Generator Set Controllers Market Outlook:

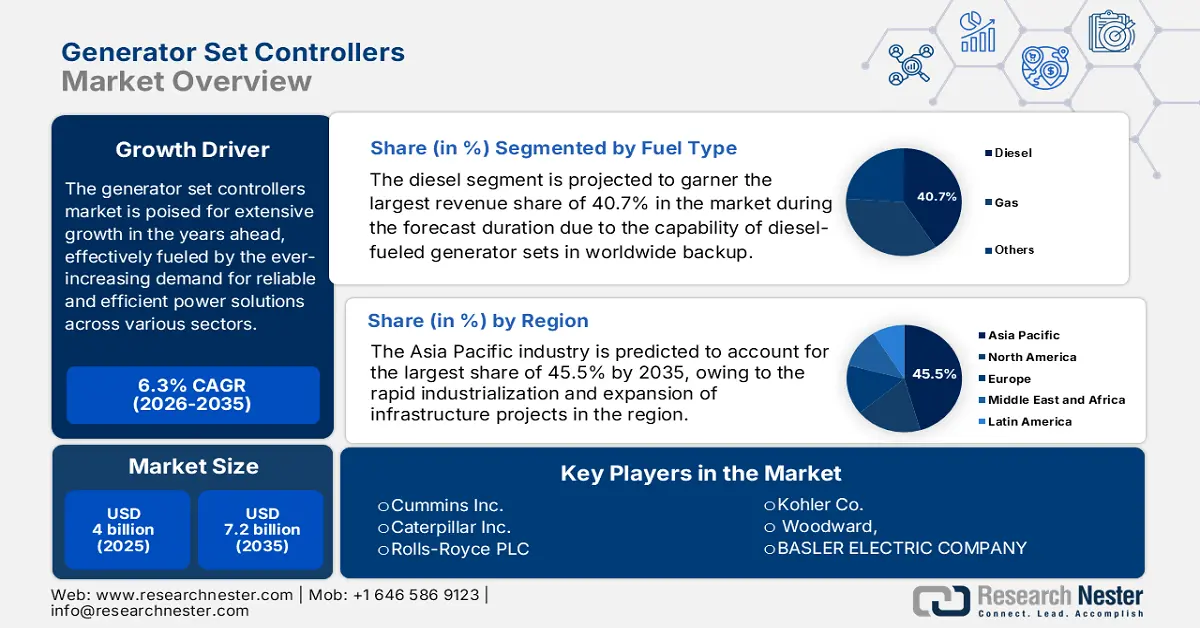

Generator Set Controllers Market size was valued at USD 4 billion in 2025 and is projected to reach USD 7.2 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of generator set controllers is estimated at USD 4.2 billion.

The market is poised for extensive growth in the years ahead, effectively fueled by the ever-increasing demand for reliable and efficient power solutions across various sectors. As evidence Ministry of Power in March 2022 reported that its national smart grid mission aims to enhance the reliability of India’s electricity networks and integrate renewable energy through smart grid technologies. It also stated that the mission has successfully implemented pilot projects, such as the smart city pilot at IIT Kanpur, resulting in significant reductions in technical losses, wherein the deployment of prepaid smart meters by EESL in Bihar has improved revenue collections by around 20%.

In addition, the growing adoption of hybrid power systems due to the frequent power outages in certain regions also contributes to the market expansion. As per a report published by NSGM in September 2022, the President's sanction is continuing the national smart grid mission under the umbrella scheme, thereby strengthening the power system for the tenure 1st April 2021 to 31st March 2024. It also stated that the mission has been allocated an estimated amount of Rs. 136.95 crore (USD 16.5 million), including a gross budgetary support of Rs. 45.42 crore (USD 5.5 million). Further, this will help assist in completing ongoing smart grid projects, supporting training, capacity building, and providing technical assistance to power utilities.

