Geofencing Market Outlook:

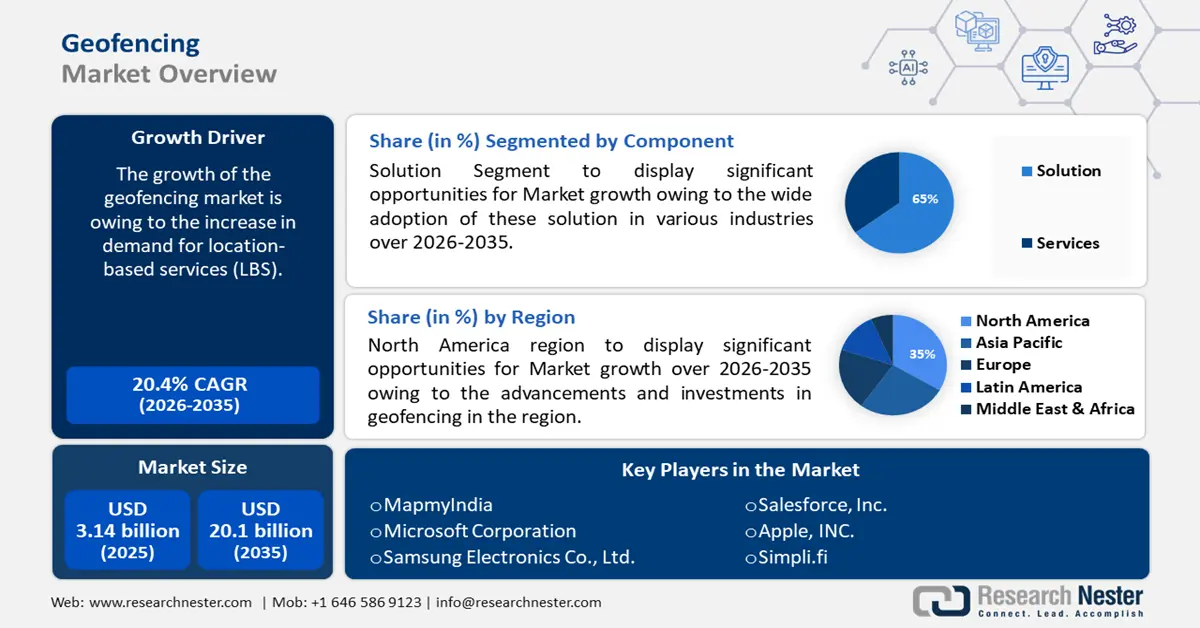

Geofencing Market size was valued at USD 3.14 billion in 2025 and is expected to reach USD 20.1 billion by 2035, expanding at around 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of geofencing is evaluated at USD 3.72 billion.

The growth of the market is owing to the increase in demand for location-based services (LBS). Twenty-eight percent of adult Americans use mobile or social location-based services.

In addition to this, the need for geofencing has grown dramatically since the coronavirus outbreak. With working from home becoming the new norm, many companies are transitioning to long-term remote employment. Consequently, there is a great demand for geofencing software that enables employees to electronically clock in and depart. Because geofencing enables employees to better manage their time, workers become more productive. Consequently, this factor is anticipated to drive up sales in the geofencing market.

Key Geofencing Market Insights Summary:

Regional Highlights:

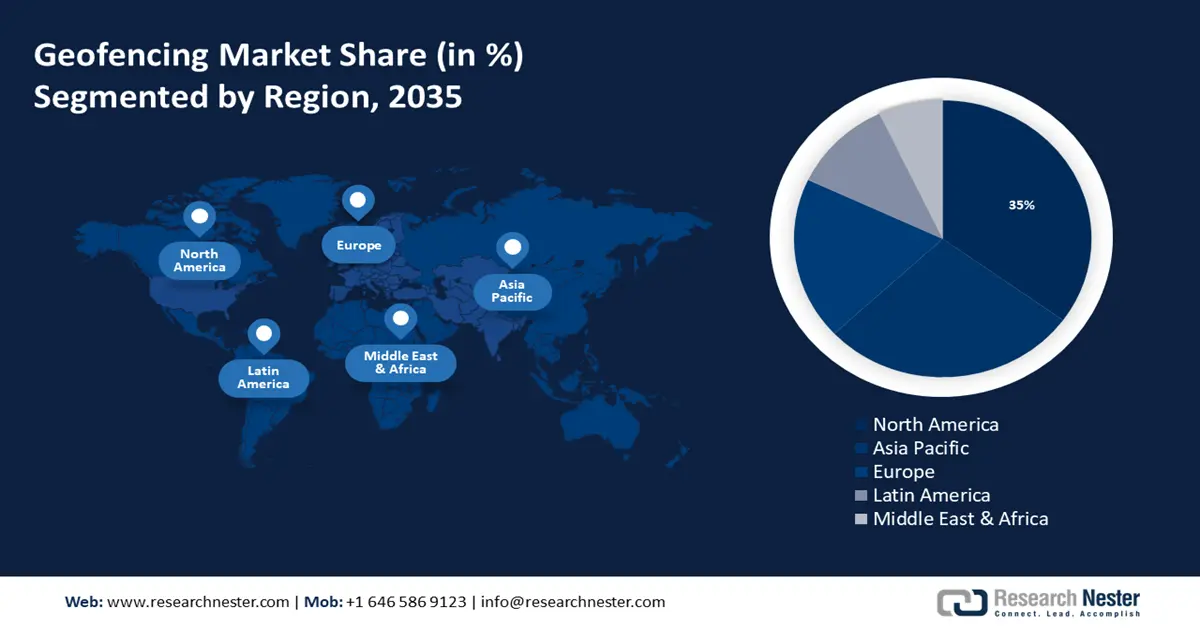

- North America geofencing market will dominate around 35% share by 2035, driven by significant advancements in geofencing technologies, robust internet infrastructure, and widespread adoption across BFSI, retail, and logistics sectors.

- Asia Pacific market will secure 28% share by 2035, driven by innovative product launches, diverse sector applications, and increasing use of geofencing for targeted marketing.

Segment Insights:

- The solution segment in the geofencing market is forecasted to achieve a 65% share by 2035, driven by widespread adoption in industries like retail and logistics and growing integration of location-based services.

- The active geofencing segment in the geofencing market is anticipated to witness substantial growth over the forecast period 2026-2035, fueled by rising demand for business intelligence tools and real-time tracking across industries.

Key Growth Trends:

- Retailers are using geofencing services more frequently

- Expanding Use of Geofencing In Transportation and Logistics

Major Challenges:

- Growing Concerns About Privacy

- Problems with battery depletion could hinder market expansion.

Key Players: Microsoft Corporation, MapmyIndia, Samsung Electronics Co., Ltd., Salesforce, Inc., Apple, INC., Simpli.fi, Fi Holdings Inc., Mobinius Technologies, Raveon Technologies, Urban Airship.

Global Geofencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.14 billion

- 2026 Market Size: USD 3.72 billion

- Projected Market Size: USD 20.1 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Geofencing Market Growth Drivers and Challenges:

Growth Drivers

- Retailers are using geofencing services more frequently- Because digitalization makes it possible for businesses to interact with customers more effectively and remotely, retailers are embracing technology in an effort to build a more devoted client base. With the use of these systems, retailers can track client foot traffic as soon as they enter a geofenced area and use that information to deliver promotional offers to customers, encouraging them to visit the store and make purchases. Retailers are using geofenced services to deliver goods to clients as well.

- Expanding Use of Geofencing In Transportation and Logistics- Over the course of the projection period, it is anticipated that the growing use of geofencing technology in transportation and logistics for proximity-based advertising and marketing will further accelerate market expansion. In addition, a lot of contemporary meal delivery apps and taxi aggregation services rely heavily on technology. At LAX, for instance, Uber Car Hiring Service additionally makes use of geofencing so that locals may easily hail a cab and travel to their location in the matter of minutes. Geo-targeting is presently being used by Domino's in their text message marketing strategy. With more than 10,000 locations across 70 countries, the pizza company needs to deliver geo-targeted text messages to ensure that each client receives relevant content.

- Growing Advancements in Technology- The growing significance of technical advancements in preserving the security and safety of regions and organizations is the fundamental driver of market expansion. The Global Navigation Satellite System (GNSS), wireless technologies that enable Location-Based Services and the Global Positioning System (GPS), as well as ongoing technological developments in cloud computing applications, all greatly contribute to the market's expansion. For 33% of firms, geofencing technology is being used to proactively improve workplace safety as well as to educate staff. For example, geofences are utilized in the construction sector to set off a device alarm when workers get near hazards like overhead powerlines or dangerous materials. In addition to alerting managers when personnel or machinery crosses a border, geofencing allows for quick action in case of an emergency.

