market. Specifically, the enactment of the Assistance to Disabled Persons (ADIP) Scheme is boosting pediatric adoption in the country by enabling free CIs to eligible children from low-income families. Several medical and research institutions are also participating in this cohort to support widespread access in this sector. For instance, in February 2023, Lilavati Hospital and Research Centre launched its advanced Surgically Implantable Hearing Device Program to help children who are deaf or hard of hearing regain 100% hearing.

Country-wise Industry Highlights

|

Country |

Highlights/Key Points |

Timeline |

|

India |

Army Hospital conducted 50 bilateral simultaneous CIs in just 18 months; the Cochlear Implant Scheme (up to USD 6817.9 allocation for eligible children aged 5-6 years) |

2023; 2024 |

|

China |

Bulk procurement of 11.0 thousand CIs; over 100 thousand people CI surgery conducted nationwide from |

2024; 1995 to 2024 |

|

Australia |

USD 137,872 awarded to a project on diagnostics in cochlear implant recipients to better understand the healing process |

2024 |

Source: PIB, COV.CN, and Ear Science Institute Australia

Europe Market Insights

Europe is predicted to show steady progress in the global cochlear implant market throughout the tenure from 2026 to 2035. State-of-the-art medical systems, rigorous newborn hearing screening, and expanded insurance coverage across are cumulatively fueling the region’s consistent performance in this sector. National health programs that cover the cost of both implantation and post-operative rehabilitation are also making the treatment widely accessible. Moreover, the region is home to some of the leading cochlear implant manufacturers, indicating continuous innovation and clinical research, which secures the future progress of Europe in the field.

The amplifying geriatric population and a concentrated focus on MedTech innovation are making Germany a mature yet steadily expanding landscape for the Europe market. According to the findings from the Gutenberg Health Study, published in 2023, the occurrence rate of hearing loss in at least one ear among residents of Germany crossed 40.6%, where people aged between 60 and 89 years were the most prevalent demographic. Further, the NLM reported that the count of individuals aged 65 and above in Germany totaled 18.6 million in 2022, with 6.1 million of them being 80 years and older.

The UK is a prominent landscape of the Europe cochlear implant market, empowered by the consistent financial backing from the National Health Service (NHS). The country is also home to a well-established medical system that offers advanced newborn hearing screening facilities, ensuring early detection and timely intervention. Particularly in pediatric cases, specialist implant centers across the country offer comprehensive care, from assessment to post-implant rehabilitation, encouraging a large volume of parents to invest in this category. Besides, strong clinical guidelines from the National Institute for Health and Care Excellence (NICE) cultivate equitable access to implants.

Country-wise Feasible Opportunities for the CI Market

|

Country |

Key Opportunity |

Timeline |

|

UK |

12 million people nationwide were deaf or have hearing loss or tinnitus |

2022-2023 |

|

Italy |

38% of residents aged 74 were suffering from self-declared HL |

2024 |

|

France |

HAS and the French Ministry of Health dedicated resources to identify tools for improving the national newborn screening programme for permanent bilateral HL |

2022 |

Source: Gov.UK, Hearing Health Forum EU, and HAS

Key Cochlear Implant Market Players:

- Cochlear Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MED-EL

- Advanced Bionics

- Oticon Medical

- Nurotron Biotechnology Inc.

- Listent Medical Co., Ltd.

The competitive landscape of the market features continuous innovation and strong rivalry among key global players, including Cochlear Ltd., MED-EL, and Advanced Bionics. The strategy of these pioneers for consolidating their leadership in this sector can be exemplified by the launch of SONNET 3, a next-generation behind-the-ear (BTE) audio processor, by MED-EL in September 2024. This external CI system provides unmatched sound quality while enabling direct streaming from Android and iOS devices, integrated wireless connectivity, and robust waterproofing. Moreover, the sector is booming with increasing activities in rigorous development of digital solutions and patient-centered designs.

Such key players are:

Recent Developments

- In July 2025, Cochlear introduced a smart cochlear implant system, Nucleus Nexa, featuring upgradeable firmware that allows recipients use future innovations through updates. The tool contains an 8 Nexa Sound Processor and a new compact rechargeable battery, offering users the best hearing power all day.

- In June 2025, MED-EL allied with Starkey under a DualSync partnership to advance bluetooth connectivity for cochlear implant users. This partnership allows Apple technology to seamlessly stream to compatible Starkey hearing aids and MED-EL cochlear implants.

- Report ID: 2117

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cochlear Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.