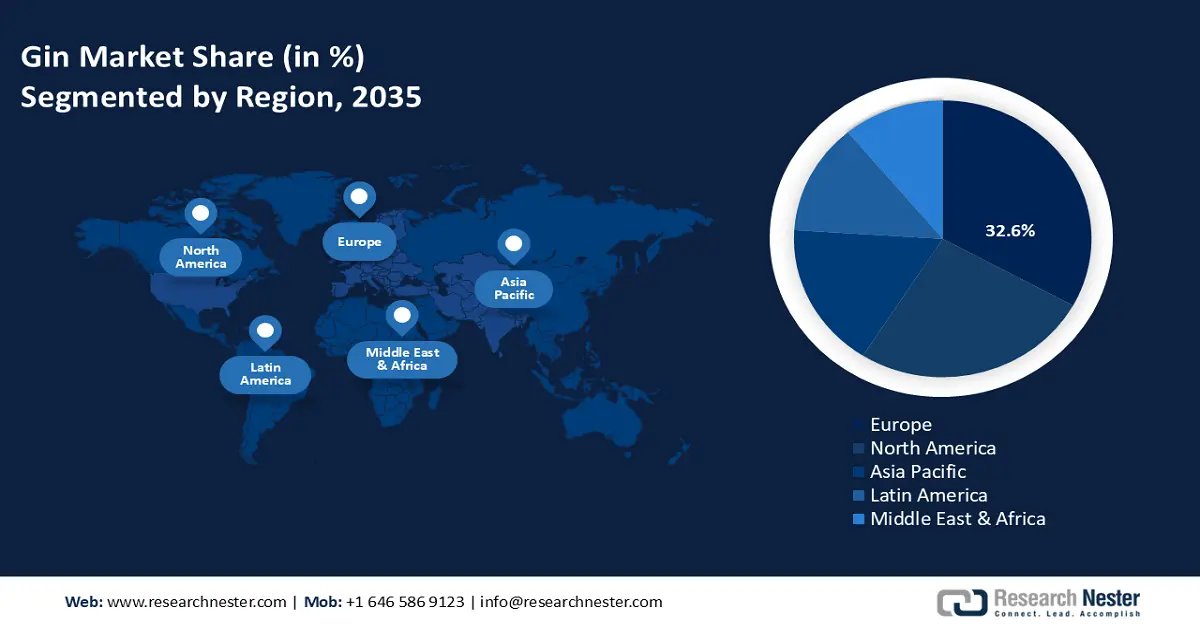

Gin Market - Regional Analysis

Europe Market Insights

By the year 2035, Europe is anticipated to take the lead in the global gin market with a 32.6% market share, fueled by an increasing demand for premium, environmentally friendly, and botanical-based spirits. Consumption has experienced continual growth over the past few years, driven by the popularity of flavored and low-alcohol variants. The growth of gin consumption continues to occur in Spain, the U.K., and Germany, among others, with gin exports to markets outside of Europe increasing since 2020. Sustainable activities, including reduced bottle weight and sourcing local botanicals, are shaping brand positioning and product development.

Germany's gin market is being driven by premium gin products and consumer interest in unusual botanical combinations. The growth of domestic distilleries producing craft gin has also been significant, especially in Bavaria and Berlin, with interest from both local consumers and export buyers. Exports of German gin have been rising each year in volume, primarily to neighboring European countries. Trends in consumer demand are also being influenced by limited and seasonal offerings, sustainability initiatives, and increased use of organic botanicals and environmentally friendly packaging.

UK Exports of Gin and Geneva

|

Destination |

Export Value (1,000 USD) |

Quantity (Liters) |

|

United States |

269,013.48 |

29,457,000 |

|

Spain |

76,941.00 |

8,425,040 |

|

Italy |

76,624.90 |

8,390,430 |

|

Germany |

49,826.27 |

5,455,980 |

|

Canada |

31,159.72 |

3,411,990 |

Source: WITS

North America Market Insights

By the year 2035, it is anticipated that North America will represent 28.5% of the global gin market, due to increasing craft-distillery movement and cocktail culture. Small-batch producers are trying new things with native botanicals, barrel-aging, and specialty flavor infusions outside of normal juniper-driven gin. Both the U.S. and Canada have regulatory bodies involved in oversight of production standards and labeling. Major producers will continue to thrive alongside artisanal producers, and the premium and flavored gin categories will continue to grow with consumer preference changes.

In 2024, U.S. distilled spirits exports reached a record total of $2.4 billion, representing nearly a 10% increase from 2023. Among these, American Whiskeys, despite experiencing a 5.4% decline overall, still contributed over $1.3 billion in export value, accounting for 54% of the value and 33% of the volume. Gin exports grew by 32% in 2024 to $53 million, firmly establishing itself as one of the industry’s fastest-growing categories. Other notable segments included cordials, which surged 128% to $367 million, and vodka, which increased by 82% to $292 million. Conversely, exports of rum and brandy declined by 12% and 39%, respectively, amounting to $86 million and $23 million. The value of these exports has quintupled from $478 million to over $2.4 billion in 2024.

Asia Pacific Market Insights

By the year 2035, it is anticipated that the Asia Pacific will represent 17.5% of the global gin market, due to increasing consumer consumption of premium and craft spirits that are influenced by global cocktail culture. Mega trends, including urbanization, a growing middle class, and exposure to Western drinking styles, are increasing demand for novel flavors and the botanicals that create gin. More local distillers are using local ingredients such as yuzu, pandan, and lemongrass to reflect emerging tastes. In the Asia Pacific, e-commerce and specialty liquor sellers are increasingly providing access to more options, while local brands replacing or complementing international brands are supporting gin’s premium positioning in the region.

India Exports of Gin and Geneva (2022)

|

Export Destination |

Trade Value (USD thousands) |

Quantity (Liters) |

|

Togo |

1,003.55 |

662,970 |

|

United Arab Emirates |

638.13 |

86,274 |

|

Ghana |

423.42 |

331,438 |

|

United States |

383.66 |

33,838 |

|

Netherlands |

353.78 |

37,229 |

Source: WITS