Automotive Lubricants Market Outlook:

Automotive Lubricants Market size was over USD 84.68 Billion in 2025 and is anticipated to cross USD 117.16 Billion by 2035, growing at more than 3.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive lubricants is assessed at USD 87.19 Billion.

The primary factor that is attributed to the market growth is the rapid expansion of the automotive industry across the world, along with the surging demand to protect the automotive components. For instance, a recent report suggested that the global automotive industry is expected to reach approximately USD 9 trillion by 2030. The increased demand for lightweight and high-performance vehicles in every region of the world is also anticipated to drive the market in the upcoming years.

Automotive lubricants are playing a huge role in upgrading the performance and ensuring proper conduction of the vehicles on the road. Thus, with the increasing spending capacity, and rising per capita income, many consumers are adopting high-quality automotive lubricants to protect against wear and tear of various automotive components while increasing their durability. Also, the high demand for individualized transportation, along with increased sales and production of vehicles around the world, is considered growth factor of the market during the assessment period. Furthermore, there has also been an increase in demand for engine oils, brake fluids, and transmission fluids among both consumer and commercial automobiles, which is projected to create a positive outlook for the global automotive lubricants market. In addition to the other factors, the recent focus on shifting towards green derivatives to lessen air pollution is expected to bring growth opportunities for bio-based automotive lubricants market in the upcoming years. The stringent government rules regarding carbon emission along with the presence of regulatory associations including EPA, and REACH, are projected to help in market growth.

Key Automotive Lubricants Market Insights Summary:

Regional Highlights:

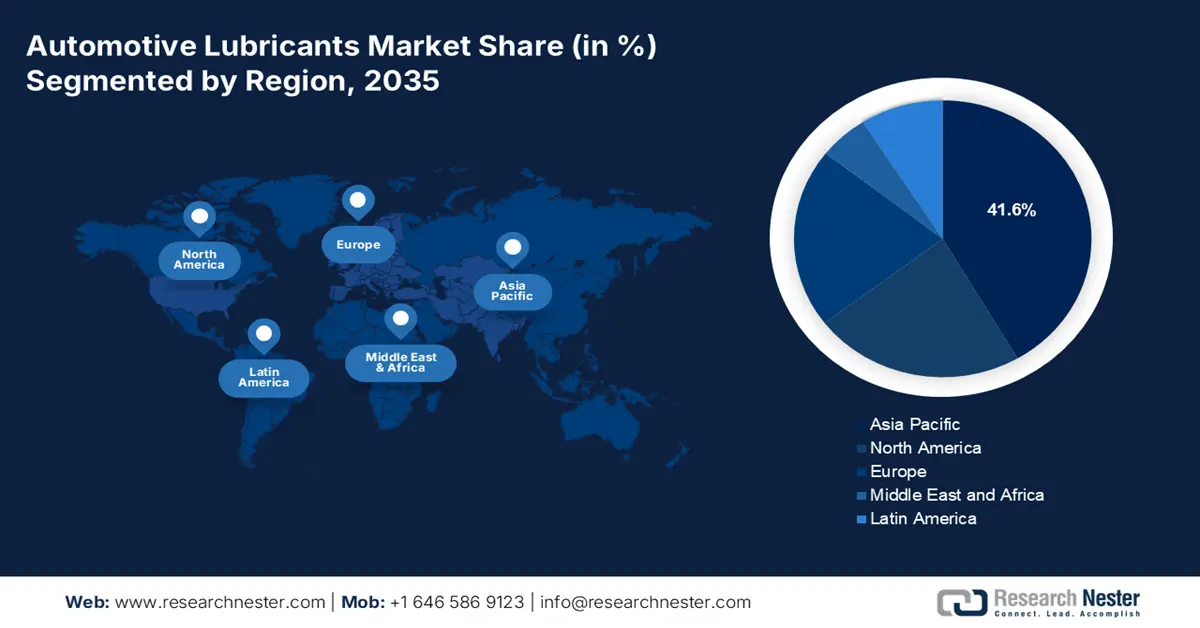

- Asia Pacific automotive lubricants market is predicted to capture 41.6% share by 2035, driven by increased vehicle production, sales, and rising GDP levels.

Segment Insights:

- The passenger cars segment in the automotive lubricants market is expected to achieve the highest market share by 2035, attributed to rising disposable income and increasing production and sales of passenger vehicles.

- The conventional oil segment in the automotive lubricants market is expected to hold the largest share by 2035, driven by its accessibility and performance advantages under various conditions.

Key Growth Trends:

- High Number of Road Accidents in the Past Years

- Growth in Production of Sports Cars

Major Challenges:

- High Costs of Automotive Lubricants

- Increased Preference for an Extended Oil Drain Period

Key Players: Eurol B.V., Shell International B.V., Chevron Corporation, CNPC, Exxon Mobil Corporation, Phillips 66 Company, Valvoline Inc., BP p.l.c., Klüber Lubrication München GmbH & Co. KG, FUCHS PETROLUB SE.

Global Automotive Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 84.68 Billion

- 2026 Market Size: USD 87.19 Billion

- Projected Market Size: USD 117.16 Billion by 2035

- Growth Forecasts: 3.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Automotive Lubricants Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid Swelling of Population with Middle Income - Population growth has driven the production of automotive lubricants owing to the rising demand for vehicles. With the growth of the Gross Domestic Level (GDP) level, the disposable income of individuals has increased, which in turn, is expected to increase the adoption rate of automotive lubricants owing to rising spending capacity. According to World Bank, the total population with middle income in the world rose from 5.51 Billion in 2015 to 5.86 Billion in 2021.