Key Generator Set Controllers Market Insights Summary:

Regional Highlights:

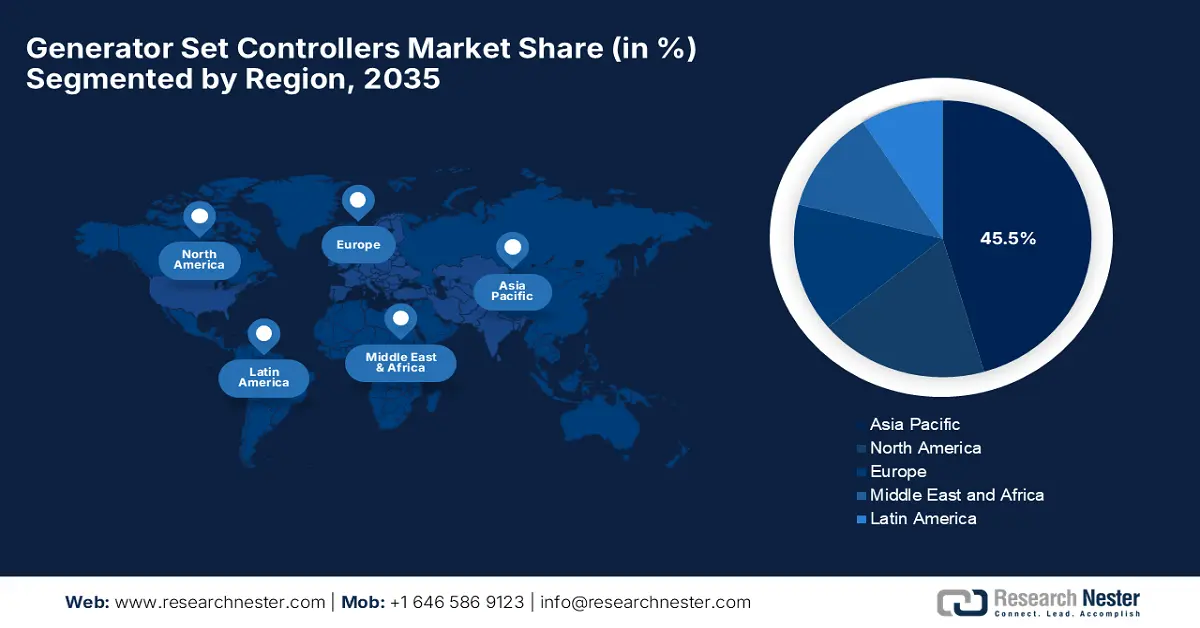

- Asia Pacific is projected to secure a 45.5% share by 2035 in the generator set controllers market, bolstered by accelerating industrialization and expanding infrastructure projects.

- North America is anticipated to command a notable portion of global revenues by 2035, supported by escalating demand for dependable backup power solutions across diversified sectors.

Segment Insights:

- The diesel segment in the generator set controllers market is poised to account for a 40.7% revenue share during 2026–2035, underpinned by its broad suitability for backup and standby power applications worldwide.

- The industrial segment is expected to capture a 35.3% share by 2035, reinforced by the expanding footprint of manufacturing, mining, oil & gas, infrastructure, and heavy industries.

Key Growth Trends:

- Increasing demand for uninterrupted power supply

- Rapid urbanization & industrialization

Major Challenges:

- High initial costs

- Lack of standardization

Key Players: Cummins Inc. (U.S.), Caterpillar Inc. (U.S.), Rolls-Royce PLC (UK), Kohler Co. (U.S.), Woodward, Inc. (U.S.), BASLER ELECTRIC COMPANY (U.S.), DEIF A/S (Denmark), ComAp a.s. (Czech Republic), GAC (Generator Automatic Controls) (U.S.), AMETEK Powervar (U.S.), MTU (A Rolls-Royce Solutions brand) (Germany), Himoinsa S.L. (Spain), Deep Sea Electronics Ltd (DSE) (UK), Mitsubishi Heavy Industries, Ltd. (Japan), Yanmar Holdings Co., Ltd. (Japan), DENYO Co., Ltd. (Japan), Samsung SDI Co., Ltd. (South Korea), Greaves Cotton Limited (India), Leroy-Somer (France), Geneglace Ltd. (Malaysia).

Global Generator Set Controllers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4 billion

- 2026 Market Size: USD 4.2 billion

- Projected Market Size: USD 7.2 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Mexico, Indonesia, Vietnam, UAE

Last updated on : 27 October, 2025

Generator Set Controllers Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for uninterrupted power supply: Most of the industries, such as data centers, telecom, necessitate continuous power fosters an extremely favorable business environment for the backup generator sets and their controllers. According to the report from Our World in Data, firms in high-income countries such as Germany, the UK, and Japan face virtually no power outages. Meanwhile, businesses in emerging economies often experience frequent disruptions, wherein Nigeria reports an average of 33 outages per month, while India, though more stable, still averages one outage per month, reflecting a strong requirement for generator set controllers.

