Gear Oil Market Outlook:

Gear Oil Market size was valued at USD 9.25 Billion in 2025 and is expected to reach USD 13.05 Billion by 2035, expanding at around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gear oil is evaluated at USD 9.54 Billion.

The recent shift towards increasing the use of bio-based lubricants is driving the growth of the market. For instance, the production of bio-based lubricants was around USD 23 million in Germany in 2021. Therefore, companies have increased the production of environmentally friendly base oil in order to reduce dependence on petroleum and other non-renewable raw material sources.

The adoption of innovative machinery to enhance and optimize production is further supported by the increase in demand for products resulting from a variety of applications, which is boosting the growth of the gear oil market. Also, the increasing use of IoT-based applications is also expected to drive the market growth rapidly.

Key Gear Oils Market Insights Summary:

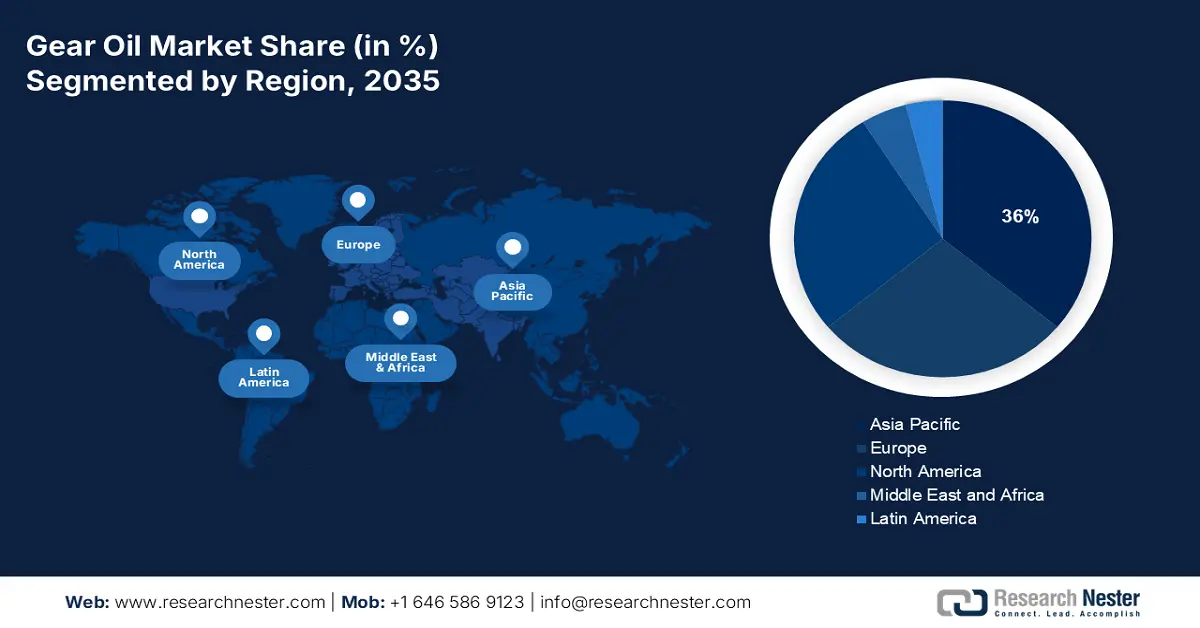

Regional Highlights:

- The Asia Pacific gear oil market will dominate more than 36% share by 2035, attributed to the growing consumption of lubricants and greases and fast-paced development in industrial and automotive sectors.

- The North America market will secure 27% share by 2035, driven by the restoration of the automobile industry and demand from oil & gas and construction sectors.

Segment Insights:

- The synthetic-based lubricants segment in the gear oil market is projected to achieve a 54% share by 2035, attributed to superior thermal and mechanical properties for vehicle applications.

- The automotive segment in the gear oil market is projected to achieve a 34% share by 2035, fueled by rising vehicle sales and the growing commercial transportation sector.

Key Growth Trends:

- Growing Demand from Marine Industry

- Increasing Implementation of Automation in Manufacturing

Major Challenges:

- Adoption of Automatic Lubrication Systems

- Fluctuation of Raw Material Prices to Restraint Market Growth

Key Players: Repsol, Exxon Mobil Corporation, BP p.l.c., Chevron Products Company, Novvi LLC, Japan Petroleum Exploration Co., Ltd, Cosmo Energy Holdings Co. Ltd, Mitsubishi Corporation, Inpex Corp, Fuji Oil Company Ltd.

Global Gear Oils Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.25 Billion

- 2026 Market Size: USD 9.54 Billion

- Projected Market Size: USD 13.05 Billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Gear Oil Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand from Marine Industry – The seaborne trade has observed a steady increase, which is likely to drive the market growth due to the need for gear oil for marine engines and other parts of ships. Significant growing economies like China and India have developed into key hubs for the production of a variety of goods and commodities. Bulk goods like grain and oil are transported aboard container ships. For instance, the majority of the commodities that are traded by the United States are transported via waterways, primarily by seagoing vessels. Over 41% of the entire value of products traded by the United States is transported by ships. Therefore, the expansion of the marine industry is escalating the gear oil market growth rapidly.

