Cholinesterase Inhibitors Market Outlook:

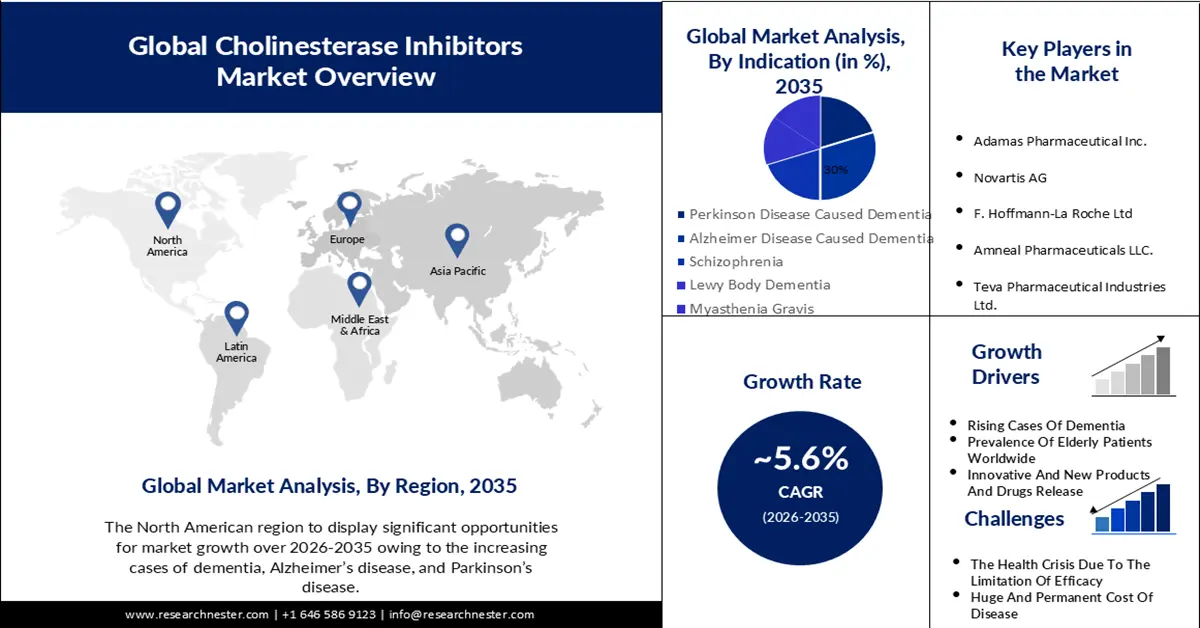

Cholinesterase Inhibitors Market size was over USD 4.69 billion in 2025 and is projected to reach USD 8.09 billion by 2035, growing at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cholinesterase inhibitors is evaluated at USD 4.93 billion.

The market growth is wheeled majorly by the growing prevalence of and hike in frequency rate of dementia caused because of Alzheimer’s and Parkinson’s diseases all over the world. Recently, more than 55 million people have been suffering from dementia globally, over 60% of whom live in low- and middle-income countries, and women are more disproportionately influenced by dementia. Every year, there are nearly 10 million new cases.

The second major factor that is anticipated to drive the growth of the cholinesterase inhibitors market in the forecast period is the prevalence of LATE disease in elderly people and the increase in the percentage of aged people across the planet. Depending on the newest estimations, the number of people older than 65 years with Alzheimer’s dementia is projected to reach 12.7 million by 2050. For instance, a group of researchers assessed the brains of 6,196 people with an average age at death of 88 years and discovered that almost 40% of them may have got limbic-predominant age-related TDP-43 encephalopathy (LATE). LATE creates symptoms equivalent to Alzheimer’s, comprising issues with thinking, reminding, and reasoning, but has other inherent causes involving abnormal clusters of a protein called TDP-43. This protein is also included in frontotemporal dementia, but LATE shows a distinctive pattern of brain transformations and tends to impact people over the age of 80. Therefore, this might increase and drive the market expansion of cholinesterase inhibitors as this is the only effective therapy to cure these diseases.

Key Cholinesterase Inhibitors Market Insights Summary:

Regional Highlights:

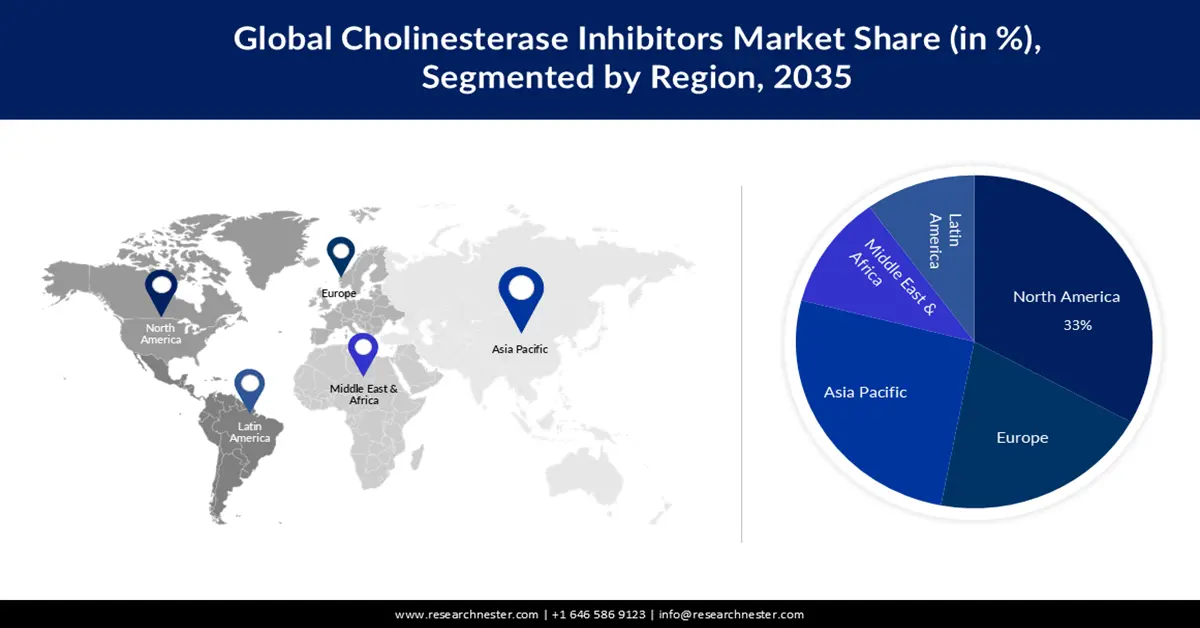

- By 2035, North America is estimated to command a 33% share in the Cholinesterase Inhibitors Market, impelled by the rising prevalence of dementia cases in the region.

- During 2026–2035, the Asia Pacific region is poised to capture notable growth in market share owing to the rapid expansion of hospitals and ambulatory surgery centers.

Segment Insights:

- By 2035, the Alzheimer's disease-caused dementia segment in the Cholinesterase Inhibitors Market is projected to secure around a 30% share, propelled by its high prevalence in patients.

- The intravenous segment is expected to dominate through 2035, holding the largest share supported by the high bio-attainability of drugs.

Key Growth Trends:

- The Increasing Launches of New Products and Drugs

- High Requirement for Therapies in the Field of Alzheimer’s and Dementia

Major Challenges:

- The Health Crisis Due to the Limitation of Efficacy

- The Shortage of Innovative and New Lines of Drugs on Cholinesterase Inhibitors

Key Players: Allergan Plc, Adamas Pharmaceutical Inc., Novartis AG, F. Hoffmann-La Roche Ltd, Avadel Pharmaceuticals, Teva Pharmaceutical Industries Limited, BioVie Inc., Pfizer Inc., Eisai Co., Ltd., Janssen Global Services, Sanofi-Aventis U.S. LLC, Daiichi Sankyo Company, Limited, Shionogi & Co., Ltd. and Eli Lilly and Company.

Global Cholinesterase Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.69 billion

- 2026 Market Size: USD 4.93 billion

- Projected Market Size: USD 8.09 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 19 November, 2025

Cholinesterase Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- The Increasing Launches of New Products and Drugs - The cholinesterase inhibitors market has encountered a lot of new launches of products and drugs globally in recent years. Moreover, recently two most popular drugs – Leqembi, from partner biotech companies Eisai Co., Ltd. (4523.T) and Biogen (BIIB.O), and a trial therapy created by Eli Lilly and Company (LLY.N), donanemab - are the first to present actual hope of slowing the fatal disease for the 6.5 million people living with Alzheimer's. The developing proof of an imbalance around amyloid, an explaining trait of Alzheimer's, is increasing questions among some scientists about who will profit from the two new therapies – the first ever proven to delay the rate of cognitive decrease.

- High Requirement for Therapies in the Field of Alzheimer's and Dementia - Alzheimer's disease (AD) is rising, and so is the demand for new and more effective therapies. Progresses in therapy are being accomplished; aducanumab, the first disease improving therapy (DMT) to be accepted for AD, became accessible on the market for those with MCI because of AD and mild AD dementia in 2021. Aducanumab is a cholinesterase inhibitor, that is made of an antiamyloid monoclonal antibody, are under the feedback process by the US Food and Drug Administration (FDA). Additionally, more new therapies for AD may become accessible in the cholinesterase inhibitors market in the upcoming future.

- Increased Economic Importance of Cholinesterase Inhibitors - The high cost of cholinesterase inhibitor drugs is providing a huge profit to healthcare pharmaceuticals worldwide. The international costs of cholinesterase inhibitor drugs for dementia were recently calculated at USD 1.3 trillion. GE HealthCare Technologies Inc (GEHC.O) stated on 25th July 2023 that the advertising launch of Alzheimer's treatment and associated testing for patients would assist in pushing the demand for its imaging gadgets at hospitals and medical centers next year.