- Rapid urbanization & industrialization: Both the established and emerging regions are building new infrastructure such as industrial parks, commercial buildings, smart cities, and transport systems, creating a reliable demand for power backup. In October 2025, Telesat reported that it had acquired land in Timmins, Ontario, to develop a landing station for its Telesat Lightspeed low-earth-orbit satellite network, which is a part of Canada’s largest space program. It also stated that this station will connect satellite data to terrestrial fiber networks, supporting rural broadband, Arctic security, and industries like energy and aviation.

- Technological advancements: The modern systems are integrating digital features, IoT connectivity, remote monitoring, and predictive diagnostics, which are readily enhancing uptake in this field. As evidence, Mitsubishi Heavy Industries Engine & Turbocharger in March 2022 announced the launch of the MGS-R series, which is a new lineup of diesel generator sets designed to meet the growing power demands of data centers and large commercial facilities across Asia and the Middle East. Besides, it also features 21 models with outputs ranging from 460 to 2,750 kVA; the series offers fast 10-second start times and extended overhaul intervals.

Frequency of Power Disruptions in Businesses Per Month (2023)

|

Country / Region |

Number of Outages |

Country / Region |

Number of Outages |

|

Papua New Guinea |

42 |

India |

1 |

|

Nigeria |

33 |

China |

0 |

|

Bangladesh |

26 |

U.S. |

n/a |

|

Benin |

28 |

Germany |

0 |

|

Central African Republic |

28 |

Brazil |

n/a |

|

Pakistan |

22 |

U.K. |

0 |

|

Niger |

22 |

Japan |

0 |

|

Afghanistan |

12 |

Singapore |

n/a |

Source: Our World in Data

Key Product Releases Fueling Market Growth

|

Year |

Company |

Update |

Key Features |

|

2025 |

ComAp |

Latest InteliConfig Release |

Supports new controllers; new customizable docking system for improved user experience |

|

2025 |

FranklinWH |

Launch of a Power S & MAC |

Advanced home battery with solar integration; Meter Adapter Controller simplifies installation |

|

2023 |

Kohler |

26 kW Home Standby Generator Release |

Quiet, powerful air-cooled generator; commercial-grade durability; 5-year warranty; 14 color options |

Source: Company Official Press Releases

Challenges

- High initial costs: This, along with integration complexity, is posing a persistent hurdle for the market, making it challenging for adoption in price-sensitive markets. The advanced controllers come with features such as digital interfaces, wireless communications, and IoT capabilities, which are ultimately expensive. On the other hand, integrating these modern controllers with existing generator systems can be both complex and costly, necessitating skilled work personnel.

- Lack of standardization: The absence of universal standards for generator controller interfaces and communication protocols is yet another factor negatively influencing the expansion of the market. This is because it creates compatibility issues with the service providers and consumers, thereby limiting seamless integrations across different generator brands and models as well. Furthermore, this fragmentation creates limitations in customer options and makes system upgrades even more complex.

Generator Set Controllers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 4 billion |

|

Forecast Year Market Size (2035) |

USD 7.2 billion |

|

Regional Scope |

|

Generator Set Controllers Market Segmentation:

Fuel Type Segment Analysis

Based on fuel type diesel segment is projected to garner the largest revenue share of 40.7% during the forecast duration. The segment’s dominance in this field is effectively attributable to the capability of diesel-fueled generator sets in worldwide backup and standby power applications. The ease of availability, established infrastructure, and reliability of grid or unstable grid solutions are also making them extremely preferable, hence allowing a steady cash influx in the market.

Application Segment Analysis

In terms of application industrial segment is expected to attain a significant share of 35.3% by the end of 2035. The large-scale manufacturing, mining, oil & gas, infrastructure, and heavy industry are key factors behind the leadership. In September 2024, Cummins India Limited announced that it had launched the retrofit aftertreatment system, which helps existing CPCBII and CPCBI gensets comply with the latest emission standards by reducing particulate matter, carbon monoxide, and hydrocarbons by up to 90% thus denoting a positive market outlook.