- Increasing Implementation of Automation in Manufacturing – The increasing demand for automation in the manufacturing sector is escalating the market growth rapidly. Through increased production capacity, predictable maintenance, and lower costs, automation increases efficiency. These advantages also assist the business in developing a wide range of product kinds that appeal to consumers while requiring little investment and producing a favourable return on investment. Because of this, there is a greater reliance on machinery and equipment, both of which need regular maintenance and lubrication to operate. As a result, the gear oil market is expanding due to the increase in demand for industrial equipment backed by automation.

- Growing Adoption in Wind Turbines – Gear oils are extensively used in the gearbox and other gear motor components. There is an increasing demand for gear oils in wind turbines, because of their improved properties over their mineral-based counterparts. Additionally, with the installed capacity of wind turbines consistently rising each year, the production of electricity from wind energy is expanding quickly on a global scale. One factor in the rise in power generation has been the decline in offshore sector prices. These factors are driving the market growth.

Challenges

- Adoption of Automatic Lubrication Systems – Increased use of automatic lubrication systems will result in less lubricant being needed, which will have an effect on gear oil market expansion. Significant damage may cause an eight-month delay in the renovation process. The end-user is forced to pursue an alternative path for better maintenance and servicing as a result of these delays. The development of the global market for gear oils would be hampered by all of these reasons throughout the forecast period.

- Fluctuation of Raw Material Prices to Restraint Market Growth

- Growing Apprehensions About Environmental Pollution to Limit Uptake

Gear Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 9.25 Billion |

|

Forecast Year Market Size (2035) |

USD 13.05 Billion |

|

Regional Scope |

|

Gear Oil Market Segmentation:

Type Segment Analysis

Gear oil market from the synthetic -based lubricants are expected to hold the largest share of 54% during the forecast period. The growth can be attributed to the enhanced properties of synthetic-based lubricants such as assisting in temperature control by absorbing the heat generated by the moving vehicle parts and transmitting them to a cooler or sump. Also, these types of lubricants are used extensively in automobiles due to their superior properties. Consequently, it is anticipated that rising automobile production and the installation of new machinery will further fuel the segment's expansion. The need for synthetic fibers is also increasing as a result of technological developments like the NSF Food Lubricants standard, which was established for the use of synthetic lubricants by significant equipment manufacturers in the food sector.

Industry Vertical Segment Analysis

The automotive segment in the gear oil market is anticipated to hold a share of 34% during the forecast period. The growth can be attributed to the rise in sales of passenger vehicles like buses, lorries, and other consumer cars. Public transportation has improved in rising economies like China, India, and Brazil as a result of economic expansion in these countries. The need for commercial automotive lubricants is anticipated to increase due to this trend. Over the projected period, rising sales of commercial vehicles including heavy-duty trucks and construction machinery like cranes, bulldozers, and concrete mixers are anticipated to support the expansion of the Middle East & Africa region. As per a report, with more than 21 million vehicles manufactured in 2021, China is the greatest producer of passenger automobiles in the world, making up nearly one-third of global output. Therefore, these factors are escalating the growth of this segment.

Our in-depth analysis of the global gear oil market includes the following segments:

|

Type |

|

|

Industry Vertical |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gear Oil Market Regional Analysis:

APAC Market Insights

Asia Pacific gear oil market is expected to hold the largest share of 36% during the forecast period. The growth can be attributed to the growing consumption of lubricants and greases in the region. Due to its extensive manufacturing activity across a variety of industries and its fast-paced development in the industrial and automotive sectors, Asia Pacific is one of the world's largest manufacturers and users of lubricants. As per the recent report, compared to the prior year, China's industrial production rose by roughly 3.6% in 2022. Also, the region holds the leading position in the marine industry, owing to a large number of ports and increasing trade activities with the neighbouring nations. These factors are accelerating the market growth in the region.

North America Market Insights

The gear oil market in North America is expected to hold a share of 27% during the forecast period. The market is rising owing to the restoration of the automobile industry in the region. High-end construction machinery is needed to build these skyscrapers, increasing the demand for lubricants. A growing oil and gas industry in North America is providing value-creation opportunities for producers of industrial lubricants. In the local oil and gas industry, drilling and exploration activities are driving up demand for gear oil. Due to the rising demand for lubrication for particular applications in cars, building construction, metallurgy, and other areas, the region is also predicted to experience relatively significant expansion in the gear oils market. Therefore, these factors may positively impact the market growth of gear oil in the region.

Gear Oil Market Players:

- Repsol

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- BP p.l.c.

- Chevron Products Company

- Novvi LLC

Recent Developments

- April 2022 - For use in their Mark 9 and newer 2-stroke marine engine designs, ExxonMobil has produced MobilgardTM 540 AC, a premium 40BN marine cylinder oil awarded Category II classification by MAN ES. Following rigorous field testing, the engine builder has issued a No Objection Letter for the premium lubricant, which has been designed to give increased cleanliness to match the needs of these more modern engines.

- February 2023 - A global leader in lubricants and a member of the bp group, Castrol unveiled its redesigned brand, which includes a modernized look and feel. The brand update aims to more accurately reflect the company's distinct market positioning and the potential it sees in adapting to clients' shifting needs.

- Report ID: 5363

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gear Oils Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.