Challenges

- Growing Concerns About Privacy- Getting people's locations is the hardest goal to accomplish. Because most people are apprehensive about sharing their location and other personal information, geofencing is more challenging. Geofencing is an invasive type of monitoring that puts people's privacy and liberties at risk. Throughout the course of the projection period, the geofencing market will slow considerably due to technical advancements being resisted by growing privacy concerns and movements supporting individual freedom.

- Problems with battery depletion could hinder market expansion.

- Over the projection period, the industry's growth will be hampered by a shortage of professional skills.

Geofencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 3.14 billion |

|

Forecast Year Market Size (2035) |

USD 20.1 billion |

|

Regional Scope |

|

Geofencing Market Segmentation:

Component

Based on component, solution segment in the geofencing market is attributed to hold largest revenue share of about 65% during the forecast period. The growth of the segment is because a number of industries, including retail, the transportation and logistics sector, the automobile industry, and the public sector, have widely adopted these solutions. In April 2022 to March 2023, the industry produced 2,59,31,867 vehicles, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 2,30,40,066 units in April 2021 to March 2022. The solutions industry has a sizable portion of the overall market owing to enterprises integrating location-based services and growing the solution's functionalities. To facilitate the deployment of geofencing techniques, this software solution typically combines location-based technologies with user-friendly interfaces. The software-enabled app allows developers to create dynamic push alerts that include action buttons, videos, and photographs. By enabling users to take immediate action from the idle screen, this type raises the response rate. Ordering, purchasing, responding, or participating in an activity like filling out a questionnaire are examples of direct actions, depending on the topic.

Technology

Based on technology, active segment in the geofencing market is estimated to hold largest revenue share of about 55% during the forecast period. Using active geofencing, retailers target customers within a predefined radius of a specific location with offers and messaging in an effort to bring them into the store and make a purchase. Additionally, the increasing acceptance of digital technology and the rising need for business intelligence tools across multiple industries have led to the rise in popularity of automation solutions that employ various geofencing techniques. Manufacturers have access to real-time process and workforce tracking solutions because of active geofencing services and real-time location systems.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Service |

|

|

Technology |

|

|

Type |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geofencing Market Regional Analysis:

North American Market Insights

Geofencing market in North America region is projected to hold largest revenue share of about 35% during the forecast period. North America is seeing significant advancements and investments in geofencing across a wide range of end users, including defense, healthcare, logistics, transportation, and BFSI. The market is driving the integration of spatial data and real-time location technologies in the region. Furthermore, the majority of companies in this sector operate in the BFSI, retail, transportation, and logistics industries all of which have the potential to use geofencing. Furthermore, the economies of North America more especially, the United States and Canada are among the most developed in the world. The region controls the market because of its robust internet and communication infrastructure. Eighty-two percent of Americans had internet connection as of 2023, compared to seventy-five percent in 2012. In 2022, there were around 299 million internet users in the United States, making it one of the largest online markets in the world.

APAC Market Insights

Geofencing market in Asia Pacific region is anticipated to hold second largest revenue share of about 28% during the forecast period. The expansion of the market in this area is driven by major players in the industry introducing innovative products and new solutions. In the Asia Pacific region, geofencing has been applied for a range of uses in numerous sectors. Geofencing is a popular tool used by retailers and other businesses to target customers with incentives and marketing when they approach their physical stores or visit specific locations.

Geofencing Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MapmyIndia

- Samsung Electronics Co., Ltd.

- Salesforce, Inc.

- Apple, INC.

- Simpli.fi

- Fi Holdings Inc.

- Mobinius Technologies

- Raveon Technologies

- Urban Airship

Recent Developments

- February 2023: Smart helmet kits, GPS trackers, and dash cams were introduced by MapmyIndia, an Indian tech company that develops GIS AI technologies, telematics solutions, digitized map data, and location-based software as a service. Dash cams, in-dash navigation systems, smart helmet kits, and car GPS trackers are some of the latest items. Owners of two-wheelers utilize smart helmet kits and GPS trackers, but autos are meant to use dash cameras and in-dash navigation systems.

- March 2022: The first next-generation Mission Critical Push-to-X (MCPTX) services in Canada have been successfully deployed, according to a statement released by TELUS and Samsung Networks. This new MCPTX solution, when implemented over TELUS' internationally renowned network, will provide Canada's first responders with the knowledge and data they require to enhance public safety outcomes, increase operational efficiency, improve responsiveness, and more precisely assess emergency situations. Communities will be safer thanks to this cutting-edge technology, which will improve multimedia communications with essential operational elements including video, geographic information systems (GIS), geo-fencing, remote database access, and more.

- Report ID: 5994

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Geofencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.