Type Segment Analysis

Based on type automatic segment is predicted to capture a considerable share of 30.5% during the analyzed time frame. These controllers reduce human intervention, increase uptime, and support remote monitoring, making it suitable for mission-critical applications. Caterpillar in December 2024 announced the launch of new Cat G3500K series gas generator sets, starting with the 2.5 MW G3520K HR model, which is designed for quick response, high efficiency, and reliable operation. Besides, these generators offer up to 89% engine efficiency, fuel flexibility including natural gas and propane, and asset monitoring, thereby minimizing downtime.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Fuel Type |

|

|

Application |

|

|

Type |

|

|

Communication Protocol |

|

|

Component |

|

|

Power Rating |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Generator Set Controllers Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to capture the highest revenue share of 45.5% in the market throughout the discussed tenure. The region’s prominence in this field is effectively propelled by rapid industrialization and the expansion of infrastructure projects. In July 2023, Tata Motors announced the launch of a new range of high-performance, CPCB IV+ compliant gensets in India, which are available in 25kVA to 125kVA configurations. The company also stated that these gensets are fuel-efficient, offering a strong block loading capability and lower operating costs with continuous power delivery across numerous industries.

China is the dominating player in the regional market owing to the presence of a large manufacturing base, focus on sustainability, and a heightened demand for continuous power. In September 2023, Shanghai Electric reported that it showcased its vision for a zero-carbon future, introducing a management system for carbon emissions, the SEunicloud industrial Internet platform 4.0, and integrated wind, solar, storage, and regulation solutions at the CIIF 2023. It also stated that these technologies comprise smart energy, intelligent manufacturing, and digital integration to support green, low-carbon development.

India also holds a strong position in the generator set controllers market, efficiently backed by the expansion of commercial & industrial facilities and increasing focus on energy efficiency. For instance, in May 2025, Mahindra Powerol reported that it had been named the country’s no.1 diesel genset manufacturer for the year by Frost & Sullivan, securing a 23.8% market share by volume. The company further stated that this achievement was driven by strong performance across telecom and retail sectors, and the rollout of CPCB4+ compliant gensets, hence suitable for standard market growth.

North America Market Insights

North America stands out as one of the most prominent players in the global generator set controllers market by the end of 2035. The region benefits from the heightened demand for reliable backup power solutions across various sectors and the rising adoption of generator sets. In June 2025, Cummins Inc. reported that it had launched its new S17 centum series generator set, which is a 17-liter engine platform engineered to deliver 1 MW of power with a compact footprint for critical urban applications. The company further stated that this genset is deliberately backed by over 25,000 hours of testing, features HVO fuel flexibility, and compliance with emission standards.

The U.S. is augmenting its leadership in the regional generator set controllers market on account of the proliferation of data centers, especially, which propels this demand, as these facilities require an uninterrupted power supply and advanced generator management systems to ensure operational continuity. In addition, the industrial sector, which includes oil and gas, manufacturing, and healthcare, is also adopting these controllers to maintain a consistent power supply, especially in terms of remote areas. Furthermore, the environmental regulations and emission standards are also assets of this landscape, fostering a profitable business environment.

Canada is readily blistering growth in the generator set controllers market, efficiently backed by the heightened demand for reliable power solutions and advancements in generator technology that improve efficiency and reduce emissions. In December 2024, the country’s government reported that its ecoEII allocated a total of USD 2,224,000 towards a total project cost of USD 3,483,000. Hatch Ltd. developed the HμGrid utility-grade microgrid controller. It further stated that the controller is designed to integrate high levels of renewable generation into remote, off-grid communities and industrial sites, thereby managing complex energy dynamics through real-time optimization.

Europe Market Insights

Europe is gaining traction in the generator set controllers market, backed by a strong focus on energy reliability, automation, and digital monitoring of power systems. Testifying this Bobcat in July 2024 reported that it has introduced the new PG40 and PG50 portable generators for Europe, which comprise powerful Stage V D24 engines and Stamford alternators that offer increased power and improved fuel efficiency when compared to previous models. The firm also underscored that the PG50 delivers a true 50 kVA prime output while staying below diesel exhaust fluid system requirements.

Germany is solidifying its dominance in the generator set controllers market due to the strong consumer base and a focus on integrating renewable energy sources. Besides the increasing frequency of power outages and grid instability is also providing an encouraging opportunity for the pioneers in this field. The demand for reliable backup has been on the rise across various sectors, including manufacturing and logistics. Furthermore, the country’s commitment to reducing carbon emissions is also prompting the adoption of technologies such as hybrid and gas-powered generators, hence stimulating the market.