Challenges

- The Health Crisis Due to the Limitation of Efficacy - A high rise in the cases of dementia due to various diseases but comparatively the drugs are not that effective. This is posing a health crisis across the world. The exceptional pressure of Alzheimer's disease (AD) and dementia is extensively attained, and opinion leaders and policymakers globally call for action. The calculated international number of patients with dementia now surpasses 50 million, costing more than a trillion US dollars per year. The effects of recently available drug treatments which are majorly dependent on Cholinesterase inhibitors are unassuming, so it may be daunting to tell if Alzheimer's disease attacks are assisting in limiting symptoms. This can cause a bumper in the projected growth of the market in the anticipated period.

- The Shortage of Innovative and New Lines of Drugs on Cholinesterase Inhibitors

- The Huge and Long-Term Cost of The Treatment

Cholinesterase Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 4.69 billion |

|

Forecast Year Market Size (2035) |

USD 8.09 billion |

|

Regional Scope |

|

Cholinesterase Inhibitors Market Segmentation:

Indication Segment Analysis

The Alzheimer's disease-caused dementia segment in the cholinesterase inhibitors market is projected to have the largest revenue share with a hold of around 30% by the end of 2035. This segment will have a substantial growth in the market due to its prevalence in patients. Almost 60 to 70% of cases of dementia due to Alzheimer's have been noticed in people in the world. Currently, more than 6 million people across different countries of different ages are suffering from Alzheimer's and this number is anticipated to go around 13 million by 2050. In 2020, the healthcare pressure related to the disease was calculated to be almost USD 305 billion. In 2020, the competitive landscape in AD presented drugs like acetylcholinesterase inhibitors and N-methyl-D-aspartate (NMDA) receptor opponents, which are focused on curing the symptoms of the disease. These medications are quietly efficient and mainly off-patent, therefore making a substantial scope for new entrants into the market.

Route of Administration Segment Analysis

The intravenous segment is anticipated to predominance the global market at the time of the forecast period. High bio-attainability of drugs through an intravenous route using large volume wearable injections and expensive rate of IV cholinesterase inhibitors are factors that are calculated to contribute to the largest share of the segment. Moreover, intravenous is usually the prescribed route of administration. This is another reason attributed to the hike of the segment.

Our In-Depth Analysis of the Global Market Includes the Following Segments:

|

Indication |

|

|

Route of Administration |

|

|

Distribution Channels |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cholinesterase Inhibitors Market - Regional Analysis

North American Market Insights

North America industry is estimated to dominate majority revenue share of 33% by 2035, impelled by prevalence of dementia cases in the region.. High incidence rates of dementia, Alzheimer’s disease, and Parkinson’s disease will drive the market in North America. A calculated 6.7 million Americans age 65 and older are living with Alzheimer's in 2023. Seventy-three percent are aged 75 or older. The number of Americans living with Alzheimer's is increasing and increasing very quickly. It is also anticipated that by 2050, the number of people age 65 and older with Alzheimer’s may develop to an anticipated 12.7 million, barring the growth of medical advances to stop or cure Alzheimer’s disease. North America’s advanced therapy medicinal products are helping patients worldwide and helping the region to hold its position.

APAC Market Insights

The cholinesterase inhibitors market in the Asia Pacific is projected to grow at a dynamic CAGR by the end of the forecast period. The quick advancement of the market in the Asia Pacific can be attributed to the development of several hospitals and ambulatory surgery centers. The developed infrastructure will help this region to share significant revenue as the more hospitals are formed the more will be the need of cholinesterase inhibitors drugs. In 2021, the number of beds in medical institutions all over the country achieved 9.4 million, involving 7.4 million in hospitals, 1.7 million in township-level health places, and 0.3 million in public health colleges. Other than that, there are a total of 67,153 ICU beds across all of China. As an outcome, the country has created a unified healthcare system of high quality and efficacy and modified the attainability and approachability of medical resources like cholinesterase inhibitors.

Cholinesterase Inhibitors Market Players:

- Eli Lilly and Company

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Allergan Plc.

- Adamas Pharmaceutical Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Amneal Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Limited.

- BioVie Inc.

- Pfizer Inc.

- Eisai Co., Ltd.

Recent Developments

- February 2022: McGill University's Dementia Education Program’s new initiative was among the 15 projects that got backing from the Public Health Agency of Canada to increase concern for dementia and encourage dementia-inclusive communities.

- Sept. 12, 2023: Corium, LLC, a commercial-place biopharmaceutical organization leading the growth and commodification of novel neuroscience treatments, released the publication of information strengthening that ADLARITY (donepezil transdermal system) showed positive skin adequacy and coherence in a placebo-tackled trial with healthy volunteers

- Report ID: 2416

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cholinesterase Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.