-

High Number of Road Accidents in the Past Years – In the past few years, the number of road accidents has considerably risen. This has generated the need for enhanced on-road performance of vehicles, and impact resistance from extreme pressure, weight, and force through automotive lubricants. Thus, the rising number of deaths owing to road accidents is expected to fuel the global automotive lubricants market’s growth in the forecast period. For instance, in 2022, the World Health Organization revealed that globally, approximately 1.3 million people die each year due to road traffic crashes.

-

Rise in Demand and Production of Vehicles - As per the Organization of Motor Vehicle Manufacturers (OICA), the global production of vehicles was 80 million units in 2021. This is a rise from 77 million units in 2020 across the globe.

-

Growth in Production of Sports Cars – As per estimations, sports car sales are anticipated to augment to 920K vehicles in 2026. This is an increase from 840K vehicles in 2022.

-

Worldwide Surge in Air Pollution - For instance, air pollution is a severe hazard to the health of almost 4 billion people (93%) across Asia and the Pacific region. In 2019, four Asian countries, including China and India, had the highest population-weighted average exposure to PM 2.5.

-

Stringent Government Rules Regarding Carbon Dioxide Emission- Increasing carbon emission is a major concern for the government of the nations to keep it in necessary control for environmental safety. Hence, various governments have disposed of some regulations to lower the carbon emissions, that are estimated to favor the market growth during the forecast period. For instance, for model years 2023–2026 of passenger automobiles and light trucks, the EPA issued new national greenhouse gas (GHG) emissions regulations in December 2021 in the United States. The final regulations are anticipated to reduce other essential pollutants as well as GHG emissions significantly.

Challenges

-

High Costs of Automotive Lubricants – As automotive lubricants are composed of base oils that are extracted through refineries, their cost ultimately increases. As a result, the population with low-income levels is not able to opt for automotive lubricants for their vehicles. This trend is anticipated to hinder market growth in the upcoming years.

-

Increased Preference for an Extended Oil Drain Period

-

Low Awareness Among the Population

Automotive Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 84.68 Billion |

|

Forecast Year Market Size (2035) |

USD 117.16 Billion |

|

Regional Scope |

|

Automotive Lubricants Market Segmentation:

Vehicle Type Segment Analysis

The global automotive lubricants market is segmented and analyzed for demand and supply by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. Out of these, the passenger cars segment is anticipated to garner the highest market share by 2035, owing to its increased sales and production worldwide, along with the rising level of disposable income. As per the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, 49 million new passenger cars were sold and 57 million passenger cars were produced across the globe. Moreover, nowadays, consumers are opting for more efficient and easy transportation, making passenger cars a viable option. Further, the utilization rate of automotive lubricants in passenger cars is forecasted to witness major developments owing to rising per capita disposable income along with its increased preference for a better driving experience.

Oil Segment Analysis

The global automotive lubricants market is also segmented and analyzed for demand and supply by oil into synthetic, semi-synthetic, and conventional. Out of these three segments, the conventional segment is attributed to holding the largest segment share by the end of the forecast period. As conventional oil is derived from crude oil, its greater accessibility makes it a favorable option for consumers. Furthermore, its various advantages, such as temperature resistance and stability against harsh physical conditions, make it an excellent option in the production of automotive engine oil for enhanced lubrication and better engine protection. On the other hand, the synthetic segment is also estimated to grow at a steady growth during the forecast period. Synthetic oil is the best alternative to mineral-based conventional oils. Also, synthetic oil carries numerous advantages, including temperature regulation, extended drain intervals, lessened friction, improved in fuel economy, and better engine performance, which makes it a product in high demand for automotive manufacturers.

Our in-depth analysis of the global automotive lubricants market includes the following segments:

|

By Oil |

|

|

By Product |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Lubricants Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is projected to account for more than 41.6% market share by 2035, due to increased vehicle production, sales, and rising GDP levels. The International Organization of Motor Vehicle Manufacturers (OICA) statistics revealed that the total production of vehicles in the region was 46 million in 2021, a rise from 44 million in 2020. Similarly, the total sales in the region were 42 million in 2021, a rise from 40 million in 2020. Automotive lubricants provide better lubrication, better protection from corrosion, and effective cooling to an engine, and are highly beneficial for any commercial vehicle. Hence, the enhanced use of automotive lubricants owing to the large number of vehicles on the streets, as well as the presence of prominent stakeholders and renowned exporters and importers of vehicles in the region, are expected to provide lucrative opportunities for growth for the market throughout the forecast period. For instance, in 2021, China exported around 402,000 commercial vehicles and around 2 million passenger vehicles. Also, the growing Gross Domestic Product (GDP) level, along with the rising economies, and rising income levels of the population, are other factors for the increased adoption rate of automotive interior materials. Moreover, favorable government policies such as 100% FDI in the auto sector of India, and massive investments from international players in the automotive industry are projected to boost the market size.

Automotive Lubricants Market Players:

- Eurol B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shell International B.V.

- Chevron Corporation

- CNPC

- Exxon Mobil Corporation

- Phillips 66 Company

- Valvoline Inc.

- BP p.l.c.

- Klüber Lubrication München GmbH & Co. KG

- FUCHS PETROLUB SE

Recent Developments

-

Eurol B.V. has launched the new Actence RNT 5W-30. It is a fully synthetic engine oil for gasoline and diesel engines that has the official Renault RN17 approval and meets the ACEA C3 classification.

-

Shell International B.V. has acquired Solenergi Power Private Limited and with it, the Sprng Energy group of companies from Actis Solenergi Limited (Actis).

- Report ID: 4494

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.