The U.K. is considered to be one of the most prominent players in the generator set controllers market, primarily benefiting from its commitment to enhancing energy resilience and integrating renewable energy sources. Also, the ever-increasing construction of data centers has significantly boosted the demand for high-power generators. WB Power Services declared that it has committed £6 million (approximately USD 8.064 million ) to ensure compliance with Stage V emissions standards for diesel generators. This initiative is a response to stricter EU regulations aimed at reducing harmful pollutants from non-road mobile machinery, and this was scheduled for completion by the end of 2023.

Key Generator Set Controllers Market Players:

- Cummins Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Caterpillar Inc. (U.S.)

- Rolls-Royce PLC (UK)

- Kohler Co. (U.S.)

- Woodward, Inc. (U.S.)

- BASLER ELECTRIC COMPANY (U.S.)

- DEIF A/S (Denmark)

- ComAp a.s. (Czech Republic)

- GAC (Generator Automatic Controls) (U.S.)

- AMETEK Powervar (U.S.)

- MTU (A Rolls-Royce Solutions brand) (Germany)

- Himoinsa S.L. (Spain)

- Deep Sea Electronics Ltd (DSE) (UK)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Yanmar Holdings Co., Ltd. (Japan)

- DENYO Co., Ltd. (Japan)

- Samsung SDI Co., Ltd. (South Korea)

- Greaves Cotton Limited (India)

- Leroy-Somer (France)

- Geneglace Ltd. (Malaysia)

- Cummins Inc., a firm based in the U.S., is the dominant force in the global landscape of power generation. Besides, the company manufactures its own prominent controllers, such as the PowerCommand series, which are seamlessly integrated into its generator sets. Therefore, this vertical integration allows the firm to offer unparalleled reliability, making it preferred among a wide range of applications.

- Caterpillar Inc. is representing intensifying competition with Cummins through almost similar vertically integrated model. Also, the firm's proprietary control systems, such as the Cat EMCP and newer digital control panels, are engineered specifically for Cat generator sets, ensuring enhanced performance and durability. Moreover, the firm’s strength is its extensive global dealer network, which provides domestic sales, service, and technical support.

- Woodward, Inc. is one of the premier independent designers and manufacturers of control systems for aerospace and industrial engines and turbines. The company is best known for its high-performance, technologically advanced controllers that are often selected by other OEMs for demanding applications. It specializes in developing controls that can handle complex fuel mixes and advanced grid-support functionalities.

- DEIF A/S is based in Denmark and is a central player in control solutions for power generation, marine, and wind industries. The organization is widely recognized for its innovation and high-quality standalone controller offering highly versatile and flexible solutions that can be integrated with generator sets from various OEMs.

- Kohler Co. is yet another major integrated power systems manufacturer that produces its own line of generator set controllers, such as the Kohler Decision-Maker series. Besides, the company competes effectively with a combination of robust product engineering with a strong brand reputation in both power and plumbing.

Below is the list of some prominent players operating in the global market:

The global generator set controllers market is readily evolving owing to the presence of both established multinational corporations and specialized technology providers. The key pioneers in the market, such as Cummins, Caterpillar, and Kohler, are leveraging a strong brand reputation and integrated generator set offerings along with profitable collaborations. In April 2024, Rolls-Royce, Landmark Power Holdings, and ASCO Carbon Dioxide Ltd announced that they entered into a strategic alliance to develop scalable solutions for clean power generation with integrated CO₂ recovery from mtu gas reciprocating engines for industries such as food production, sustainable aviation fuels, e-fuels, cement, and plastic manufacturing.

Corporate Landscape of the Generator Set Controllers Market:

Recent Developments

- In April 2025, Deep Sea Electronics announced that it had launched the DSEG4500, which is a compact, next-generation single genset controller designed for remote start and automatic mains failure applications. The product comprises a real-time monitoring of key engine and electrical parameters, a high-resolution multi-line display, and compatibility with both electronic (J1939) and non-electronic engines.

- In April 2025, HIMOINSA introduced the CE8 family of controller units, which includes CEM8, CEA8, and CEC8 as part of its mission to build a smart, cloud-connected ecosystem for generator set management.

- Report ID: 8195

- Published Date: Oct 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Generator Set Controllers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.